Please help me answer the following. Will leave upvote!

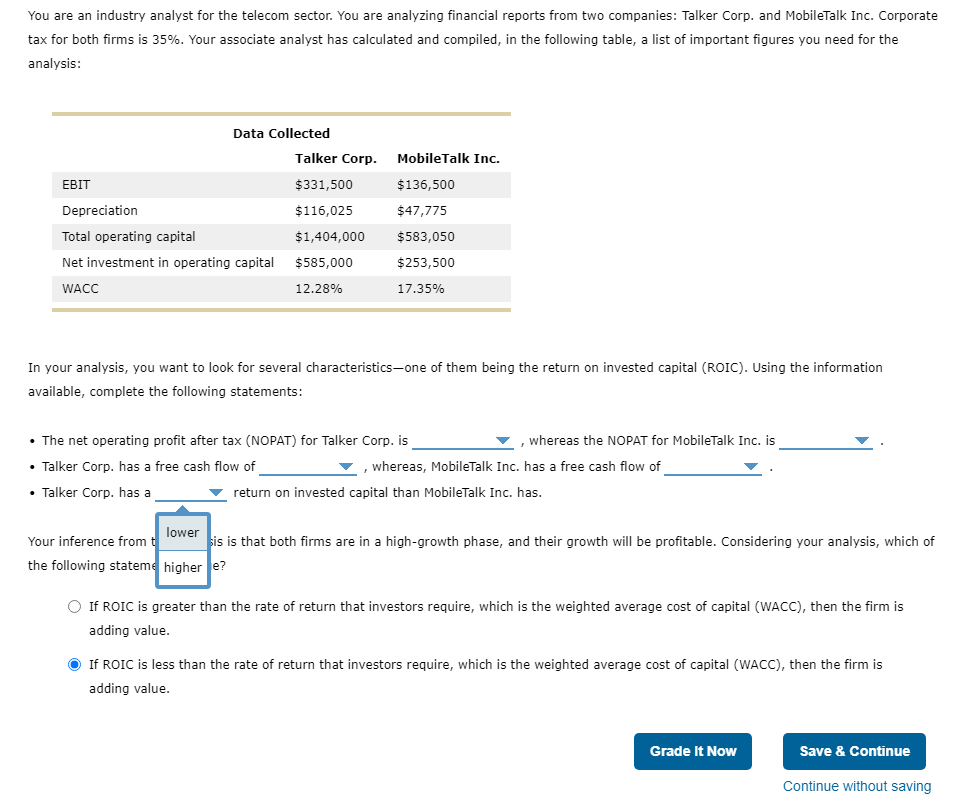

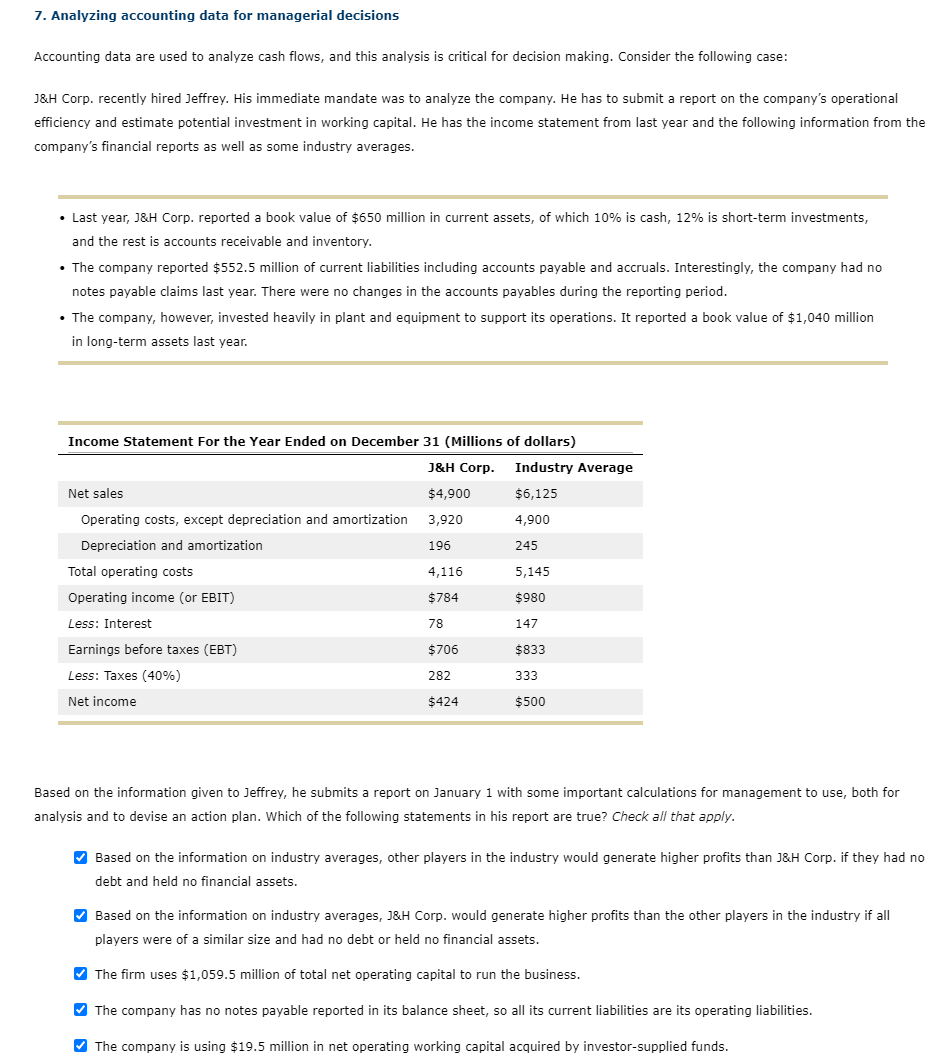

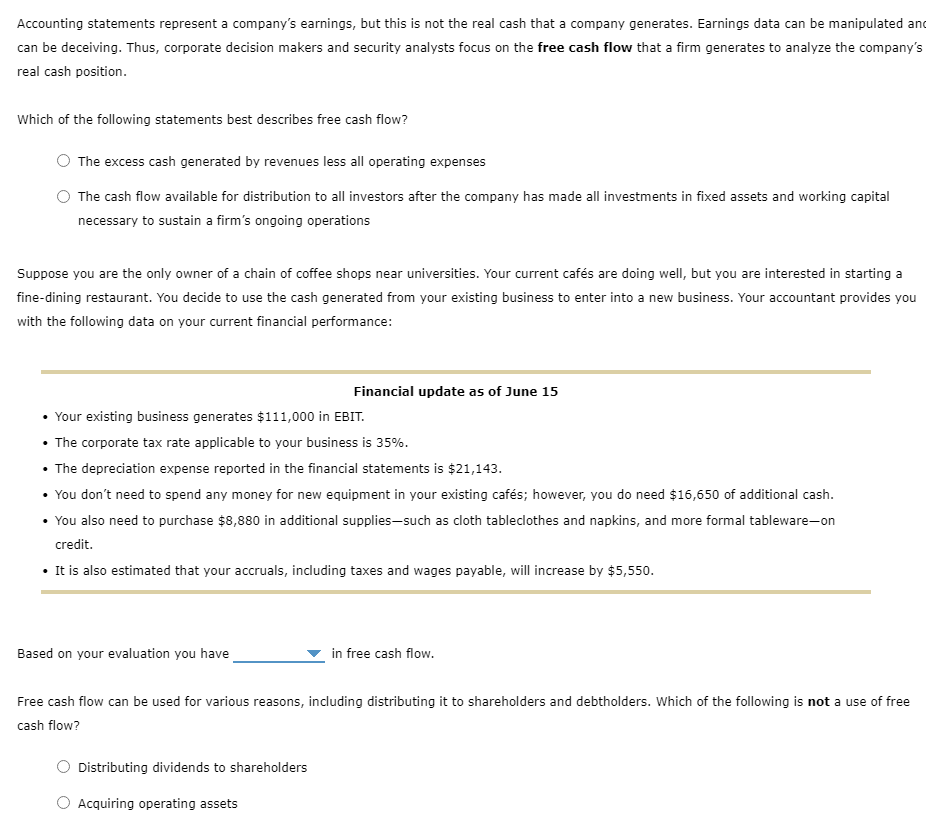

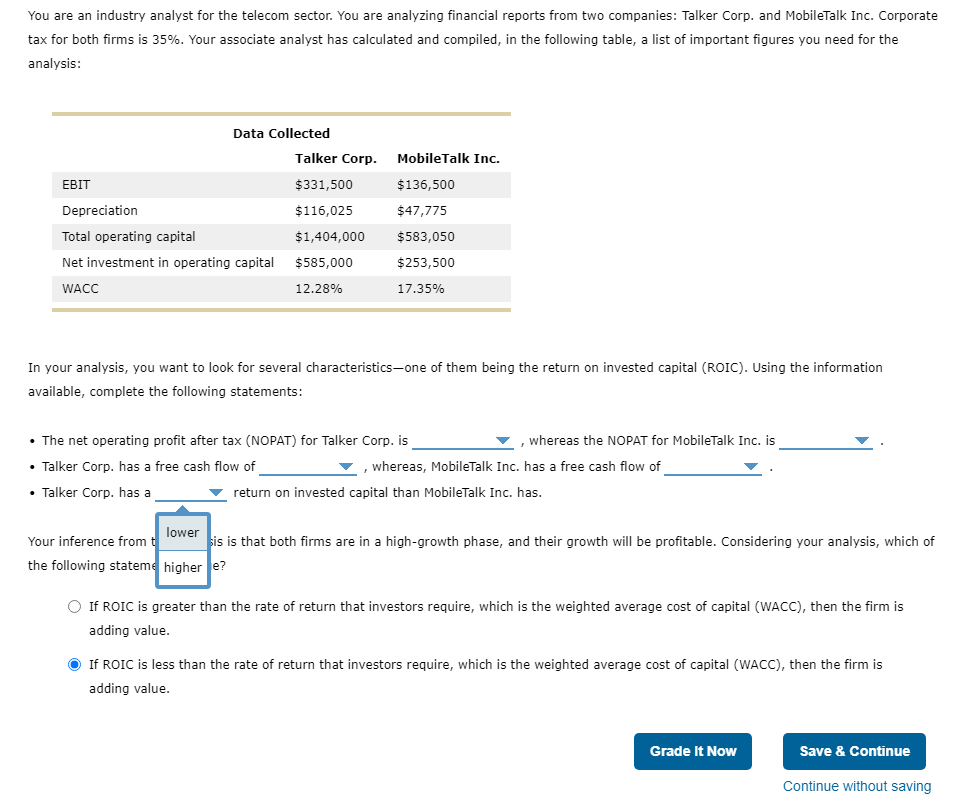

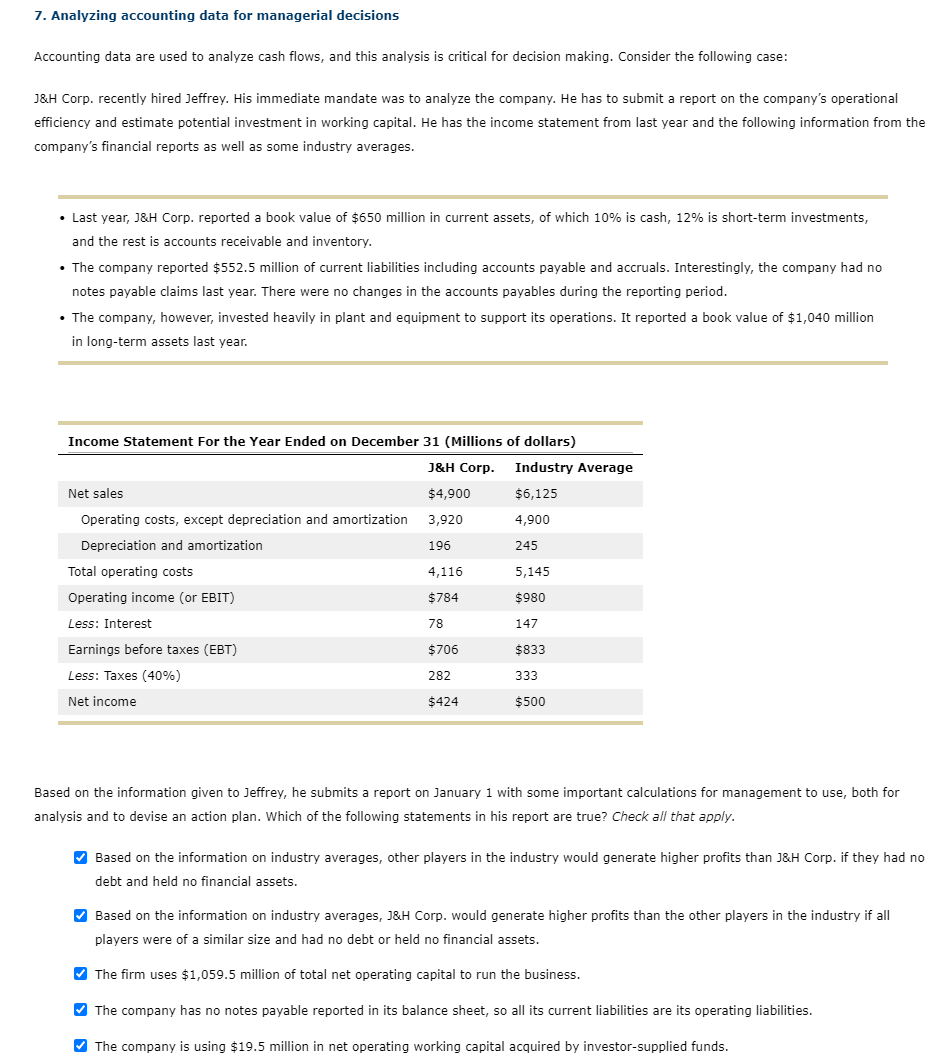

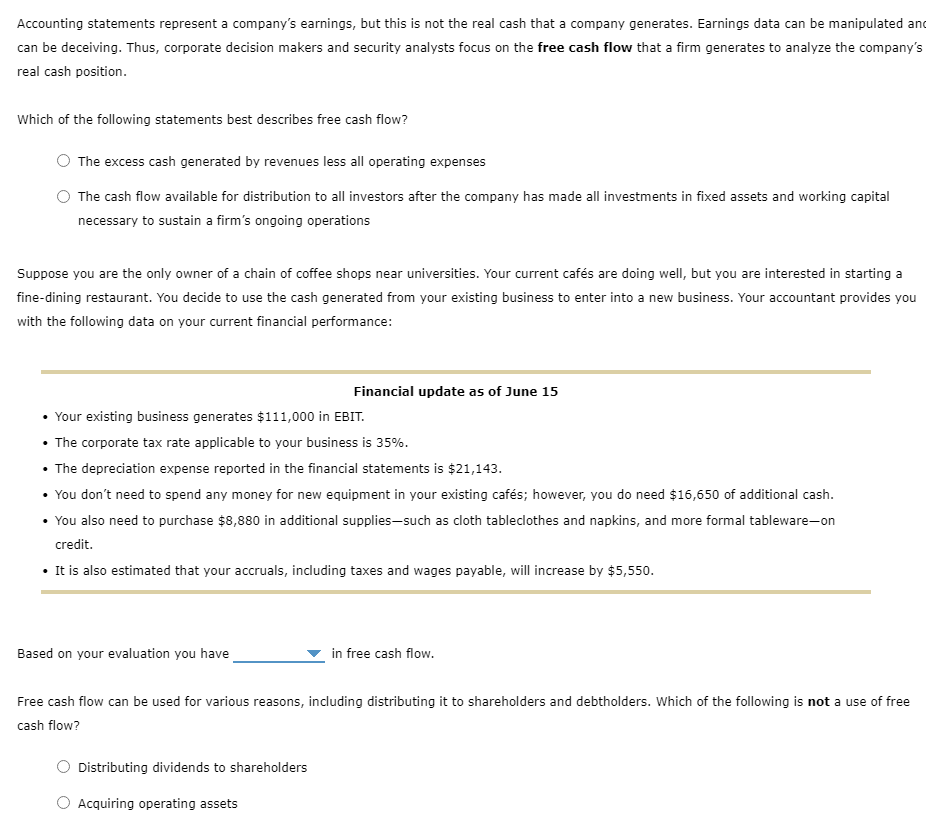

You are an industry analyst for the telecom sector. You are analyzing financial reports from two companies: Talker Corp. and MobileTalk Inc. Corporate tax for both firms is 35%. Your associate analyst has calculated and compiled, in the following table, a list of important figures you need for the analysis: Data Collected Talker Corp. MobileTalk Inc. EBIT $331,500 $136,500 Depreciation $116,025 $47,775 Total operating capital $1,404,000 $583,050 Net investment in operating capital $585,000 $253,500 WACC 12.28% 17.35% In your analysis, you want to look for several characteristics one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: The net operating profit after tax (NOPAT) for Talker Corp. is whereas the NOPAT for MobileTalk Inc. is Talker