Answered step by step

Verified Expert Solution

Question

1 Approved Answer

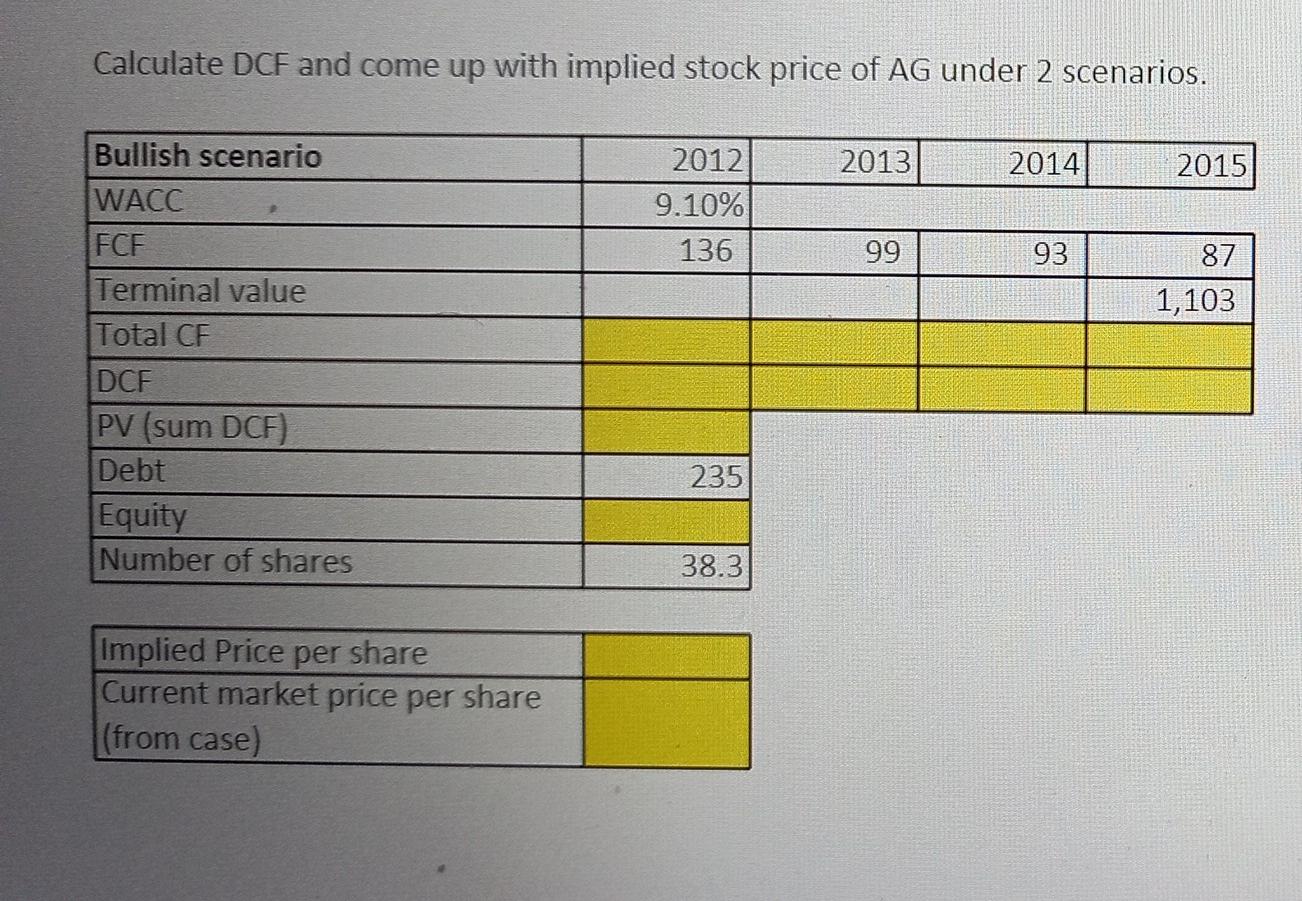

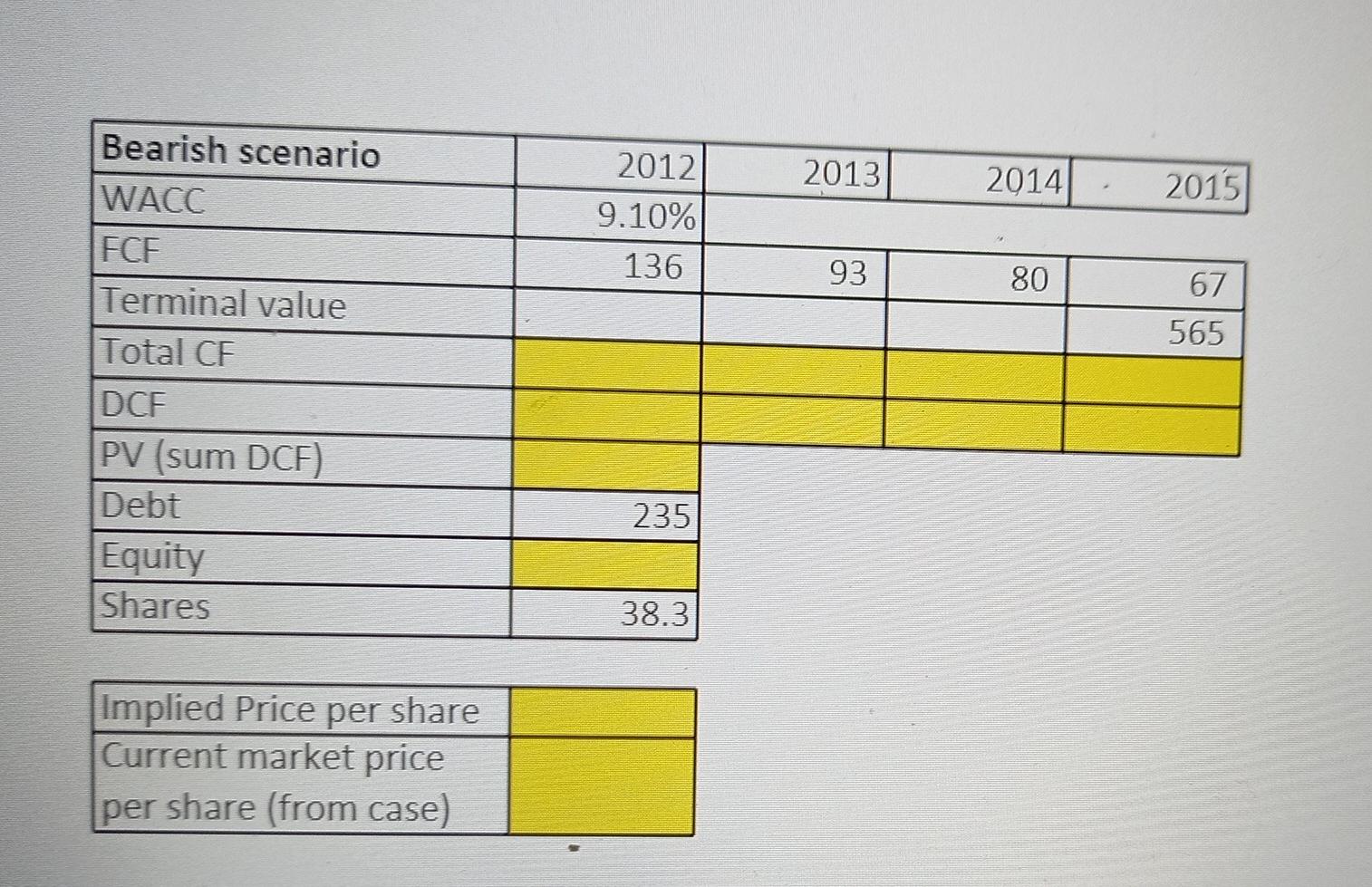

please help me calculate for bullish and bearish scenario. thank you Calculate DCF and come up with implied stock price of AG under 2 scenarios.

please help me calculate for bullish and bearish scenario. thank you

Calculate DCF and come up with implied stock price of AG under 2 scenarios. 2013 2014 2015 2012 9.10% 136 99 93 87 1,103 Bullish scenario WACC FCF Terminal value Total CF DCF PV (sum DCF) Debt Equity Number of shares 235 38.3 Implied Price per share Current market price per share (from case) 2013 2014 2015 2012 9.10% 136 93 80 67 565 Bearish scenario WACC FCF Terminal value Total CF DCF PV (sum DCF) Debt Equity Shares 235 38.3 Implied Price per share Current market price per share (from case)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started