Please help me answer the questions based off of the information provided :)

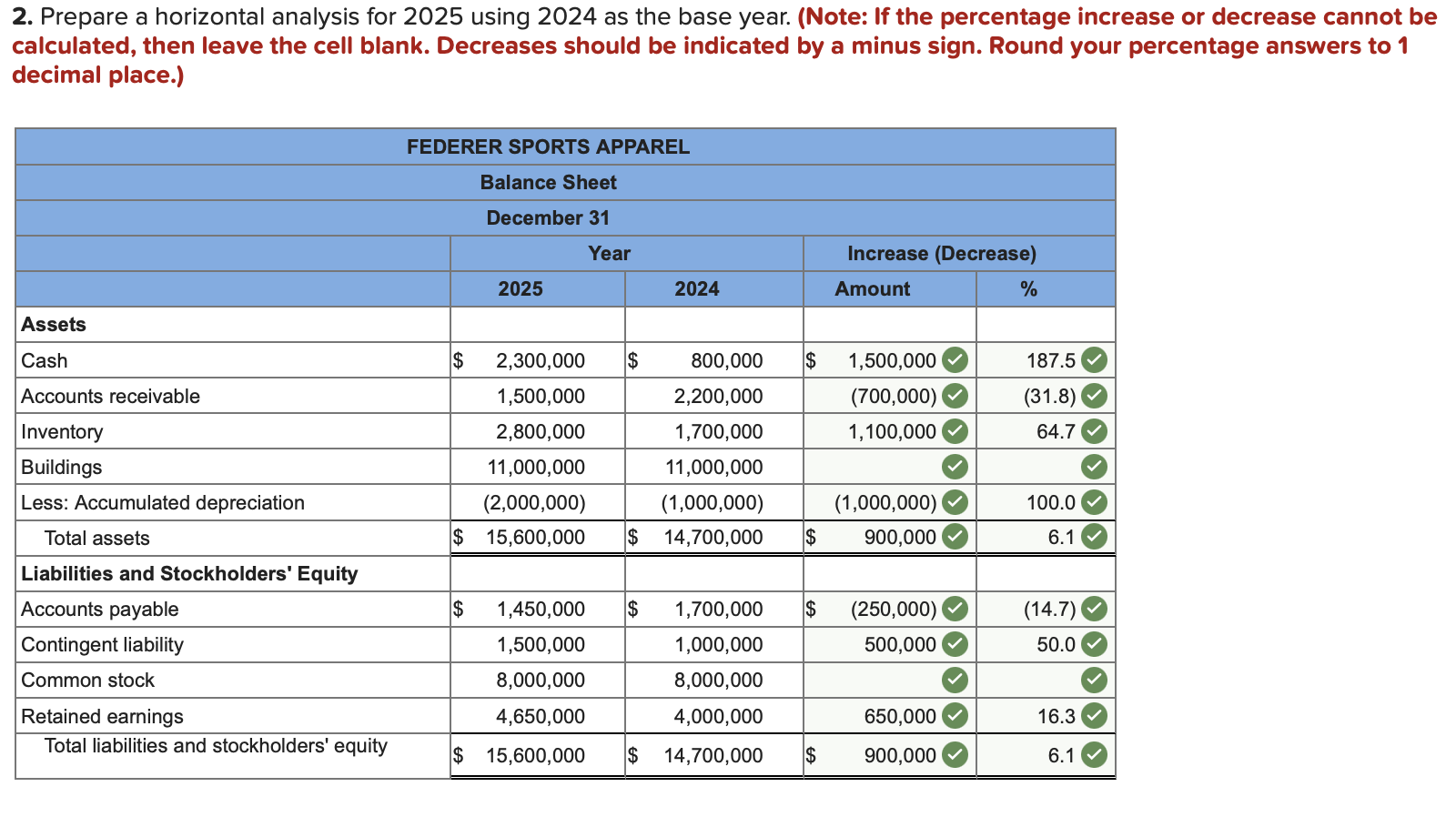

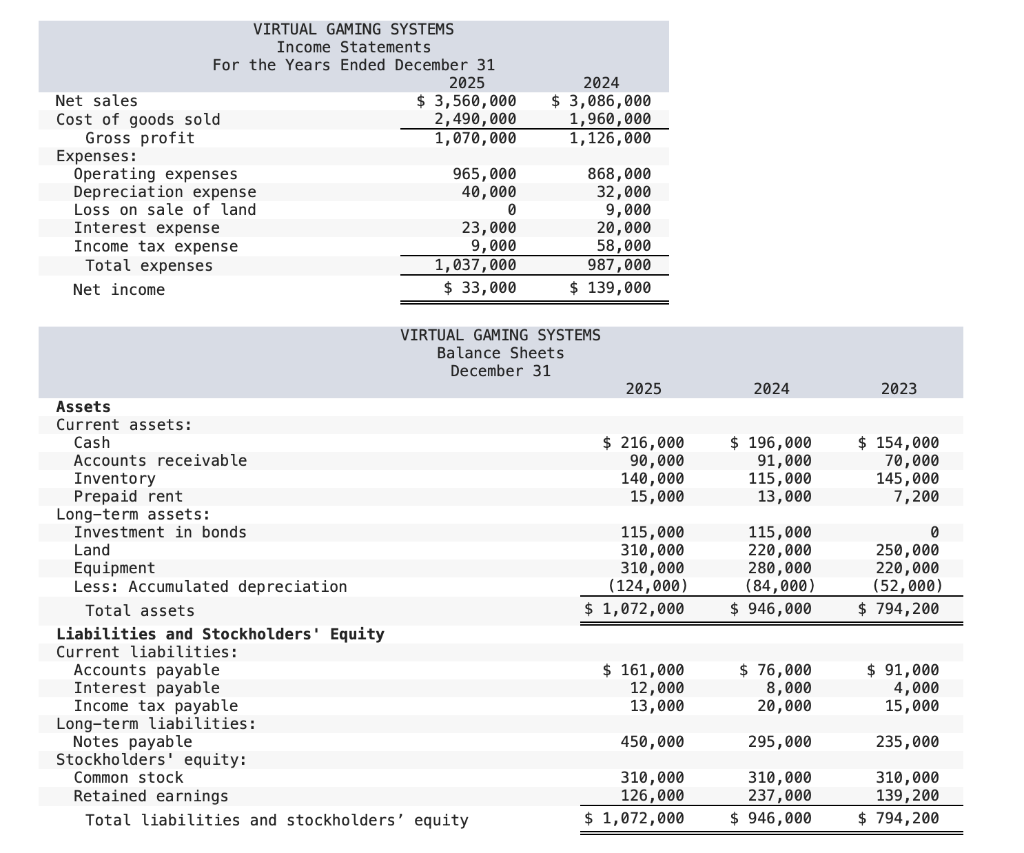

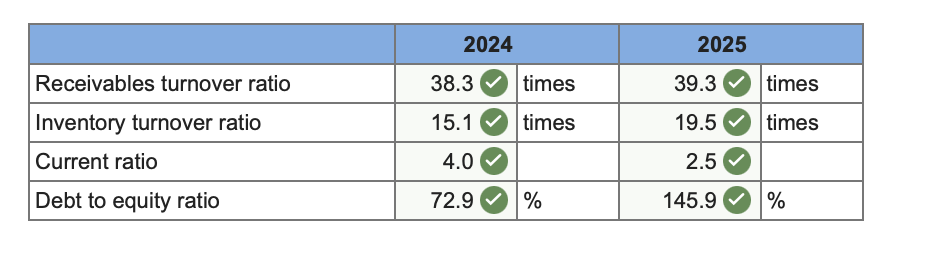

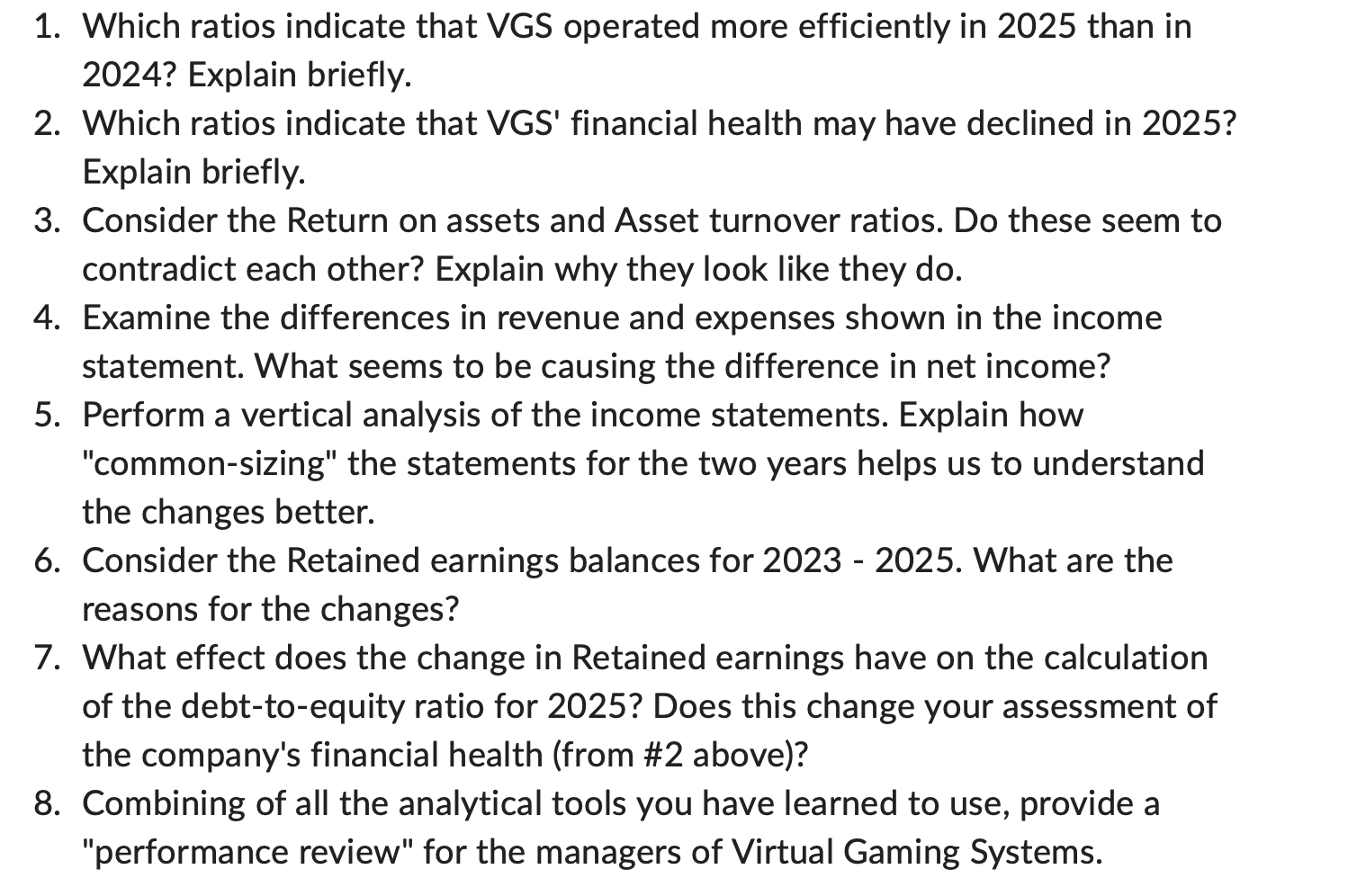

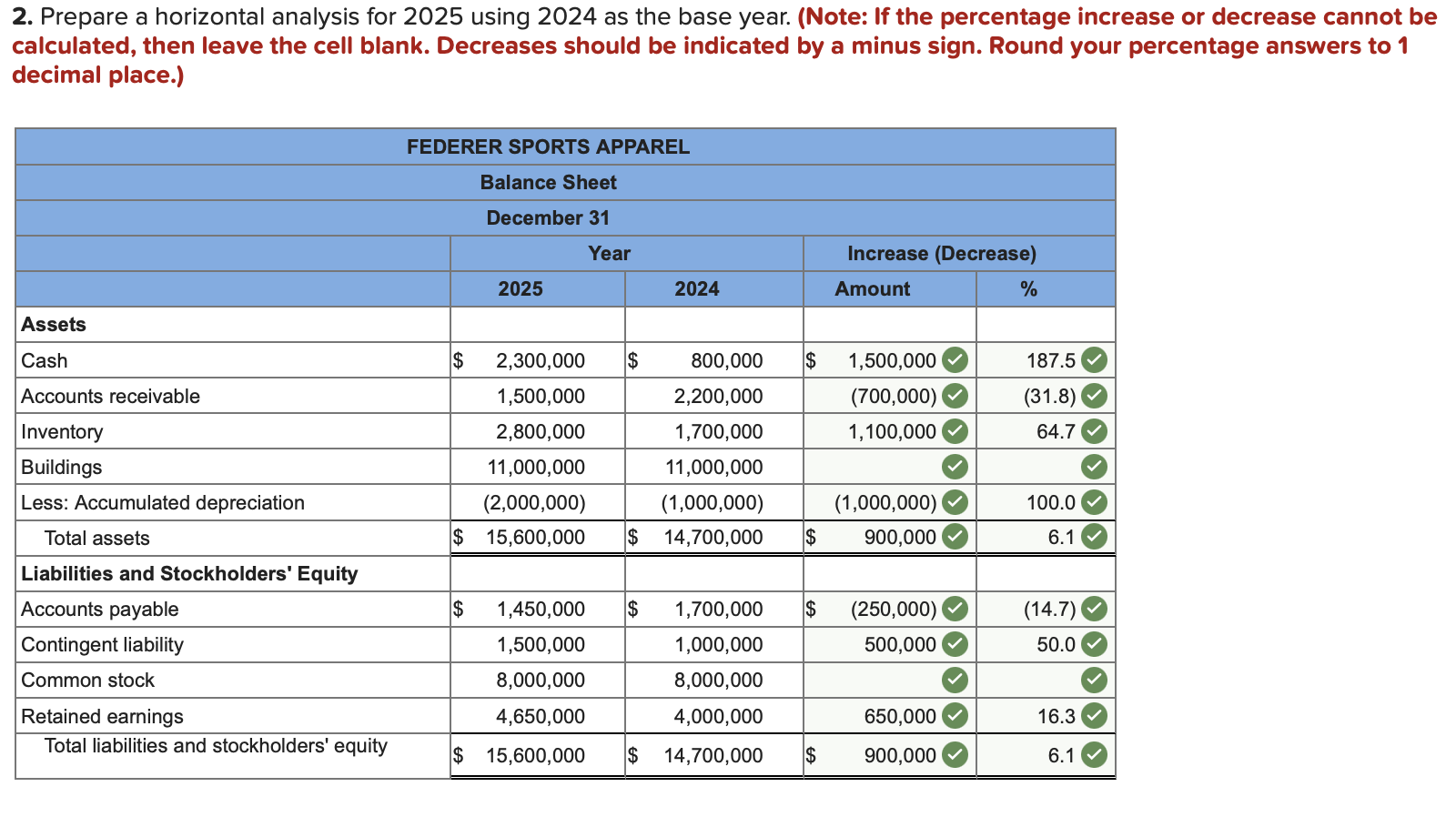

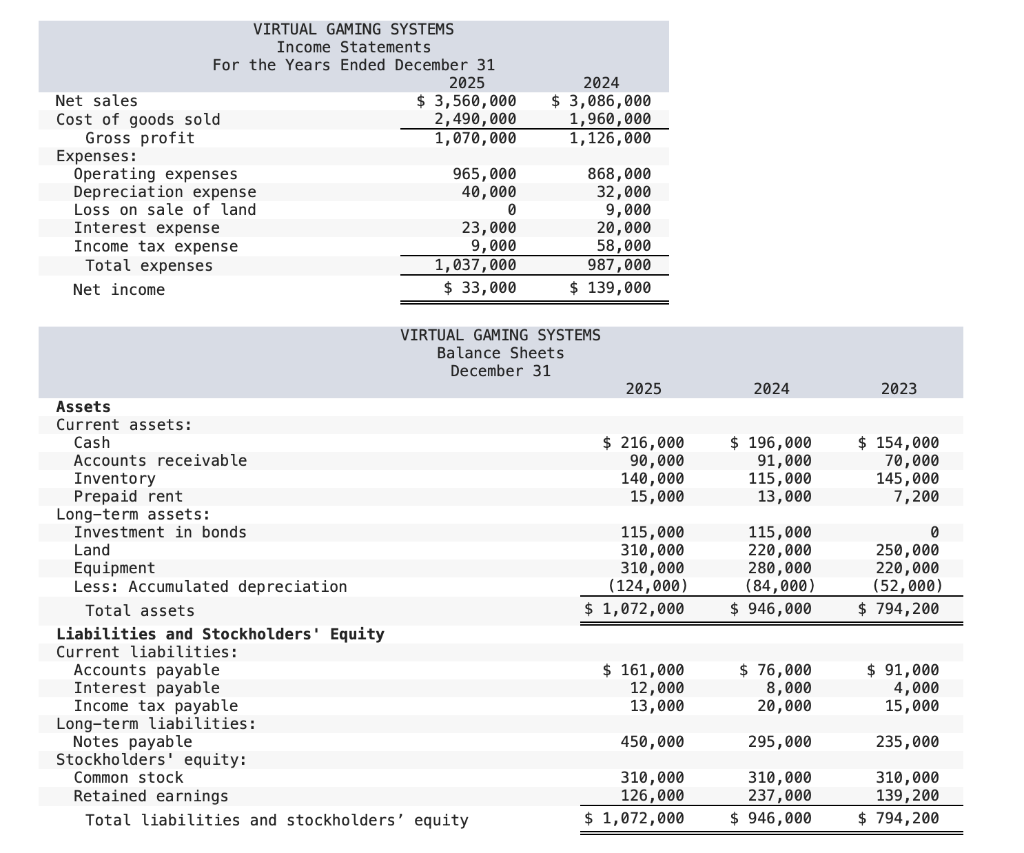

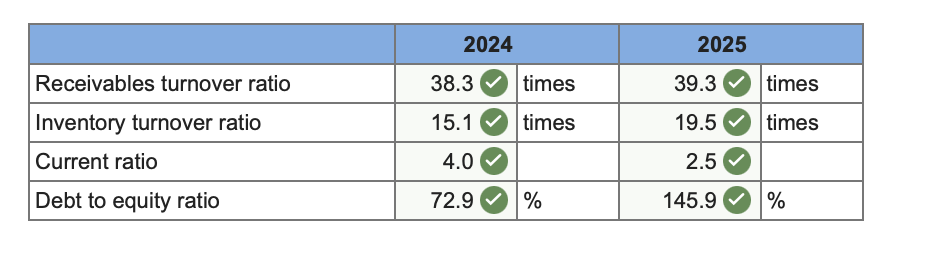

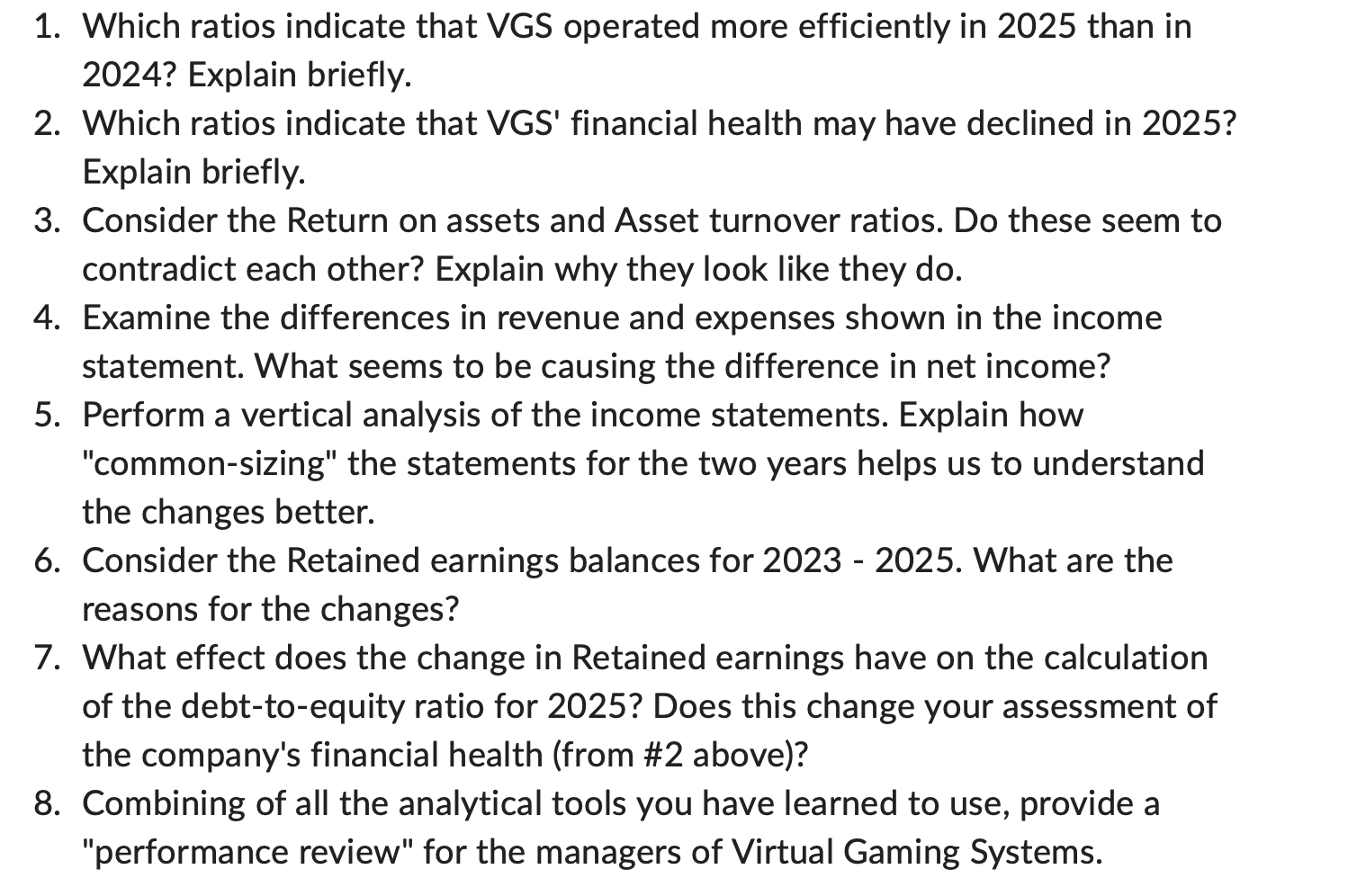

