Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please! help me all question please i really appreciate! D Question 1 2 pts A____ is the cost of or the money used in acquiring

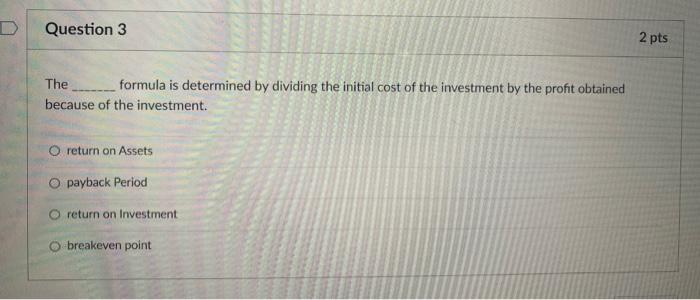

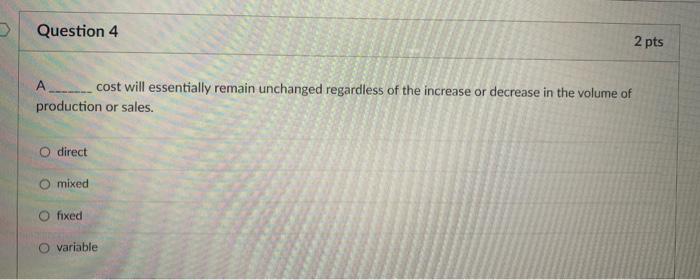

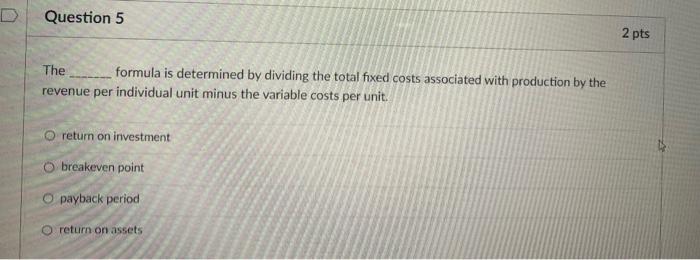

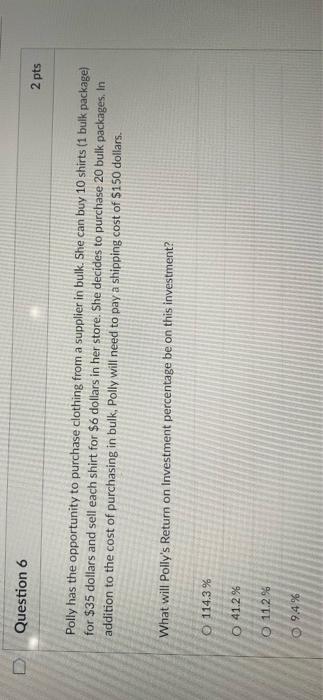

please! help me all question please

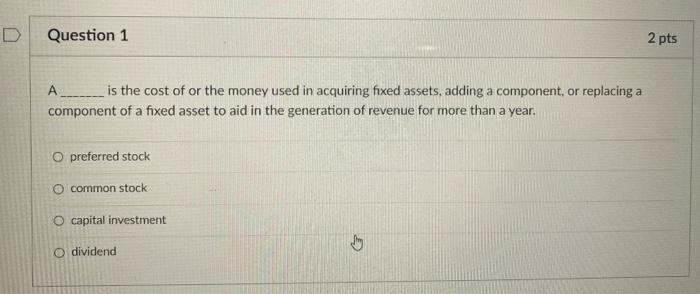

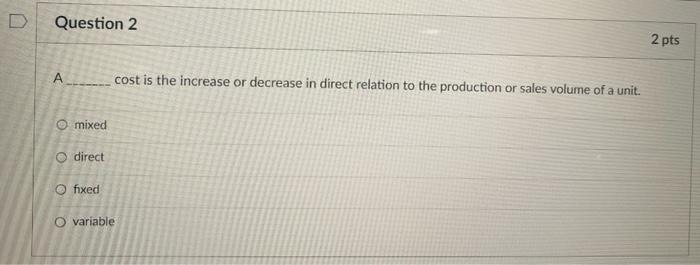

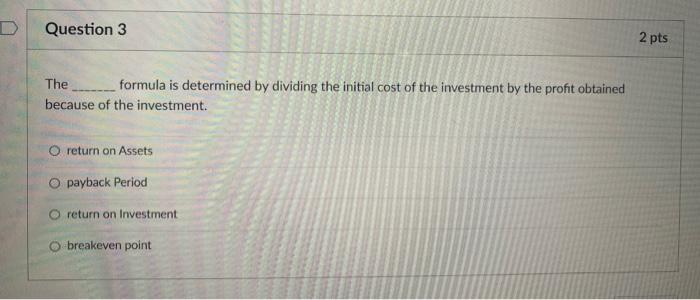

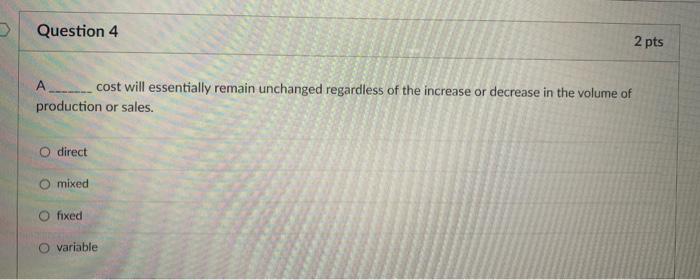

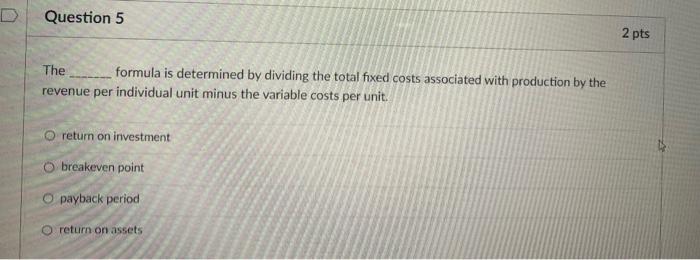

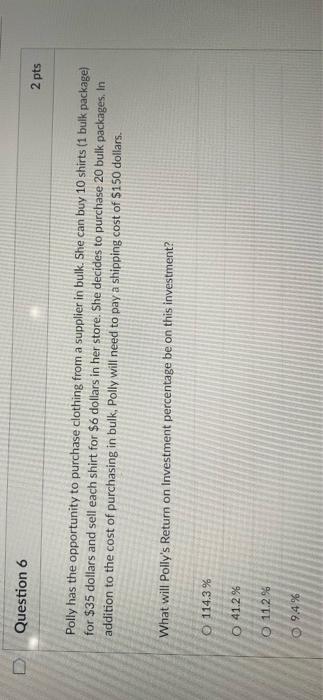

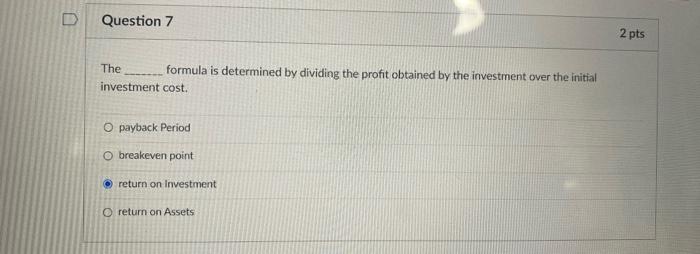

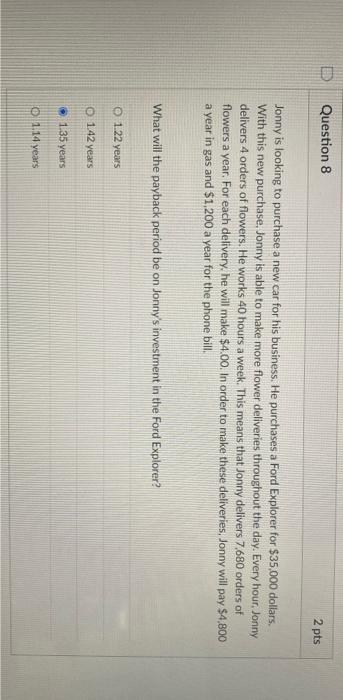

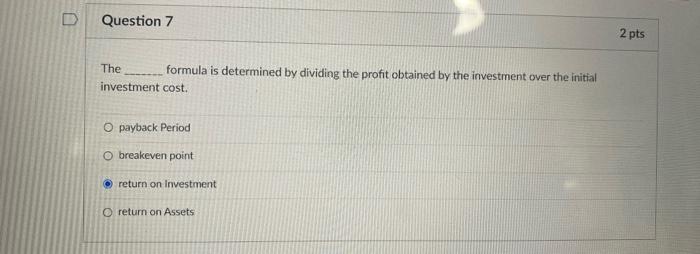

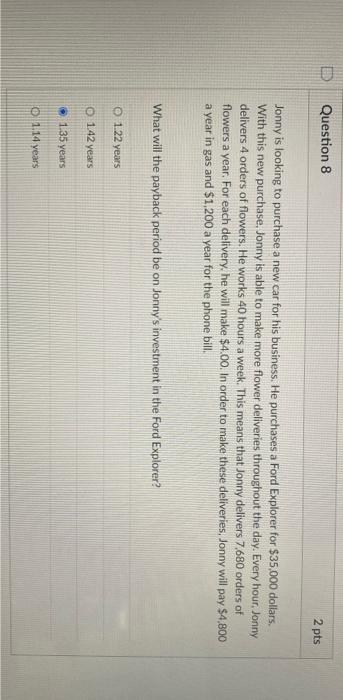

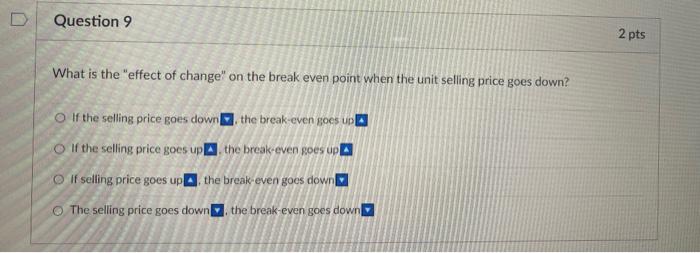

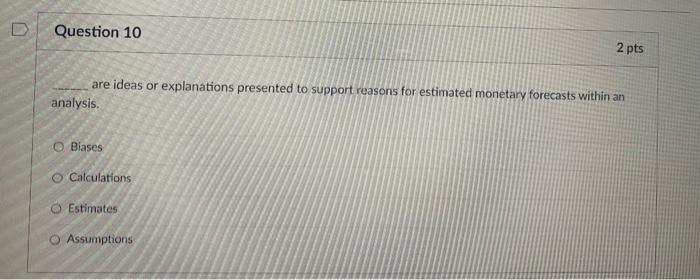

D Question 1 2 pts A____ is the cost of or the money used in acquiring fixed assets, adding a component, or replacing a component of a fixed asset to aid in the generation of revenue for more than a year. O preferred stock O common stock O capital investment Jy O dividend Question 2 2 pts Acost is the increase or decrease in direct relation to the