Answered step by step

Verified Expert Solution

Question

1 Approved Answer

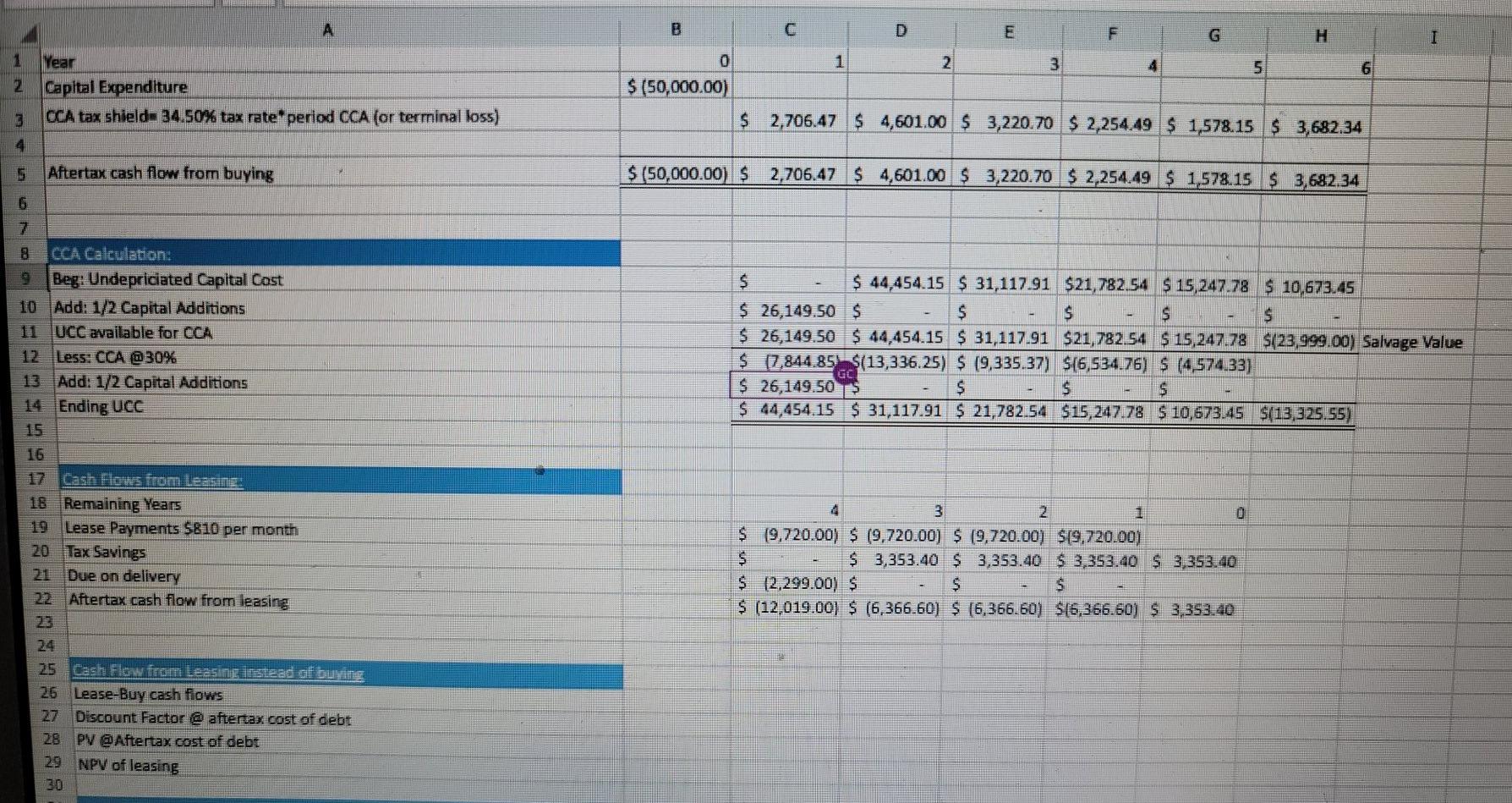

please help me answer this and show the formula in excel A B D F G I 1 2 3 4 5 6 Year Capital

