PLEASE HELP ME!!!!

all instructions included & answers must be in that layout thank you!!

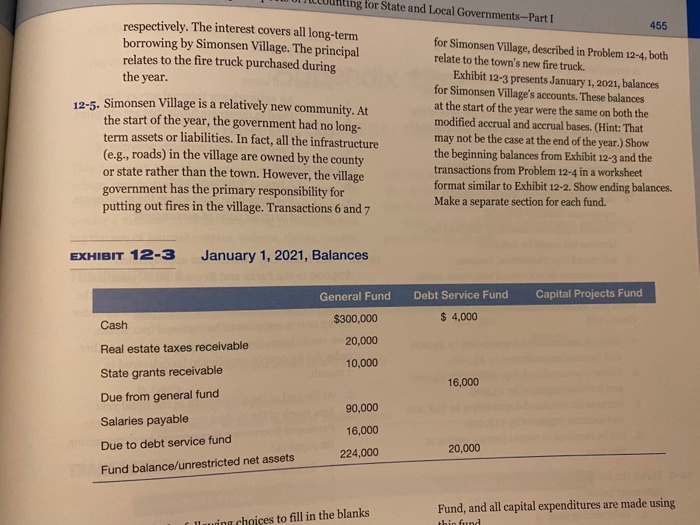

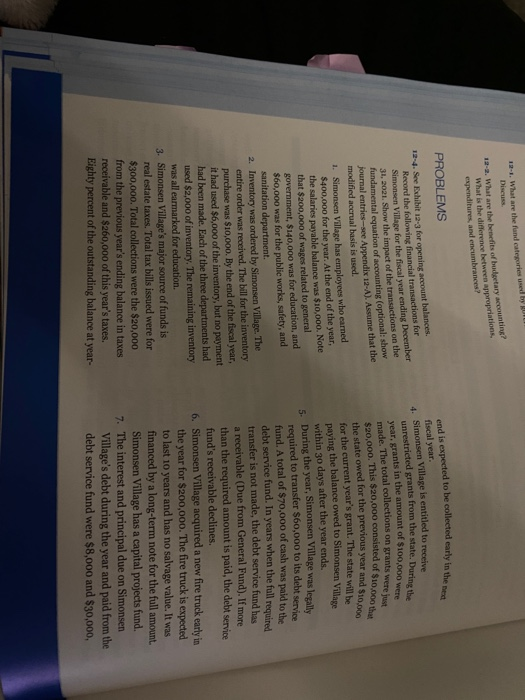

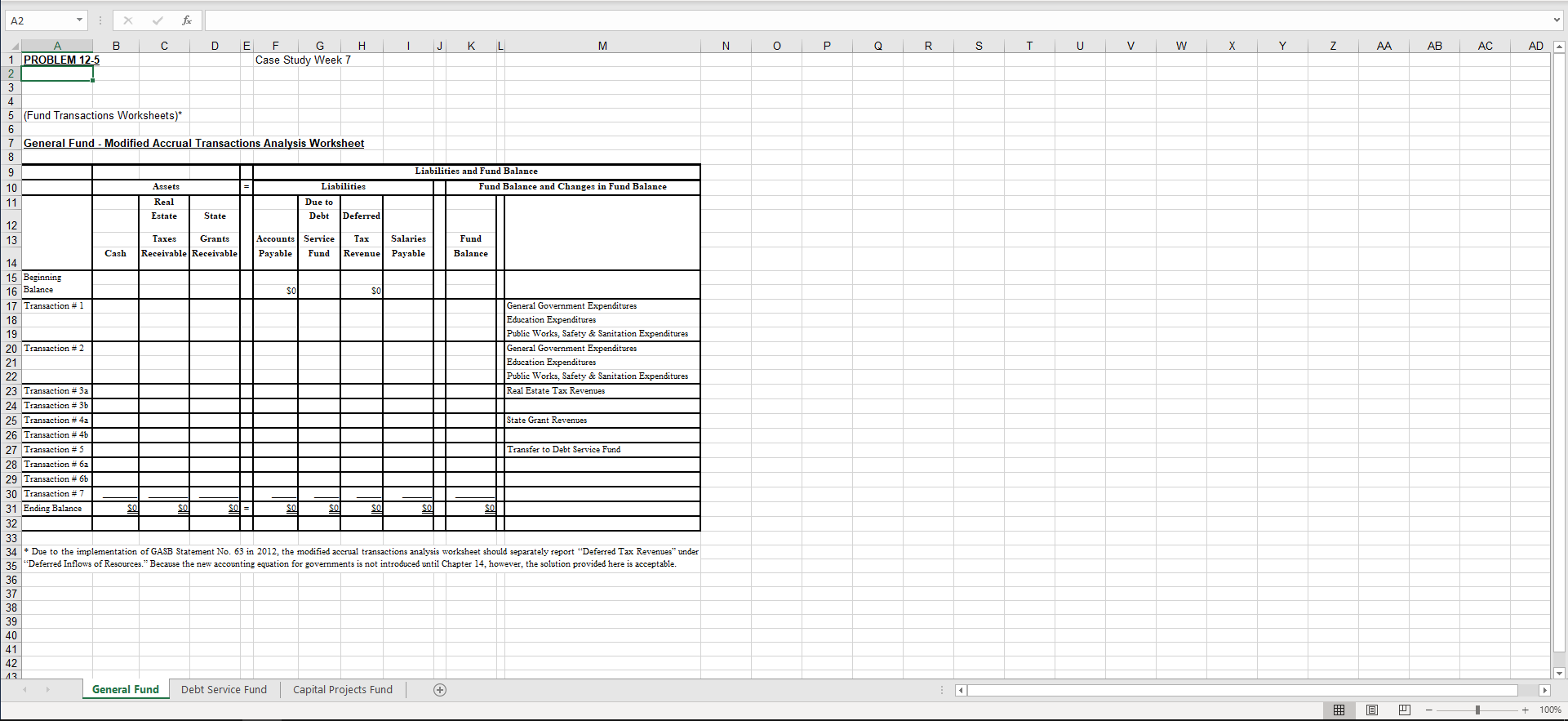

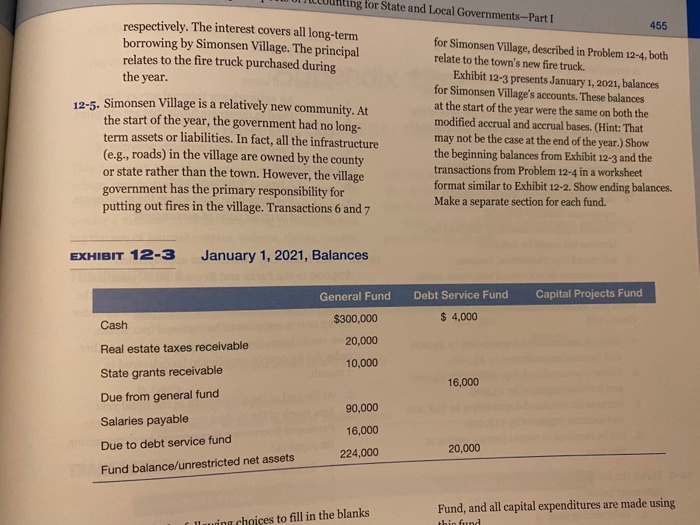

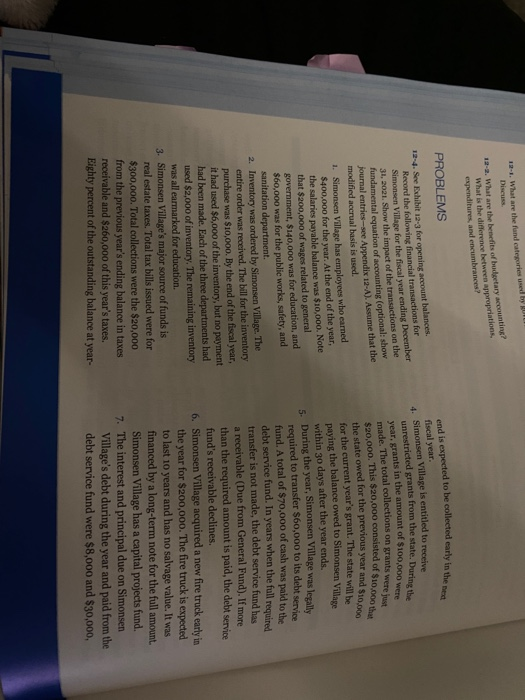

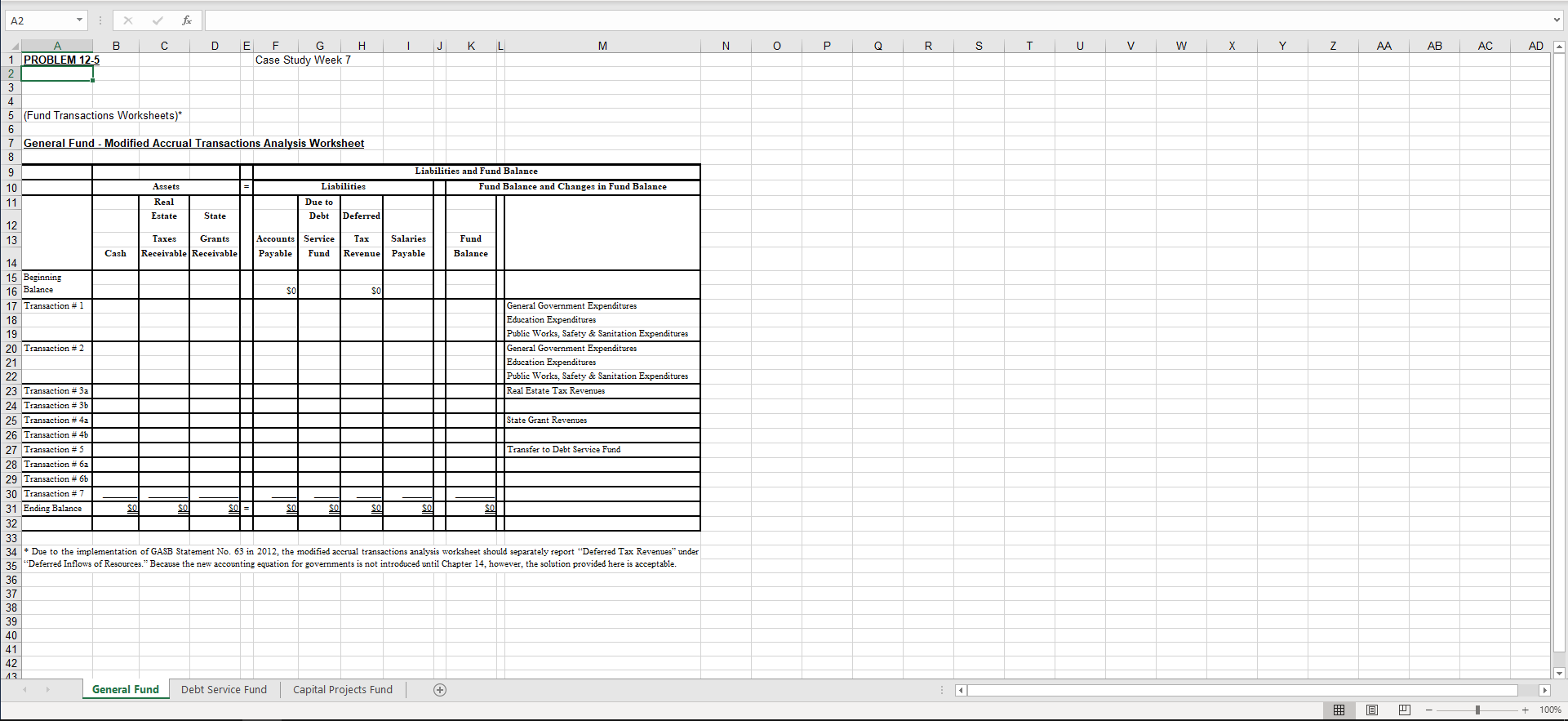

ating for State and Local Governments-Part I 455 respectively. The interest covers all long-term borrowing by Simonsen Village. The principal relates to the fire truck purchased during the year. 12-5. Simonsen Village is a relatively new community. At the start of the year, the government had no long- term assets or liabilities. In fact, all the infrastructure (e.g., roads) in the village are owned by the county or state rather than the town. However, the village government has the primary responsibility for putting out fires in the village. Transactions 6 and 7 for Simonsen Village, described in Problem 12-4, both relate to the town's new fire truck. Exhibit 12-3 presents January 1, 2021, balances for Simonsen Village's accounts. These balances at the start of the year were the same on both the modified accrual and accrual bases. (Hint: That may not be the case at the end of the year.) Show the beginning balances from Exhibit 12-3 and the transactions from Problem 12-4 in a worksheet format similar to Exhibit 12-2. Show ending balances. Make a separate section for each fund. EXHIBIT 12-3 January 1, 2021, Balances General Fund Debt Service Fund Capital Projects Fund $300,000 $ 4,000 Cash 20,000 10,000 Real estate taxes receivable State grants receivable Due from general fund Salaries payable 16,000 90,000 16,000 Due to debt service fund 224,000 20,000 Fund balance/unrestricted net assets Fund, and all capital expenditures are made using thin fund uring choices to fill in the blanks 12-1. What are the fund categories used by Discuss 12-2. What are the benefits of budgetary accounting? What is the difference between appropriations, expenditures, and encumbrances? fiscal year. 4. Simonsen Village is entitled to receive PROBLEMS 12-4. See Exhibit 12-3 for opening account balances. Record the following financial transactions for Simonsen Village for the fiscal year ending December 31, 2021. Show the impact of the transactions