Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me answer as soon as possible. it is urgent, thank you the question is in picture form below Q2. (a) A multinational corporation

please help me answer as soon as possible. it is urgent, thank you the question is in picture form below

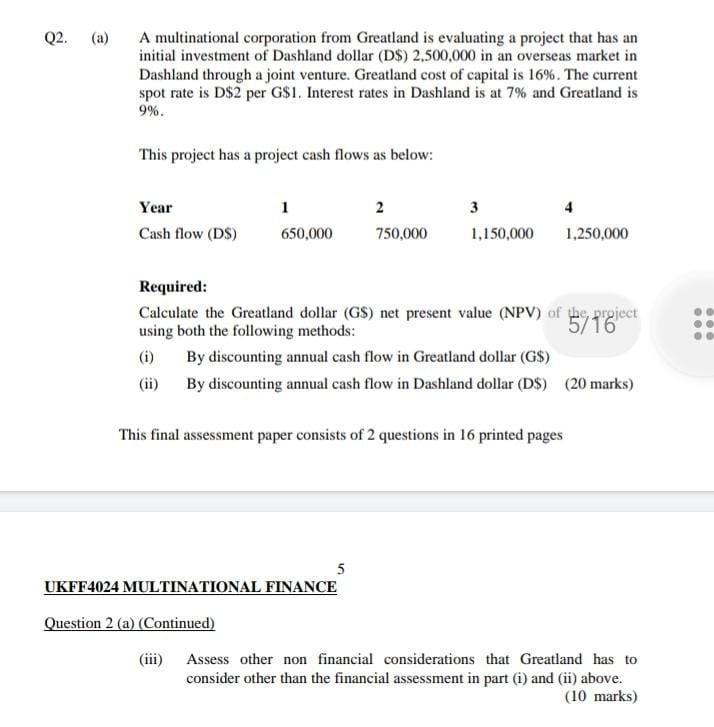

Q2. (a) A multinational corporation from Greatland is evaluating a project that has an initial investment of Dashland dollar (D$) 2.500,000 in an overseas market in Dashland through a joint venture. Greatland cost of capital is 16%. The current spot rate is D$2 per G$1. Interest rates in Dashland is at 7% and Greatland is 9%. This project has a project cash flows as below: Year Cash flow (DS) 1 650,000 2 750,000 3 1,150,000 4 1,250,000 Required: Calculate the Greatland dollar (G$) net present value (NPV) of the project using both the following methods: 5/16 (1) By discounting annual cash flow in Greatland dollar (G$) (ii) By discounting annual cash flow in Dashland dollar (D$) (20 marks) .. This final assessment paper consists of 2 questions in 16 printed pages 5 UKFF4024 MULTINATIONAL FINANCE Question 2 (a) (Continued) (iii) Assess other non financial considerations that Greatland has to consider other than the financial assessment in part (i) and (ii) above. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started