PLEASE HELP ME ANSWER THESE PAYROLL PROBLEMS 1

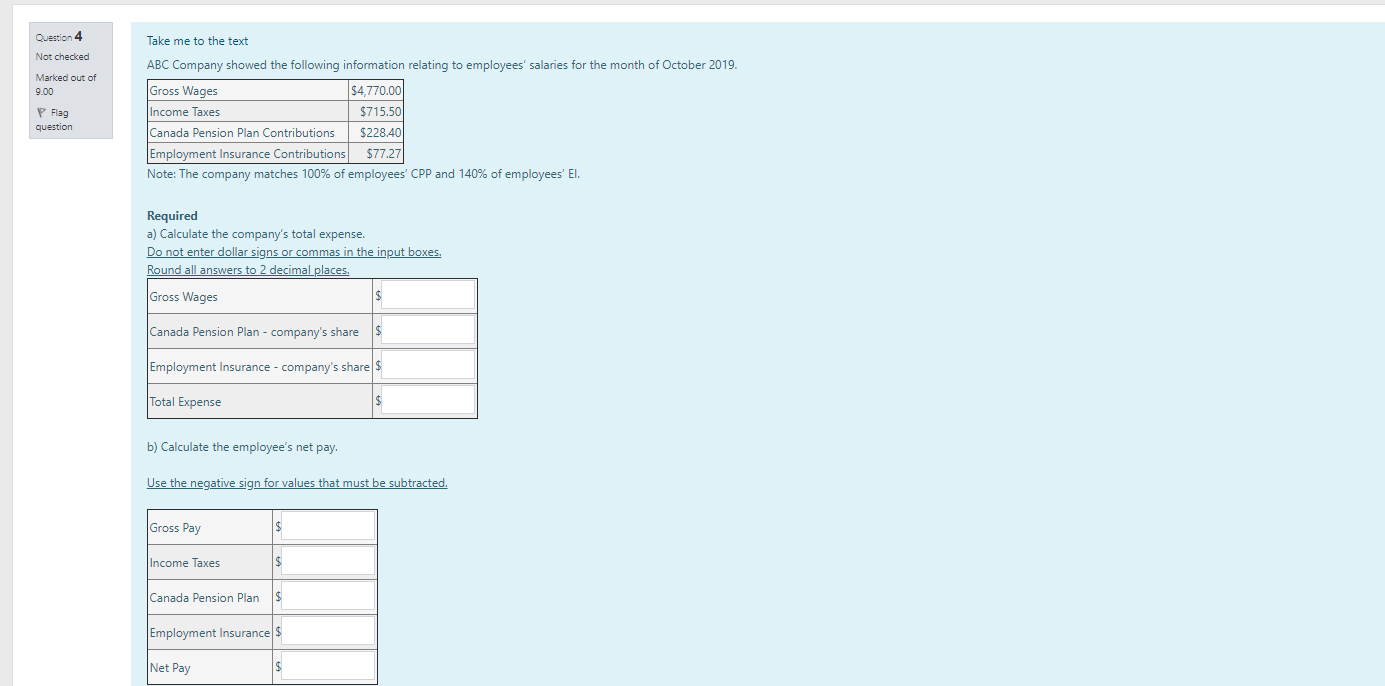

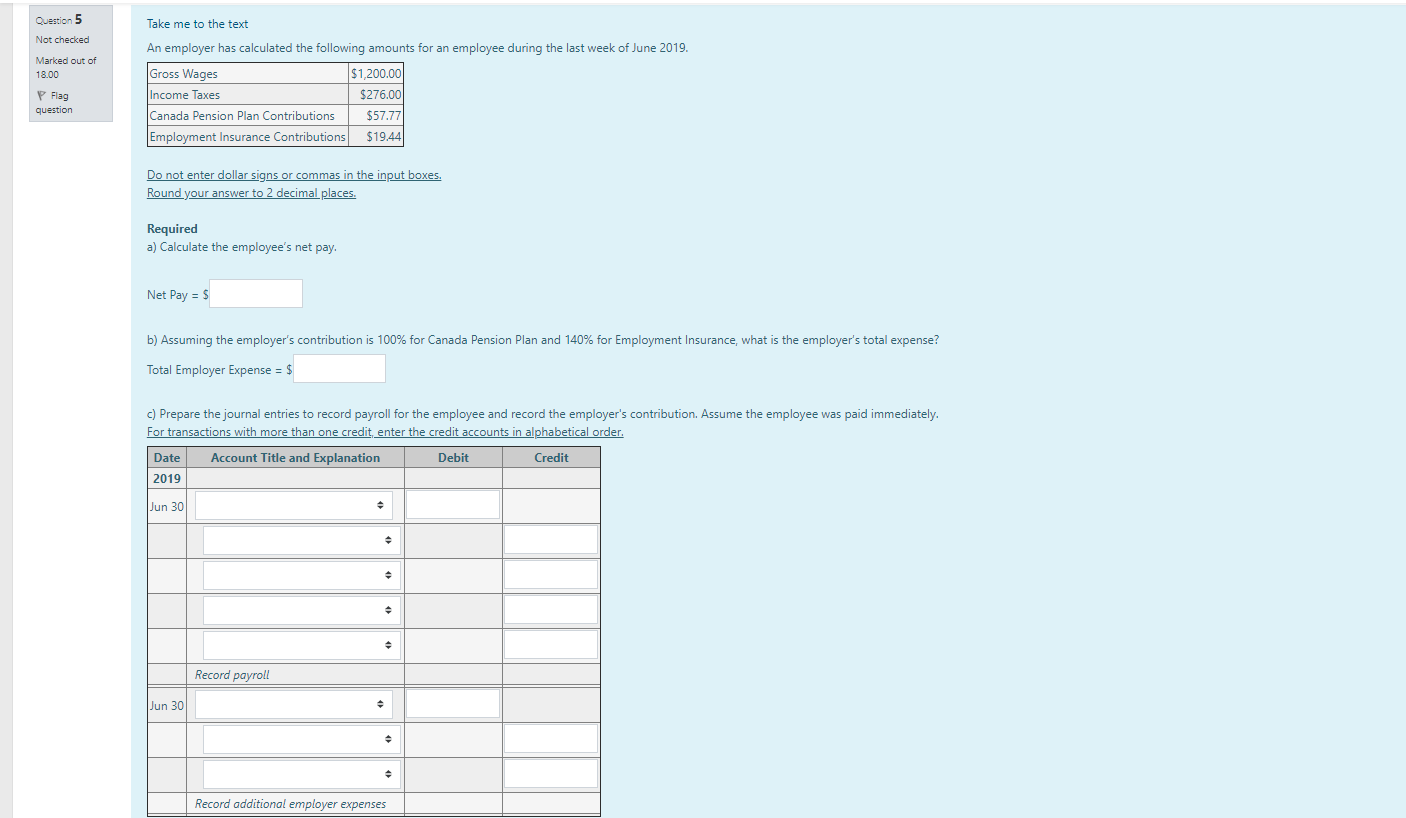

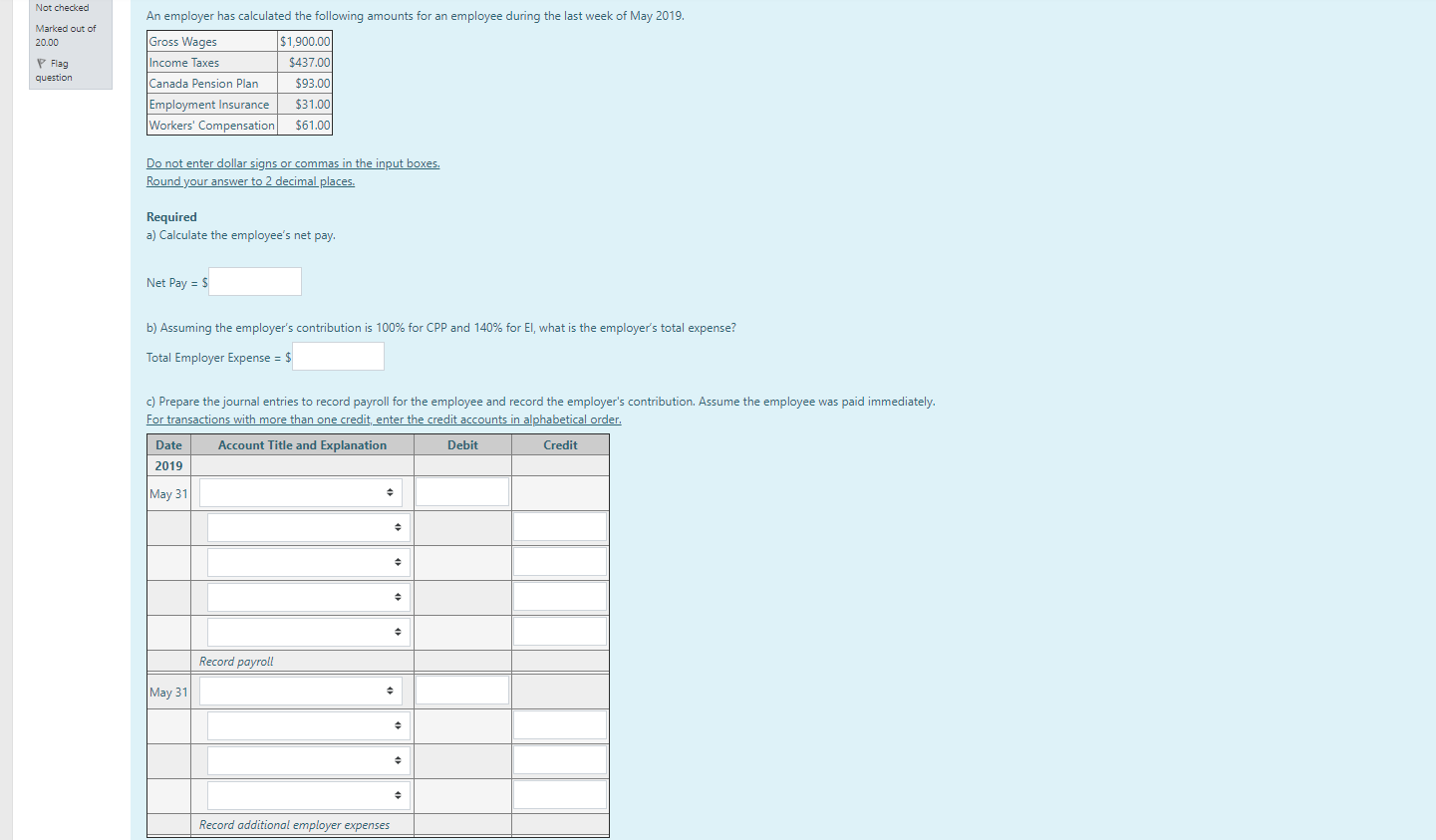

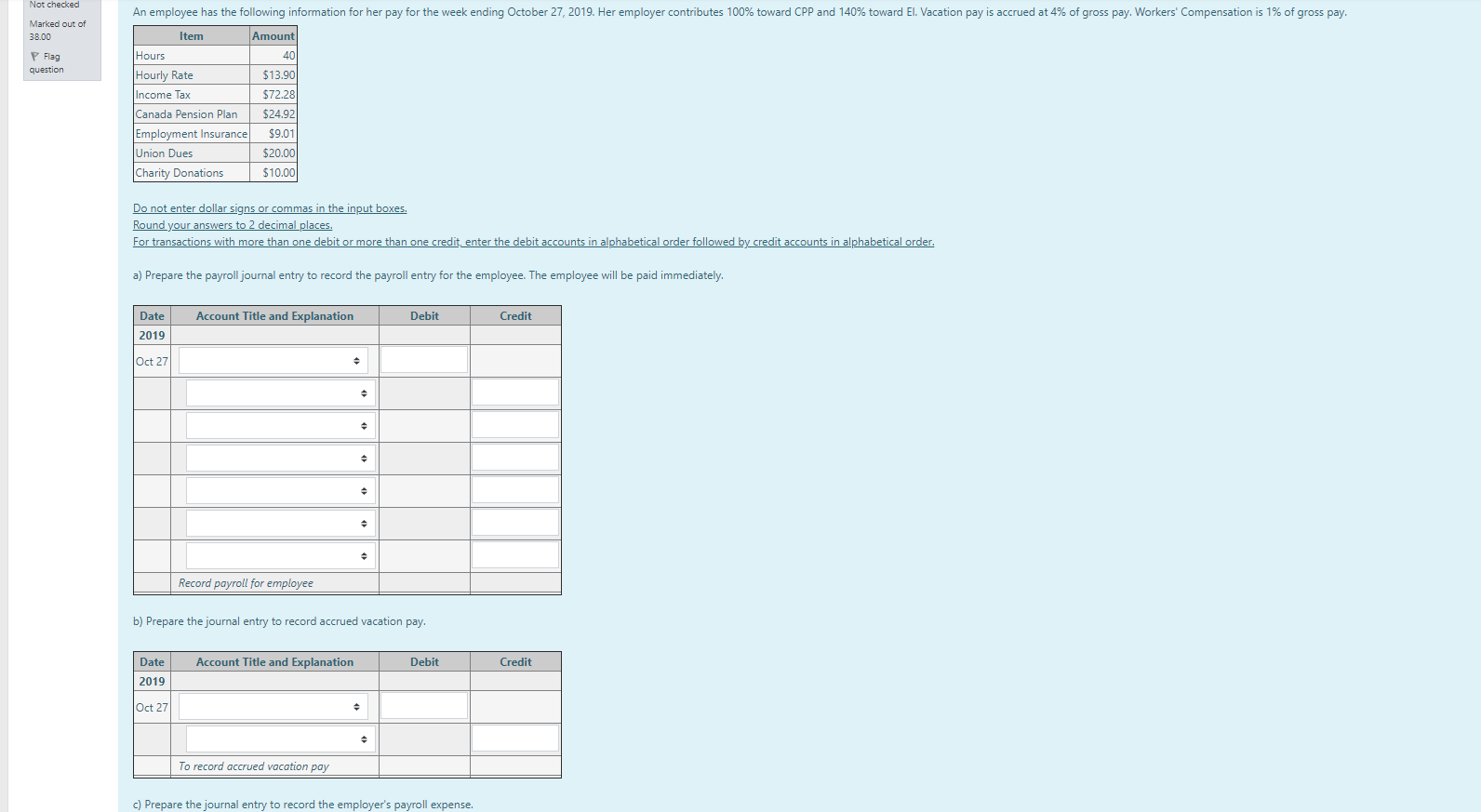

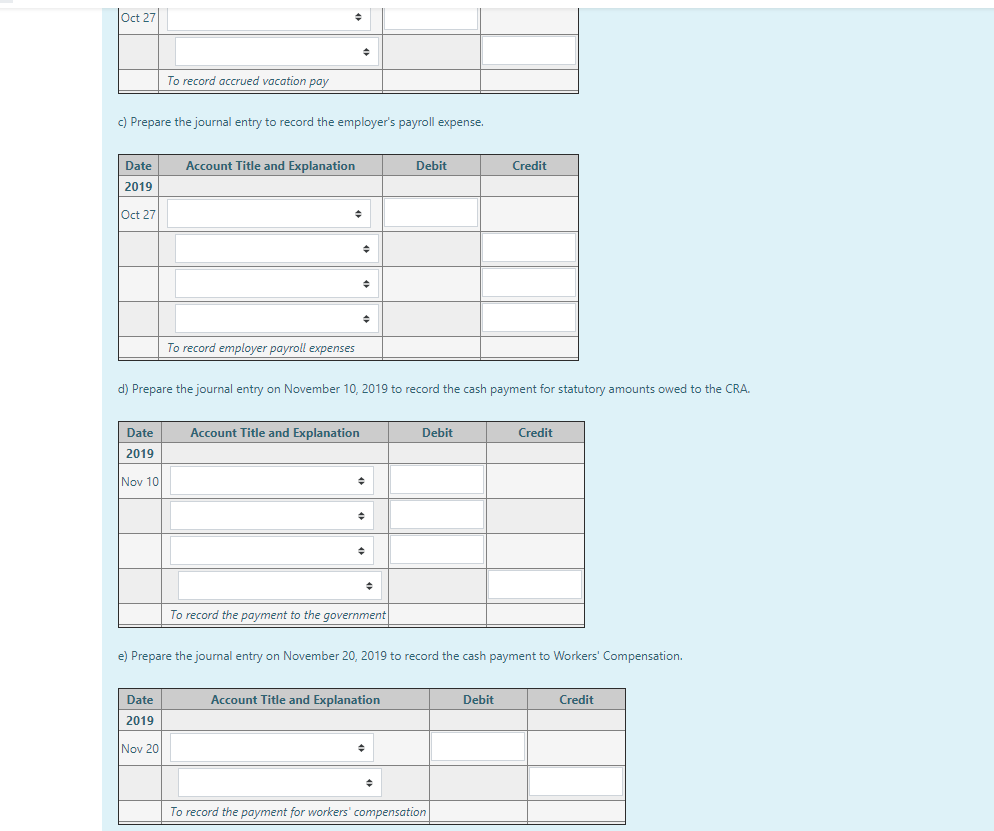

Question 4 Take me to the text Not checked ABC Company showed the following information relating to employees' salaries for the month of October 2019. Marked out of 9.00 Gross Wages $4,770.00 P Flag Income Taxes $715.50 question Canada Pension Plan Contributions $228.40 Employment Insurance Contributions $77.27 Note: The company matches 100% of employees' CPP and 140% of employees' El. Required a) Calculate the company's total expense. Do not enter dollar signs or commas in the input boxes. Round all answers to 2 decimal places. Gross Wages Canada Pension Plan - company's share Employment Insurance - company's share | $ Total Expense $ b) Calculate the employee's