on the fundamental equation of accounting (optional show journal entries-see Appendix 12-A). Assume that the modified accrual basis is used. 1. Simonsen Village has employees who earned $400,000 for the year. At the end of the year, the salaries payable balance was $10,000. Note that $200,000 of wages related to general government, $140,000 was for education, and $60,000 was for the public works, safety, and sanitation department. 2. Inventory was ordered by Simonsen Village. The entire order was received. The bill for the inventory purchase was $10,000. By the end of the fiscal year, it had used $6,000 of the inventory, but no payment had been made. Each of the three departments had used $2,000 of inventory. The remaining inventory was all earmarked for education. 3. Simonsen Village's major source of funds is real estate taxes. Total tax bills issued were for $300,000. Total collections were the $20,000 from the previous year's ending balance in taxes receivable and $260,000 of this year's taxes. Eighty percent of the outstanding balance at year- for the current year's grant. The state will be paying the balance owed to Simonsen Village within 30 days after the year ends. 5. During the year, Simonsen Village was legally required to transfer $60,000 to its debt service fund. A total of $70,000 of cash was paid to the debt service fund. In years when the full required transfer is not made, the debt service fund has a receivable (Due from General Fund). If more than the required amount is paid, the debt service fund's receivable declines. 6. Simonsen Village acquired a new fire truck early in the year for $200,000. The fire truck is expected to last 10 years and has no salvage value. It was financed by a long-term note for the full amount. Simonsen Village has a capital projects fund. 7. The interest and principal due on Simonsen Village's debt during the year and paid from the debt service fund were $8,000 and $30,000, end is expected to be collected early in the next unrestricted grants from the state. During the year, grants in the amount of $100.000 were made. The total collections on grants were just $20,000. This $20,000 consisted of $10,000 that the state owed for the previous year and $10.000 A2 B D E H 1 J K L M N O R S T V w Y Z AA AB AC AD F