2. Prepare a horizontal analysis for 2025 using 2024 as the base year. (Note: If the percentage increase or decrease cannot be calculated, then leave the cell blank. Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) VIRTUAL GAMING SYSTEMS Income Statements For the Years Ended December 31 NetsalesCostofgoodssoldGrossprofitExpenses:OperatingexpensesDepreciationexpenseLossonsaleoflandInterestexpenseIncometaxexpenseTotalexpensesNetincome2025$3,560,0002,490,0001,070,000965,00040,000023,0009,0001,037,000$33,0002024$3,086,0001,960,0001,126,000868,00032,0009,00020,00058,000987,000$139,000 VIRTUAL GAMING SYSTEMS Balance Sheets December 31 Assets Current assets: CashAccountsreceivableInventoryPrepaidrent$216,00090,000140,00015,000$196,00091,000115,00013,000$154,00070,000145,0007,200 Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable 450,000295,000235,000 Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity \begin{tabular}{rrr} 310,000 & 310,000 & 310,000 \\ 126,000 & 237,000 & 139,200 \\ \hline$1,072,000 & $946,000 & $794,200 \\ \hline \hline \end{tabular} \begin{tabular}{|l|r|l|r|l|} \hline & \multicolumn{2}{|c|}{2024} & \multicolumn{2}{c|}{2025} \\ \hline Receivables turnover ratio & 38.3 & times & 39.3 & times \\ \hline Inventory turnover ratio & 15.1 & times & 19.5 & times \\ \hline Current ratio & 4.0 & & 2.5 & \\ \hline Debt to equity ratio & 72.9 & % & 145.9 & % \\ \hline \end{tabular} 1. Which ratios indicate that VGS operated more efficiently in 2025 than in 2024? Explain briefly. 2. Which ratios indicate that VGS' financial health may have declined in 2025? Explain briefly. 3. Consider the Return on assets and Asset turnover ratios. Do these seem to contradict each other? Explain why they look like they do. 4. Examine the differences in revenue and expenses shown in the income statement. What seems to be causing the difference in net income? 5. Perform a vertical analysis of the income statements. Explain how "common-sizing" the statements for the two years helps us to understand the changes better. 6. Consider the Retained earnings balances for 2023 - 2025. What are the reasons for the changes? 7. What effect does the change in Retained earnings have on the calculation of the debt-to-equity ratio for 2025? Does this change your assessment of the company's financial health (from \#2 above)? 8. Combining of all the analytical tools you have learned to use, provide a "performance review" for the managers of Virtual Gaming Systems