please help me answer the questions in the photos

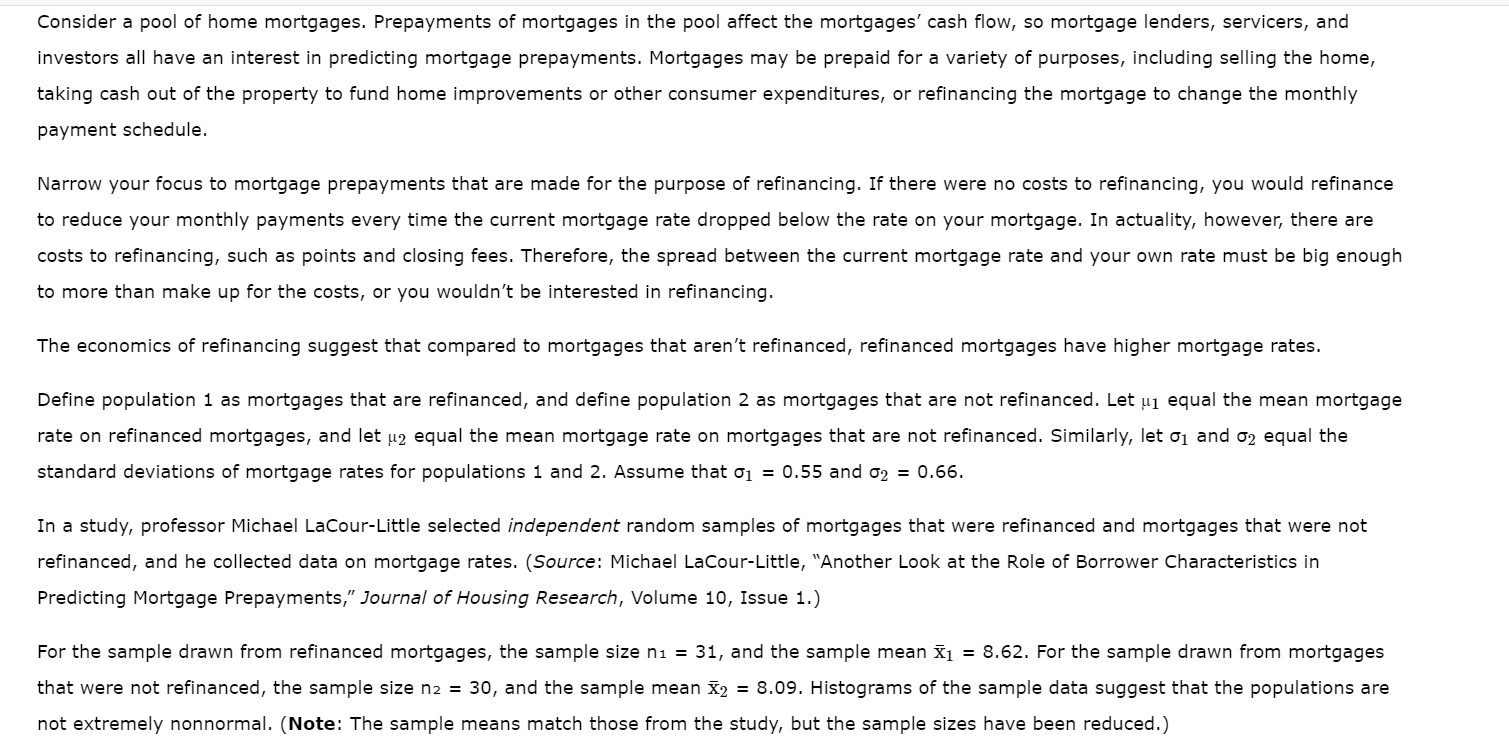

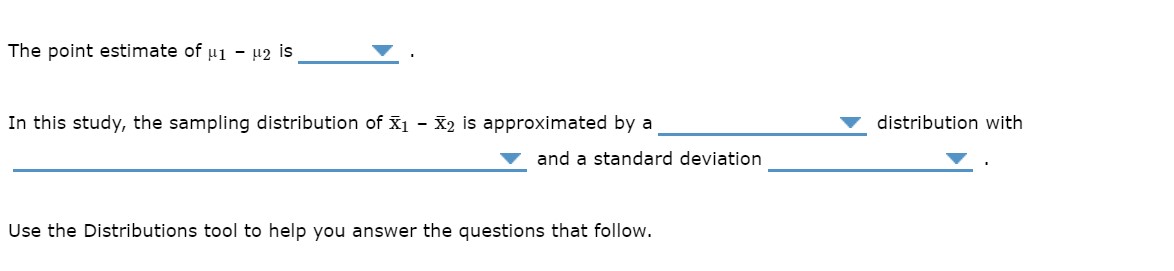

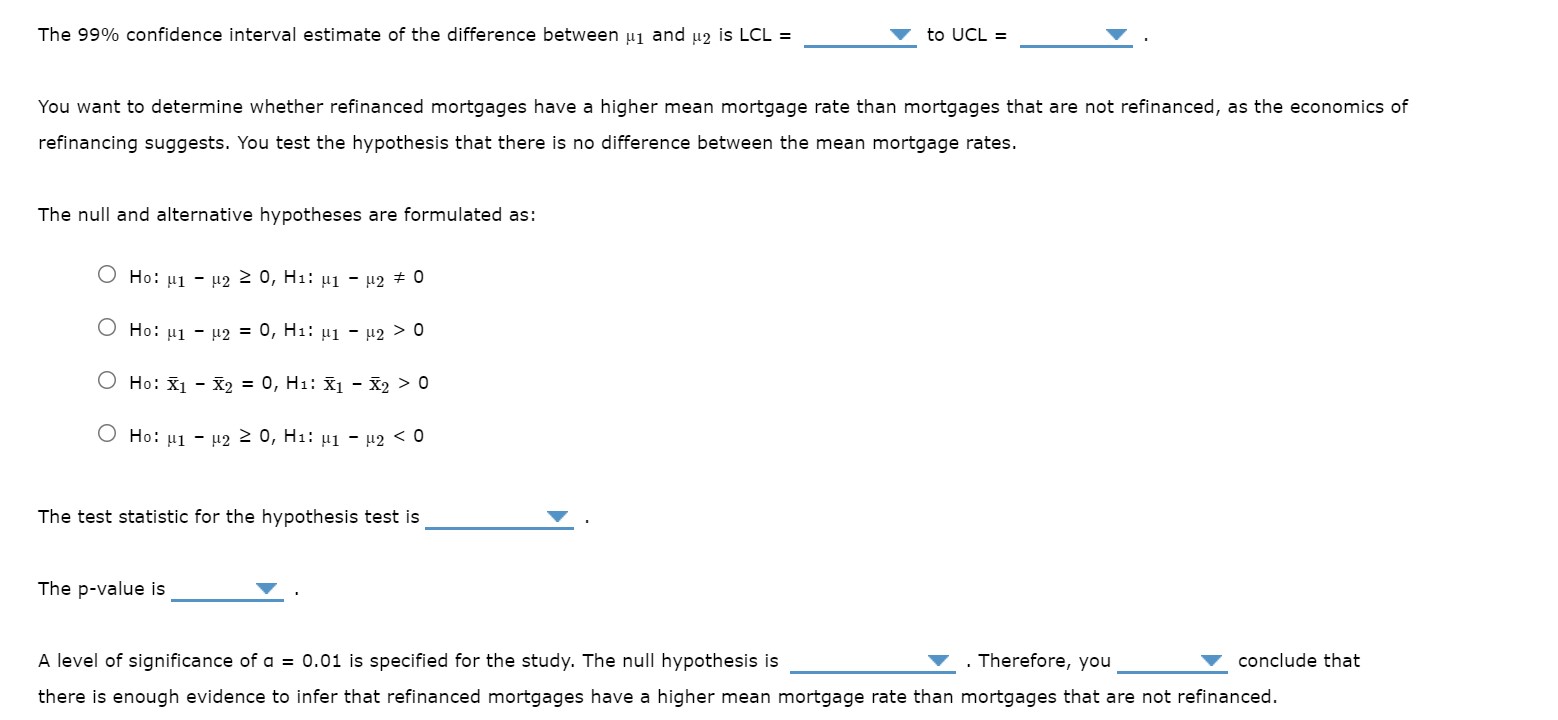

Consider a pool of home mortgages. Prepayments of mortgages in the pool affect the mortgages' cash flow, so mortgage lenders, servicers, and investors all have an interest in predicting mortgage prepayments. Mortgages may be prepaid for a variety of purposes, including selling the home, taking cash out of the property to fund home improvements or other consumer expenditures, or refinancing the mortgage to change the monthly payment schedule. Narrow your focus to mortgage prepayments that are made for the purpose of refinancing. If there were no costs to refinancing, you would refinance to reduce your monthly payments every time the current mortgage rate dropped below the rate on your mortgage. In actuality, however, there are costs to refinancing, such as points and closing fees. Therefore, the spread between the current mortgage rate and your own rate must be big enough to more than make up for the costs, or you wouldn't be interested in refinancing. The economics of refinancing suggest that compared to mortgages that aren't refinanced, refinanced mortgages have higher mortgage rates. Define population 1 as mortgages that are refinanced, and define population 2 as mortgages that are not refinanced. Let uj equal the mean mortgage rate on refinanced mortgages, and let u2 equal the mean mortgage rate on mortgages that are not refinanced. Similarly, let o1 and o2 equal the standard deviations of