Case Study Week 7 1 PROBLEM 12-5 3 4 5 (Fund Transactions Worksheets)* 6 7 General Fund - Modified Accrual Transactions Analysis Worksheet 8 9 Liabilities and Fund Balance 10 Assets Liabilities Fund Balance and Changes in Fund Balance 11 Real Due to Estate State Debt Deferred 12 13 Taxes Grants Accounts Service Tax Salaries Fund Cash Receivable Receivable Payable Fund Revenue Payable Balance 14 15 Beginning 16 Balance SO SO 17 Transaction 1 General Government Expenditures 18 Education Expenditures 19 Public Works, Safety & Sanitation Expenditures 20 Transaction # 2 General Government Expenditures 21 Education Expenditures 22 Public Works, Safety & Sanitation Expenditures 23 Transaction # 3a Real Estate Tax Revenues 24 Transaction #36 25 Transaction #4a State Grant Revenves 26 Transaction # 4b 27 Transaction # 5 Transfer to Debt Service Fund 28 Transaction # 6a 29 Transaction # 6b 30 Transaction #7 31 Ending Balance so 32 33 34 * Due to the implementation of GASB Statement No. 63 in 2012, the modified accrual transactions analysis worksheet should separately report "Deferred Tax Revenves" under 35 Deferred Inflows of Resources." Because the new accounting equation for governments is not introduced until Chapter 14. however, the solution provided here is acceptable. 36 37 38 39 40 41 42 13 General Fund Debt Service Fund Capital Projects Fund A @ + 100% 116 X D E F G H J K L M N 0 Q R s T V w X Y Z AB AC AD AB c 1 Debt Service Fund 2 3 Liabilities and Fund Balance Fund Balance and Changes in Fund Balance Assets = Liabilities Due from General Fund Cash Fund Balance Beginning Balance Transaction #1 Transaction #2 Transaction #3 Transaction #4 Transaction # 5 Transaction #6 Transaction Transfer from General fund Interest Expenditure Debt Service-Principal Expenditure Sol Ending Balance SO 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 General Fund Debt Service Fund Capital Projects Fund + 100% 116 X D E F G H 1 K M N O Q R s T U V w X Y z AA AB AC 1 Capital Projects Fund 2 Capital Projects Fund 3 4 Liabilities and Fund Balance Fund Balance and Changes in Fund Balance 5 Liabilities Assets Due from General Cash Fund Fund Balance Beginning Balance Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6a Transaction # 6b Transaction #7 Other Sources of FinancingNote