Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me answer this problem in detail, im preparing for my exam 3 question (40 marks). The draft statement of financial position shown below

please help me answer this problem in detail, im preparing for my exam

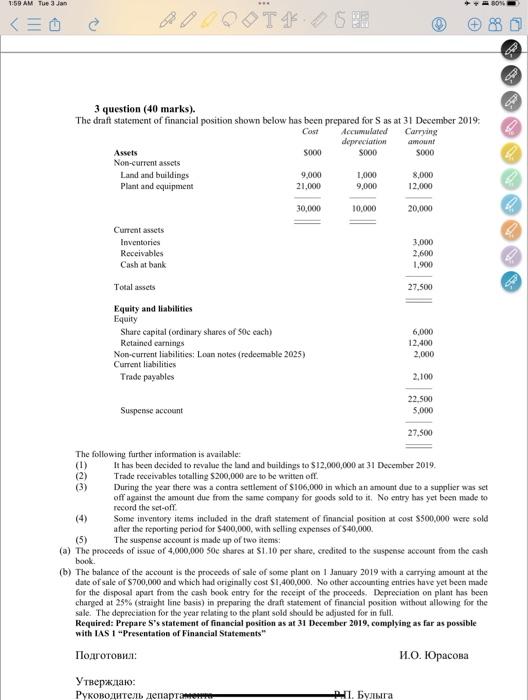

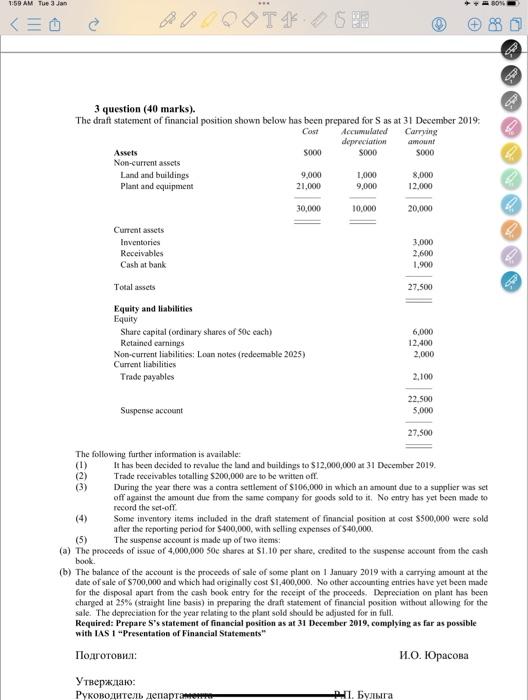

3 question (40 marks). The draft statement of financial position shown below has been prepared for S as at 31 December 2019: The following further information is available: (1) It has been decided to revalue the land and buildings to $12,000,000 at 31 Decernber 2019. (2) Trade receivables totalting $200,000 are to be written off. (3) During the year there was a contra settlement of 5106,000 in which an amsount doe to a supplier was set off against the amount due from the same company for goods sold to it. No entry has yet been made to record the set-off. (4) Some inventory items included in the draft statersent of financial position at cost $500,000 were sold after the reporting period for $400,000, with selling expenses of $40,000. (5) The suspense account is made up of two items: (a) The procends of issue of 4,000,00050e shares at $1.10 per share, credited to the suspense accoant from the cash book. (b) The balance of the account is the proceeds of sale of some plant on 1 Jantary 2019 with a carrying amount at the date of sale of $700,000 and which had originally cost $1,400,000. No other acoounting entries have yet been made for the disposal apart from the cash book entry for the receipt of the proceeds. Depreciation on plant has been charged at 25% (straight line basis) is preparing the draft statement of financial position without allowing for the sale. The depreciation for the year relaing to the plant sold stould be adjusted for in full. Required: Prepare S's statement of financial position as at 31 December 2019, complying as far as possible with LAS 1 "Presentation of Financial Statements" 3 question (40 marks). The draft statement of financial position shown below has been prepared for S as at 31 December 2019: The following further information is available: (1) It has been decided to revalue the land and buildings to $12,000,000 at 31 Decernber 2019. (2) Trade receivables totalting $200,000 are to be written off. (3) During the year there was a contra settlement of 5106,000 in which an amsount doe to a supplier was set off against the amount due from the same company for goods sold to it. No entry has yet been made to record the set-off. (4) Some inventory items included in the draft statersent of financial position at cost $500,000 were sold after the reporting period for $400,000, with selling expenses of $40,000. (5) The suspense account is made up of two items: (a) The procends of issue of 4,000,00050e shares at $1.10 per share, credited to the suspense accoant from the cash book. (b) The balance of the account is the proceeds of sale of some plant on 1 Jantary 2019 with a carrying amount at the date of sale of $700,000 and which had originally cost $1,400,000. No other acoounting entries have yet been made for the disposal apart from the cash book entry for the receipt of the proceeds. Depreciation on plant has been charged at 25% (straight line basis) is preparing the draft statement of financial position without allowing for the sale. The depreciation for the year relaing to the plant sold stould be adjusted for in full. Required: Prepare S's statement of financial position as at 31 December 2019, complying as far as possible with LAS 1 "Presentation of Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started