Answered step by step

Verified Expert Solution

Question

1 Approved Answer

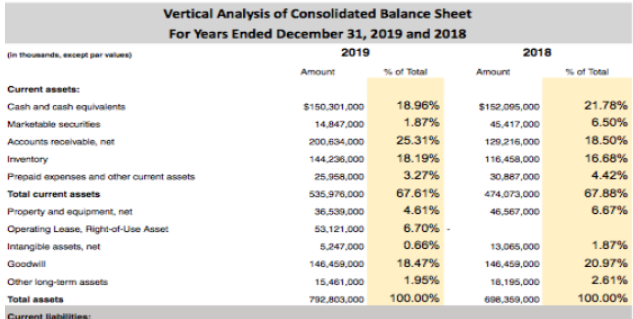

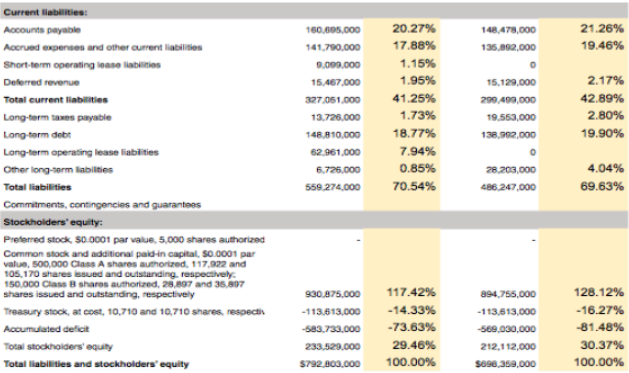

Please help me come up with some comments regarding the vertical analysis of Go Pro's balance sheet. - What major observations about the income statements

Please help me come up with some comments regarding the vertical analysis of Go Pro's balance sheet.

- What major observations about the income statements

-explain what jumps out to you & implications of that

-How this statement can cause someone to recommend not to invest into the company.

-Bad decisions that are being made?

-Good decision that are being made?

Vertical Analysis of Consolidated Balance Sheet For Years Ended December 31, 2019 and 2018 2019 2018 Amount of Total Amount Current assets: Cash and cash equivalents $150.301.000 18.96% $152,095,000 Marketable Securities 14.847,000 1.87% 45,417,000 Accounts receivabis, net 200.634.000 25.31% 129 216,000 Inventory 144.238.000 18.19% 116,458,000 Prepaid expenses and other current assets 25.958.000 3.27% 30.887,000 Total current assets 535,976.000 67.61% 474.073,000 Property and equipment, net 36.539,000 4.61% 46.567,000 Operating Lease, Right-of-Use Asset 53.121.000 6.70% Intangible assets, net 5.247.000 0.66% 13.065,000 Goodwill 146,459,000 18.47% 146,450,000 Other long-term assets 15,461,000 1.95% 18.195,000 Total assets 792.803,000 100.00% 698,350,000 21.78% 6.50% 18.50% 16.68% 4.42% 67.88% 6.67% 1.87% 20.97% 2.61% 100.00% Current les 148.478,000 135,892,000 21.26% 19.46% O 160,695.000 141,790,000 9.000.000 15.467.000 327051.000 13.726,000 148.810,000 62.961.000 6.726.000 559.274.000 Current liabilities: Accounts payable Accrued expenses and other current liabilities Short-term operating si tes Deferred revenue Total current liabilities Long-term taxes payable Long-term det Long-term operating lease liabilities Other long-term liabilities Total liabilities Commitments, contingencies and guarantees Stockholders' equity: Preferred stock 50 0001 par value. 5,000 shares authorized Common stock and additional paid in capital, S0.0001 par value, 500,000 Class A shares authorized. 117.922 and 105.170 Shares sued and outstanding, respectively 150,000 Class B shares authorized, 28,897 and 35.897 shares issued and outstanding, respectively Treasury stock, at cost, 10.710 and 10,710 shares, respect Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity 20.27% 17.88% 1.15% 1.95% 41.25% 1.73% 18.77% 7.94% 0.85% 70.54% 15,129,000 290.490,000 19,553,000 138.992,000 2.17% 42.89% 2.80% 19.90% 28.209,000 486.247,000 4.04% 69.63% 930.875.000 - 113,613.000 -583.730.000 233,529.000 $792,800.000 117.42% - 14.33% -73.63% 29.46% 100.00% 894.755,000 -113,513,000 -569.030,000 212,112,000 S690.359,000 128.12% -16.27% -81.48% 30.37% 100.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started