Payable Capital Outlay Expenditure Ending Balance 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 General Fund Debt Service Fund Capital Projects Fund + 7 100% ating for State and Local Governments-Part I 455 respectively. The interest covers all long-term borrowing by Simonsen Village. The principal relates to the fire truck purchased during the year. 12-5. Simonsen Village is a relatively new community. At the start of the year, the government had no long- term assets or liabilities. In fact, all the infrastructure (e.g., roads) in the village are owned by the county or state rather than the town. However, the village government has the primary responsibility for putting out fires in the village. Transactions 6 and 7 for Simonsen Village, described in Problem 12-4, both relate to the town's new fire truck. Exhibit 12-3 presents January 1, 2021, balances for Simonsen Village's accounts. These balances at the start of the year were the same on both the modified accrual and accrual bases. (Hint: That may not be the case at the end of the year.) Show the beginning balances from Exhibit 12-3 and the transactions from Problem 12-4 in a worksheet format similar to Exhibit 12-2. Show ending balances. Make a separate section for each fund. EXHIBIT 12-3 January 1, 2021, Balances General Fund Debt Service Fund Capital Projects Fund $300,000 $ 4,000 Cash 20,000 10,000 Real estate taxes receivable State grants receivable Due from general fund Salaries payable 16,000 90,000 16,000 Due to debt service fund 224,000 20,000 Fund balance/unrestricted net assets Fund, and all capital expenditures are made using thin fund uring choices to fill in the blanks 12-1. What are the fund categories used by Discuss 12-2. What are the benefits of budgetary accounting? What is the difference between appropriations, expenditures, and encumbrances? fiscal year. 4. Simonsen Village is entitled to receive PROBLEMS 12-4. See Exhibit 12-3 for opening account balances. Record the following financial transactions for Simonsen Village for the fiscal year ending December 31, 2021. Show the impact of the transactions on the fundamental equation of accounting (optional show journal entries-see Appendix 12-A). Assume that the modified accrual basis is used. 1. Simonsen Village has employees who earned $400,000 for the year. At the end of the year, the salaries payable balance was $10,000. Note that $200,000 of wages related to general government, $140,000 was for education, and $60,000 was for the public works, safety, and sanitation department. 