Answered step by step

Verified Expert Solution

Question

1 Approved Answer

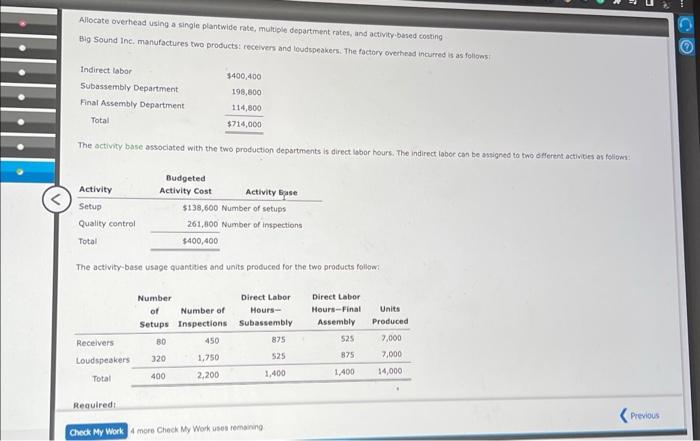

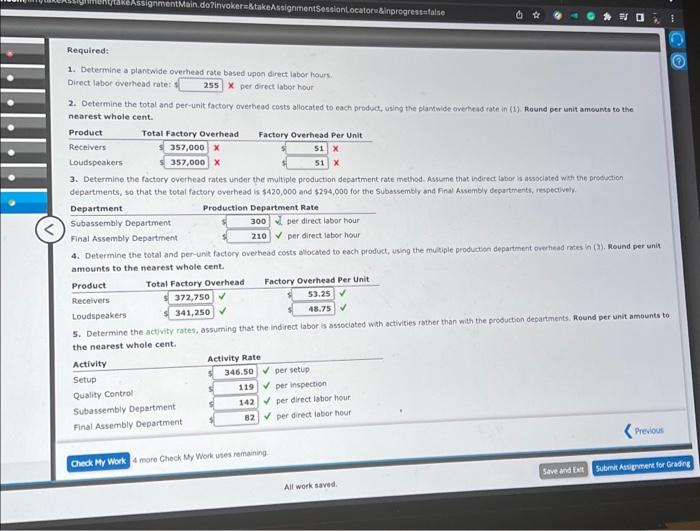

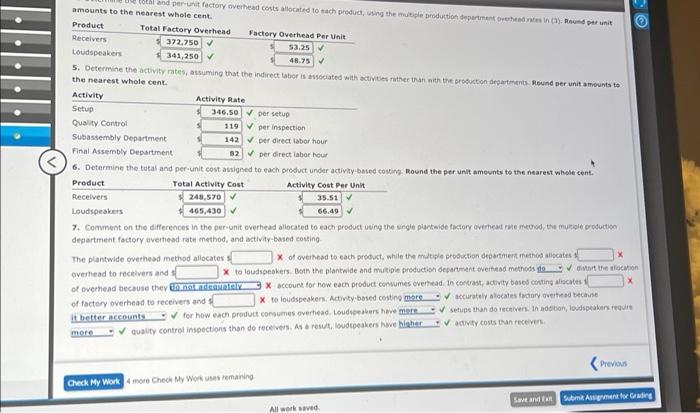

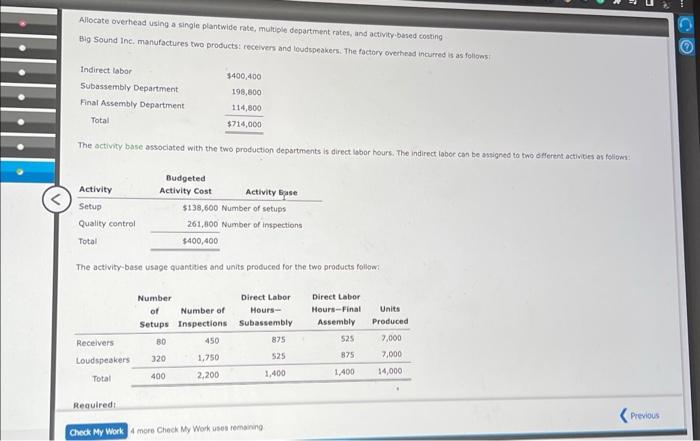

please help me Allocate overhead using a single plantwide rate, multiple department rates, and activity bused cosbing Big Sound Inc. manufactures two products: receivers and