please help me answer this and show the formula in excel

A B D F G I 1 2 3 4 5 6 Year Capital Expenditure CCA tax shield= 34.50% tax rate* period CCA (or terminal loss) 0 $ (50,000.00) $ 2,706.47 $ 4,601.00 $ 3,220.70 $ 2,254.49 $ 1,578.15 $3,682.34 3 4 Aftertax cash flow from buying $ (50,000.00) $ 2,706.47 $4,601.00 $ 3,220.70 $ 2,254.49 $ 1,578.15 $ 3,682.34 6 7 8 CCA Calculation: 9 Beg: Undepriciated Capital Cost 10 Add: 1/2 Capital Additions 11 UCC available for CCA 12 Less: CCA @ 30% 13 Add: 1/2 Capital Additions 14 Ending UCC $ $ 44,454.15 $ 31,117.91 $21,782.54 $ 15,247.78 $ 10,673.45 $ 26,149.50 $ $ $ $ $ $ 26,149.50 $ 44,454.15 $ 31,117.91 $21,782.54 $ 15,247.78 $(23,999.00) Salvage Value $ 17,844.85% $(13,336.25) $ (9,335.37) ${6,534.76) S (4,574.33) $ 26,149.50 $ $ 5 $ 44,454.15 $ 31,117.91 $ 21,782.54 $15, 247.78 $ 10,673.45 $(13,325.55) 16. Cash Ho from E. 18 Remaining Years 19 Lease Payments 5810 per month 20 Tax Savings 21 Due on delivery 22 Aftertax cash flow from leasing 3 2. $ 19,720.00) $ (9,720.00) $ (9,720.00) $(9,720.00) $ $ 3,353.40 $ 3,353.40 $ 3.353.40 S 3,353.40 $ (2,299.00) $ $ $ $ (12,019.00) $ (6.366.60) $ (6,366.60) $(6,366.60) $ 3,353.40 25 Cash Flow from leasinginstead of buying 26 Lease-Buy cash flows 27 Discount Factor @ aftertax cost of debt 28 PV @Aftertax cost of debt 29 NPV of leasing A B D F G I 1 2 3 4 5 6 Year Capital Expenditure CCA tax shield= 34.50% tax rate* period CCA (or terminal loss) 0 $ (50,000.00) $ 2,706.47 $ 4,601.00 $ 3,220.70 $ 2,254.49 $ 1,578.15 $3,682.34 3 4 Aftertax cash flow from buying $ (50,000.00) $ 2,706.47 $4,601.00 $ 3,220.70 $ 2,254.49 $ 1,578.15 $ 3,682.34 6 7 8 CCA Calculation: 9 Beg: Undepriciated Capital Cost 10 Add: 1/2 Capital Additions 11 UCC available for CCA 12 Less: CCA @ 30% 13 Add: 1/2 Capital Additions 14 Ending UCC $ $ 44,454.15 $ 31,117.91 $21,782.54 $ 15,247.78 $ 10,673.45 $ 26,149.50 $ $ $ $ $ $ 26,149.50 $ 44,454.15 $ 31,117.91 $21,782.54 $ 15,247.78 $(23,999.00) Salvage Value $ 17,844.85% $(13,336.25) $ (9,335.37) ${6,534.76) S (4,574.33) $ 26,149.50 $ $ 5 $ 44,454.15 $ 31,117.91 $ 21,782.54 $15, 247.78 $ 10,673.45 $(13,325.55) 16. Cash Ho from E. 18 Remaining Years 19 Lease Payments 5810 per month 20 Tax Savings 21 Due on delivery 22 Aftertax cash flow from leasing 3 2. $ 19,720.00) $ (9,720.00) $ (9,720.00) $(9,720.00) $ $ 3,353.40 $ 3,353.40 $ 3.353.40 S 3,353.40 $ (2,299.00) $ $ $ $ (12,019.00) $ (6.366.60) $ (6,366.60) $(6,366.60) $ 3,353.40 25 Cash Flow from leasinginstead of buying 26 Lease-Buy cash flows 27 Discount Factor @ aftertax cost of debt 28 PV @Aftertax cost of debt 29 NPV of leasingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started