Please help me calculate the times-interest-earn ratio, and return on common equity ratio. Please explain

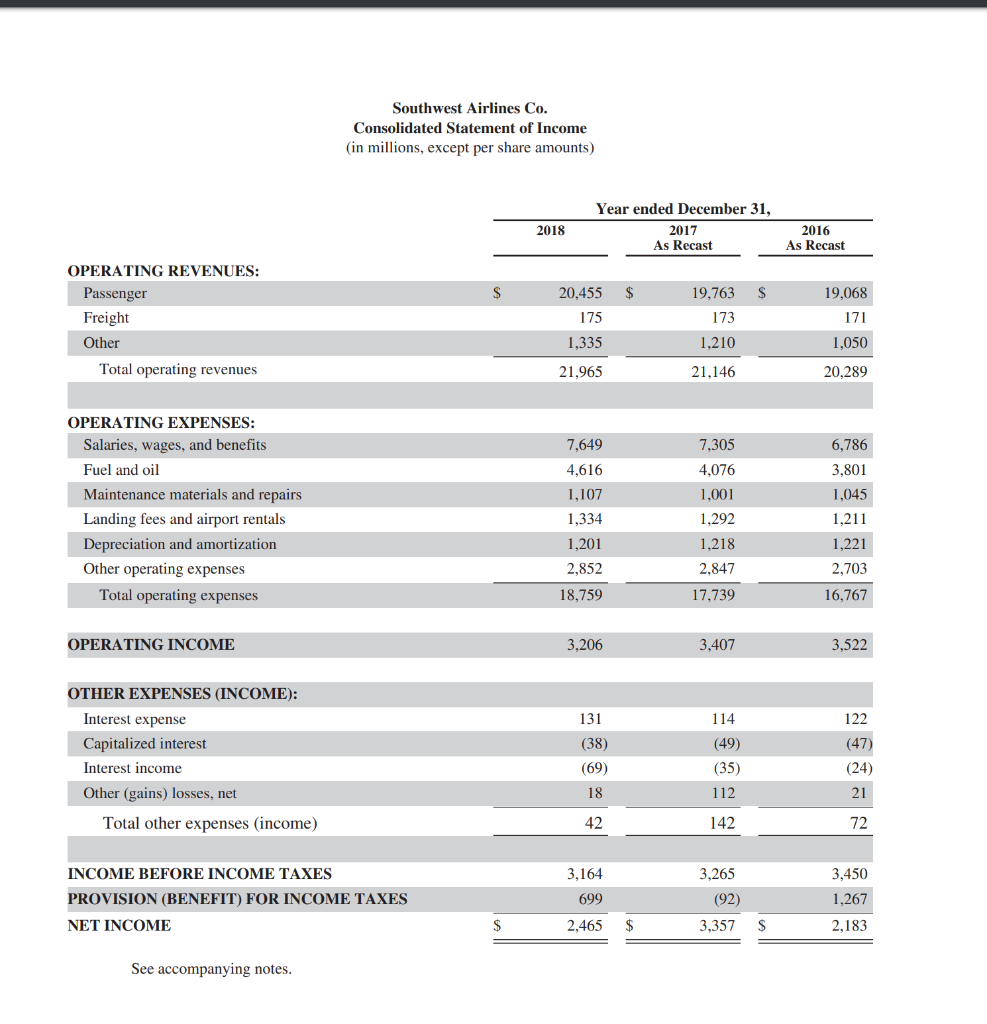

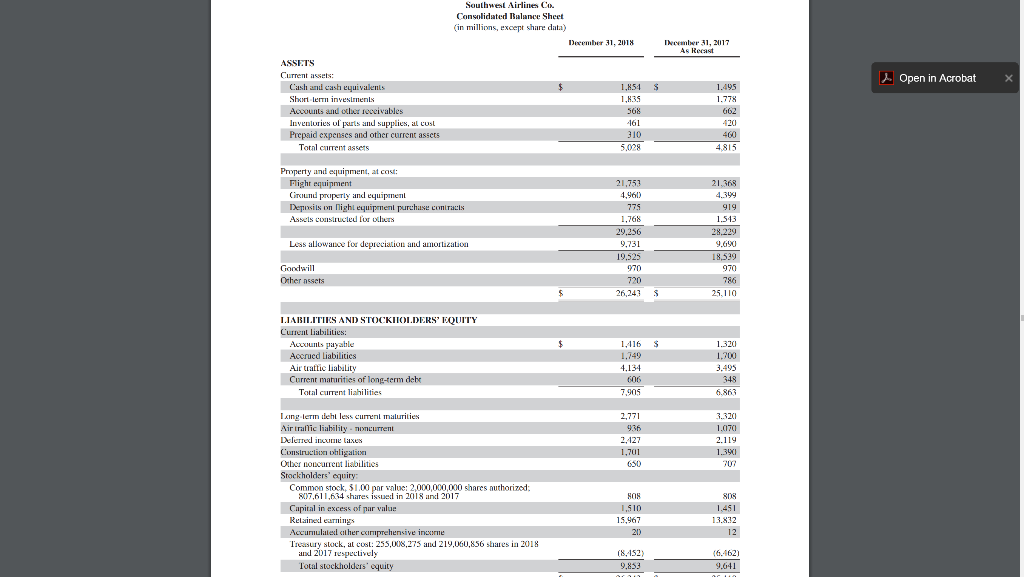

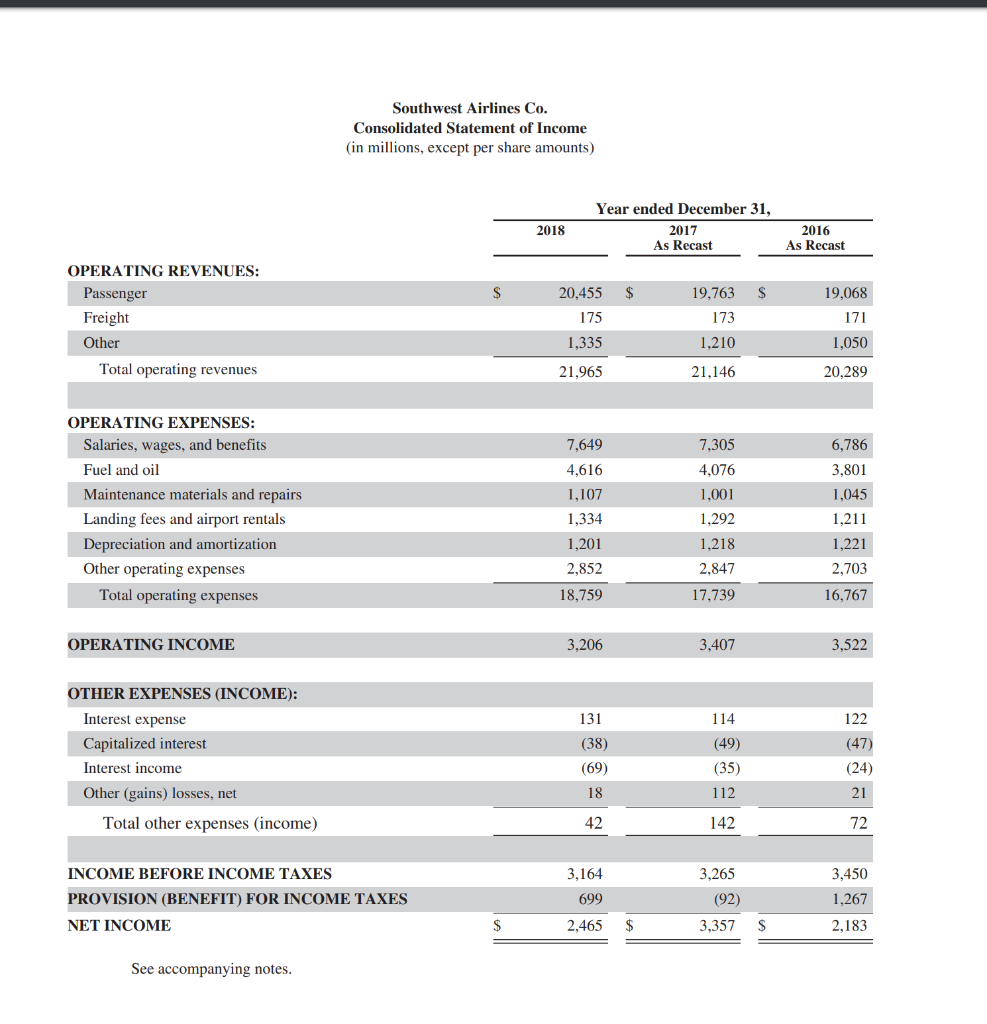

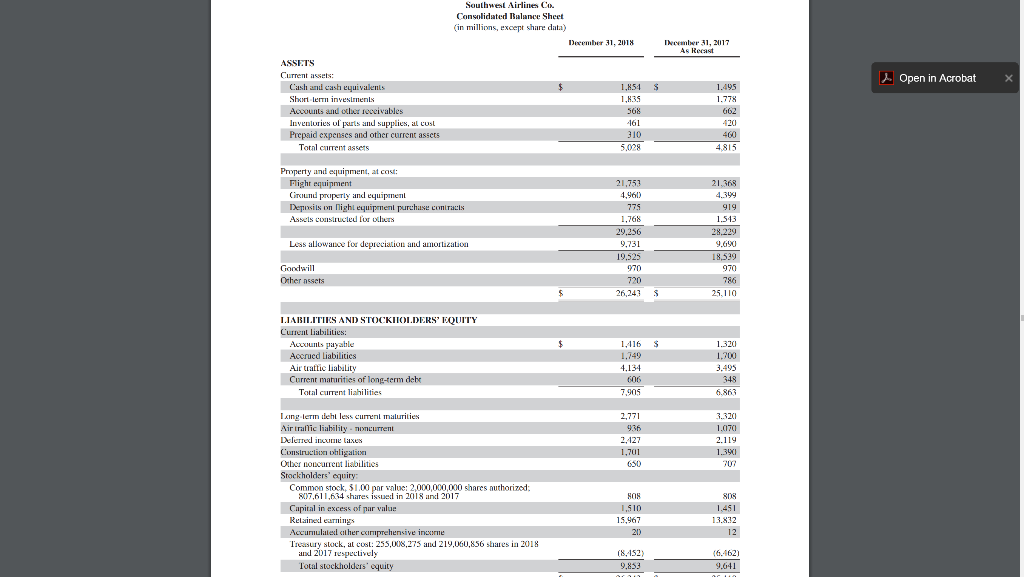

Southwest Airlines Co. Consolidated Statement of Income (in millions, except per share amounts) 2018 Year ended December 31, 2017 As Recast 2016 As Recast $ $ $ OPERATING REVENUES: Passenger Freight Other Total operating revenues 20,455 175 1,335 21,965 19,763 173 1,210 19,068 171 1,050 21,146 20,289 7,649 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Landing fees and airport rentals Depreciation and amortization Other operating expenses Total operating expenses 7,305 4,076 1,001 4,616 1,107 1,334 1,292 6,786 3,801 1,045 1,211 1,221 2,703 16,767 1,201 1,218 2,847 2,852 18,759 17,739 OPERATING INCOME 