please help me

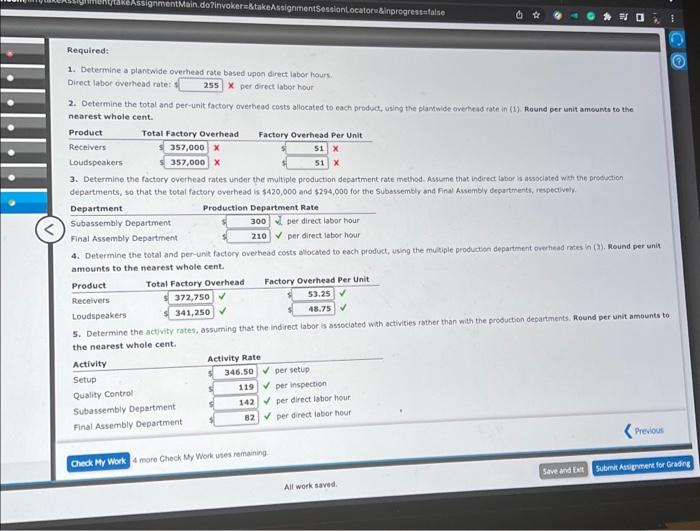

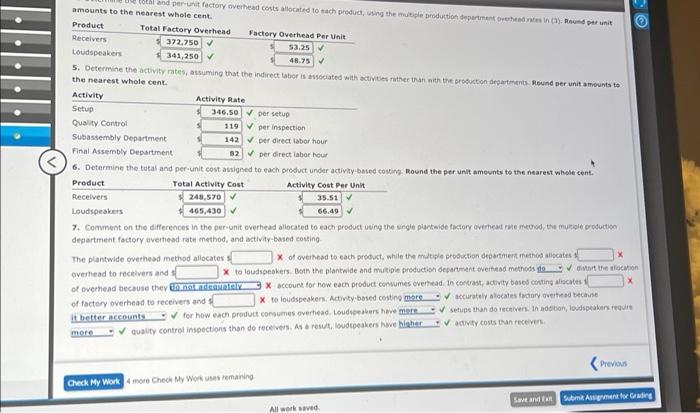

Allocate overhead using a single plantwide rate, multiple department rates, and activity bused cosbing Big Sound Inc. manufactures two products: receivers and loudspeakers. The foctorv ovethead incurred is as follons The activiy base associated with the two production departments is direct labor hours. The indirect laboe can be assigned to two defenent activites as foliome The activity base usage quantales and units produced for the two products follow: Reaulred 4 mere Check My Work uses remaing 1. Determine a plankwide overhead rate based upon direct labor hours. Direct labor overhead rate: 1 x per direct labor hour 2. Determine the total and per-unit factory overhead costs allocated to each product, using the plamwice overticad rate in (1). Round per unit amourts to the nearest whole cent. 3. Determine the factory overhead rates under the multiple production degartment rate method. Asume that indirect abor is assoclated with the precyetion departments, so that the total factory overhead is $420,000 and $294,000 for the Subassembly and Final Awembly decarments, respectively. 4. Determine the total and per-unit factory overhead corts aliocated to each product, using the musipie productog department orerhead raties ia (a), Mound per unit amounts to the nearest whole cent. 5. Determine the activity rates, assuming that the indirect labor is associated wah activities rather than with the production departments. Atound per unit amounts to the nearest whole cent. 4 more Chock My Work wtes remaining amounts to the nearest whole cent. 3. vecermine the activity rates, assuming that the indirect labor is assceated with activites rather than nith the probuction aesartments Mound per unit a mounts to the nearest whole cent. 6. Determine the totas and per-unit cost assigned to-each product under activily-bbsed costivg. Round the per unit amewnts to the nearest whole cent. 7. Comment on the differences in the per-unit overhead aliocated to each product uving the single punteide fuctory overhead rue michod, the mugiple production degartment factory avertead rate method, and activity-based cosing- The plantwide overhead method allocates 1x of overhead to each product while the multiple production debartmert meithiga alibcates 1 overhead to receivers and 3 X to loudsbeskers. Both the plantwide and mutiple preduction department overtwed methods Givhrt the alocmpin of overhead bectuie they X account for how each product cowumes everhead. in coctra3t, activity bases costing alipcates 1 of factory overhead to receivers and 1 x ta loudspeakers. Activtyrbosed conting accurately alocaties toctnry guerte od because for how each product consumes overhead. Loudvealers heve setupe than do rectivers. In a0dton, lokdspeaken requie quality control inspections than do recentis. As a resid, loudipeakers hwe adivify coses than fecevers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started