Please help me complete the following question:

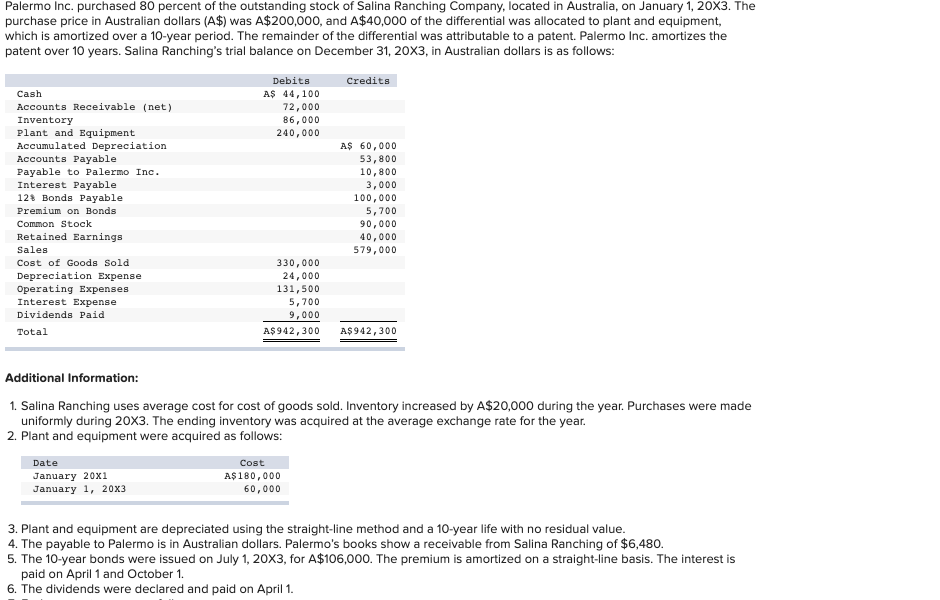

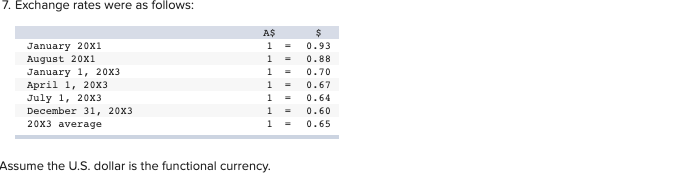

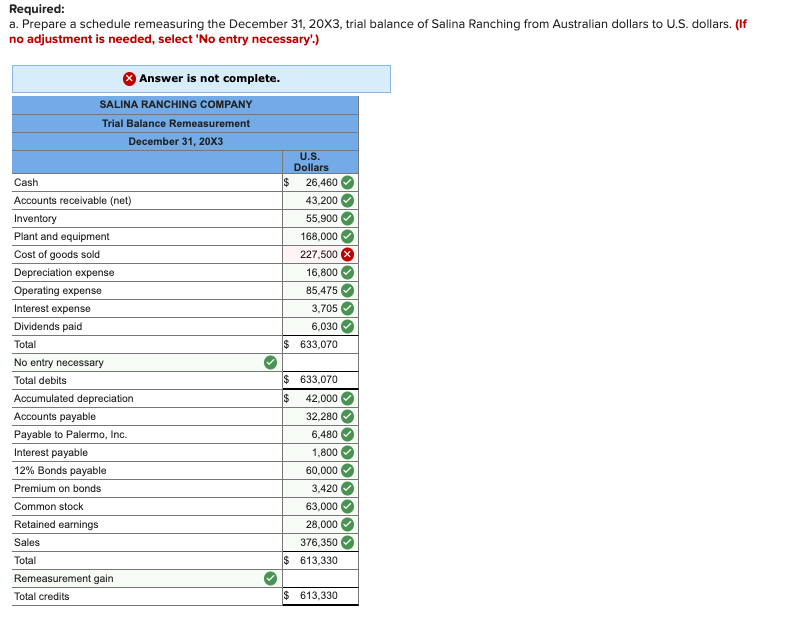

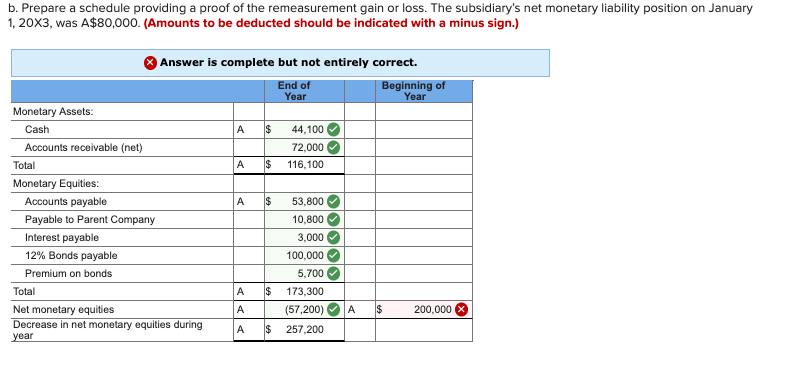

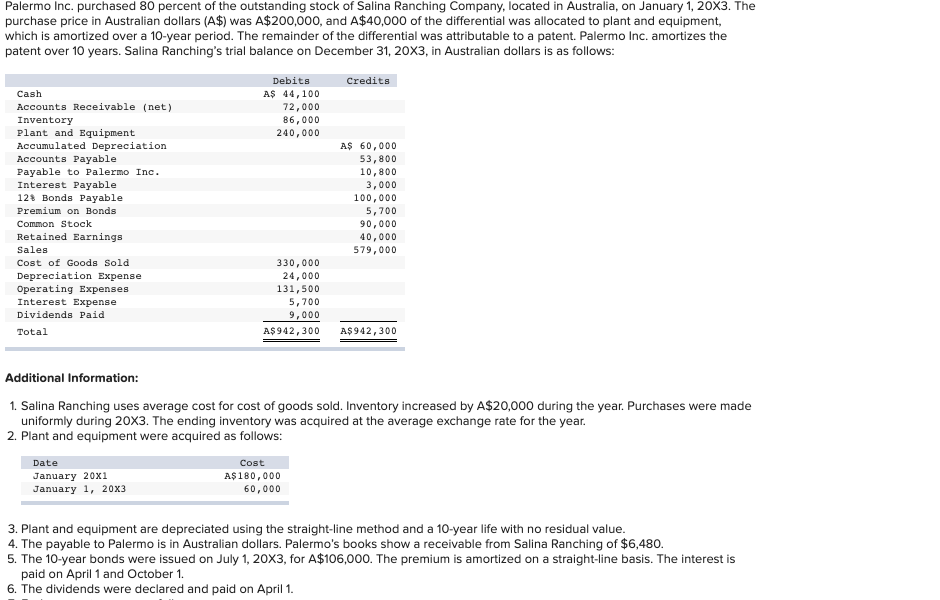

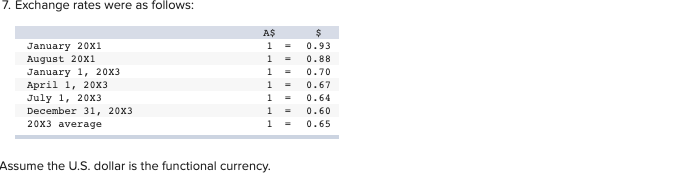

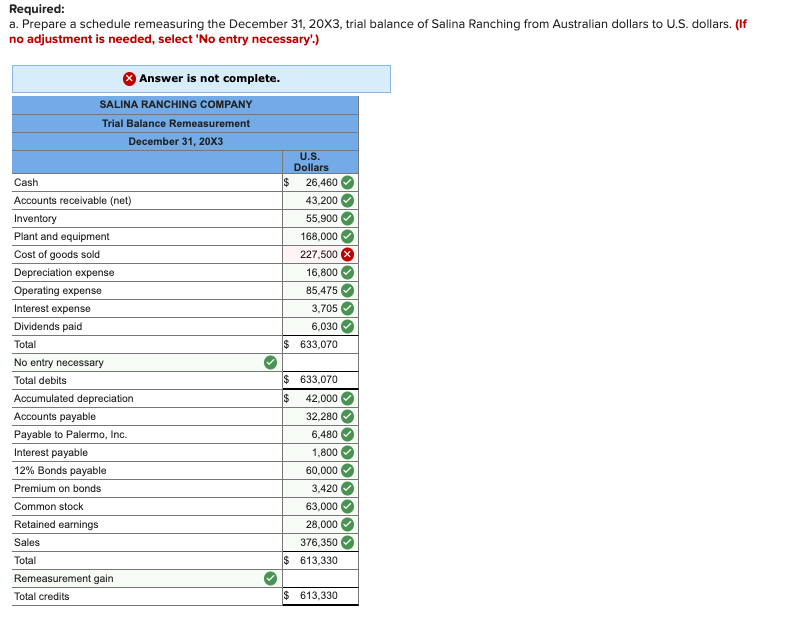

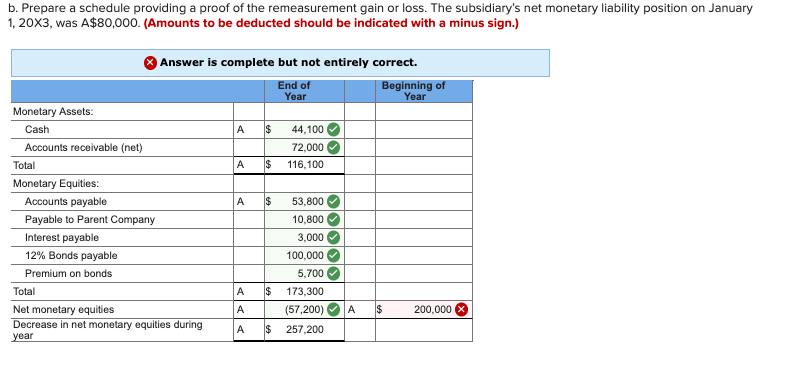

Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (A$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10-year period. The remainder of the differential was attributable to a patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching's trial balance on December 31, 20X3, in Australian dollars is as follows: Debits Credits Cash AS 44,100 72,000 86,000 240,000 Accounts Receivable (net) Inventory Plant and Equipment Accumulated Depreciation Accounts Payable Payable to Palermo Inc. AS 60,000 53,800 10,800 Interest Payable 12 Bonds Payable 3,000 100,000 5,700 90,000 40,000 579,000 Premium on Bonds Common Stock Retained Earnings Sales Cost of Goods Sold 330,000 24,000 Depreciation Expense Operating Expenses 131,500 5,700 9,000 Interest Expense Dividends Paid A$942,300 A$942,300 Total Additional Information: 1. Salina Ranching uses average cost for cost of goods sold. Inventory increased by A$20,000 during the year. Purchases were made uniformly during 20x3. The ending inventory was acquired at the average exchange rate for the year. 2. Plant and equipment were acquired as follows: Date Cost A$180,000 60,000 January 20X1 January 1, 20x3 3. Plant and equipment 4. The payable to Palermo is in Australian dollars. Palermo's books show a receivable from Salina Ranching of $6,480. 