Corp. has a free cash flow of whereas, MobileTalk Inc. has a free cash flow of Talker Corp. has a return on invested capital than MobileTalk Inc. has. lower Your inference from sis is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following stateme highere? If ROIC is greater than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. If ROIC is less than the rate of return that investors require, which is the weighted average cost of capital (WACC), then the firm is adding value. Grade It Now Save & Continue Continue without saving 7. Analyzing accounting data for managerial decisions Accounting data are used to analyze cash flows, and this analysis is critical for decision making. Consider the following case: J&H Corp. recently hired Jeffrey. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages. Last year, J&H Corp. reported a book value of $650 million in current assets, of which 10% is cash, 12% is short-term investments, and the rest is accounts receivable and inventory. The company reported $552.5 million of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable claims last year. There were no changes in the accounts payables during the reporting period. The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $1,040 million in long-term assets last year. Income Statement For the Year Ended on December 31 (Millions of dollars) J&H Corp. Industry Average Net sales $4,900 $6,125 Operating costs, except depreciation and amortization 3,920 4,900 Depreciation and amortization 196 245 Total operating costs 4,116 5,145 Operating income (or EBIT) $784 $980 Less: Interest 78 147 $706 $833 Earnings before taxes (EBT) Less: Taxes (40%) Net income 282 333 $424 $500 Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check all that apply. Based on the information on industry averages, other players in the industry would generate higher profits than J&H Corp. if they had no debt and held no financial assets. Based on the information on industry averages, J&H Corp. would generate higher profits than the other players in the industry if all players were of a similar size and had no debt or