..Please help me answer the following questions .,,

Your uncle has given you one coal mine to extract from this year and again in 4 years. The demand for coal is P(demand)= 100 - 0.6q. The supply of coal is P(supply)= 40+0.4q. The discount rate for the second year is 3%. Answer the following.

1.The mine has a total of 140 tons of coal available what will you extract in the first period and the second period? That is, what is q for each period? What are the corresponding prices for each period? Show your work.

2. After a correction in their estimate of the available resource, it is realized that the mine has only 35 tons of coal available. Graph the Present Value of Marginal Net Benefit curves for periods 1 and 2 together. What quantities will you now extract in each period as a result? What are the corresponding prices? Show your work.

3. What is the Marginal User Costs of the coal for period 1 when only 35 tons are available and it is efficiently extracted across the two periods? Show your work.

4. What is the Present Value of Net Benefit when only 35 tons of coal is available and you choose to extract according to your answers in #2? Show your work.

These are the answers not including the graph. I need to see the work in detail though because I do not know how to get these numbers and I'm confused as to why in #1 the quantities do not equal 140.

1. q1 =60;q2 =60;P1 =64;P2 =64

2. q1 = 20.01; q2 = 14.99; P1 = 87.99; P2 = 91.01

3. MUC1 = 39.99

4. Present Value of Net Benefits = 1000.40 + 699.28 =1699.68

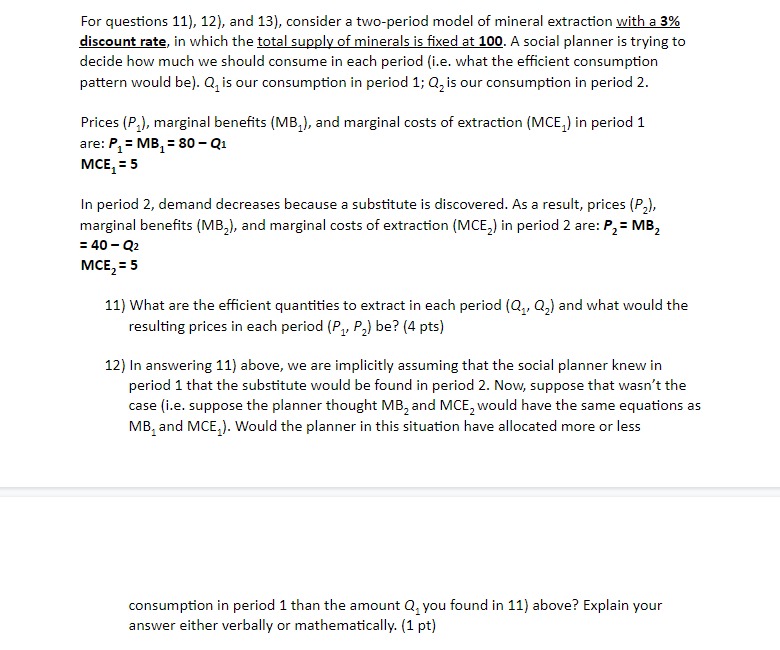

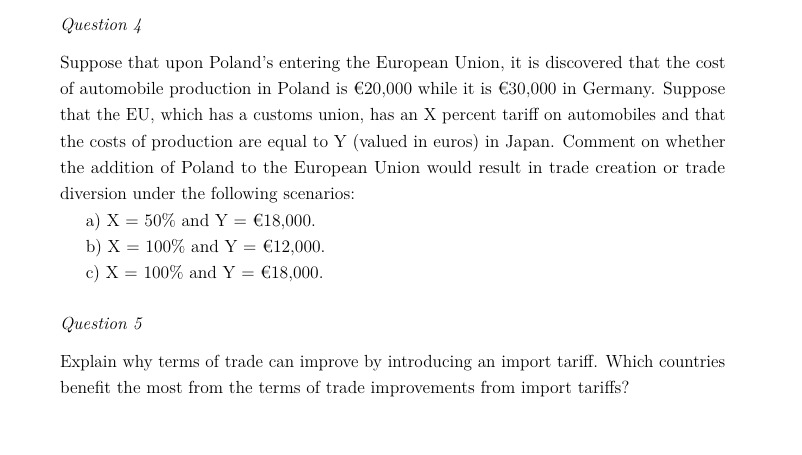

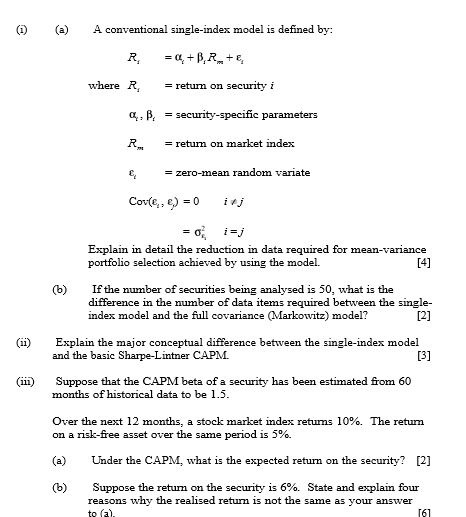

For questions 11), 12), and 13), consider a two-period model of mineral extraction with a 3% discount rate, in which the total supply of minerals is fixed at 100. A social planner is trying to decide how much we should consume in each period (i.e. what the efficient consumption pattern would be). Q, is our consumption in period 1; Q, is our consumption in period 2. Prices (P ), marginal benefits (MB, ), and marginal costs of extraction (MCE,) in period 1 are: P = MB, = 80 - Q1 MCE, = 5 In period 2, demand decreases because a substitute is discovered. As a result, prices (P,), marginal benefits (MB,), and marginal costs of extraction (MCE,) in period 2 are: P2 = MB, = 40 - Q2 MCE, = 5 11) What are the efficient quantities