please help me . and please make the answer clearly . then i can unstandard . please make the answer clealy. thank you

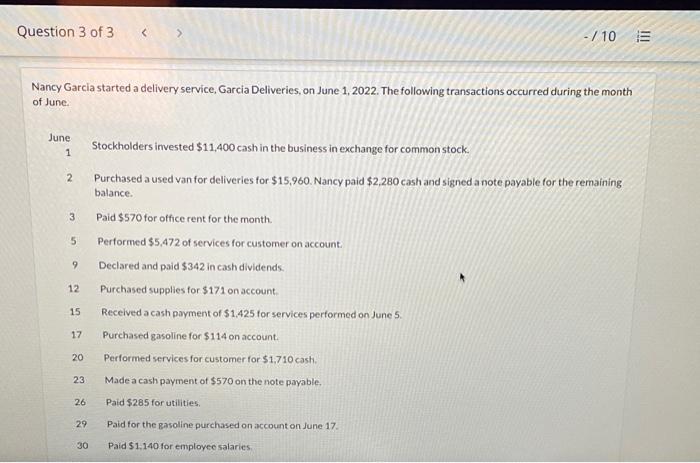

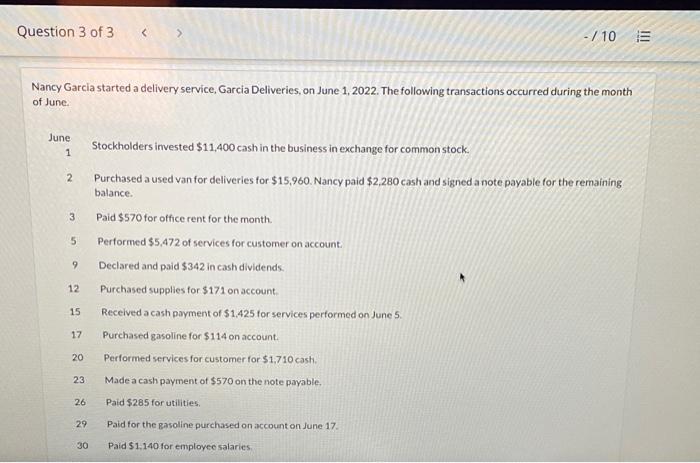

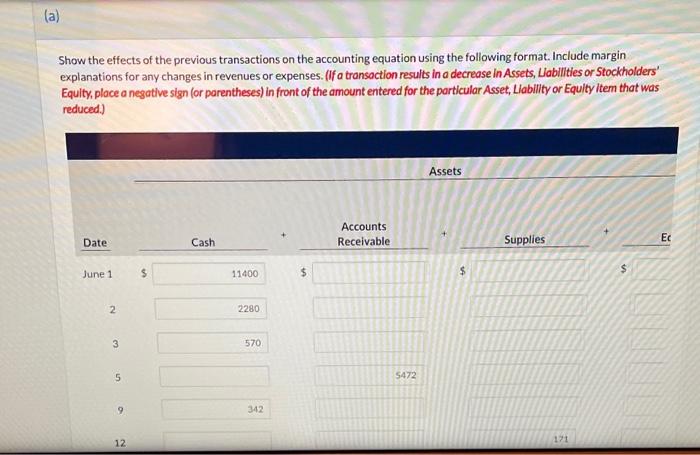

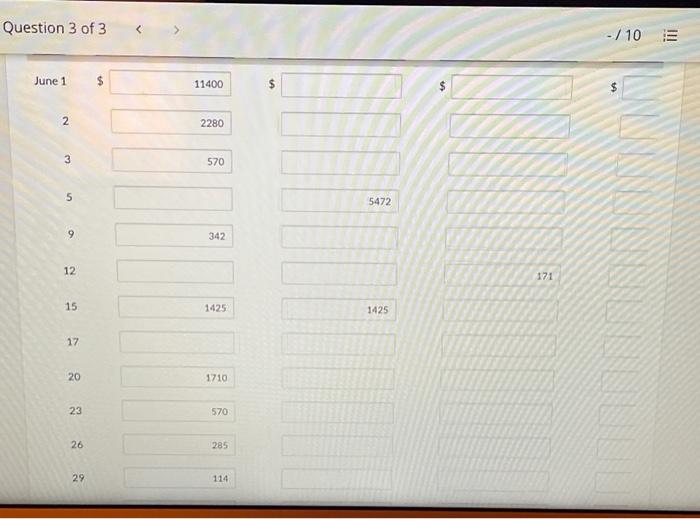

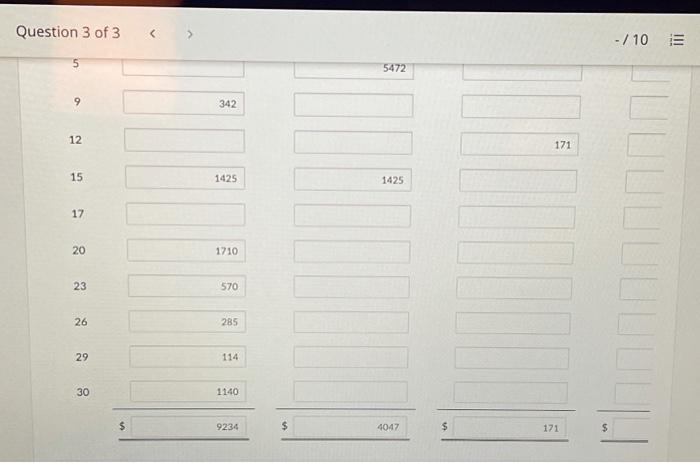

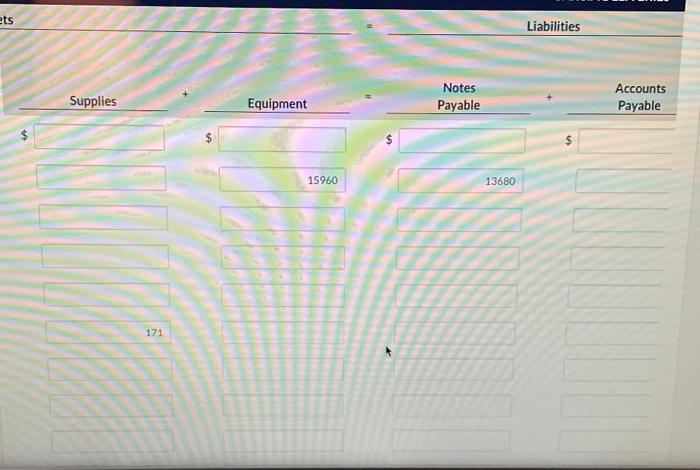

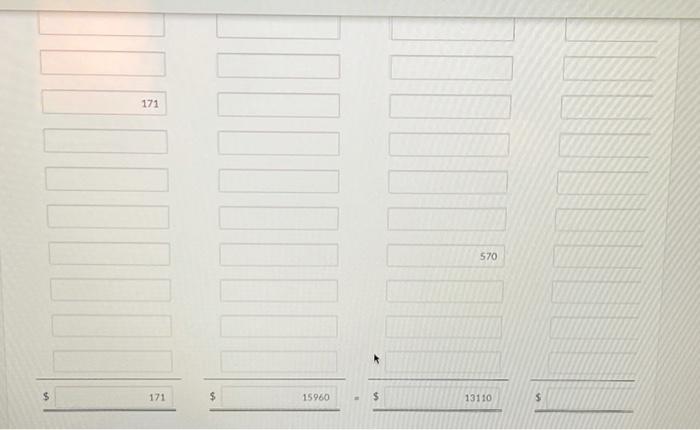

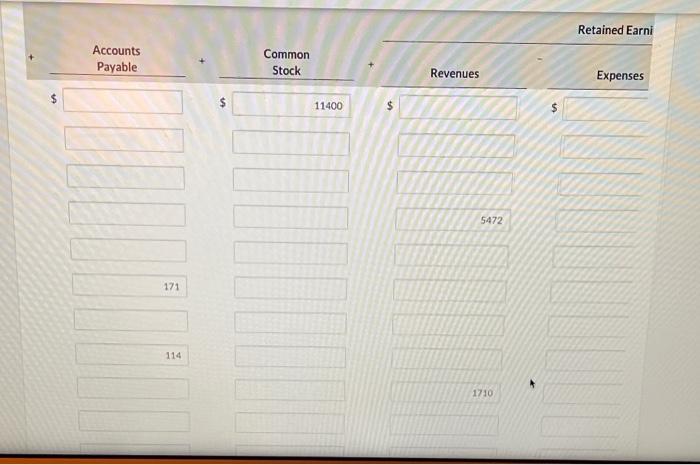

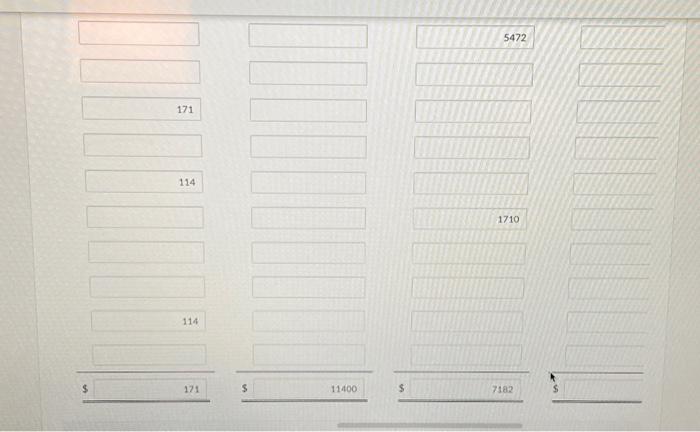

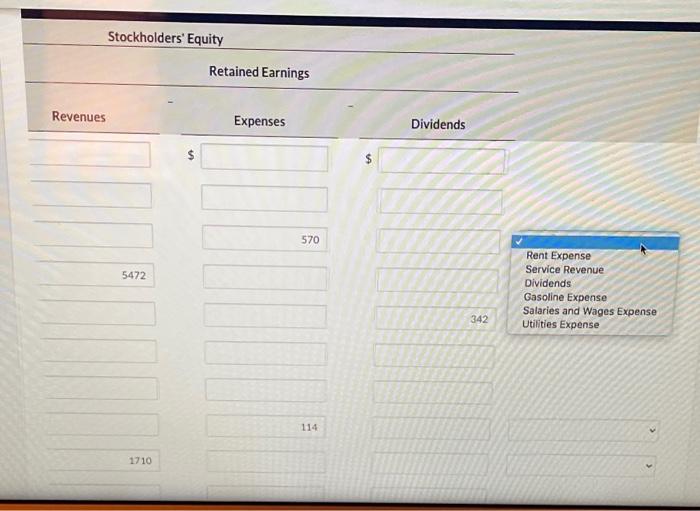

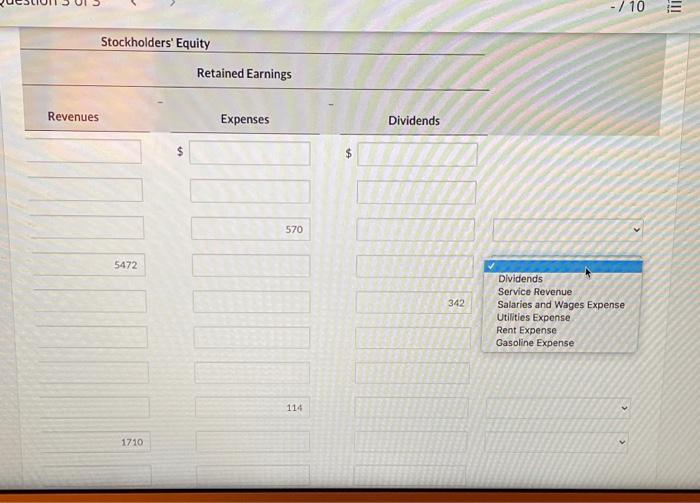

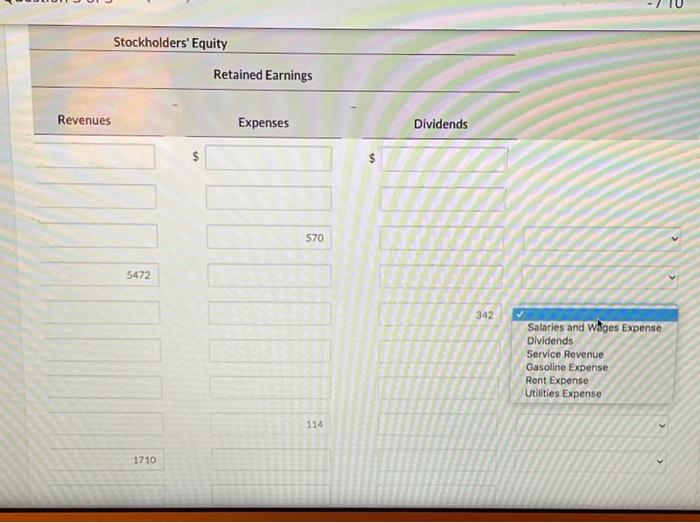

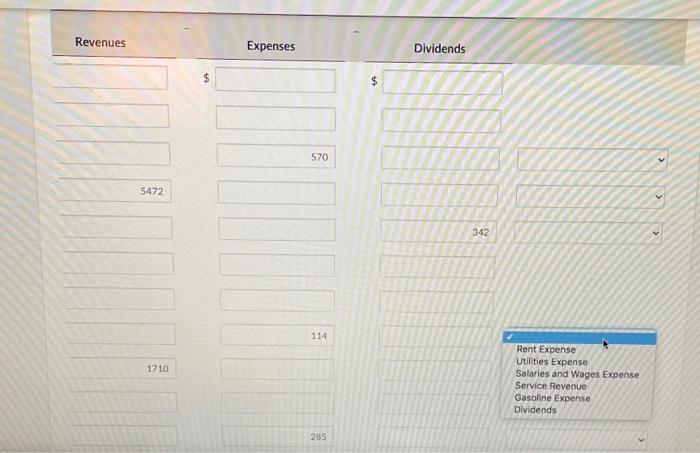

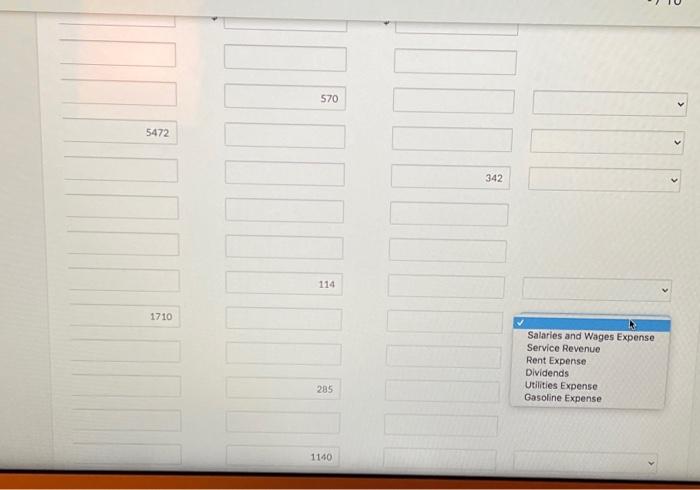

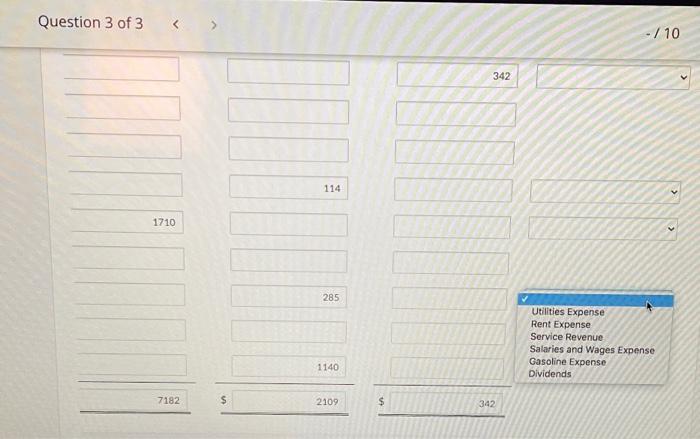

