Answered step by step

Verified Expert Solution

Question

1 Approved Answer

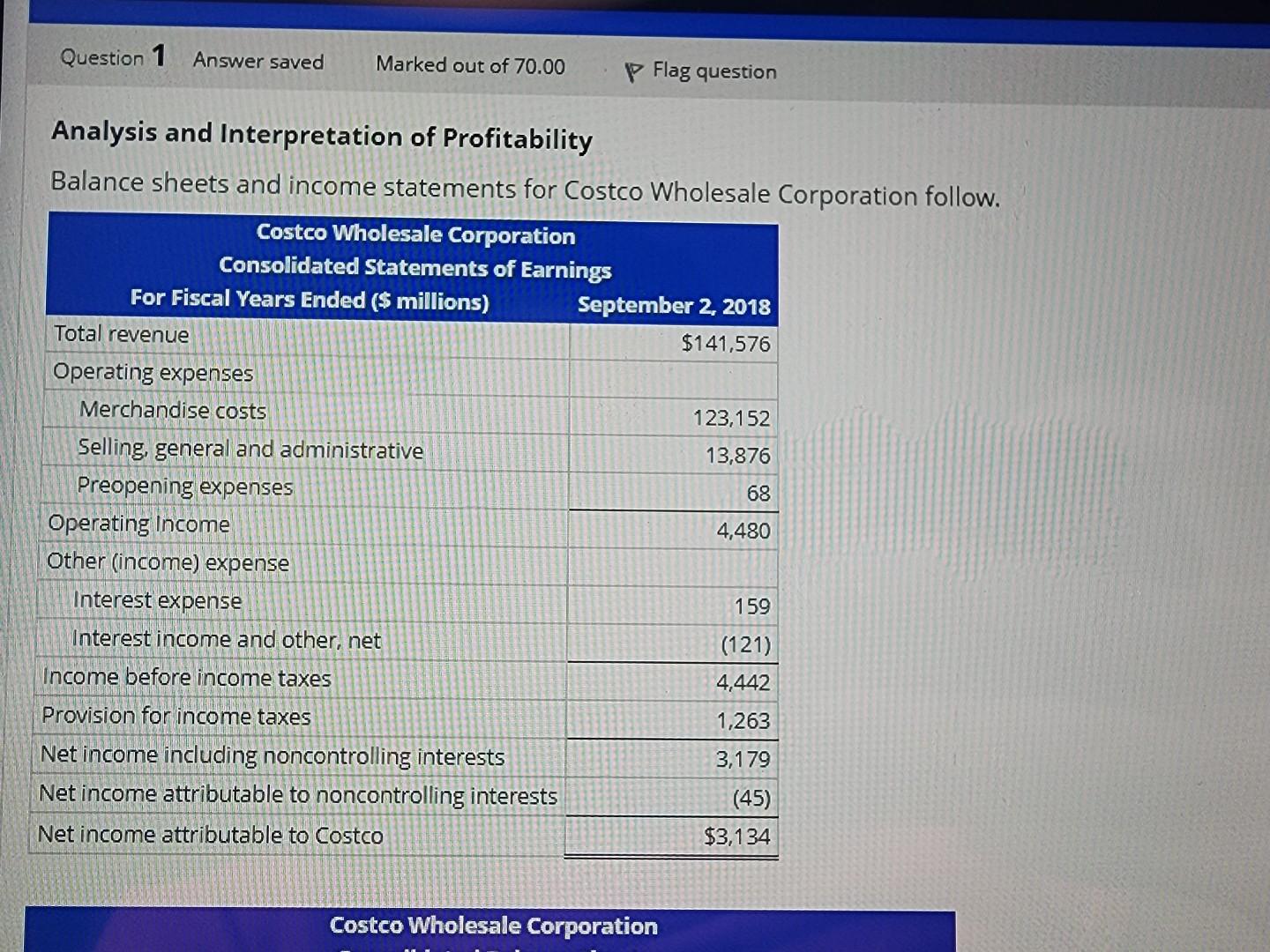

