Question

Please help me answer this tax question: As you can see, I've already worked this problem out, so I'm just needing some guidance. Here is

Please help me answer this tax question:

As you can see, I've already worked this problem out, so I'm just needing some guidance. Here is the rest of my answers:

As you can see, I've already worked this problem out, so I'm just needing some guidance. Here is the rest of my answers:

I'm stuck on part e)

I'm stuck on part e)

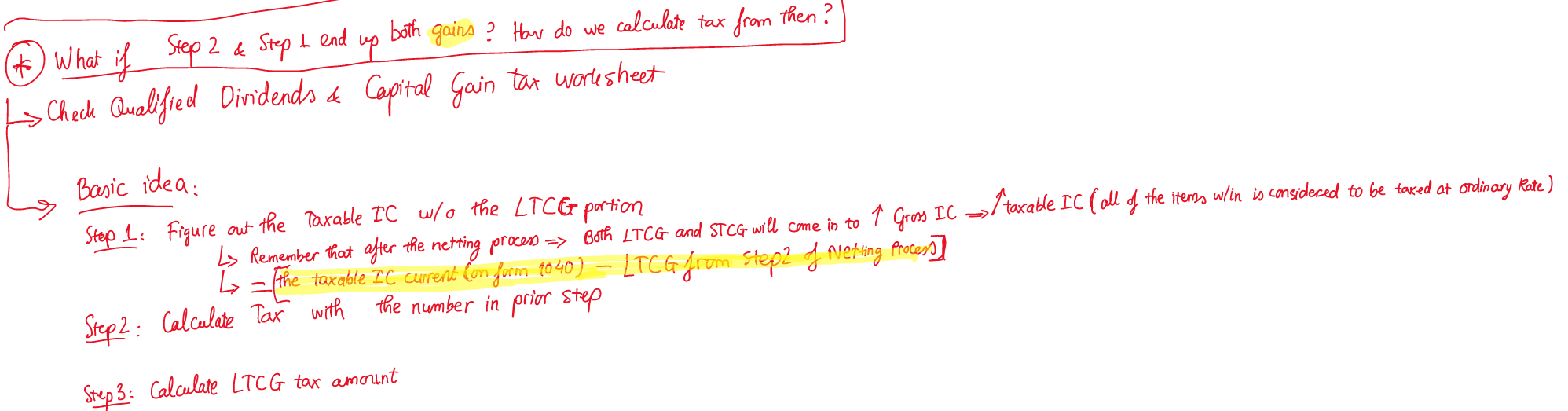

Initially, I got the question wrong. My professor then gave us some guidance on how to solve this part:

He rephrased the question in part e) to be:

How much of the capital gain due to the stock trading activity (if any) can be taxed at a preferential rate?

And here's some extra guidance from my notes on how to solve the problem:

