please help me,

b. Complete Form 6251 for Deon and NeNe. Visit the IRS website and download Form 6251. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." (Use 2021 tax rules regardless of the year on the form.

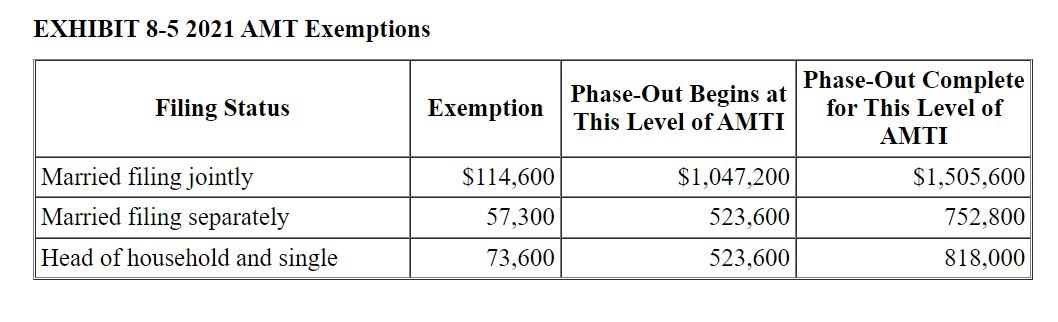

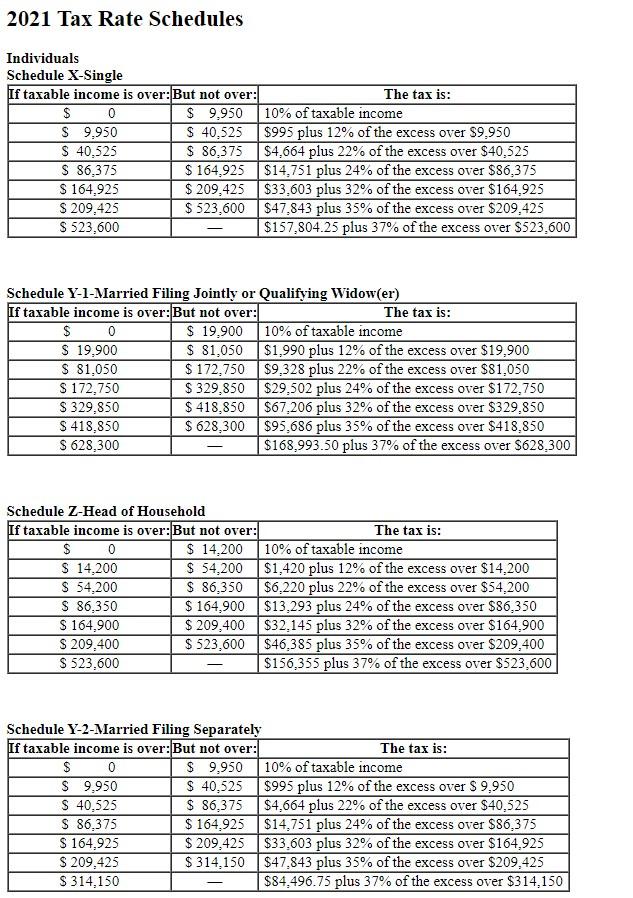

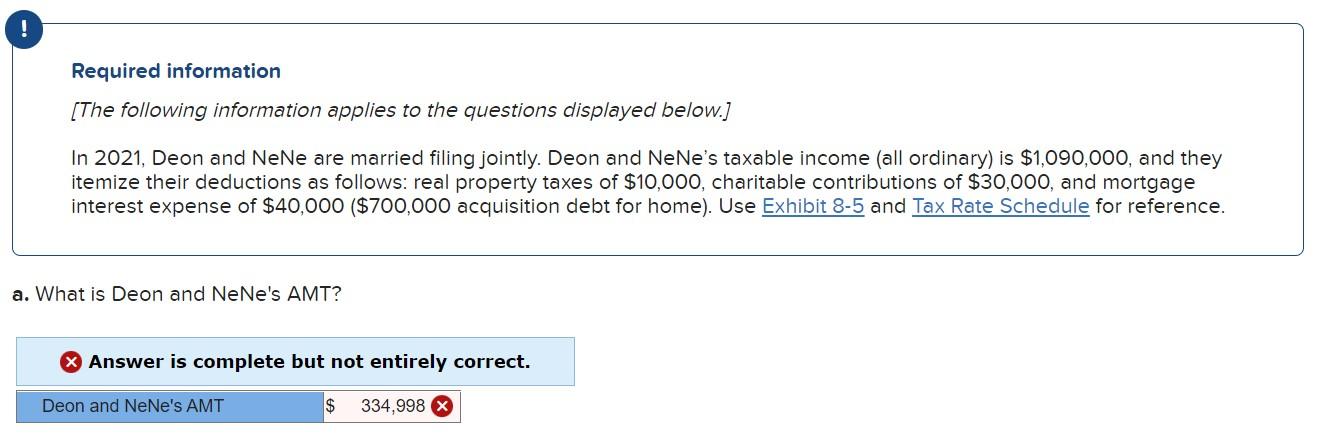

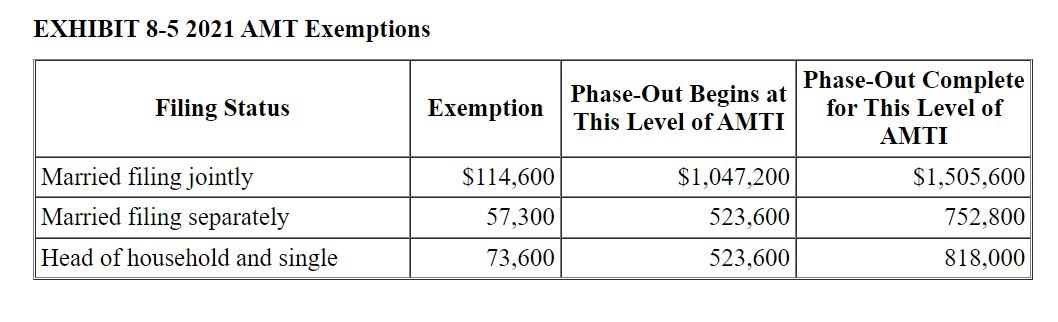

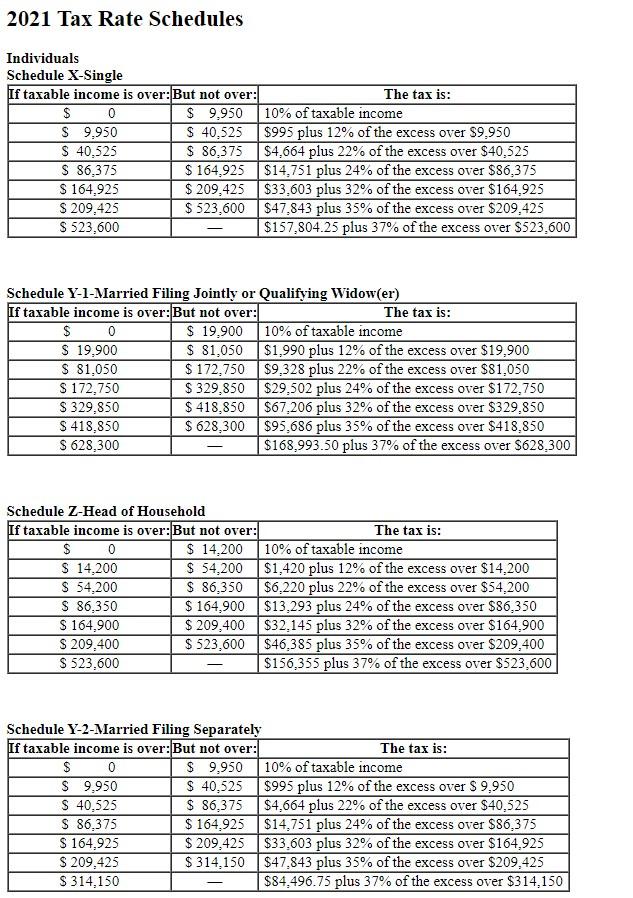

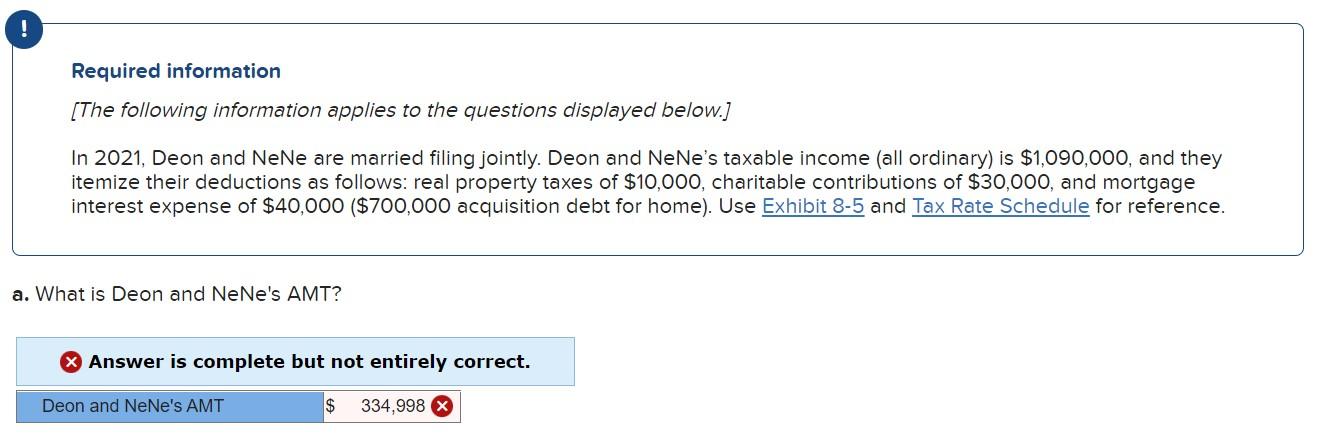

EXHIBIT 8-5 2021 AMT Exemptions Filing Status Exemption Phase-Out Begins at This Level of AMTI Phase-Out Complete for This Level of AMTI Married filing jointly Married filing separately Head of household and single $114,600 57,300 $1,047,200 523,600 $1,505,600 752,800 73,600 523,600 818,000 2021 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income S 9,950 $ 40,525 $995 plus 12% of the excess over $9.950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40.525 $ 86,375 $164,925 $14.751 plus 24% of the excess over $86,375 $ 164,925 $ 209,425 $33.603 plus 