Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me answer the questions below, calculations are not necessary Buddy cc absorbs overheads based on labour hours at N$32/hour. The company sells two

please help me answer the questions below, calculations are not necessary

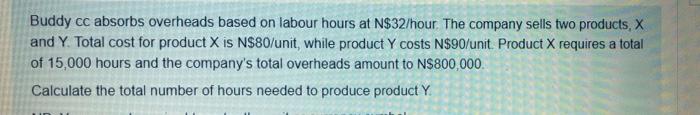

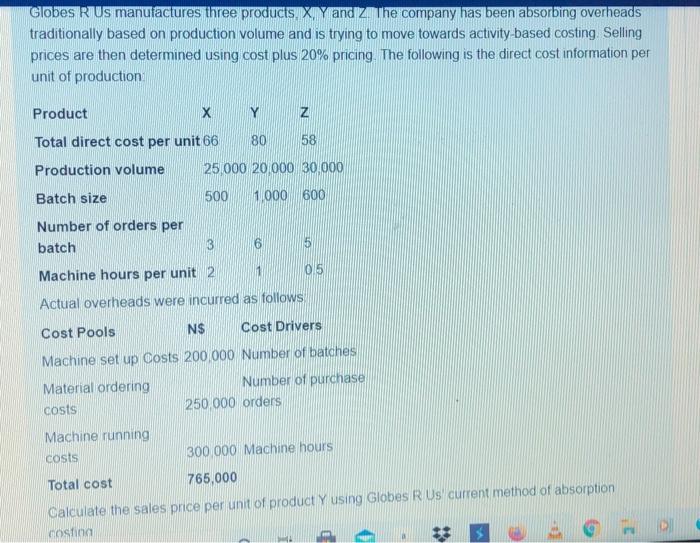

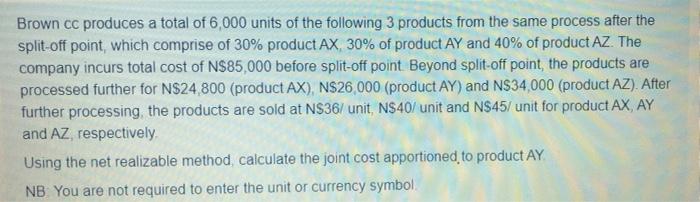

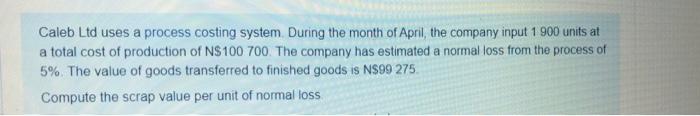

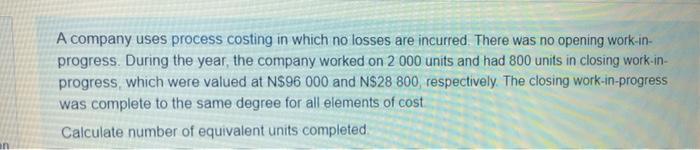

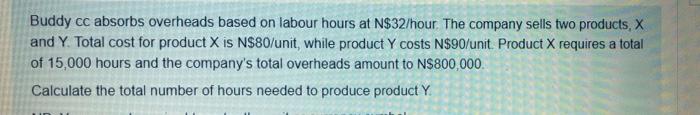

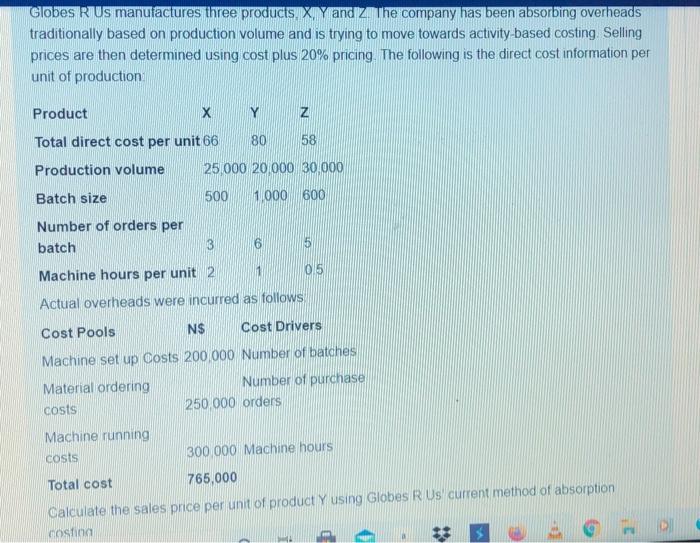

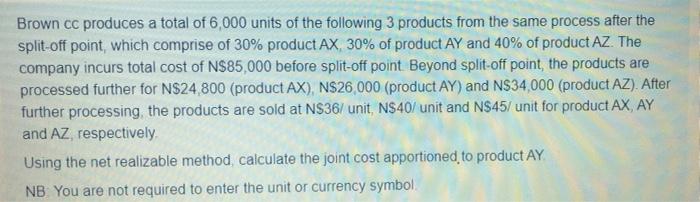

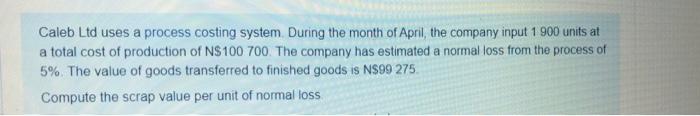

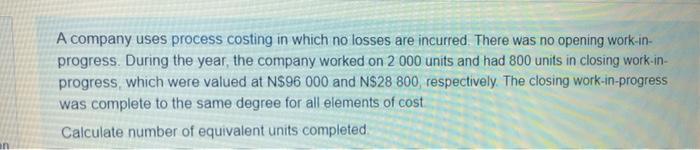

Buddy cc absorbs overheads based on labour hours at N$32/hour. The company sells two products, X and Y. Total cost for product X is N$80/unit, while product Y costs N$90/unit. Product X requires a total of 15,000 hours and the company's total overheads amount to N$800,000 Calculate the total number of hours needed to produce product Y. Globes R Us manufactures three products, X, Yand Z. The company has been absorbing overheads traditionally based on production volume and is trying to move towards activity based costing Selling prices are then determined using cost plus 20% pricing. The following is the direct cost information per unit of production Product X Z Total direct cost per unit 66 80 58 Production volume 25,000 20.000 30.000 500 1,000 600 Batch size Number of orders per batch 3 6 5 Machine hours per unit 2 05 Actual overheads were incurred as follows Cost Pools NS Cost Drivers Machine set up Oosts 200 000 Number of batches Material ordering Number of purchase 250,000 orders costs Machine running costs 300 000 Machine hours Total cost 765,000 Calculate the sales price per unit of product Y using Globes R Us current method of absorption costing GO Brown cc produces a total of 6,000 units of the following 3 products from the same process after the split-off point, which comprise of 30% product AX, 30% of product AY and 40% of product AZ. The company incurs total cost of N$85,000 before split-off point Beyond split-off point, the products are processed further for N$24.800 (product AX), NS26 000 (product AY) and N$34,000 (product AZ). After further processing, the products are sold at NS36/ unit, NS40/unit and N$45/ unit for product AX, AY and AZ, respectively, Using the net realizable method calculate the joint cost apportioned to product AY NB: You are not required to enter the unit or currency symbol Caleb Ltd uses a process costing system During the month of April, the company input 1 900 units at a total cost of production of NS 100 700. The company has estimated a normal loss from the process of 5%. The value of goods transferred to finished goods is NS99 275. Compute the scrap value per unit of normal loss A company uses process costing in which no losses are incurred. There was no