5. The 10-year bonds were issued on paid on April 1 and October 1 6. The dividends were declared and paid on April 1 depreciated using the straight-line method and a 10-year life with no residual value. are July 1, 20X3, for A$106,000. The premium is amortized straight-line basis. The interest is on a 7. Exchange rates were as follows: AS $ 0.93 January 20x1 August 20x1 January 1, 20x3 April 1, 20x3 July 1, 20X3 0.88 1 0.70 1 0.67 1 0.64 December 31, 20x3 20x3 average - 0.60 1 0.65 Assume the U.S. dollar is the functional currency. Required: a. Prepare a no adjustment is needed, select 'No entry necessary'.) schedule remeasuring the December 31, 20X3, trial balance of Salina Ranching from Australian dollars to U.S. dollars. (If Answer is not complete. SALINA RANCHING COMPANY Trial Balance Remeasurement December 31, 20X3 U.S. Dollars Cash 26,460 Accounts receivable (net) 43,200 Inventory 55,900 Plant and equipment 168,000 227,500(X Cost of goods sold Depreciation expense 16,800 Operating expense 85,475 Interest expense 3,705 Dividends paid 6,030 $ 633,070 Total No entry necessary $ 633,070 Total debits Accumulated depreciation 42,000 Accounts payable 32,280 Payable to Palermo, Inc. 6,480 Interest payable 1,800 12% Bonds payable 60,000 Premium on bonds 3,420 Common stock 63,000 Retained earnings 28,000 Sales 376,350 $ 613,330 Total Remeasurement gain Total credits 613,330 b. Prepare a schedule providing a proof of the remeasurement gain or loss. The subsidiary's net monetary liability position on January 1, 20X3, was A$80,000. (Amounts to be deducted should be indicated with a minus sign.) Answer is complete but not entirely correct. Beginning of Year End of Year Monetary Assets: A Cash 44,100 Accounts receivable (net) 72,000 A 116,100 Total Monetary Equities: Accounts payable A 53,800 Payable to Parent Company 