Answered step by step

Verified Expert Solution

Question

1 Approved Answer

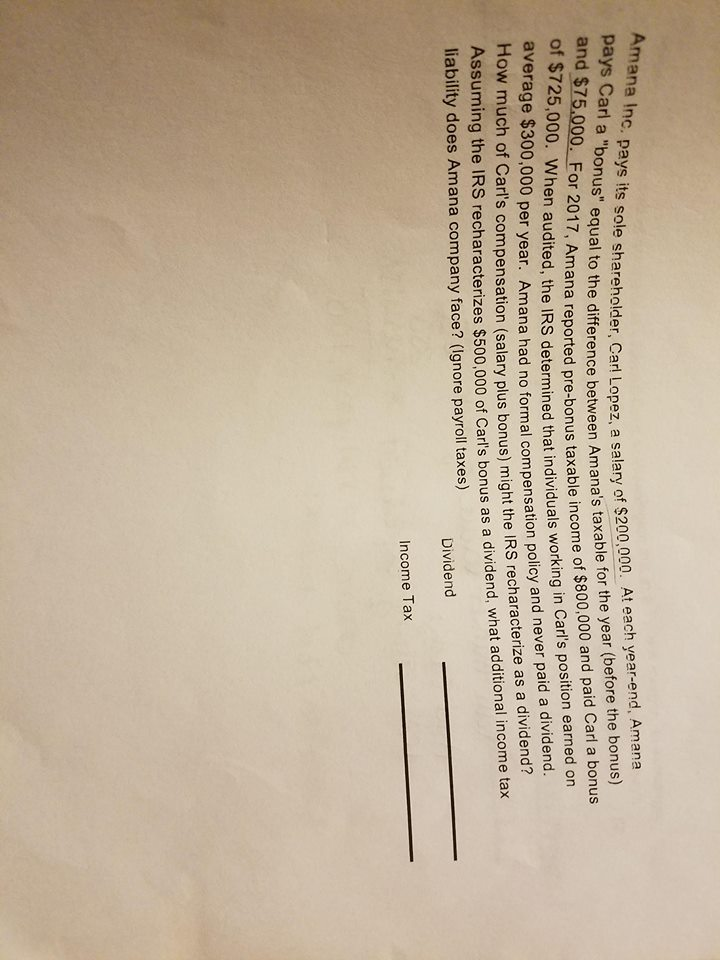

please help me as soon as possible! Picture is clear. Thank you! mana I nc. pays its sole shareholder, Carl Lopez, a salary of $200,00

please help me as soon as possible! Picture is clear. Thank you!

mana I nc. pays its sole shareholder, Carl Lopez, a salary of $200,00 0. At each year-end, Amana o the difference between Amana's taxable for the year (before the bonus) mana reported pre-bonus taxable income of $800,000 and paid Carl a bonus of $725,000. Wh average $300,000 per year. Amana had no formal compensation policy How much of Carl's compensation (salary plus bonus) might the Assuming the IRS recharacterizes $500,000 of Car's bonus as a dividend, what additional income tax en audited, the IRS determined that individuals working in Carl's position earned on and never paid a dividend IRS recharacterize as a dividend? liability does Amana company face? (Ignore payroll taxes) Dividend Income TaxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started