production or sales volume of a unit. mixed O direct fixed O variable: D Question 3 2 pts The formula is determined by dividing the initial cost of the investment by the profit obtained because of the investment. O return on Assets O payback Period O return on Investment breakeven point Question 4 2 pts A cost will essentially remain unchanged regardless of the increase or decrease in the volume of production or sales. O direct mixed fixed O variable Question 5 2 pts The formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the variable costs per unit. O return on investment Obreakeven point O payback period O return on assets Question 6 2 pts Polly has the opportunity to purchase clothing from a supplier in bulk. She can buy 10 shirts (1 bulk package) for $35 dollars and sell each shirt for $6 dollars in her store. She decides to purchase 20 bulk packages. In addition to the cost of purchasing in bulk, Polly will need to pay a shipping cost of $150 dollars. What will Polly's Return on Investment percentage be on this investment? O114.3 % O 41.2% O 11.2% 94% D Question 7 2 pts The formula is determined by dividing the profit obtained by the investment over the initial investment cost. O payback Period. O breakeven point return on investment O return on Assets D Question 8 2 pts Jonny is looking to purchase a new car for his business. He purchases a Ford Explorer for $35,000 dollars. With this new purchase, Jonny is able to make more flower deliveries throughout the day. Every hour, Jonny delivers 4 orders of flowers. He works 40 hours a week. This means that Jonny delivers 7,680 orders of flowers a year. For each delivery, he will make $4.00. In order to make these deliveries, Jonny will pay $4,800 a year in gas and $1,200 a year for the phone bill. What will the payback period be on Jonny's investment in the Ford Explorer? O 1.22 years O 1.42 years 1.35 years O 1.14 years 0 Question 9 What is the "effect of change" on the break even point when the unit selling price goes down? If the selling price goes down the break-even goes up O If the selling price goes up the break-even goes up If selling price goes up the break-even goes down O The selling price goes down the break-even goes down 2 pts D Question 10 2 pts are ideas or explanations presented to support reasons for estimated monetary forecasts within an analysis. O Biases: O Calculations Estimates O Assumptions i really appreciate!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started