Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me and also please explain part c thanku the net present value of this investment using a rate of 10 percent. Round to

please help me and also please explain part c thanku

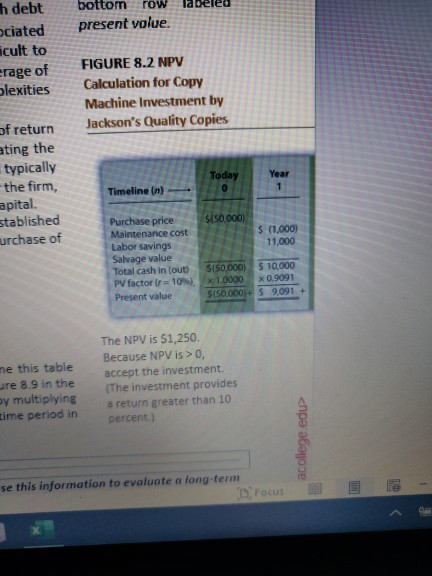

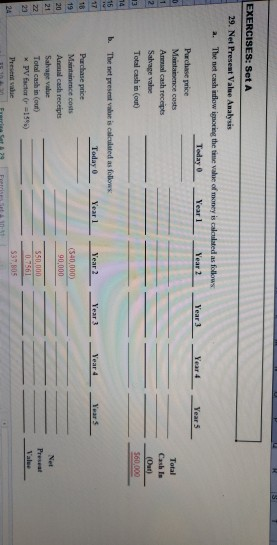

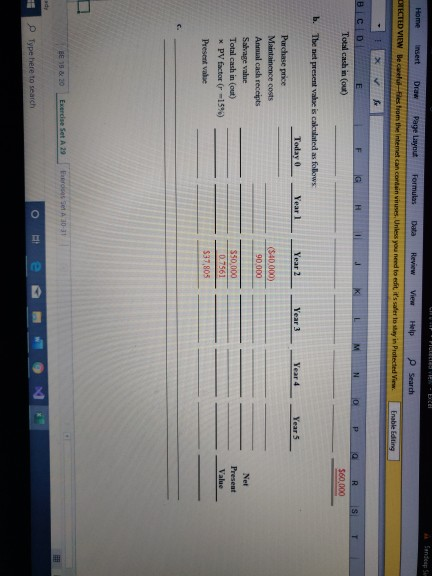

the net present value of this investment using a rate of 10 percent. Round to the nearest dolar SVSU 58,00 per year for 15 years. Find 28. Net Present Value Calculation with Taxes. An investment costing $200,000 today will result in cash Savings of $85,000 per year for 3 years. The company has a tax rate of 40 percent, and requires an 11 percent rate of return. Find the net present value of this investment using the format shown in Figure 8.7. Round to the nearest dollar Exercises: Set A 29. Net Present Value Analysis. Excavating, Inc., would like to purchase a tractor for $200,000. The tractor is expected to have a life of 5 years, and a salvage value of $10,000. Annual maintenance costs will total $40,000. Annual net cash receipts resulting from this machine are predicted to be $90,000. The company's required rate of return is 15 percent. Required: a. Ignoring the time value of money, calculate the net cash inflow or outflow resulting from this investment opportunity. b. Find the net present value of this investment using the format presented in Figure 8.2. Round all calculations to the nearest dollar. C. Should the company purchase the tractor? Explain. 2017 Boston Academic Publishing, Inc., db. a Flat World. All rights reserved al Rate of Return Analysis. Excavating, Inc., would like to purchase a tractor for $200,000. The of 10000 Annual maintenance costs labeled bottom row present volue. h debt ociated icult to erage of lexities FIGURE 8.2 NPV Calculation for Copy Machine Investment by Jackson's Quality Copies Today of return ating the typically -the firm, apital. stablished urchase of Timeline (n) $150,000) S (1.000) 11,000 Purchase price Maintenance cost Labor savings Salvage value Total cash in (out) PV factor (r= 10%), Present value 5150,000) 5 10,000 x 1.0000 x 0.9091 $150,000+ $ 9,091 + me this table ure 8.9 in the by multiplying time period in The NPV is $1,250. Because NPV is > 0, accept the investment. (The investment provides a return greater than 10 percent) acollege edu> se this information to evaluate a long-term Focus EXERCISES: Set A 29. Net Present Value Analysis a. The net cash inflow ignoring the value of money is calculated as follows Today Year 1 Year 2 Purchase price Mainance costs An cash receipts Salvage value Total cash in (out) Year 3 Year 4 Total Cashes 160 000 b. The ne present voor is calculated as follows: (540,000) 90,000 Purchase price Manence costs Anual cash receipts Sahrage value Total cash in (out) * PV factor ( 159) Net 550.000 0.7561 $37,805 151 Fri Sat 79 Fre Home Insert DECHD VIEW Becul Draw P age Layout Formulas Data Review View Help Search e s from the Internet can continues. Unless you need to edit it's safe to stay in Protected view Enable Editing B C F G H I D E Total cash in (out) L M N O P Q S T R 560,000 b. Year 1 Year 2 Year 3 Year - Tears The net present value is calculated as follows Today Purchase price Maintainence costs Annual cash receipts Salvage vahae Total cash in (out) * PV factor (r -15%) ($40.000) 90.000 Net Present S50,000 0.7561 Value Present value $37,805 BE 19 & 20 Exercise Set A 29 d e A10-31 Type here to search Ofte @Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started