Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me asap Tom lent $10000 to a friend in January 2015. In June 2016, his friend declared bankruptcy and had this loan discharged

please

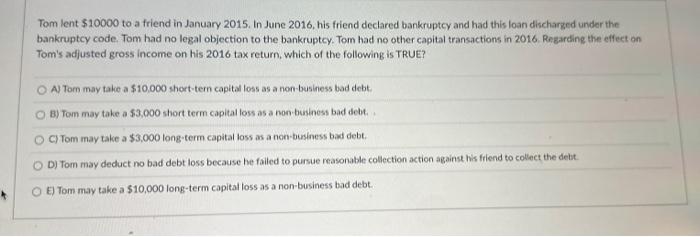

Tom lent $10000 to a friend in January 2015. In June 2016, his friend declared bankruptcy and had this loan discharged under the bankruptcy code. Tom had no legal objection to the bankruptcy. Tom had no other capital transactions in 2016. Regarding the effect on Tom's adjusted gross income on his 2016 tax return, which of the following is TRUE? A) Tom may take a $10,000 short-tern capital loss as a non-business bad debt. B) Tom may take a 53,000 short term capital loss as a non-business bad debt. . C) Tom may take a \$3,000 long-term capital loss as a non-business bad debt. D) Tom may deduct no bad debt loss because he failed to pursue reasonable collection action against his friend to collect the debt. E) Tom may take a $10,000 long-term capital loss as a non-business bad debt help me

asap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started