opening work-in- progress. During the year, the company worked on 2 000 units and had 800 units in closing work-in- progress, which were valued at N$96 000 and N$28 800, respectively. The closing work-in-progress was complete to the same degree for all elements of cost Calculate number of equivalent units completed n Buddy cc absorbs overheads based on labour hours at N$32/hour. The company sells two products, X and Y. Total cost for product X is N$80/unit, while product Y costs N$90/unit. Product X requires a total of 15,000 hours and the company's total overheads amount to N$800,000 Calculate the total number of hours needed to produce product Y. Globes R Us manufactures three products, X, Yand Z. The company has been absorbing overheads traditionally based on production volume and is trying to move towards activity based costing Selling prices are then determined using cost plus 20% pricing. The following is the direct cost information per unit of production Product X Z Total direct cost per unit 66 80 58 Production volume 25,000 20.000 30.000 500 1,000 600 Batch size Number of orders per batch 3 6 5 Machine hours per unit 2 05 Actual overheads were incurred as follows Cost Pools NS Cost Drivers Machine set up Oosts 200 000 Number of batches Material ordering Number of purchase 250,000 orders costs Machine running costs 300 000 Machine hours Total cost 765,000 Calculate the sales price per unit of product Y using Globes R Us current method of absorption costing GO Brown cc produces a total of 6,000 units of the following 3 products from the same process after the split-off point, which comprise of 30% product AX, 30% of product AY and 40% of product AZ. The company incurs total cost of N$85,000 before split-off point Beyond split-off point, the products are processed further for N$24.800 (product AX), NS26 000 (product AY) and N$34,000 (product AZ). After further processing, the products are sold at NS36/ unit, NS40/unit and N$45/ unit for product AX, AY and AZ, respectively, Using the net realizable method calculate the joint cost apportioned to product AY NB: You are not required to enter the unit or currency symbol Caleb Ltd uses a process costing system During the month of April, the company input 1 900 units at a total cost of production of NS 100 700. The company has estimated a normal loss from the process of 5%. The value of goods transferred to finished goods is NS99 275. Compute the scrap value per unit of normal loss A company uses process costing in which no losses are incurred. There was no opening work-in- progress. During the year, the company worked on 2 000 units and had 800 units in closing work-in- progress, which were valued at N$96 000 and N$28 800, respectively. The closing work-in-progress was complete to the same degree for all elements of cost Calculate number of equivalent units completed n

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started