2. Inventory was ordered by Simonsen Village. The entire order was received. The bill for the inventory purchase was $10,000. By the end of the fiscal year, it had used $6,000 of the inventory, but no payment had been made. Each of the three departments had used $2,000 of inventory. The remaining inventory was all earmarked for education. 3. Simonsen Village's major source of funds is real estate taxes. Total tax bills issued were for $300,000. Total collections were the $20,000 from the previous year's ending balance in taxes receivable and $260,000 of this year's taxes. Eighty percent of the outstanding balance at year- for the current year's grant. The state will be paying the balance owed to Simonsen Village within 30 days after the year ends. 5. During the year, Simonsen Village was legally required to transfer $60,000 to its debt service fund. A total of $70,000 of cash was paid to the debt service fund. In years when the full required transfer is not made, the debt service fund has a receivable (Due from General Fund). If more than the required amount is paid, the debt service fund's receivable declines. 6. Simonsen Village acquired a new fire truck early in the year for $200,000. The fire truck is expected to last 10 years and has no salvage value. It was financed by a long-term note for the full amount. Simonsen Village has a capital projects fund. 7. The interest and principal due on Simonsen Village's debt during the year and paid from the debt service fund were $8,000 and $30,000, end is expected to be collected early in the next unrestricted grants from the state. During the year, grants in the amount of $100.000 were made. The total collections on grants were just $20,000. This $20,000 consisted of $10,000 that the state owed for the previous year and $10.000 A2 B D E H 1 J K L M N O R S T V w Y Z AA AB AC AD F Case Study Week 7 1 PROBLEM 12-5 3 4 5 (Fund Transactions Worksheets)* 6 7 General Fund - Modified Accrual Transactions Analysis Worksheet 8 9 Liabilities and Fund Balance 