Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me calculate the Payout Ratio and the Return on Common Stock Equity Ratio (round answers to 2 decimal places, e.g. 52.75%). Thank you!

Please help me calculate the Payout Ratio and the Return on Common Stock Equity Ratio (round answers to 2 decimal places, e.g. 52.75%). Thank you!

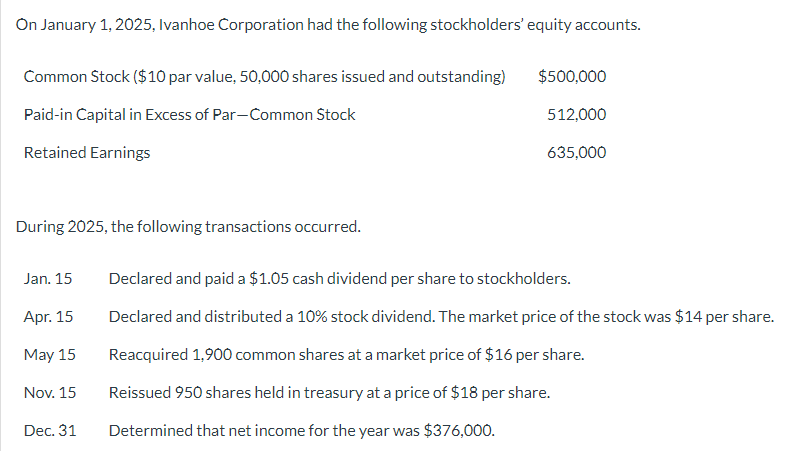

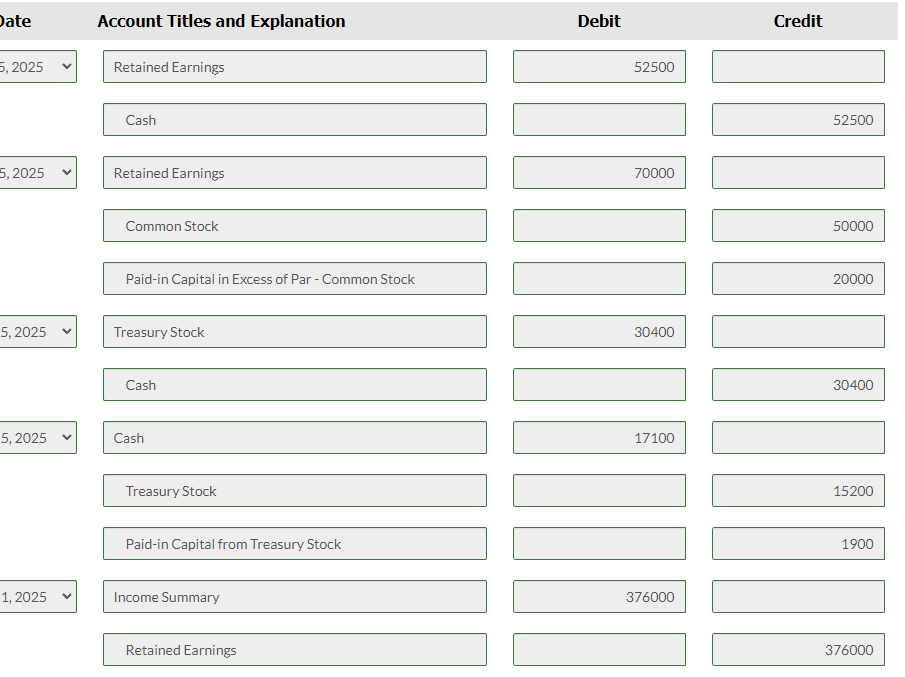

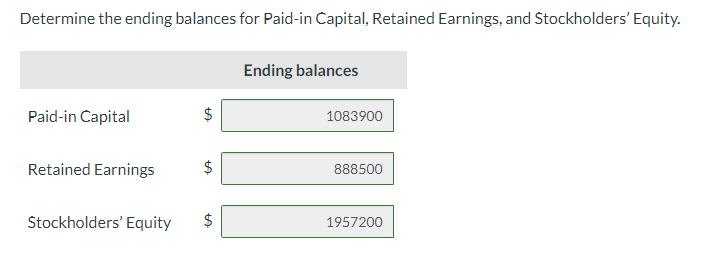

On January 1, 2025, Ivanhoe Corporation had the following stockholders' equity accounts. During 2025 , the following transactions occurred. Jan. 15 Declared and paid a $1.05 cash dividend per share to stockholders. Apr. 15 Declared and distributed a 10\% stock dividend. The market price of the stock was $14 per share. May 15 Reacquired 1,900 common shares at a market price of $16 per share. Nov. 15 Reissued 950 shares held in treasury at a price of $18 per share. Dec. 31 Determined that net income for the year was $376,000. Account Titles and Explanation Debit Credit Retained Earnings 52500 Cash Retained Earnings 70000 Common Stock 50000 Paid-in Capital in Excess of Par - Common Stock 20000 5,2025 Treasury Stock 30400 Cash Cash 17100 Treasury Stock Paid-in Capital from Treasury Stock Income Summary 376000 Retained Earnings 376000 Determine the ending balances for Paid-in Capital, Retained Earnings, and Stockholders' EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started