*please help me answer 1a & 1b*

*please help me answer 1a & 1b*

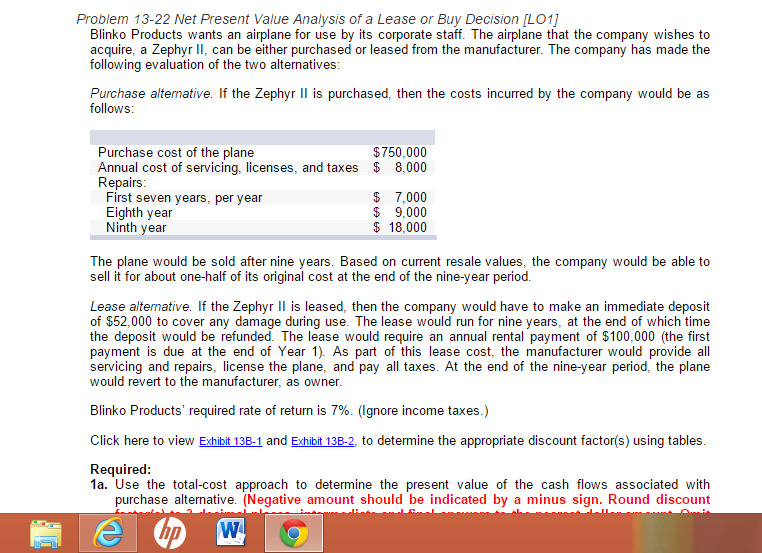

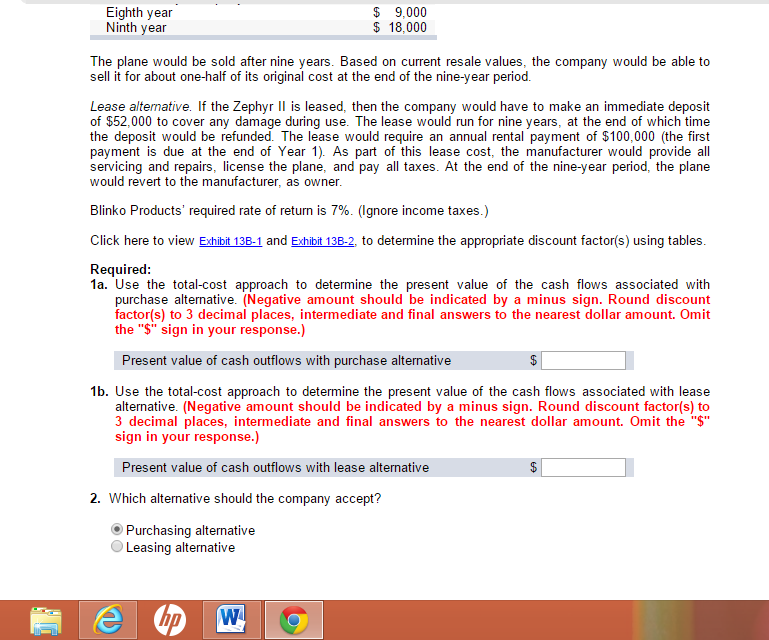

Net Present Value Analysis of a Lease or Buy Decision [LO1] Blinko Products wants an airplane for use by its corporate staff. The airplane that the company wishes to acquire, a Zephyr II, can be either purchased or leased from the manufacturer. The company has made the following evaluation of the two alternatives: Purchase alternative. If the Zephyr II is purchased, then the costs incurred by the company would be as follows: Purchase cost of the plane $750,000 Annual cost of servicing, licenses, and taxes Repairs: $ 8,000 First seven years, per year $ 7,000 Eighth year $ 9,000 Ninth year $ 18,000 The plane would be sold after nine years. Based on current resale values, the company would be able to sell it for about one-half of its original cost at the end of the nine-year period. Lease alternative. If the Zephyr II is leased, then the company would have to make an immediate deposit of $52,000 to cover any damage during use. The lease would run for nine years, at the end of which time the deposit would be refunded. The lease would require an annual rental payment of $100,000 (the first payment is due at the end of Year 1). As part of this lease cost, the manufacturer would provide all servicing and repairs, license the plane, and pay all taxes. At the end of the nine-year period, the plane would revert to the manufacturer, as owner. Blink 0 Products' required rate of return is 7%. (Ignore income taxes.) Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables. Required: Use the total-cost approach to determine the present value of the cash flows associated with purchase alternative (Negative amount should be indicated by a minus sign. Round discount Eighth year $ 9,000 Ninth year $18,000 The plane would be sold after nine years. Based on current resale values, the company would be able to sell it for about one-half of its original cost at the end of the nine-year period. Lease alternative. If the Zephyr II is leased, then the company would have to make an immediate deposit of $52,000 to cover any damage during use. The lease would run for nine years, at the end of which time the deposit would be refunded. The lease would require an annual rental payment of $100,000 (the first payment is due at the end of Year 1). As part of this lease cost, the manufacturer would provide all servicing and repairs, license the plane, and pay all taxes. At the end of the nine-year period, the plane would revert to the manufacturer, as owner. Blinko Products' required rate of return is 7%. (Ignore income taxes.) Click here to view Exhibit 13B-1 and Exhibit 13B-2. to determine the appropriate discount factor(s) using tables. Required: Use the total-cost approach to determine the present value of the cash flows associated with purchase alternative (Negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, intermediate and final answers to the nearest dollar amount. Omit the "$" sign in your response.) Present value of cash outflows with purchase alternative $ Use the total-cost approach to determine the present value of the cash flows associated with lease alternative (Negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, intermediate and final answers to the nearest dollar amount. Omit the "$" sign in your response.) Present value of cash outflows with lease alternative $ Which alternative should the company accept? Purchasing alternative Leasing alternative

*please help me answer 1a & 1b*

*please help me answer 1a & 1b*