10 Assets Liabilities Fund Balance and Changes in Fund Balance 11 Real Due to Estate State Debt Deferred 12 13 Taxes Grants Accounts Service Tax Salaries Fund Cash Receivable Receivable Payable Fund Revenue Payable Balance 14 15 Beginning 16 Balance SO SO 17 Transaction 1 General Government Expenditures 18 Education Expenditures 19 Public Works, Safety & Sanitation Expenditures 20 Transaction # 2 General Government Expenditures 21 Education Expenditures 22 Public Works, Safety & Sanitation Expenditures 23 Transaction # 3a Real Estate Tax Revenues 24 Transaction #36 25 Transaction #4a State Grant Revenves 26 Transaction # 4b 27 Transaction # 5 Transfer to Debt Service Fund 28 Transaction # 6a 29 Transaction # 6b 30 Transaction #7 31 Ending Balance so 32 33 34 * Due to the implementation of GASB Statement No. 63 in 2012, the modified accrual transactions analysis worksheet should separately report "Deferred Tax Revenves" under 35 Deferred Inflows of Resources." Because the new accounting equation for governments is not introduced until Chapter 14. however, the solution provided here is acceptable. 36 37 38 39 40 41 42 13 General Fund Debt Service Fund Capital Projects Fund A @ + 100% 116 X D E F G H J K L M N 0 Q R s T V w X Y Z AB AC AD AB c 1 Debt Service Fund 2 3 Liabilities and Fund Balance Fund Balance and Changes in Fund Balance Assets = Liabilities Due from General Fund Cash Fund Balance Beginning Balance Transaction #1 Transaction #2 Transaction #3 Transaction #4 Transaction # 5 Transaction #6 Transaction Transfer from General fund Interest Expenditure Debt Service-Principal Expenditure Sol Ending Balance SO 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 General Fund Debt Service Fund Capital Projects Fund + 100% 116 X D E F G H 1 K M N O Q R s T U V w X Y z AA AB AC 1 Capital Projects Fund 2 Capital Projects Fund 3 4 Liabilities and Fund Balance Fund Balance and Changes in Fund Balance 5 Liabilities Assets Due from General Cash Fund Fund Balance Beginning Balance Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6a Transaction # 6b Transaction #7 Other Sources of FinancingNote Payable Capital Outlay Expenditure Ending Balance 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 General Fund Debt Service Fund Capital Projects Fund + 7 100%