Please help me answer from question #1-17. Thank you!

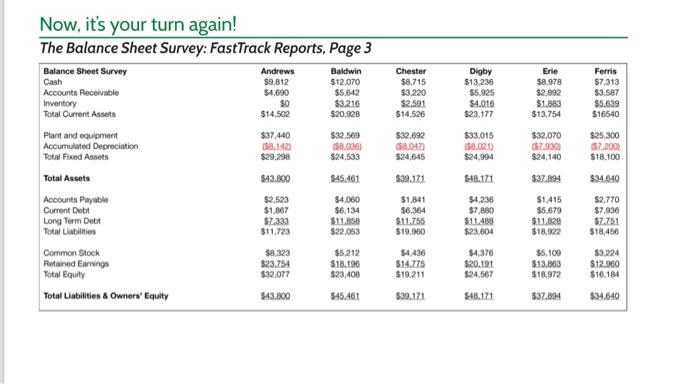

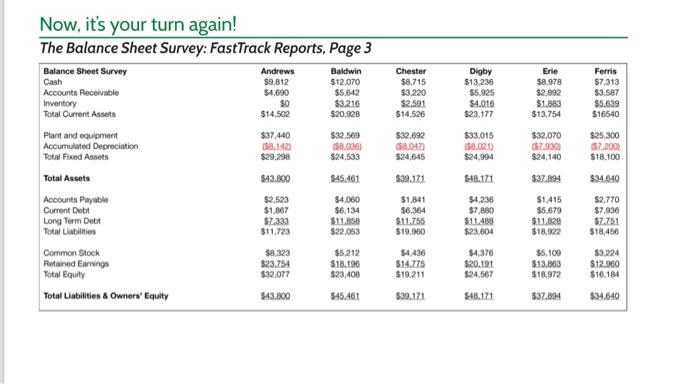

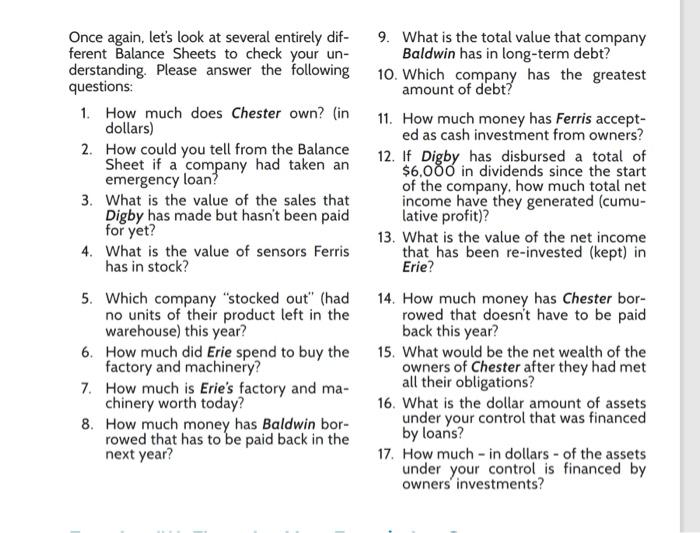

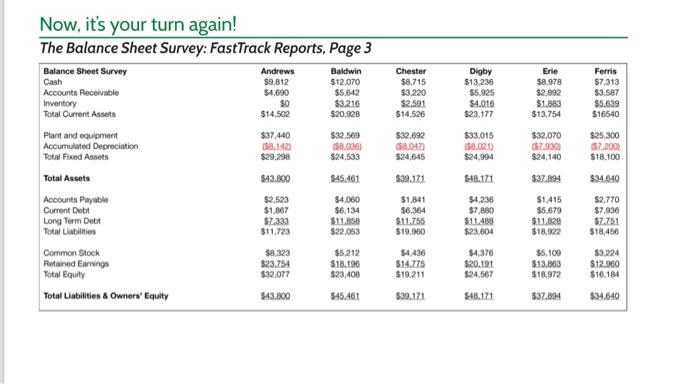

Now, it's your turn again! The Balance Sheet Survey: FastTrack Reports, Page 3 Balance Sheet Survey $4.690 Andrews $9.812 Cash Accounts Receivable Inventory Total Current Assets Baldwin $12,070 $5,842 $3.216 $20.928 Chester $8,715 $3,220 $2,591 $14,526 Digby $13.236 $5.925 $4.016 $23.177 Erie $8.978 $2,892 $1.883 $13,754 Ferris $7.313 $3.587 $5.639 $16540 $0 $14,502 Plant and equipment Accumulated Depreciation Total Fixed Assets $37,440 58.142 $29.298 $32.500 $8.000 $24.533 $32,692 (8.047 $24,645 $33,015 $3.02.1) $24.994 $32,070 (57.9301 $24.140 $25,300 2.2001 $18.100 Total Assets $43.800 $48.171 $37.894 $34.640 Accounts Payable Current Debt Long Term Debt Total Liabilities $2,523 $1.357 $7.333 $11,723 $45.461 $4,060 $6.134 $11.868 $22,053 $39.121 $1,841 $6.364 $11.755 $19.000 $4,236 $7,880 $11.488 $23,004 $1415 $5.679 $11.828 $18.922 52.770 $7.936 $7.751 $18,456 Common Stock Retained Earnings Total Equity Total Liabilities & Owners' Equity $8,323 $23.754 $32,077 $43.000 $5.212 $18.196 $23,408 $4,436 $14.775 $19,211 $4,370 $20.191 $24.567 $5,109 $13.863 $18,972 $3.224 $12.960 $16.184 $45.461 $39,171 $48,171 $37.804 $34.640 Once again, let's look at several entirely dif- ferent Balance Sheets to check your un- derstanding. Please answer the following questions: 1. How much does Chester own? (in dollars) 2. How could you tell from the Balance Sheet if a company had taken an emergency loan? 3. What is the value of the sales that Digby has made but hasn't been paid for yet? 4. What is the value of sensors Ferris has in stock? 5. Which company "stocked out" (had no units of their product left in the warehouse) this year? 6. How much did Erie spend to buy the factory and machinery? 7. How much is Erie's factory and ma- chinery worth today? 8. How much money has Baldwin bor- rowed that has to be paid back in the next year? 9. What is the total value that company Baldwin has in long-term debt? 10. Which company has the greatest amount of debt? 11. How much money has Ferris accept- ed as cash investment from owners? 12. If Digby has disbursed a total of $6,000 in dividends since the start of the company, how much total net income have they generated (cumu- lative profit)? 13. What is the value of the net income that has been re-invested (kept) in Erie? 14. How much money has Chester bor- rowed that doesn't have to be paid back this year? 15. What would be the net wealth of the owners of Chester after they had met all their obligations? 16. What is the dollar amount of assets under your control that was financed by loans? 17. How much - in dollars of the assets under your control is financed by owners investments