10,800 3,000 Interest payable 12% Bonds payable 100,000 Premium on bonds 5,700 Total A 173,300 A Net monetary equities Decrease in net monetary equities during (57,200) A 200,000 A 257,200 year 6 Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (A$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10-year period. The remainder of the differential was attributable to a patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching's trial balance on December 31, 20X3, in Australian dollars is as follows: Debits Credits Cash AS 44,100 72,000 86,000 240,000 Accounts Receivable (net) Inventory Plant and Equipment Accumulated Depreciation Accounts Payable Payable to Palermo Inc. AS 60,000 53,800 10,800 Interest Payable 12 Bonds Payable 3,000 100,000 5,700 90,000 40,000 579,000 Premium on Bonds Common Stock Retained Earnings Sales Cost of Goods Sold 330,000 24,000 Depreciation Expense Operating Expenses 131,500 5,700 9,000 Interest Expense Dividends Paid A$942,300 A$942,300 Total Additional Information: 1. Salina Ranching uses average cost for cost of goods sold. Inventory increased by A$20,000 during the year. Purchases were made uniformly during 20x3. The ending inventory was acquired at the average exchange rate for the year. 2. Plant and equipment were acquired as follows: Date Cost A$180,000 60,000 January 20X1 January 1, 20x3 3. Plant and equipment 4. The payable to Palermo is in Australian dollars. Palermo's books show a receivable from Salina Ranching of $6,480. 5. The 10-year bonds were issued on paid on April 1 and October 1 6. The dividends were declared and paid on April 1 depreciated using the straight-line method and a 10-year life with no residual value. are July 1, 20X3, for A$106,000. The premium is amortized straight-line