please help me

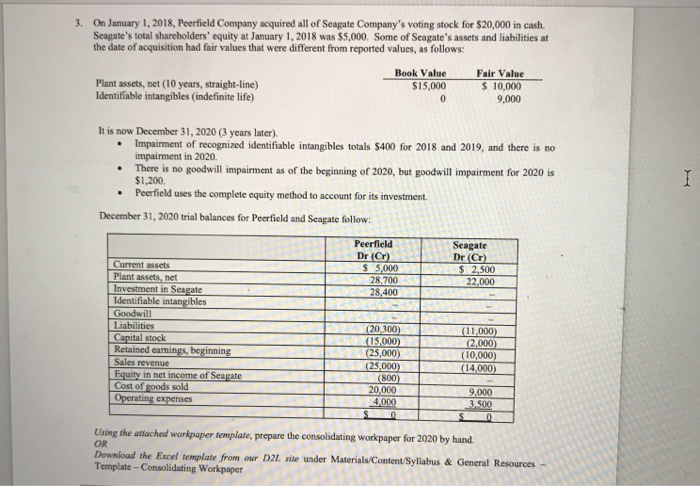

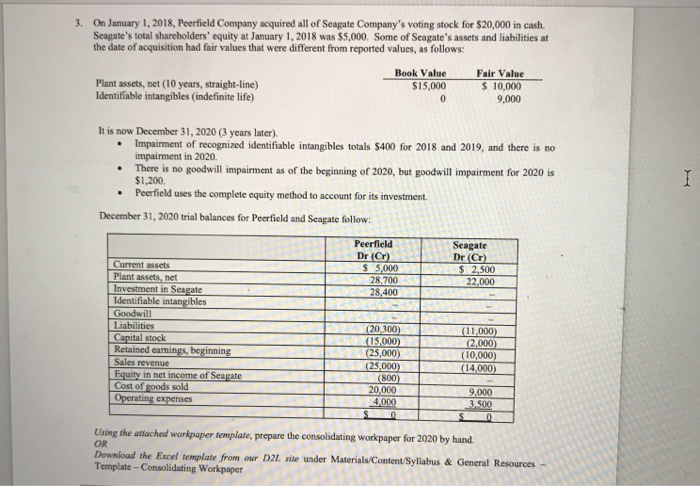

3. On January 1, 2018, Peerfield Company acquired all of Seagate Company's voting stock for $20,000 in cash. Seagate's total shareholders' equity at January 1, 2018 was $5,000. Some of Seagate's assets and liabilities at the date of acquisition had fair values that were different from reported values, as follows: Plant assets, net (10 years, straight-line) Identifiable intangibles (indefinite life) Book Value $15,000 0 Fair Value $ 10,000 9,000 . It is now December 31, 2020 (3 years later). Impairment of recognized identifiable intangibles totals $400 for 2018 and 2019, and there is no impairment in 2020 There is no goodwill impairment as of the beginning of 2020, but goodwill impairment for 2020 is $1,200 Peerfield uses the complete equity method to account for its investment. December 31, 2020 trial balances for Peerfield and Seagate follow: I Peerfield Dr (Cr) $ 5,000 28,700 28,400 Seagate Dr (Cr) $ 2,500 22.000 Current assets Plant assets, net Investment in Seagate Identifiable intangibles Goodwill Liabilities Capital stock Retained earnings, beginning Sales revenue Equity in net income of Seagate Cost of goods sold Operating expenses (20.300) (15,000) (25,000) (25,000 (800) 20,000 4.000 0 (11,000 (2.000) (10,000) (14,000) 9,000 3.500 s Using the attached workpaper template, prepare the consolidating workpaper for 2020 by hand. OR Download the Excel template from our D2L site under Materials/Content/Syllabus & General Resources Template - Consolidating Workpaper 3. On January 1, 2018, Peerfield Company acquired all of Seagate Company's voting stock for $20,000 in cash. Seagate's total shareholders' equity at January 1, 2018 was $5,000. Some of Seagate's assets and liabilities at the date of acquisition had fair values that were different from reported values, as follows: Plant assets, net (10 years, straight-line) Identifiable intangibles (indefinite life) Book Value $15,000 0 Fair Value $ 10,000 9,000 . It is now December 31, 2020 (3 years later). Impairment of recognized identifiable intangibles totals $400 for 2018 and 2019, and there is no impairment in 2020 There is no goodwill impairment as of the beginning of 2020, but goodwill impairment for 2020 is $1,200 Peerfield uses the complete equity method to account for its investment. December 31, 2020 trial balances for Peerfield and Seagate follow: I Peerfield Dr (Cr) $ 5,000 28,700 28,400 Seagate Dr (Cr) $ 2,500 22.000 Current assets Plant assets, net Investment in Seagate Identifiable intangibles Goodwill Liabilities Capital stock Retained earnings, beginning Sales revenue Equity in net income of Seagate Cost of goods sold Operating expenses (20.300) (15,000) (25,000) (25,000 (800) 20,000 4.000 0 (11,000 (2.000) (10,000) (14,000) 9,000 3.500 s Using the attached workpaper template, prepare the consolidating workpaper for 2020 by hand. OR Download the Excel template from our D2L site under Materials/Content/Syllabus & General Resources Template - Consolidating Workpaper