Answered step by step

Verified Expert Solution

Question

1 Approved Answer

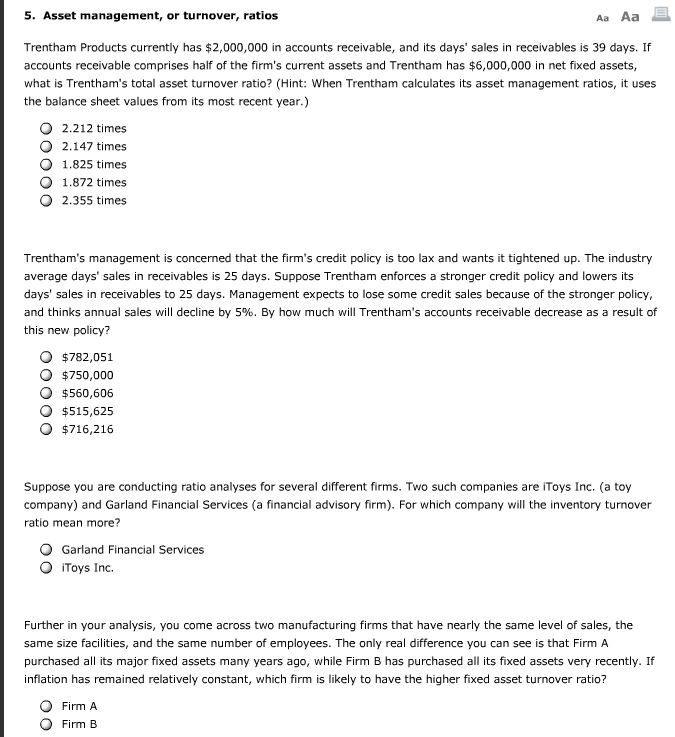

Please help me better understand Asset Management. Thanks for helping me!!! 5. Asset management, or turnover, ratios AaAa Trentham Products currently has $2,000,000 in accounts

Please help me better understand Asset Management.

Thanks for helping me!!!

5. Asset management, or turnover, ratios AaAa Trentham Products currently has $2,000,000 in accounts receivable, and its days' sales in receivables is 39 days. If accounts receivable comprises half of the firm's current assets and Trentham has $6,000,000 in net fixed assets, what is Trentham's total asset turnover ratio? (Hint: When Trentham calculates its asset management ratios, it uses the balance sheet values from its most recent year.) 2.212 times O 2.147 times O 1.825 times O 1.872 times O 2.355 times Trentham's management is concerned that the firm's credit policy is too lax and wants it tightened up. The industry average days' sales in receivables is 25 days. Suppose Trentham enforces a stronger credit policy and lowers its days' sales in receivables to 25 days. Management expects to lose some credit sales because of the stronger policy and thinks annual sales will decline by 5%. By how much will Trentham's accounts receivable decrease as a result of this new policy? O $782,051 $750,000 $560,606 O $515,625 O $716,216 Suppose you are conducting ratio analyses for several different firms. Two such companies are iToys Inc. (a toy company) and Garland Financial Services (a financial advisory firm). For which company will the inventory turnover ratio mean more? Garland Financial Services O Toys Inc. Further in your analysis, you come across two manufacturing firms that have nearly the same level of sales, the same size facilities, and the same number of employees. The only real difference you can see is that Firm A purchased all its major fixed assets many years ago, while Firm B has purchased all its fixed assets very recently. If inflation has remained relatively constant, which firm is likely to have the higher fixed asset turnover ratio? FirmA Firm BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started