to extract in each period (Q, Q,) and what would the resulting prices in each period (P], P2) be? (4 pts) 12) In answering 11) above, we are implicitly assuming that the social planner knew in period 1 that the substitute would be found in period 2. Now, suppose that wasn't the case (i.e. suppose the planner thought MB, and MCE, would have the same equations as MB, and MCE,). Would the planner in this situation have allocated more or less consumption in period 1 than the amount Q, you found in 11) above? Explain your answer either verbally or mathematically. (1 pt)Question 4 Suppose that upon Poland's entering the European Union, it is discovered that the cost of automobile production in Poland is (20,000 while it is C30,000 in Germany. Suppose that the EU, which has a customs union, has an X percent tariff on automobiles and that the costs of production are equal to Y (valued in euros) in Japan. Comment on whether the addition of Poland to the European Union would result in trade creation or trade diversion under the following scenarios: a) X = 50% and Y = (18,000. b) X = 100% and Y = (12,000. c) X = 100% and Y = (18,000. Question 5 Explain why terms of trade can improve by introducing an import tariff. Which countries benefit the most from the terms of trade improvements from import tariffs?(a) A conventional single-index model is defined by: R. =4+BR + where R. = return on security i a: B, = security-specific parameters = return on market index = zero-mean random variate Cov(s ; () = 0 i j = 0, i =j Explain in detail the reduction in data required for mean-variance portfolio selection achieved by using the model. [4] (b) If the number of securities being analysed is 50, what is the difference in the number of data items required between the single- index model and the full covariance (Markowitz) model? [2] (ii) Explain the major conceptual difference between the single-index model and the basic Sharpe-Lintner CAPM. [3] (mii) Suppose that the CAPM beta of a security has been estimated from 60 months of historical data to be 1.5. Over the next 12 months, a stock market index returns 10%. The return on a risk-free asset over the same period is 3%. (a) Under the CAPM, what is the expected return on the security? [2] (b) Suppose the return on the security is 6%. State and explain four reasons why the realised return is not the same as your answer to (3)