please help me answer this hw question

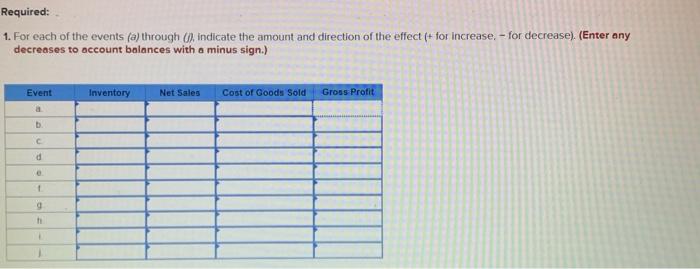

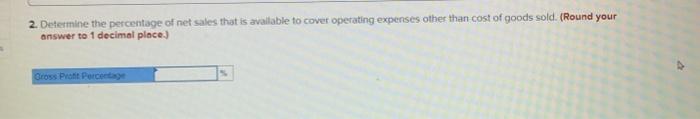

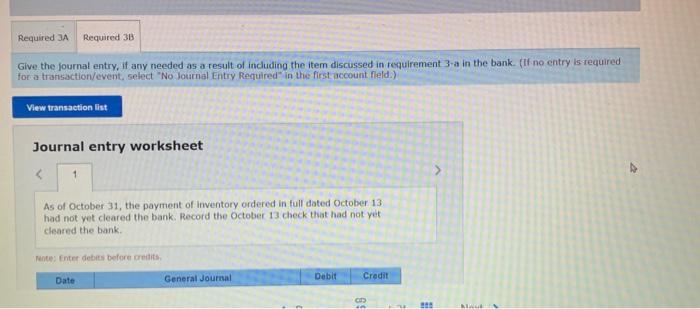

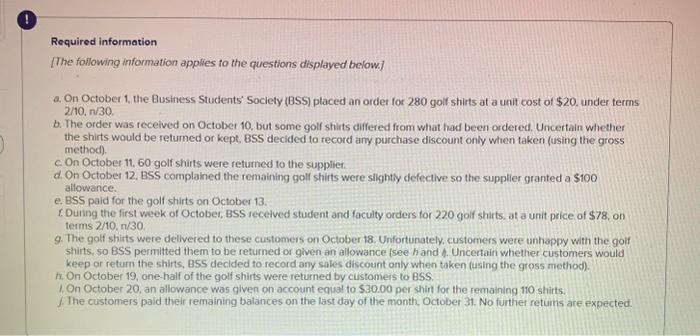

Required information [The following information applies fo the questions displayed below.] a. On October 1, the Business Students' Society (BSS) placed an order for 280 goif shirts at a unit cost of $20, under terms 2/10,n/30. b. The order was recelved on October 10, but some golf shilts differed from what had been ordered. Uncertain whether the shirts would be retumed or kept, BSS decided to record any purchase discount only when taken (using the gross method). c. On October 11, 60 golf shirts were returned to the supplier. d. On October 12. BSS complained the remaining golf shirts were silghtly defective so the supplier granted a $100 allowance. e. BSS paid for the golf shirts on October 13. 6. Duning the first week of October, BSS recelved student and faculty orders for 220 golf shirts, at a unit price of $78, on terms 2/10,n/30 9. The golf shirts were dellvered to these customers on October 18 . Unfortunately, customers were unhappy with the golf shirts, so BSS permitted them to be returned or given an allowance (see h and A. Uncertain whether customers would keep or return the shirts, BSS decided to record any sales discount only when taken (using the gross method). h. On October 19 , one-half of the golf shirts were returned by customers to BSS. 1.On October 20, an allowance was given on account equal to $30.00 per shir for the remaining 110 shirts. f. The customers paid their remaining balances on the last day of the month. October 31. No further retums are expected. 1. For each of the events (a) through (0, indicate the amount and direction of the effect (+ for increase, - for decrease). (Enter any decreases to account bolances with a minus sign.) 2. Detemine the percentage of net sales that is avallable to cover operating expenses other than cost of goods sold. (Round your onswer to 1 decimal ploce. Give the fournal entry, if any needed as a result of induding the item discussed in reguirement 3-a in the bank. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet As of October 31, the payment of inventory ordered in full dated October 13 had not yet cleared the bank. Record the October 13 check that had not yet cleared the bank. Rente: fntert debits before ereitits