mortgage rates for populations 1 and 2. Assume that o1 = 0.55 and 62 = 0.66. In a study, professor Michael LaCour-Little selected independent random samples of mortgages that were refinanced and mortgages that were not refinanced, and he collected data on mortgage rates. (Source: Michael LaCour-Little, "Another Look at the Role of Borrower Characteristics in Predicting Mortgage Prepayments," Journal of Housing Research, Volume 10, Issue 1.) For the sample drawn from refinanced mortgages, the sample size ni = 31, and the sample mean x1 = 8.62. For the sample drawn from mortgages that were not refinanced, the sample size n2 = 30, and the sample mean X2 = 8.09. Histograms of the sample data suggest that the populations are not extremely nonnormal. (Note: The sample means match those from the study, but the sample sizes have been reduced.)The point estimate of u1 - u2 is In this study, the sampling distribution of X1 - X2 is approximated by a distribution with and a standard deviation Use the Distributions tool to help you answer the questions that follow.The 99% confidence interval estimate of the difference between uj and u2 is LCL = to UCL = You want to determine whether refinanced mortgages have a higher mean mortgage rate than mortgages that are not refinanced, as the economics of refinancing suggests. You test the hypothesis that there is no difference between the mean mortgage rates. The null and alternative hypotheses are formulated as: O Ho: (1 - 12 2 0, H1: 1 - 12 # 0 O Ho: u1 - 12 = 0, Hi: 1 - 12 > 0 O Ho: X1 - X2 = 0, H1: X1 - X2 > 0 O Ho: H1 - 12 2 0, Hi: 1 - 12