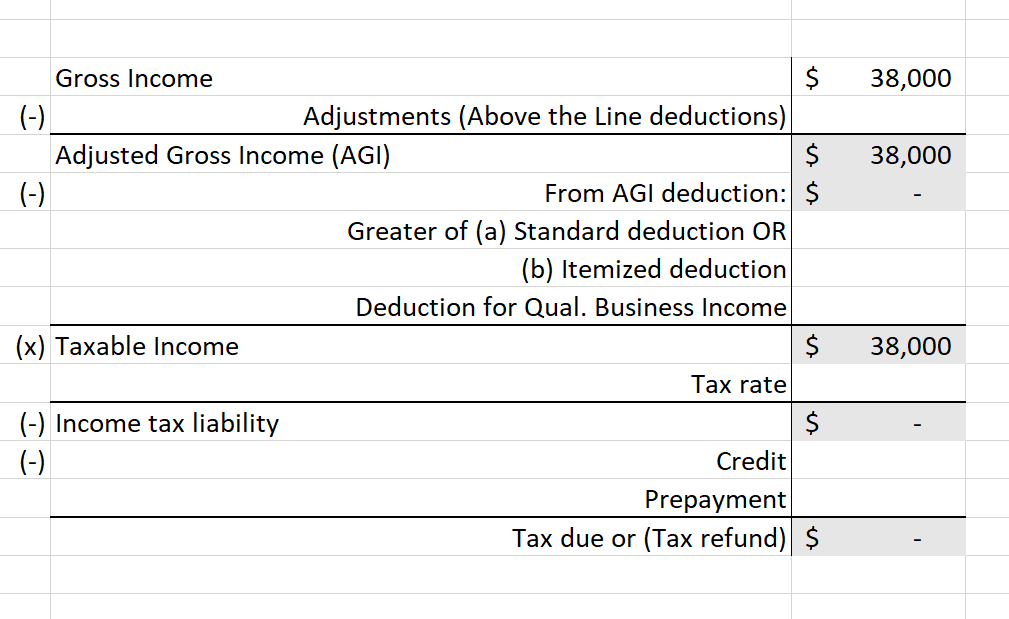

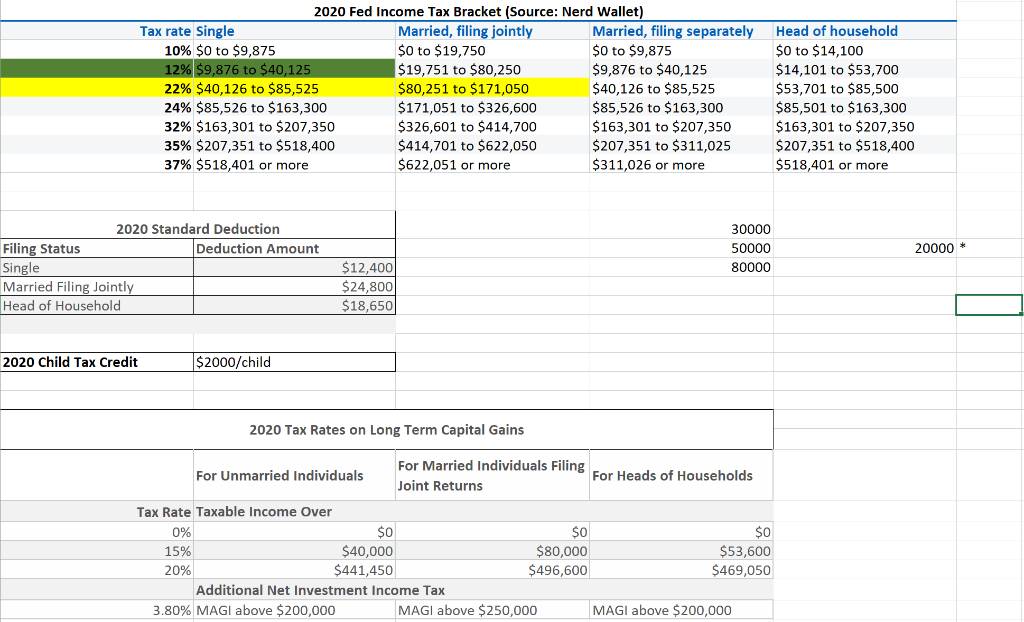

And here's the tax calculation sheet that we are using in order to input tax-related information:

And here's the tax calculation sheet that we are using in order to input tax-related information:

I've tried so hard to work this problem out but am having trouble with figuring out how to calculate part e). Can you please offer me some guidance?

EDIT: What do you mean you need more information? I've provided ALL information available. And you didn't even specify what more information you're looking for.

