please help me

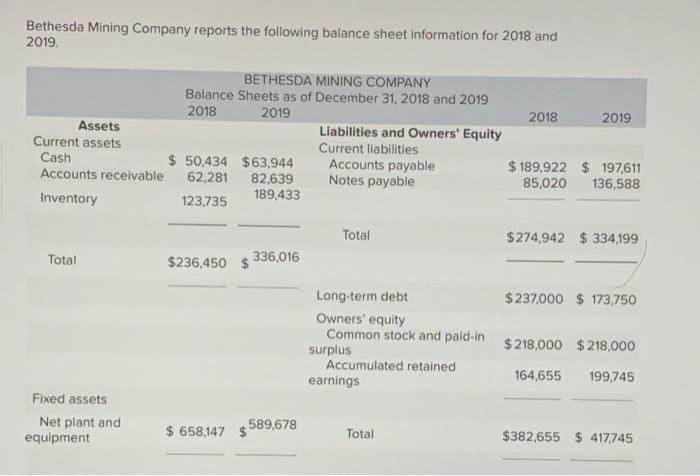

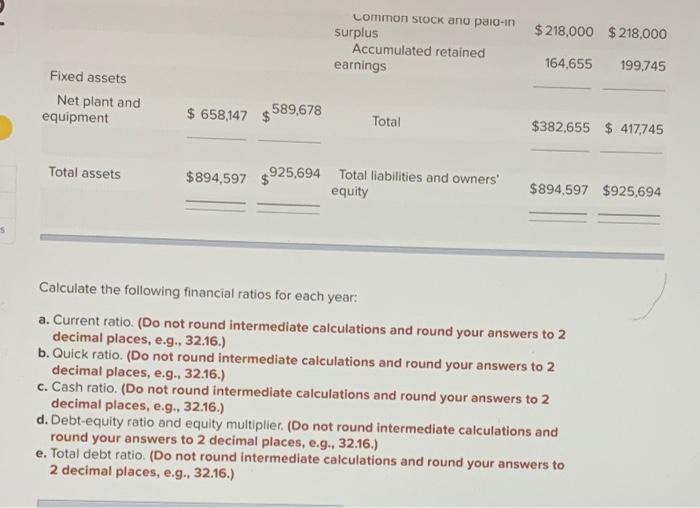

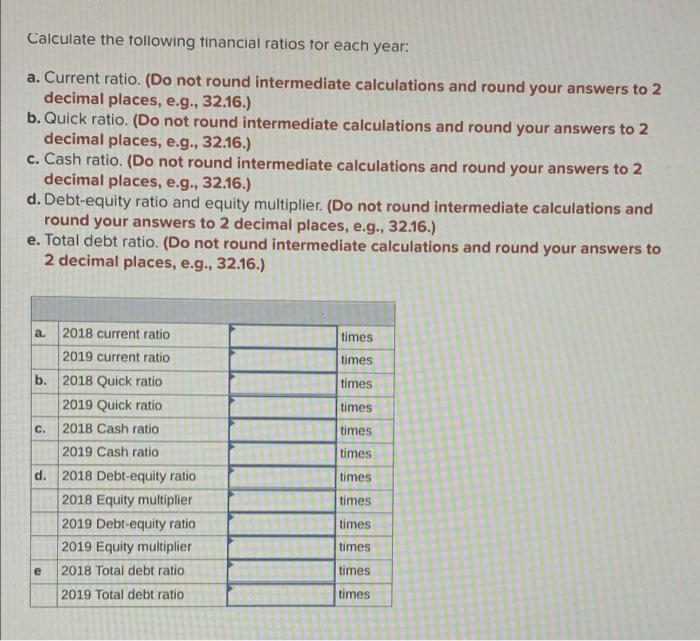

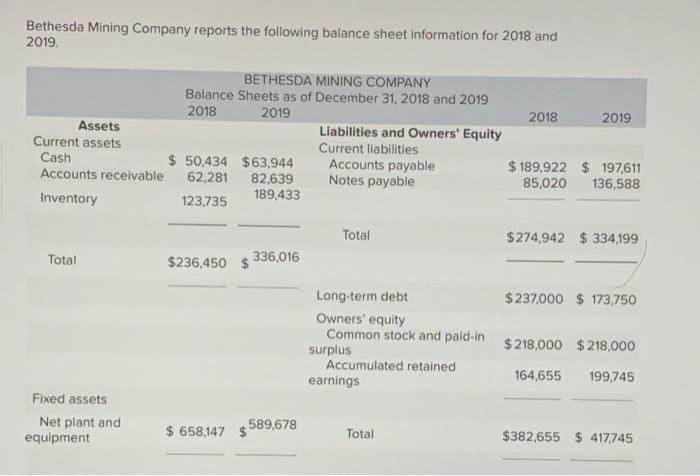

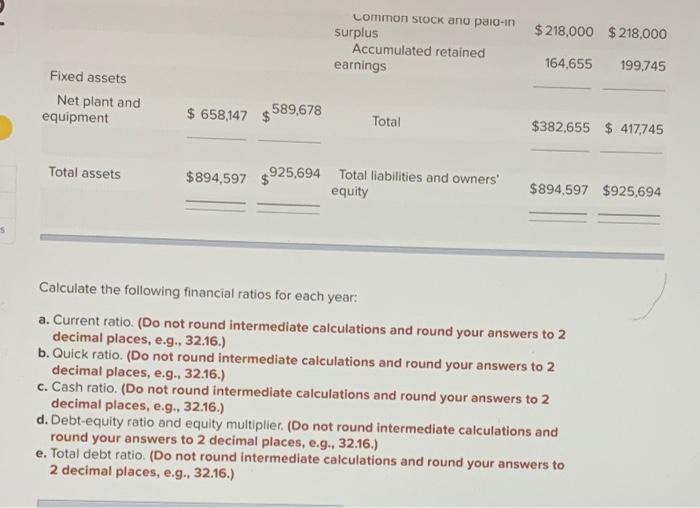

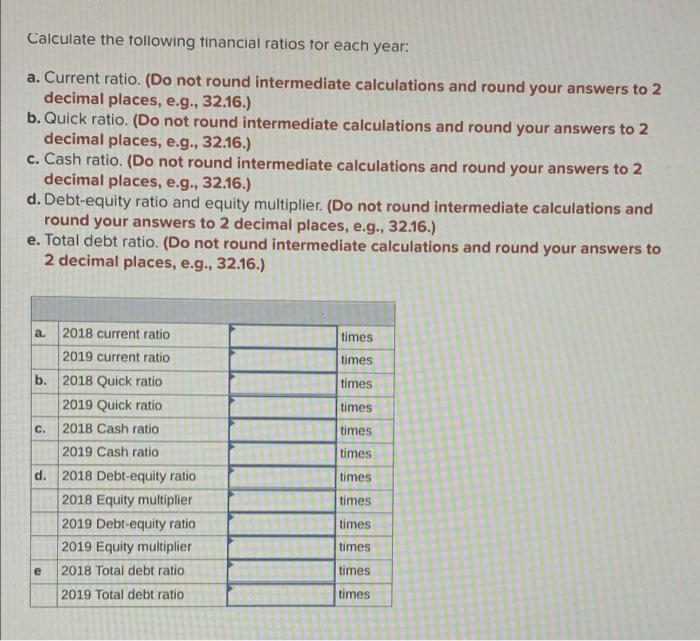

Bethesda Mining Company reports the following balance sheet information for 2018 and 2019 2018 2019 BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 50,434 $63,944 Accounts payable Accounts receivable 62,281 82,639 Notes payable Inventory 123,735 189,433 $ 189,922 $ 197,611 85,020 136,588 Total $274,942 $ 334,199 Total $236,450 $ 336,016 $ 237,000 $ 173,750 Long-term debt Owners' equity Common stock and paid in surplus Accumulated retained earnings $ 218,000 $218,000 164,655 199,745 Fixed assets Net plant and equipment $ 658,147 589,678 Total $382,655 $ 417,745 $ 218,000 $218,000 common Stock and paid in surplus Accumulated retained earnings 164,655 199,745 Fixed assets Net plant and equipment $ 658,147 589,678 Total $382,655 $ 417,745 Total assets $894,597 $ 925,694 Total liabilities and owners' equity $894,597 $925,694 Calculate the following financial ratios for each year. a. Current ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Quick ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Cash ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Debt-equity ratio and equity multiplier. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) e. Total debt ratio (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Calculate the following financial ratios for each year: a. Current ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Quick ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Cash ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Debt-equity ratio and equity multiplier. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) e. Total debt ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) times times times times times times a. 2018 current ratio 2019 current ratio b. 2018 Quick ratio 2019 Quick ratio C. 2018 Cash ratio 2019 Cash ratio d. 2018 Debt-equity ratio 2018 Equity multiplier 2019 Debt-equity ratio 2019 Equity multiplier 2018 Total debt ratio 2019 Total debt ratio times times times times e times times