Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer question P9-1 (A,B,C,D,E,F) Sorry for the bad photo. I do not see a lacking of the total inventory value. it is

Please help me answer question P9-1 (A,B,C,D,E,F) Sorry for the bad photo.

I do not see a lacking of the total inventory value. it is stated to be $300 Million worth of i ventory. if that is the wrong, i'm sorry this is how the textbook proposed the question.

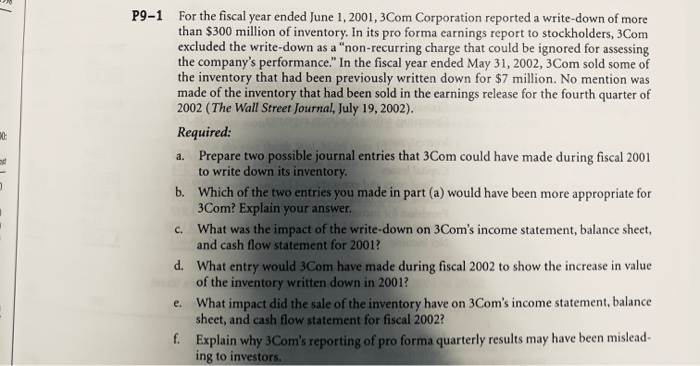

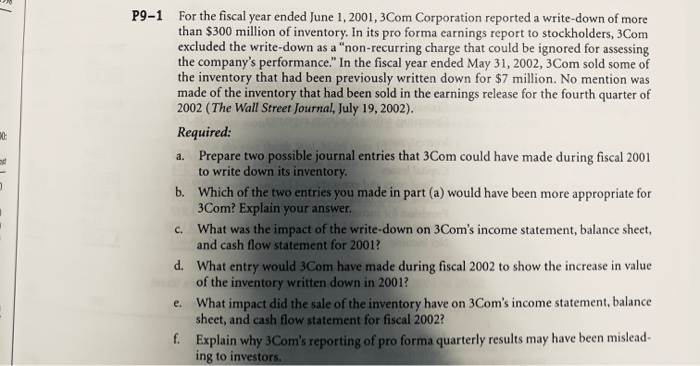

P9-1 For the fiscal year ended June 1, 2001, 3Com Corporation reported a write-down of more than $300 million of inventory. In its pro forma earnings report to stockholders, 3Com excluded the write-down as a "non-recurring charge that could be ignored for assessing the company's performance." In the fiscal year ended May 31, 2002, 3Com sold some of the inventory that had been previously written down for $7 million. No mention was made of the inventory that had been sold in the earnings release for the fourth quarter of 2002 (The Wall Street Journal, July 19, 2002). Required: a. Prepare two possible journal entries that 3Com could have made during fiscal 2001 to write down its inventory. b. Which of the two entries you made in part (a) would have been more appropriate for 3Com? Explain your answer. c. What was the impact of the write down on 3Com's income statement, balance sheet, and cash flow statement for 2001? d. What entry would 3Com have made during fiscal 2002 to show the increase in value of the inventory written down in 2001? e. What impact did the sale of the inventory have on 3Com's income statement, balance sheet, and cash flow statement for fiscal 2002? 1. Explain why 3Com's reporting of pro forma quarterly results may have been mislead- ing to investors Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started