held no financial assets. The firm uses $1,059.5 million of total net operating capital to run the business. The company has no notes payable reported in its balance sheet, so all its current liabilities are its operating liabilities. The company is using $19.5 million in net operating working capital acquired by investor-supplied funds. Accounting statements represent a company's earnings, but this is not the real cash that a company generates. Earnings data can be manipulated and can be deceiving. Thus, corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company's real cash position. Which of the following statements best describes free cash flow? The excess cash generated by revenues less all operating expenses The cash flow available for distribution to all investors after the company has made all investments in fixed assets and working capital necessary to sustain a firm's ongoing operations Suppose you are the only owner of a chain of coffee shops near universities. Your current cafs are doing well, but you are interested in starting a fine dining restaurant. You decide to use the cash generated from your existing business to enter into a new business. Your accountant provides you with the following data on your current financial performance: Financial update as of June 15 . Your existing business generates $111,000 in EBIT. The corporate tax rate applicable to your business is 35%. The depreciation expense reported in the financial statements is $21,143. . You don't need to spend any money for new equipment in your existing cafs; however, you do need $16,650 of additional cash. You also need to purchase $8,880 in additional supplies such as cloth tableclothes and napkins, and more formal tableware-on credit. It is also estimated that your accruals, including taxes and wages payable, will increase by $5,550. Based on your evaluation you have in free cash flow. Free cash flow can be used for various reasons, including distributing it to shareholders and debtholders. Which of the following is not a use of free cash flow? Distributing dividends to shareholders Acquiring operating assets