3,206 3,407 3,522 114 122 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) 131 (38) (69) (47) (49) (35) 112 (24) 18 142 72 INCOME BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME 3,164 699 2,465 3,265 (92) 3,357 3,450 1,267 2,183 $ $ See accompanying notes. Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 312018 Thember 31, 20117 Open in Acrobat X 1,854 $ 1.495 ASSETS Current assets: Cash ani cash equivalents Shairt lerti investments Accounts and other receivables Inventuries of purts and supplies, al cost Prepaid expenses and other current assets Total current assets 568 161 662 420 400 310 5,028 4815 21,753 21.368 Property and equipment, at cast: Flight equipment Circund properly and equipment Desiis on Night equipment purchase contacts Assets constructed for its 4.960 919 1.543 28,229 Less allowance for depreciation and amortization 9,690 775 1.768 29.256 9,731 19.525 970 720 26.247 18,529 970 Goodwill Other Assets 786 25.110 S S LIABILITIES AND STOCKITOLDERS' ROUITY Current liabilities: Axunts payable Accrued Liabilities Air traffic liability Current maturities of long-term deh Totalcument liabilities 1416 1.749 4.134 1.320 1.700 3.495 318 7.905 6.863 2,771 9.36 2.127 3.3201 1.070 2.119 1.391 1,701 Laing leri lehi lens cumini malurities Air trallic liability. The current Darred indume axes Construc h ligation Other concurrent liabilities Stockholders' cquiry Common stock $1.00 por vnlue: 2,000,000,000 shares outhorized: 807,611,634 shares issued in 2018 and 2017 Capital in excess of par value Relain earnings Accumulatex cher cimprehensive income Treasury stock, al cost: 255,008,275 and 219,060,856 shares in 2018 and 2017 respectively Total stockholders equity SOS 1.510 15,967 1.451 13.832 12 (8.152) 9,853 6,4621 9.641