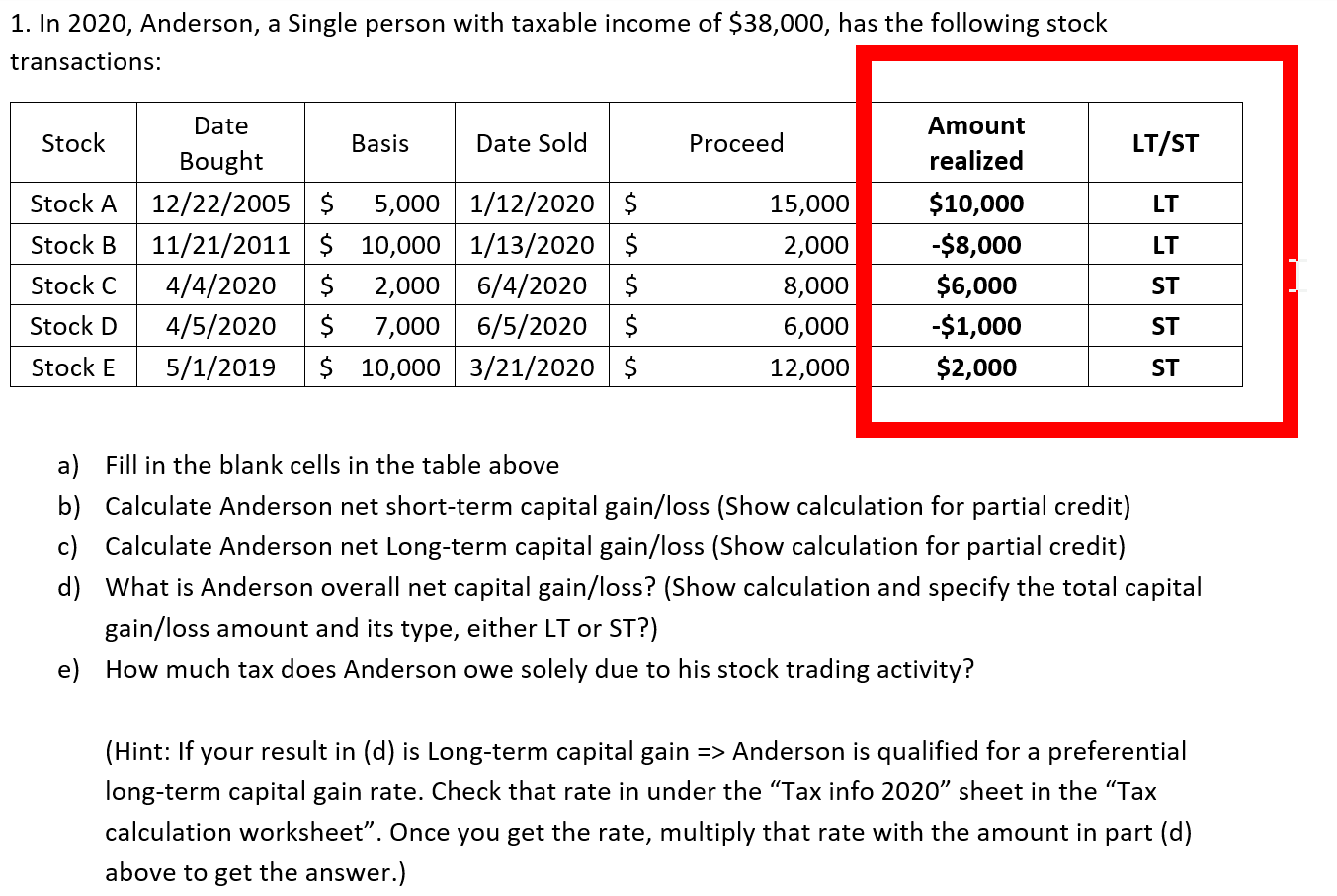

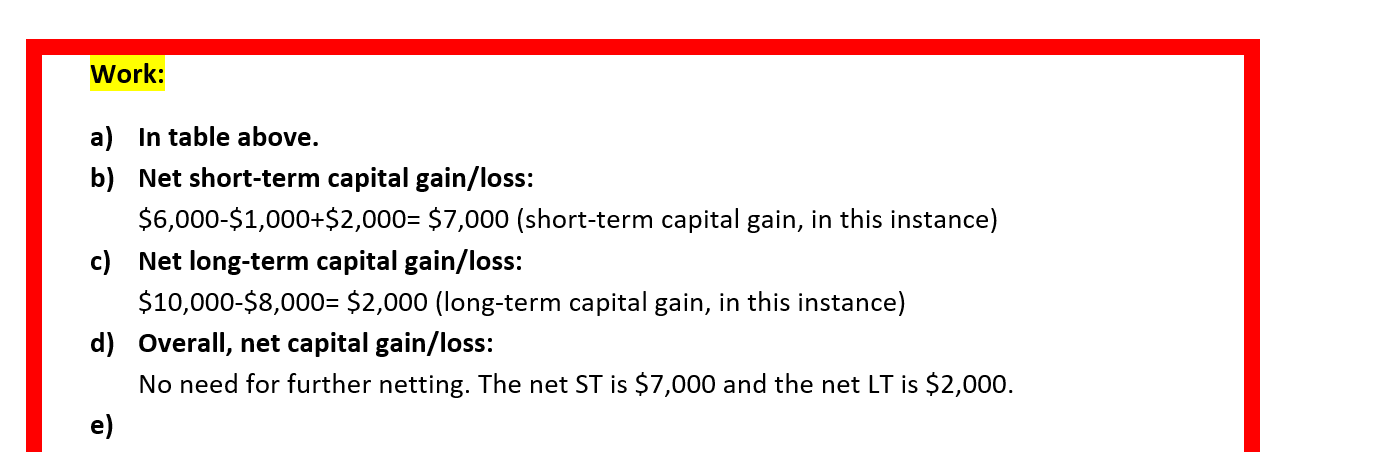

1. In 2020, Anderson, a Single person with taxable income of $38,000, has the following stock transactions: Stock Proceed LT/ST Stock A LT Stock B Date Basis Date Sold Bought 12/22/2005 $ 5,000 1/12/2020 $ 11/21/2011 $ 10,000 1/13/2020 $ 4/4/2020 $ 2,000 6/4/2020 $ 4/5/2020 $ 7,000 6/5/2020 $ 5/1/2019 $ 10,000 3/21/2020 $ Amount realized $10,000 -$8,000 $6,000 -$1,000 $2,000 LT 15,000 2,000 8,000 6,000 12,000 Stock C ST Stock D ST Stock E ST a) Fill in the blank cells in the table above b) Calculate Anderson net short-term capital gain/loss (Show calculation for partial credit) c) Calculate Anderson net Long-term capital gain/loss (Show calculation for partial credit) d) What is Anderson overall net capital gain/loss? (Show calculation and specify the total capital gain/loss amount and its type, either LT or ST?) e) How much tax does Anderson owe solely due to his stock trading activity? (Hint: If your result in (d) is Long-term capital gain => Anderson is qualified for a preferential long-term capital gain rate. Check that rate in under the Tax info 2020" sheet in the Tax calculation worksheet". Once you get the rate, multiply that rate with the amount in part (d) above to get the answer.) Work: a) In table above. b) Net short-term capital gain/loss: $6,000-$1,000+$2,000= $7,000 (short-term capital gain, in this instance) c) Net long-term capital gain/loss: $10,000-$8,000= $2,000 (long-term capital gain, in this instance) d) Overall, net capital gain/loss: No need for further netting. The net ST is $7,000 and the net LT is $2,000. e) up & What if Step 2 & Step 1 end both gains ? How do we calculate tax from then? > Check Qualified Dividends a Capital Gain tar warlesheet Basic idea, Step 1: Figure out the Taxable IC w/o the LTCG portion Remember that after the netting proces => Sota LTCG and Steam will come in to 7 Gros IC >>> taxable IC Call of the terms win is consideced to be taxed at ordinary Rate) L = fue taxablezc caurent Condom 1040) LTCG from Step2 y mersing Process] Step 2: Calculate Tax with the number in prior step Step 3: Calculate LTCG tax amount 38,000 38,000 Gross Income $ (-) Adjustments (Above the Line deductions) Adjusted Gross Income (AGI) $ (-) From AGI deduction: Greater of (a) Standard deduction OR (b) Itemized deduction Deduction for Qual. Business Income (x) Taxable Income $ Tax rate (-) Income tax liability Credit Prepayment