net pay. Use the negative sign for values that must be subtracted, Gross Pay Income Taxes Canada Pension Plan Employment Insurance $ Net PayQuestion 5 Take me to the text Not checked Marked out of An employer has calculated the following amounts for an employee during the last week of June 2019. 18.00 Gross Wages $1,200.00 P Flag Income Taxes $276.00 question Canada Pension Plan Contributions $57.77 Employment Insurance Contributions $19.44 Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places. Required a) Calculate the employee's net pay. Net Pay = $ b) Assuming the employer's contribution is 100% for Canada Pension Plan and 140% for Employment Insurance, what is the employer's total expense? Total Employer Expense = $ c) Prepare the journal entries to record payroll for the employee and record the employer's contribution. Assume the employee was paid immediately. For transactions with more than one credit, enter the credit accounts in alphabetical order. Date Account Title and Explanation Debit Credit 2019 Jun 30 Record payroll Jun 30 $ Record additional employer expensesNot checked An employer has calculated the following amounts for an employee during the last week of May 2019. Marked out of 20.00 Gross Wages $1,900.00 P Flag ncome Taxes $437.00 question Canada Pension Plan $93.00 Employment Insurance $31.00 Workers' Compensation $61.00 Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places. Required a) Calculate the employee's net pay. Net Pay = $ b) Assuming the employer's contribution is 100% for CPP and 140% for El, what is the employer's total expense? Total Employer Expense = $ c) Prepare the journal entries to record payroll for the employee and record the employer's contribution. Assume the employee was paid immediately. For transactions with more than one credit, enter the credit accounts in