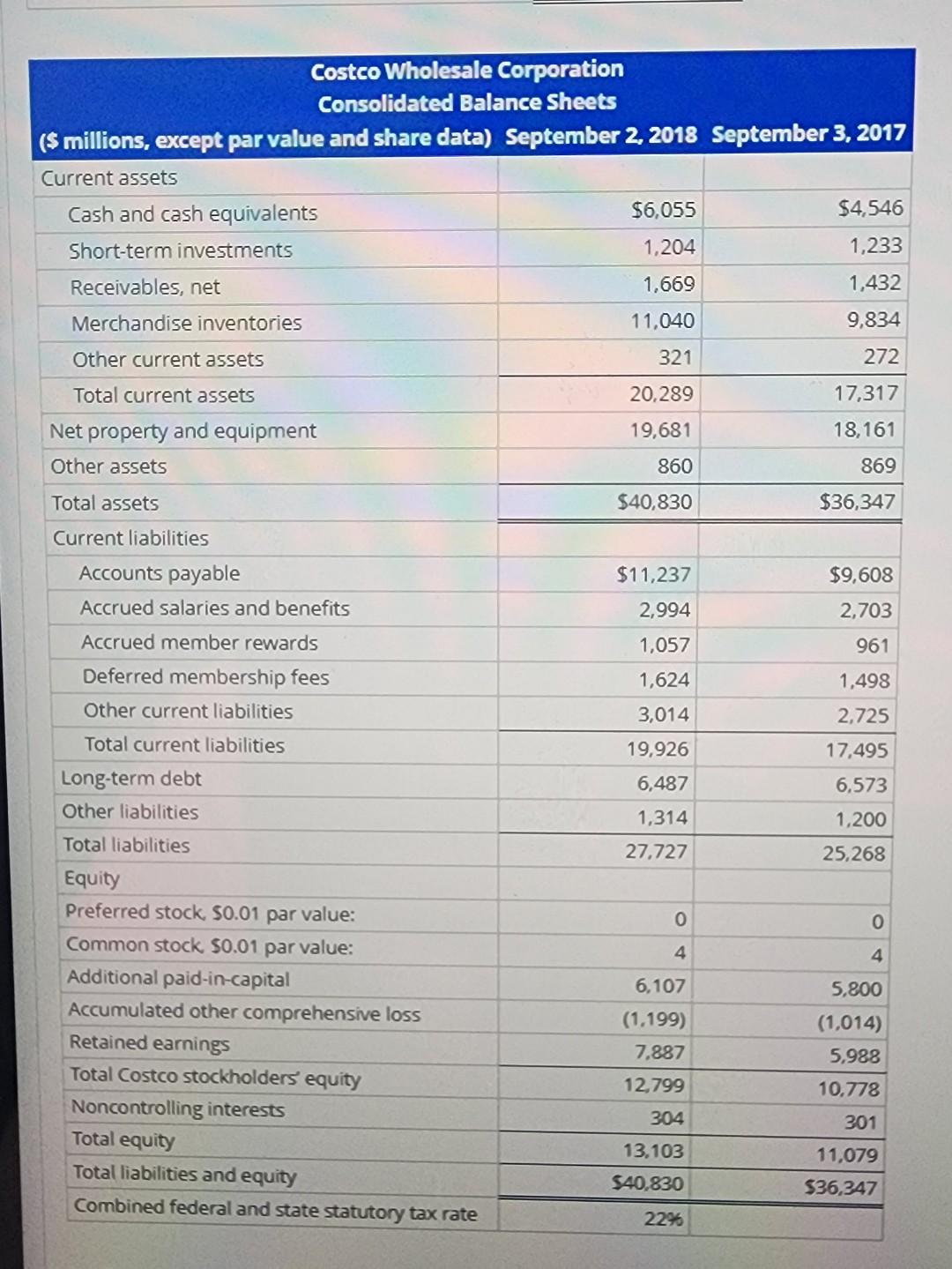

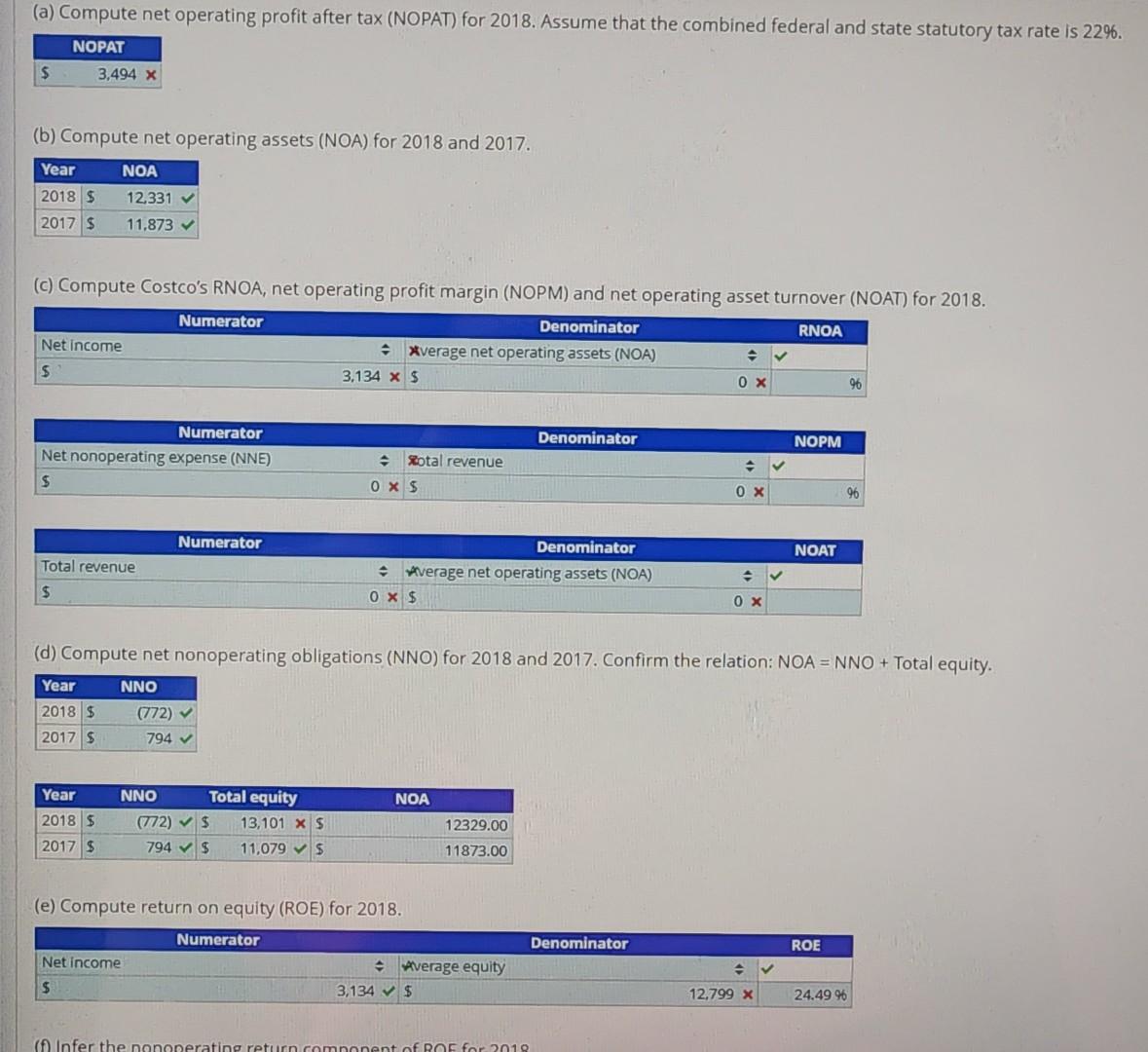

Please help me answer all incorrect answers . Analysis and Interpretation of Profitability Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale

Please help me answer all incorrect answers.

