Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME ANSWERING ALL QUESTIONS!! THANK YOU VERY MUCH If you are not able to answer all complete questions, do not answer thank you.

PLEASE HELP ME ANSWERING ALL QUESTIONS!! THANK YOU VERY MUCH

PLEASE HELP ME ANSWERING ALL QUESTIONS!! THANK YOU VERY MUCH

If you are not able to answer all complete questions, do not answer thank you.

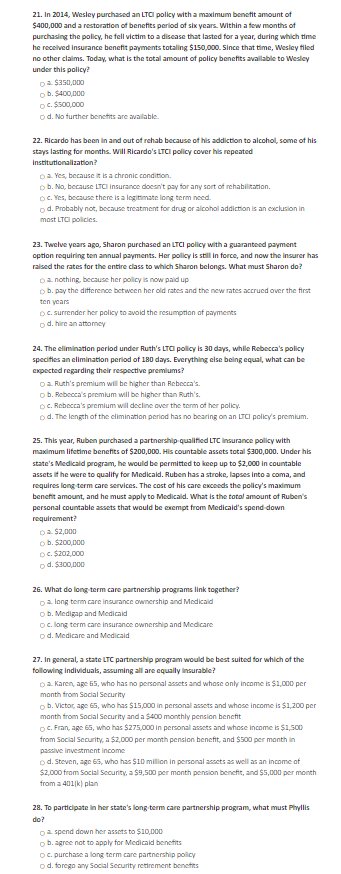

21. In 2014, Wesley purchased an LTCI policy with a maximum benefit amount of $400,000 and a restonation of benefits period of six years. within a few months of purchasing the policy, he fell victim to a disease that lasted for a year, during which time he recolved insurance benefit payments totaling $150,000. Since that time, Wesley tilied no other claims. Today, what is the total amount of policy benefits wallable to Wesley under this policy? 02.$350,000 b. $400,000 c. $500,000 Od. No further benctits are avalable. 22. Ficardo has been in and out of rehab because of his addiction to alcohol, some of his stays lasting for months. Will Ricardo's ITCI policy cover his repeated institutionalization? Q a. Yes, because it is a chranic condition. o b. No, because LTCI insuranoe docan't psy for any sort of rehabilitation. oc. Ycs, bocause there is a logitinate long term nocd. od. Probably not, bocause treatment for drug or alcohol addiction is an exclusion in most LTCI policies. 23. Twelue years ago, Sharon purchased an LTCl policy with a guarantocd payment option requiring ten annual payments. Her pollcy is stlli in force, and now the insurer has ralsed the rates for the entire class to which Sharon belongs. What must Sharon do? o a nothing, because her pollcy is now paid up o b. psy the differenoe between her old rates and the new rates accrued over the first ten years Oc. surrender her policy to avoid the resumption of payments od. hire an attomey 24. The climination period under Futh's LTO policy is 30 days, while Rebecca's policy specities an elimination period of 180 days. Everything else being equal, what can be expected regarding their respective premlums? O 2. Fush's premium will be higher than Rebocca's. o b. Rcbcoca's premium will be higher than Ruth's. oc. Rcbocca's premium will docline over the term of her policy. od. The Iongsh of the climination period has no besring on an LTC policy's premium. 25. This year, Fuben purchased a partnership-qualificd LTC Insurance policy with maximum lifetime benefits of $200,000. His countable assets total $300,000. Under his state's Medicald program, he would be permitted to keep up to $2,000 in countable assets it he were to qualify for Medicaid. Ruben has a stroke, lapses into a coma, and requires long term care services. The cost of his care excocds the pollcy's maximum bencht amount, and he must apply to Medicald. What is the total amount of Fuben's personal countable assets that would be crempt from Medicaid's spend down requirement? 02$2,000 b. $200,D00 c. $202,000 od. $300,DCD 26. What do long term care partnership programs link together? 0 2. Iong term carc insurance owncrship and Modicaid O b. Mcdigap and Mcdicaid O c. long term care insurance owncrship and Medicare d. Mcdicare and Medicaid 27. In peneral, a state LTC partnership program would be best sulted for which of the following individuak, assuming all are equally linsurable? o a. Karen, ape 65, who has no personal acscts and whose only income is $1,000 per month from Social Sccurity o b. Victor, age 65, who has $15,000 in personal anocts and whose income is $1,200 per month from Social Security and a $400 monthly pension beneftt o c. Fran, age 65, who has $275,000 in personal amocts and whose income is $1,500 from Social Sccurity, a $2,000 per month pension bencft, and $500 per month in paccive investment income D d. Steven, age 65, who has $10 million in personal acsets as well as an income of $2,000 from Social 5ccurity,2$9,500 per month penaion bencfit, and $5,000 per month from a 401(k) plan 28. To participate in her state's long term care partnership program, what must Phyllis do? D a spend down her asscts to $10,DOD o b. agree not to apply for Medicaid benctits Dc. purchase a long term care partncrship pollcy o d. forego any Social Security retirement benctiss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started