Question

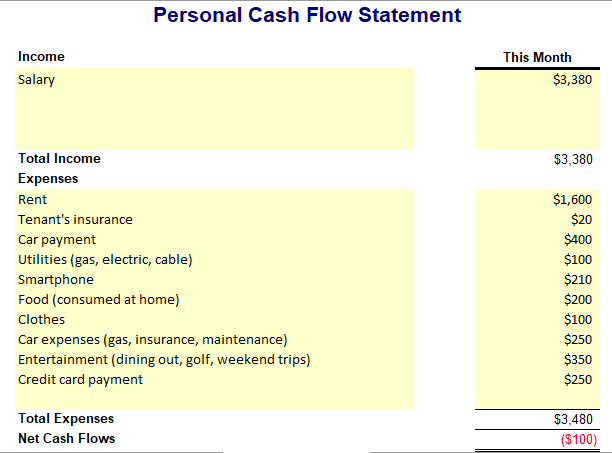

Please help me answer #4! Personal cash flow statement, please read the text below to help with question 4! Thank you! Second, he wants to

Please help me answer #4! Personal cash flow statement, please read the text below to help with question 4! Thank you!

Second, he wants to know what factors he should consider when selecting a financial institution. He is mostly interested in financial institutions that will assist him in making investment and money management decisions. He finds savings accounts boring and has no desire to have one because the interest rate is so low. Also, he has decided that it is time to upgrade his car and housing situation; However, he is concerned about his liquidity. His credit card, with a $65 annual fee and a 21% annual interest rate, compounded daily, is nearing its credit limit of $10,000. He is reluctant to sell his stock to get cash to pay off part of the credit balance. Recall that Brad thinks his stock has the potential to make him rich. Brad is questioning whether to pay off his credit card. He can easily afford the required minimum monthly payment and sees no reason to pay off the balance. To address his liquidity concerns, Brad has more closely monitored the cost of his smartphone and his entertainment expenses, reducing them by $50 per month and $100 per month, respectively. As a result, his monthly income now exceeds his expenses. However, now Brad has the urge to upgrade his car and housing situations. Brad is interested in purchasing an SUV for $25,000, which includes all fees and taxes. He still owes $10,000 on his 3-year-old sedan, which has 87,000 kilometers on it, and has found a buyer who will pay him $15,000 cash. This would enable him to pay off his current car loan and still have $5000 for a down payment on the SUV. He would finance the remainder of the purchase price for four years at 8%, compounded monthly. Anticipating your objections to purchasing the SUV, Brad has an alternate plan to lease the SUV for three years period the terms of the lease are $400 per month, a $0.35 charge per kilometer over 24,000 kilometers annually, and 1200 due upon signing for the first month lease payment and security deposit. Brad would also like to purchase his condo. He can make the purchase with 10% down. The total purchase price is 140,000. A mortgage with a five-year term and a 25-year amortization. Is available with an annual interest rate of 6%, compounded

2.) If Brads stock doubles in value over the next five years, what annual return, compounded monthly, what he realized? Based on his projected annualized return, would it be advisable to sell this stock to pay off his credit card? Should Brad consider shopping for a new credit card? If so, how should he go about doing this?

ANSWER: 13.94

3.) Address brad's reluctance to pay off his credit card balance. Show him what he could earn be in five years if he pays the credit card balance off and invested the required minimum monthly payment saved at 6%, compounded monthly, note: the required minimum monthly payment is 3% of the outstanding balance of $8000.

ANSWER: 16744.81

4.) Soon Brad has managed to pay off his credit card and no longer has required minimum monthly payment of $250. All other expenses remain the same. Re-compute his expenses to determine whether Brad can afford to:

-purchased the new car -at least the new car -purchased the condo -purchased the car and the condo -lease the car and purchased the condo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started