Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me as soon as possible Natalie opened Natalie Washing co. on July 1, 2022. During July, the following transactions were completed. July 1

Please help me as soon as possible

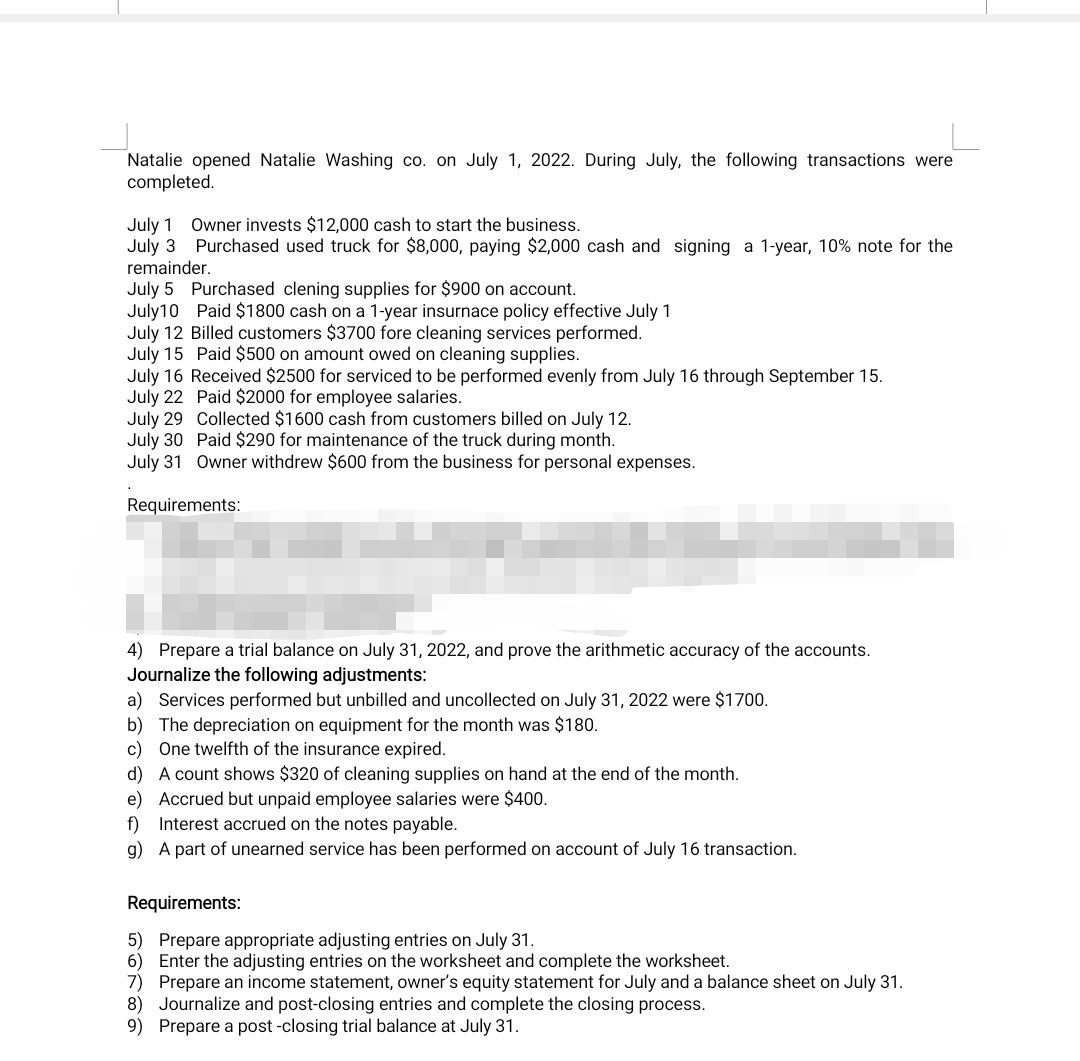

Natalie opened Natalie Washing co. on July 1, 2022. During July, the following transactions were completed. July 1 Owner invests $12,000 cash to start the business. July 3 Purchased used truck for $8,000, paying $2,000 cash and signing a 1 -year, 10% note for the remainder. July 5 Purchased clening supplies for $900 on account. July10 Paid $1800 cash on a 1-year insurnace policy effective July 1 July 12 Billed customers $3700 fore cleaning services performed. July 15 Paid $500 on amount owed on cleaning supplies. July 16 Received $2500 for serviced to be performed evenly from July 16 through September 15 . July 22 Paid $2000 for employee salaries. July 29 Collected $1600 cash from customers billed on July 12. July 30 Paid $290 for maintenance of the truck during month. July 31 Owner withdrew $600 from the business for personal expenses. Requirements: 4) Prepare a trial balance on July 31, 2022, and prove the arithmetic accuracy of the accounts. Journalize the following adjustments: a) Services performed but unbilled and uncollected on July 31,2022 were $1700. b) The depreciation on equipment for the month was $180. c) One twelfth of the insurance expired. d) A count shows $320 of cleaning supplies on hand at the end of the month. e) Accrued but unpaid employee salaries were $400. f) Interest accrued on the notes payable. g) A part of unearned service has been performed on account of July 16 transaction. Requirements: 5) Prepare appropriate adjusting entries on July 31. 6) Enter the adjusting entries on the worksheet and complete the worksheet. 7) Prepare an income statement, owner's equity statement for July and a balance sheet on July 31. 8) Journalize and post-closing entries and complete the closing process. 9) Prepare a post -closing trial balance at July 31

Natalie opened Natalie Washing co. on July 1, 2022. During July, the following transactions were completed. July 1 Owner invests $12,000 cash to start the business. July 3 Purchased used truck for $8,000, paying $2,000 cash and signing a 1 -year, 10% note for the remainder. July 5 Purchased clening supplies for $900 on account. July10 Paid $1800 cash on a 1-year insurnace policy effective July 1 July 12 Billed customers $3700 fore cleaning services performed. July 15 Paid $500 on amount owed on cleaning supplies. July 16 Received $2500 for serviced to be performed evenly from July 16 through September 15 . July 22 Paid $2000 for employee salaries. July 29 Collected $1600 cash from customers billed on July 12. July 30 Paid $290 for maintenance of the truck during month. July 31 Owner withdrew $600 from the business for personal expenses. Requirements: 4) Prepare a trial balance on July 31, 2022, and prove the arithmetic accuracy of the accounts. Journalize the following adjustments: a) Services performed but unbilled and uncollected on July 31,2022 were $1700. b) The depreciation on equipment for the month was $180. c) One twelfth of the insurance expired. d) A count shows $320 of cleaning supplies on hand at the end of the month. e) Accrued but unpaid employee salaries were $400. f) Interest accrued on the notes payable. g) A part of unearned service has been performed on account of July 16 transaction. Requirements: 5) Prepare appropriate adjusting entries on July 31. 6) Enter the adjusting entries on the worksheet and complete the worksheet. 7) Prepare an income statement, owner's equity statement for July and a balance sheet on July 31. 8) Journalize and post-closing entries and complete the closing process. 9) Prepare a post -closing trial balance at July 31 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started