32% of the excess over $164.925 $ 209,425 $ 523,600 $47,843 plus 35% of the excess over $209,425 S 523,600 $157,804.25 plus 37% of the excess over $523.600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over:But not over: The tax is: $ 0 $ 19,900 10% of taxable income S 19,900 $ 81,050 $1,990 plus 12% of the excess over $19,900 $ 81,050 $ 172.750 $9,328 plus 22% of the excess over $81,050 S 172,750 $ 329,850 $29,502 plus 24% of the excess over $172.750 $ 329,850 $ 418,850 $67,206 plus 32% of the excess over $329,850 $ 418,850 $ 628,300 $95.686 plus 35% of the excess over $418.850 S 628,300 $168.993.50 plus 37% of the excess over $628,300 Schedule Z-Head of Household If taxable income is over:But not over: The tax is: $ 0 $ 14,200 10% of taxable income S 14,200 $ 54,200 $1,420 plus 12% of the excess over $14,200 $ 54,200 $ 86,350 $6.220 plus 22% of the excess over $54,200 S 86,350 $ 164,900 $13,293 plus 24% of the excess over $86,350 S 164,900 $ 209,400 $32.145 plus 32% of the excess over $164.900 $ 209,400 $ 523,600 S46,385 plus 35% of the excess over $209,400 $ 523,600 $156,355 plus 37% of the excess over $523,600 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $ 9,950 S 40.525 $ 86,375 $4.664 plus 22% of the excess over $40,525 $ 86,375 $164.925 $14.751 plus 24% of the excess over $86,375 S 164,925 $ 209,425 $33.603 plus 32% of the excess over $164.925 $ 209,425 $ 314,150 $47.843 plus 35% of the excess over $209,425 $ 314,150 $84.496.75 plus 37% of the excess over $314,150 O Required information [The following information applies to the questions displayed below.] In 2021, Deon and NeNe are married filing jointly. Deon and NeNe's taxable income (all ordinary) is $1,090,000, and they itemize their deductions as follows: real property taxes of $10,000, charitable contributions of $30,000, and mortgage interest expense of $40,000 ($700,000 acquisition debt for home). Use Exhibit 8-5 and Tax Rate Schedule for reference. a. What is Deon and NeNe's AMT? Answer is complete but not entirely correct. Deon and NeNe's AMT $ 334,998 X