alphabetical order. Date Account Title and Explanation Debit Credit 2019 May 31 Record payroll May 31 Record additional employer expensesNot checked An employee has the following information for her pay for the week ending October 27, 2019. Her employer contributes 100% toward CPP and 140% toward El. Vacation pay is accrued at 4% of gross pay. Workers' Compensation is 1% of gross pay. Marked out of 38.00 Item Amount Flag Hours 40 question Hourly Rate $13.90 Income Tax $72.28 Canada Pension Plan $24.92 Employment Insurance $9.01 Union Dues $20.00 Charity Donations $10.00 Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. For transactions with more than one debit or more than one credit, enter the debit accounts in alphabetical order followed by credit accounts in alphabetical order. a) Prepare the payroll journal entry to record the payroll entry for the employee. The employee will be paid immediately. Date Account Title and Explanation Debit Credit 2019 Oct 27 Record payroll for employee b) Prepare the journal entry to record accrued vacation pay. Date Account Title and Explanation Debit Credit 2019 Oct 27 To record accrued vacation pay c) Prepare the journal entry to record the employer's payroll expense.Oct 27 To record accrued vacation pay c) Prepare the journal entry to record the employer's payroll expense. Date Account Title and Explanation Debit Credit 2019 Oct 27 To record employer payroll expenses d) Prepare the journal entry on November 10, 2019 to record the cash payment for statutory amounts owed to the CRA. Date Account Title and Explanation Debit Credit 2019 Nov 10 To record the payment to the government e) Prepare the journal entry on November 20, 2019 to record the cash payment to Workers' Compensation. Date Account Title and Explanation Debit Credit 2019 Nov 20 To record the payment for workers' compensation