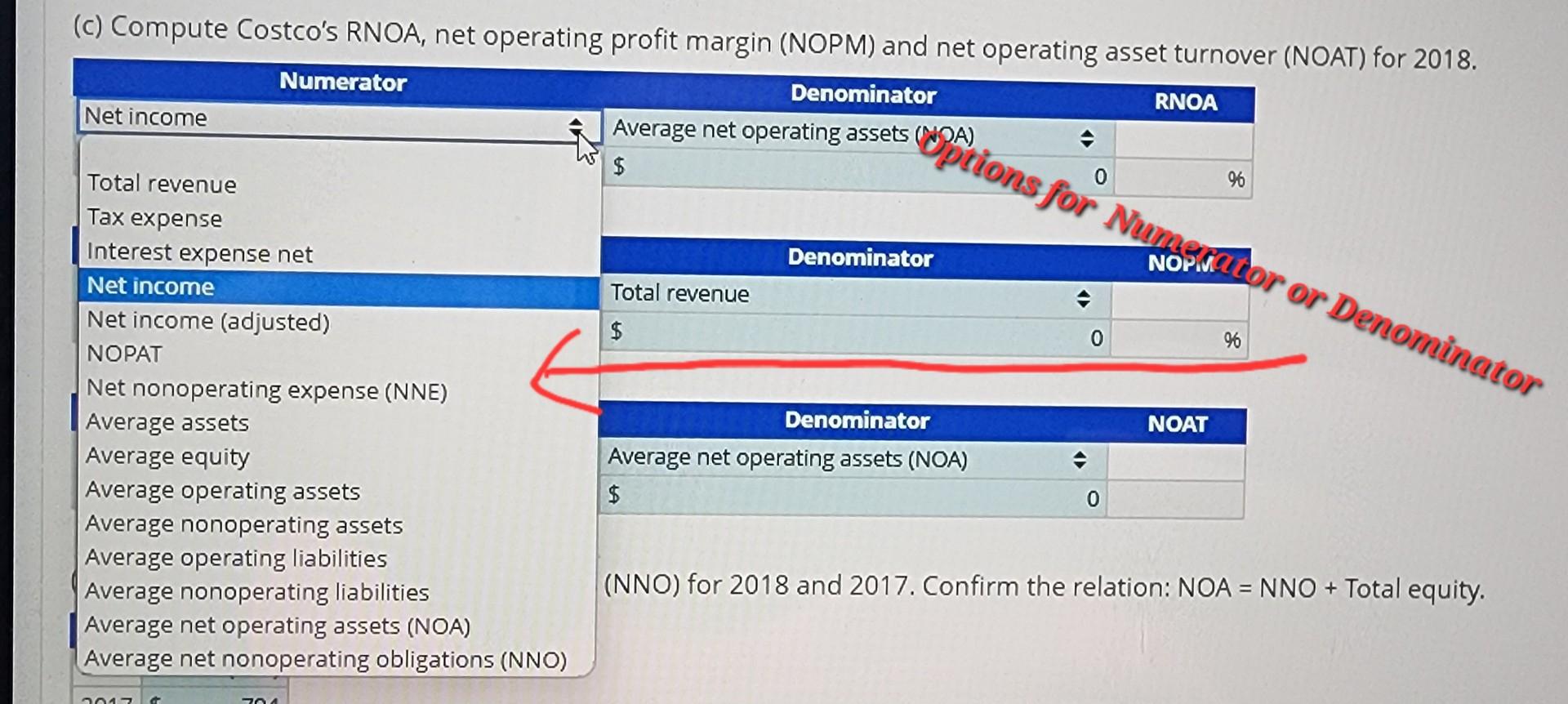

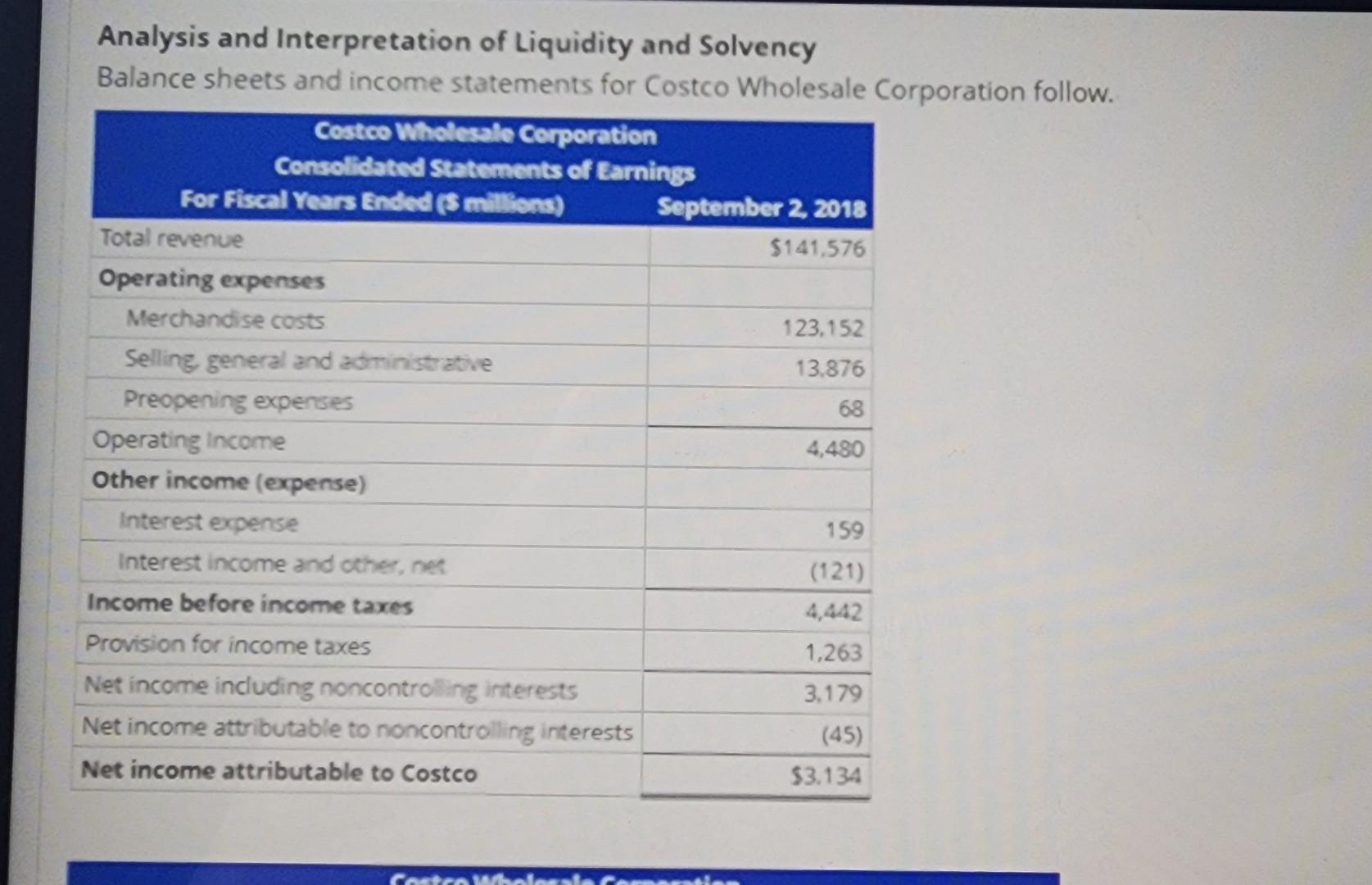

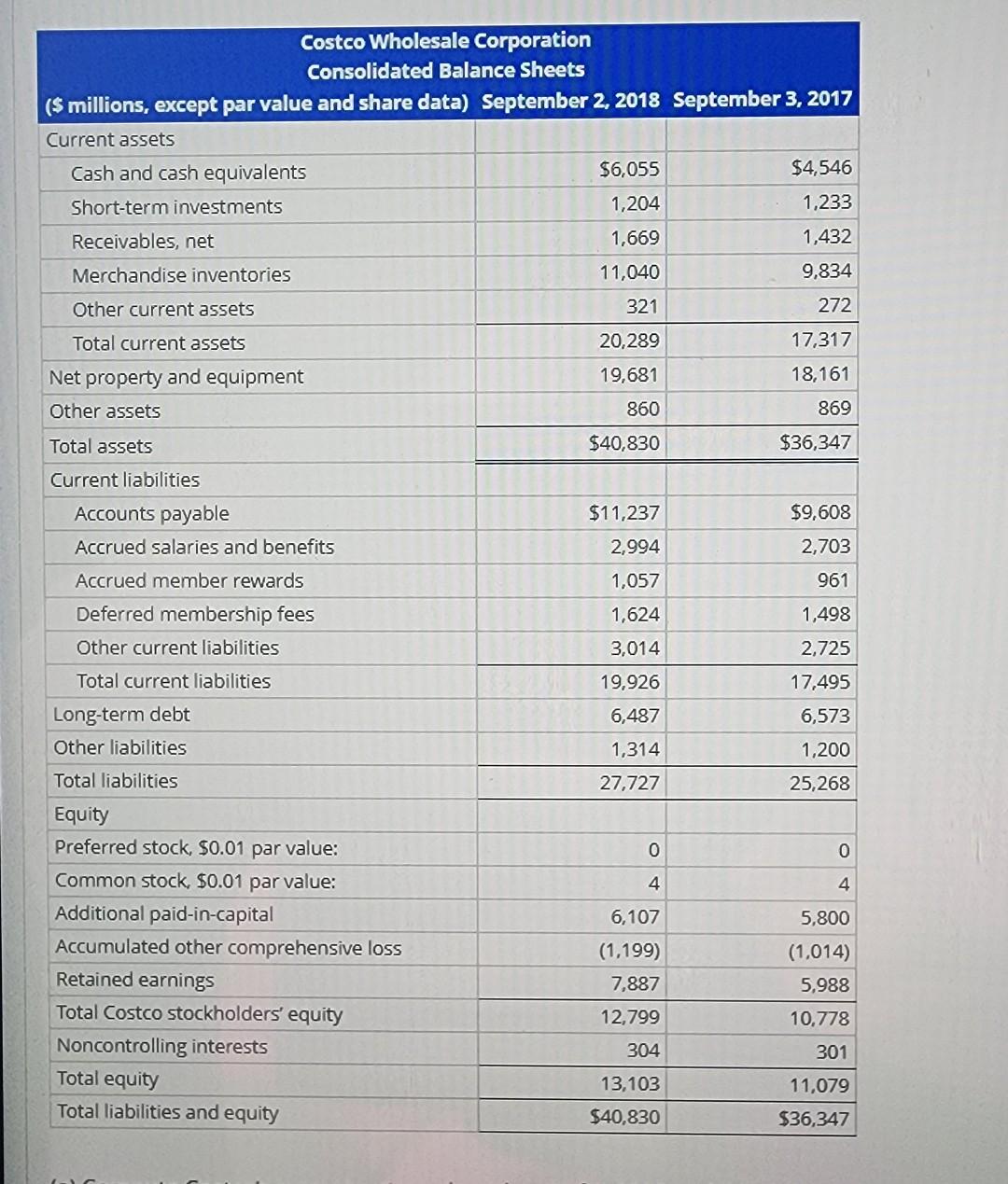

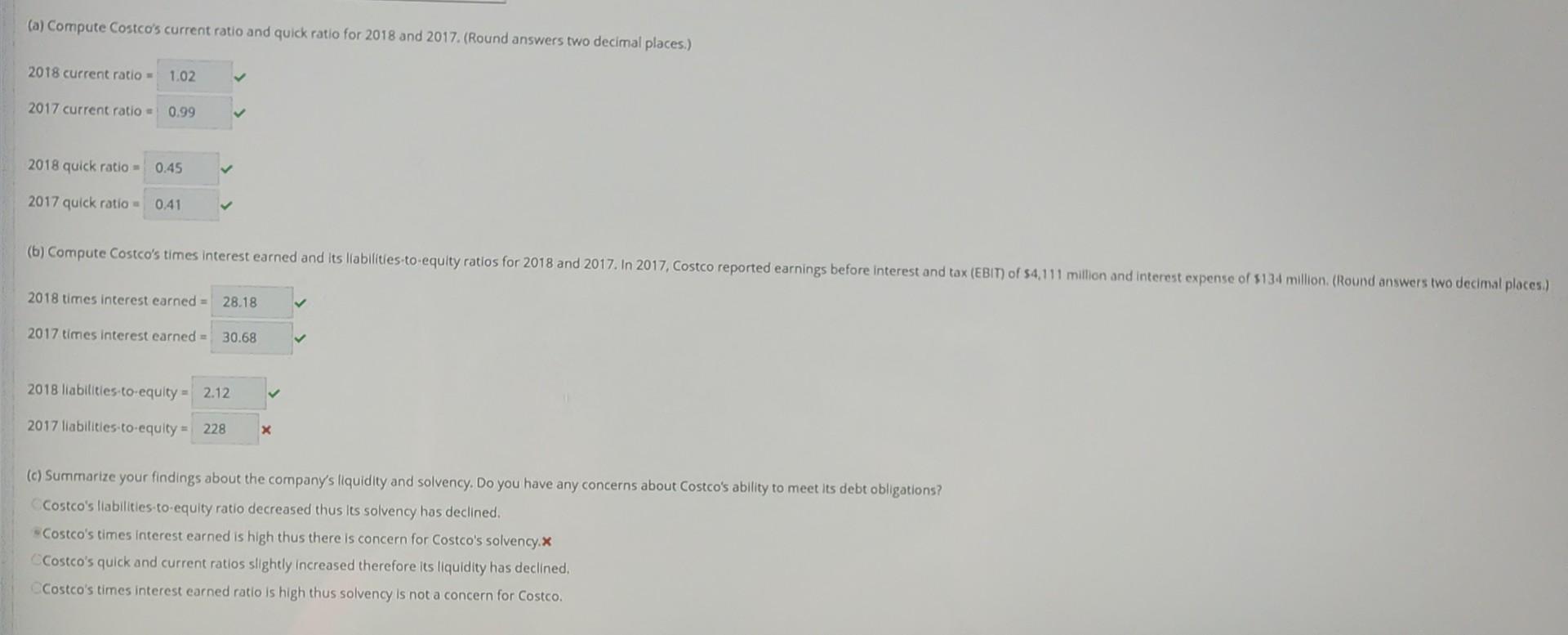

Analysis and Interpretation of Profitability Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Balance Sheets (\$ millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets (a) Compute net operating profit after tax (NOPAT) for 2018 . Assume that the combined federal and state statutory tax rate is 22%. (b) Compute net operating assets (NOA) for 2018 and 2017. (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. (d) Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. (e) Compute return on equity (ROE) for 2018. uity. Analysis and Interpretation of Liquidity and Solvency Ralance shepte and incoma ctstamante 6a. ra... wh-1., - prporation follow. Costco Wholesale