Tax due or (Tax refund) $ 38,000 2020 Fed Income Tax Bracket (Source: Nerd Wallet) Tax rate Single Married, filing jointly Married, filing separately 10% $0 to $9,875 $0 to $19,750 $0 to $9,875 12% $9,876 to $40,125 $19,751 to $80,250 $9,876 to $40,125 22% $40,126 to $85,525 $80,251 to $171,050 $40,126 to $85,525 24% $85,526 to $163,300 $171,051 to $326,600 $85,526 to $163,300 32% $163,301 to $207,350 $326,601 to $414,700 $ 163,301 to $207,350 35% $207,351 to $518,400 $414,701 to $622,050 $207,351 to $311,025 37% $518,401 or more $622,051 or more $311,026 or more Head of household $0 to $14,100 $14,101 to $53,700 $53,701 to $85,500 $85,501 to $163,300 $163,301 to $207,350 $207,351 to $518,400 $518,401 or more 2020 Standard Deduction Filing Status Deduction Amount Single Married Filing Jointly Head of Household 30000 50000 80000 20000* $12,400 $24,800 $18,650 2020 Child Tax Credit $2000/child 2020 Tax Rates on Long Term Capital Gains For Married Individuals Filing For Unmarried Individuals For Heads of Households Joint Returns Tax Rate Taxable income Over 0% $0 $0 $0 15% $40,000 $80,000 $53,600 20% $441,450 $496,600 $469,050 Additional Net Investment Income Tax 3.80% MAGI above $200,000 MAGI above $250,000 MAGI above $200,000 1. In 2020, Anderson, a Single person with taxable income of $38,000, has the following stock transactions: Stock Proceed LT/ST Stock A LT Stock B Date Basis Date Sold Bought 12/22/2005 $ 5,000 1/12/2020 $ 11/21/2011 $ 10,000 1/13/2020 $ 4/4/2020 $ 2,000 6/4/2020 $ 4/5/2020 $ 7,000 6/5/2020 $ 5/1/2019 $ 10,000 3/21/2020 $ Amount realized $10,000 -$8,000 $6,000 -$1,000 $2,000 LT 15,000 2,000 8,000 6,000 12,000 Stock C ST Stock D ST Stock E ST a) Fill in the blank cells in the table above b) Calculate Anderson net short-term capital gain/loss (Show calculation for partial credit) c) Calculate Anderson net Long-term capital gain/loss (Show calculation for partial credit) d) What is Anderson overall net capital gain/loss? (Show calculation and specify the total capital gain/loss amount and its type, either LT or ST?) e) How much tax does Anderson owe solely due to his stock trading activity? (Hint: If your result in (d) is Long-term capital gain => Anderson is qualified for a preferential long-term capital gain rate. Check that rate in under the Tax info 2020" sheet in the Tax calculation worksheet". Once you get the rate, multiply that rate with the amount in part (d) above to get the answer.) Work: a) In