Answered step by step

Verified Expert Solution

Question

1 Approved Answer

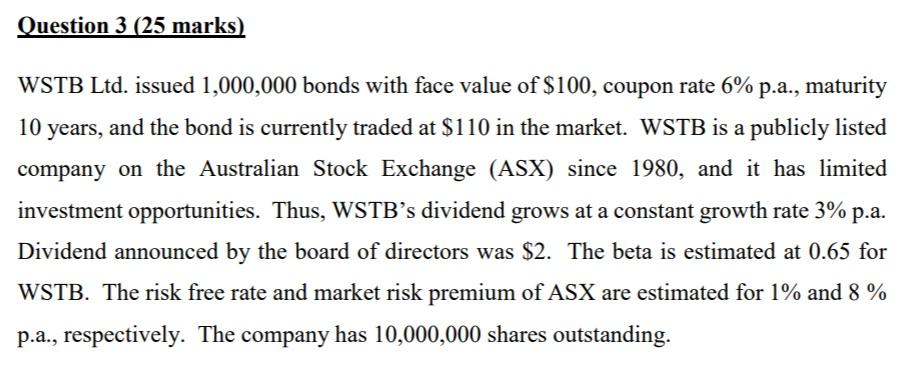

Please help me ASAP. Thank you! Question 3 (25 marks) WSTB Ltd. issued 1,000,000 bonds with face value of $100, coupon rate 6% p.a., maturity

Please help me ASAP. Thank you!

Question 3 (25 marks) WSTB Ltd. issued 1,000,000 bonds with face value of $100, coupon rate 6% p.a., maturity 10 years, and the bond is currently traded at $110 in the market. WSTB is a publicly listed company on the Australian Stock Exchange (ASX) since 1980, and it has limited investment opportunities. Thus, WSTB's dividend grows at a constant growth rate 3% p.a. Dividend announced by the board of directors was $2. The beta is estimated at 0.65 for WSTB. The risk free rate and market risk premium of ASX are estimated for 1% and 8 % p.a., respectively. The company has 10,000,000 shares outstanding. a. Compute the weights of debt (Wd) and equity (We) in WSTB's capital structure. (10 marks) b. Compute the weighted average cost of capital (WACC) of WSTB Ltd.? (7 marks) you estimate the interest rate increases by 1% p.a. next year, calculate the bond and stock prices of WSTB? (4 marks) d. If interest rate increases in (a), calculate new WACC. Cost of debt increases more or cost of equity increase more for WSTB if interest rate increases. Discuss your answer. (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started