Corporation Consolidated Balance Sheets ( $ millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets (a) Compute Costco's current ratio and quick ratio for 2018 and 2017. (Round answers two decimal places.) 2018 current ratio = 2017 current ratio = 2018 quick ratio = 2017 quick ratio = 2018 times interest earned = 2017 times interest earned = 2018 liabilities to-equity = 2017 liabilities to equity = (c) Summarize your findings about the company's liquidity and solvency. Do you have any concerns about Costco's ability to meet its debt obligations? Costco's liabilities to-equity ratio decreased thus its solvency has declined. " Costco's times interest earned is high thus there is concern for Costco's solvency. x Costco's quick and current ratios slightly increased therefore its liquidity has declined. Costco's times interest earned ratio is high thus solvency is not a concern for Costco. Analysis and Interpretation of Profitability Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Balance Sheets (\$ millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets (a) Compute net operating profit after tax (NOPAT) for 2018 . Assume that the combined federal and state statutory tax rate is 22%. (b) Compute net operating assets (NOA) for 2018 and 2017. (c) Compute Costco's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. (d) Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. (e) Compute return on equity (ROE) for 2018. uity. Analysis and Interpretation of Liquidity and Solvency Ralance shepte and incoma ctstamante 6a. ra... wh-1., - prporation follow. Costco Wholesale Corporation Consolidated Balance Sheets ( $ millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets (a) Compute Costco's current ratio and quick ratio for 2018 and 2017. (Round answers two decimal places.) 2018 current ratio = 2017 current ratio = 2018 quick ratio = 2017 quick ratio = 2018 times interest earned = 2017 times interest earned = 2018 liabilities to-equity = 2017 liabilities to equity = (c) Summarize your findings about the company's liquidity and solvency. Do you have any concerns about Costco's ability to meet its debt obligations? Costco's liabilities to-equity ratio decreased thus its solvency has declined. " Costco's times interest earned is high thus there is concern for Costco's solvency. x Costco's quick and current ratios slightly increased therefore its liquidity has declined. Costco's times interest earned ratio is high thus solvency is not a concern for CostcoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started