table above. b) Net short-term capital gain/loss: $6,000-$1,000+$2,000= $7,000 (short-term capital gain, in this instance) c) Net long-term capital gain/loss: $10,000-$8,000= $2,000 (long-term capital gain, in this instance) d) Overall, net capital gain/loss: No need for further netting. The net ST is $7,000 and the net LT is $2,000. e) up & What if Step 2 & Step 1 end both gains ? How do we calculate tax from then? > Check Qualified Dividends a Capital Gain tar warlesheet Basic idea, Step 1: Figure out the Taxable IC w/o the LTCG portion Remember that after the netting proces => Sota LTCG and Steam will come in to 7 Gros IC >>> taxable IC Call of the terms win is consideced to be taxed at ordinary Rate) L = fue taxablezc caurent Condom 1040) LTCG from Step2 y mersing Process] Step 2: Calculate Tax with the number in prior step Step 3: Calculate LTCG tax amount 38,000 38,000 Gross Income $ (-) Adjustments (Above the Line deductions) Adjusted Gross Income (AGI) $ (-) From AGI deduction: Greater of (a) Standard deduction OR (b) Itemized deduction Deduction for Qual. Business Income (x) Taxable Income $ Tax rate (-) Income tax liability Credit Prepayment Tax due or (Tax refund) $ 38,000 2020 Fed Income Tax Bracket (Source: Nerd Wallet) Tax rate Single Married, filing jointly Married, filing separately 10% $0 to $9,875 $0 to $19,750 $0 to $9,875 12% $9,876 to $40,125 $19,751 to $80,250 $9,876 to $40,125 22% $40,126 to $85,525 $80,251 to $171,050 $40,126 to $85,525 24% $85,526 to $163,300 $171,051 to $326,600 $85,526 to $163,300 32% $163,301 to $207,350 $326,601 to $414,700 $ 163,301 to $207,350 35% $207,351 to $518,400 $414,701 to $622,050 $207,351 to $311,025 37% $518,401 or more $622,051 or more $311,026 or more Head of household $0 to $14,100 $14,101 to $53,700 $53,701 to $85,500 $85,501 to $163,300 $163,301 to $207,350 $207,351 to $518,400 $518,401 or more 2020 Standard Deduction Filing Status Deduction Amount Single Married Filing Jointly Head of Household 30000 50000 80000 20000* $12,400 $24,800 $18,650 2020 Child Tax Credit $2000/child 2020 Tax Rates on Long Term Capital Gains For Married Individuals Filing For Unmarried Individuals For Heads of Households Joint Returns Tax Rate Taxable income Over 0% $0 $0 $0 15% $40,000 $80,000 $53,600 20% $441,450 $496,600 $469,050 Additional Net Investment Income Tax 3.80% MAGI above $200,000 MAGI above $250,000 MAGI above $200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started