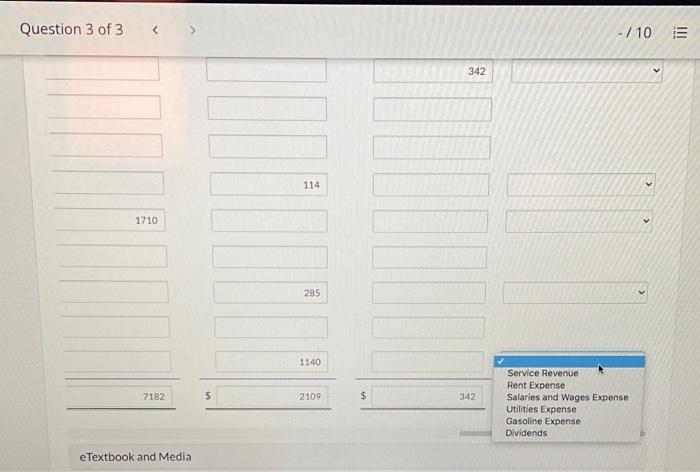

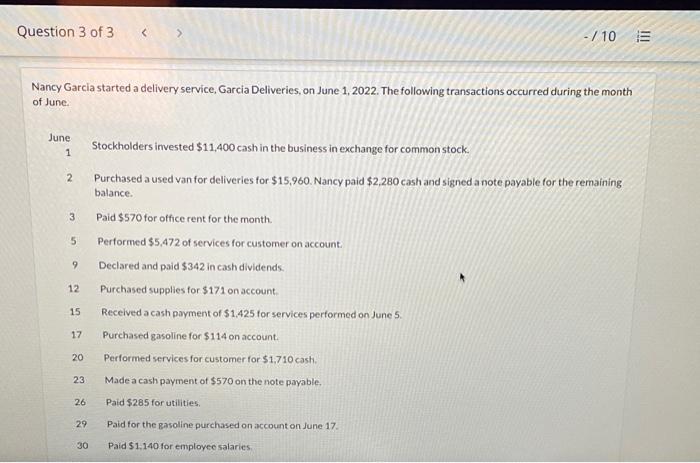

Question 3 of 3 - / 10 III Nancy Garcia started a delivery service, Garcia Deliveries, on June 1, 2022. The following transactions occurred during the month of June. June 1 Stockholders invested $11,400 cash in the business in exchange for common stock. Purchased a used van for deliveries for $15,960. Nancy paid $2,280 cash and signed a note payable for the remaining 2 balance 3 5 9 12 15 Paid $570 for office rent for the month, Performed $5.472 of services for customer on account Declared and paid $342 in cash dividends. Purchased supplies for $171 on account Received a cash payment of $1.425 for services performed on June 5 Purchased gasoline for $114 on account. Performed services