basis. The interest is on a 7. Exchange rates were as follows: AS $ 0.93 January 20x1 August 20x1 January 1, 20x3 April 1, 20x3 July 1, 20X3 0.88 1 0.70 1 0.67 1 0.64 December 31, 20x3 20x3 average - 0.60 1 0.65 Assume the U.S. dollar is the functional currency. Required: a. Prepare a no adjustment is needed, select 'No entry necessary'.) schedule remeasuring the December 31, 20X3, trial balance of Salina Ranching from Australian dollars to U.S. dollars. (If Answer is not complete. SALINA RANCHING COMPANY Trial Balance Remeasurement December 31, 20X3 U.S. Dollars Cash 26,460 Accounts receivable (net) 43,200 Inventory 55,900 Plant and equipment 168,000 227,500(X Cost of goods sold Depreciation expense 16,800 Operating expense 85,475 Interest expense 3,705 Dividends paid 6,030 $ 633,070 Total No entry necessary $ 633,070 Total debits Accumulated depreciation 42,000 Accounts payable 32,280 Payable to Palermo, Inc. 6,480 Interest payable 1,800 12% Bonds payable 60,000 Premium on bonds 3,420 Common stock 63,000 Retained earnings 28,000 Sales 376,350 $ 613,330 Total Remeasurement gain Total credits 613,330 b. Prepare a schedule providing a proof of the remeasurement gain or loss. The subsidiary's net monetary liability position on January 1, 20X3, was A$80,000. (Amounts to be deducted should be indicated with a minus sign.) Answer is complete but not entirely correct. Beginning of Year End of Year Monetary Assets: A Cash 44,100 Accounts receivable (net) 72,000 A 116,100 Total Monetary Equities: Accounts payable A 53,800 Payable to Parent Company 10,800 3,000 Interest payable 12% Bonds payable 100,000 Premium on bonds 5,700 Total A 173,300 A Net monetary equities Decrease in net monetary equities during (57,200) A 200,000 A 257,200 year 6