PLEASE HELP ME ANSWERING ALL QUESTION! I WILL BE THANKFULL! THANK YOU

PLEASE HELP ME ANSWERING ALL QUESTION! I WILL BE THANKFULL! THANK YOU

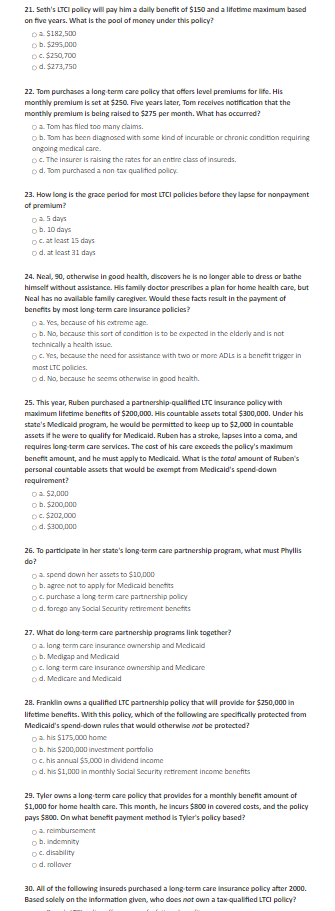

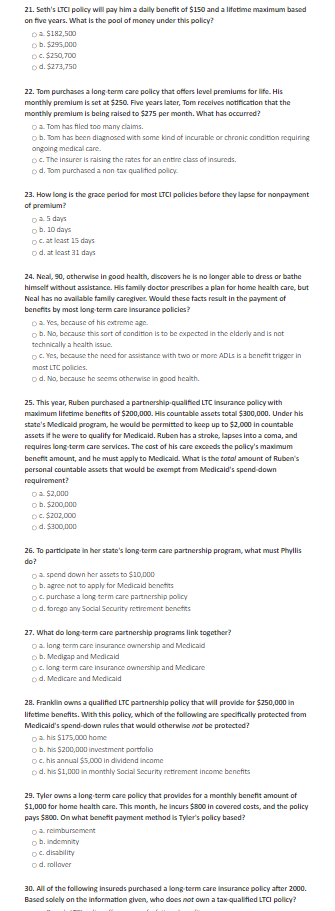

21. Seth's LTCI policy will pay him a daily benefit of $150 and a lifetime maximum based on five years. What is the pool of moncy under this policy? 2. $182,500 b. $295,000 oc. $250,700 o d. $273,750 22. Tom purchases a long term care policy that offers level premiums for life. His monthly premium is set at $250. Five years later, Tom recelves notification that the monthly premium is being raised to $275 per month. What has occurred? Q 2. Tom has filod too many claims. ob. Tom has been diagnoocd with some kind of incuabic or chronic condition requiring ongoing medical care. oc. The insurcr is raising the rates for an entire claes of insureds. od. Tom purchascd a non tax qualifiod policy. 23. How long is the grace period for most LTCI policies before they lapse for nonpayment of premilum? D 2.5dxd3 D b. 10 days O C. at lenst 15 days od. at lenst 31 days 24. Neal, 90, otherwise in good health, dlscovers he is no longer able to dress or bathe himeelt without assistance. His family doctor prescribes a plan for home health care, but Neal has no avallable tamily caregiver. Would these facts result in the payment of benchts by most long term care insurance policies? o 2. Yes, because of his cxtreme age. o b. No, because this sort of condition is to be expected in the clderly and is not: technically a health issue. oc. Yes, because the nccd for aksiatance with two or more ADL is a bencfit trigger in mast LTC pollcies. od. No, because he scems ocherwise in good heakh. 25. This year, fuben purchased a partnerahip qualificd LTC Insurance pollcy with maximum lifetime benefts of $200,000. His countable assets total $300,000. Under his state's Medicald program, he would be permitted to keep up to $2,000 in countable assets it he were to qualify for Medicaid. Ruben has a stroke, lapses into a coma, and requires long-term care services. The cost of his care ewcecds the policy's maximum bencht amount, and he must apply to Medicald. What is the total amount of Fuben's personal countable assets that would be crempt from Medicaid's spend down requirement? o 2.$2,000 o b. $200,000 o c. $202,000 o d. $300,000 26. To participate in her state's long term care partnership program, what must Phyilis do? 02 spend down her assets to $10,000 o b. agree not to apply for Medicaid benctits oc. purchase a long term care partnership policy od. forego any Social Security retirement benctits 27. What do long term care partnership progams link together? O a. Ing term carc insurance ownership and Modicaid D b. Medigop and Medicaid Dc. long term care insurance ownership and Medcare od. Medicare and Medicaid 28. Franklin owns a qualificd LTC partnership policy that will provide for $250,000 in lifetime benefits. With this policy, which of the following are specifically protocted from Medicaid's spend down rules that would otherwise not be protected? 0 2. his $175,000 home o b. his $200,000 investment portfalio Oc. his annual $5,000 in dividend lincome od. his \$1,Dou in monthly Social Socurity rettrement income benefits 29. Tyler owns a long term care policy that provides for a monthly benefit amount of $1,000 for home health care. This month, he incurs $900 in covered costs, and the policy pays $800. On what benetit payment method is Tyler's policy based? o 2 rcimbursement o b. indemnity oc. disability o d. rollover 30. All of the following insureds purchased a long.term care insurance policy after 2000. Based solely on the information given, who does not own a tax qualified LTCl policy

PLEASE HELP ME ANSWERING ALL QUESTION! I WILL BE THANKFULL! THANK YOU

PLEASE HELP ME ANSWERING ALL QUESTION! I WILL BE THANKFULL! THANK YOU