for customer for $1,710 cash. Made a cash payment of $570 on the note payable. Paid $285 for utilities Paid for the gasoline purchased on account on June 17. 17 20 23 26 29 30 Paid $1.140 for employee salaries (a) Show the effects of the previous transactions on the accounting equation using the following format. Include margin explanations for any changes in revenues or expenses. (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity Item that was reduced.) Assets Accounts Receivable Date Cash Supplies EC June 1 $ 11400 $ $ $ 2 2280 3 570 5 5472 2 342 12 171 Question 3 of 3 -/10 June 1 $ 11400 $ $ 2 2280 3 570 5 5472 9 342 12 171 15 1425 1425 17 20 1710 23 570 26 285 29 114 Question 3 of 3 - / 10 III 5 5472 9 342 12 171 15 1425 1425 17 20 1710 23 570 26 285 29 114 30 1140 $ 9234 $ 4047 $ 171 $ ets Liabilities Supplies Equipment Notes Payable Accounts Payable 15960 13680 171 171 570 $ 171 $ 15960 $ 13110 5 Retained Earni Accounts Payable Common Stock Revenues Expenses $ $ 11400 $ $ 5472 171 114 1710 5472 171 114 1710 114 $ 171 $ 11400 $ 7182 $ Stockholders' Equity Retained Earnings Revenues Expenses Dividends $ 570 5472 Rent Expense Service Revenue Dividends Gasoline Expense Salaries and Wages Expense Utilities Expense 342 114 1710 - / 10 III Stockholders' Equity Retained Earnings Revenues Expenses Dividends $ 570 5472 342 Dividends Service Revenue Salaries and Wages Expense Utilities Expense Rent Expense Gasoline Expense 114 1710 Stockholders' Equity Retained Earnings Revenues Expenses Dividends 570 5472 342 Salaries and Wages Expense Dividends Service Revenue Gasoline Expense Rent Expense Utilities Expense 114 1710 Revenues Expenses Dividends $ 570 5472 342 114 1710 Rent Expense Utilities Expense Salaries and Wages Expense Service Revenue Gasoline Expense Dividends 285 TU 570 5472 342 114 1710 Salaries and Wages Expense Service Revenue Rent Expense Dividends Utilities Expense Gasoline Expense 285 1140 Question 3 of 3 - / 10 342 114 1710 285 Utilities Expense Rent Expense Service Revenue Salaries and Wages Expense Gasoline Expense Dividends 1140 7182 $ 2109 $ 342 Question 3 of 3 - / 10 III 342 114 1710 285 1140 7182 $ 2109 $ 342 Service Revenue Rent Expense Salaries and Wages Expense Utilities Expense Gasoline Expense Dividends e Textbook and Media