Please help me complete the question and fill in the 2017 1040 EZ.

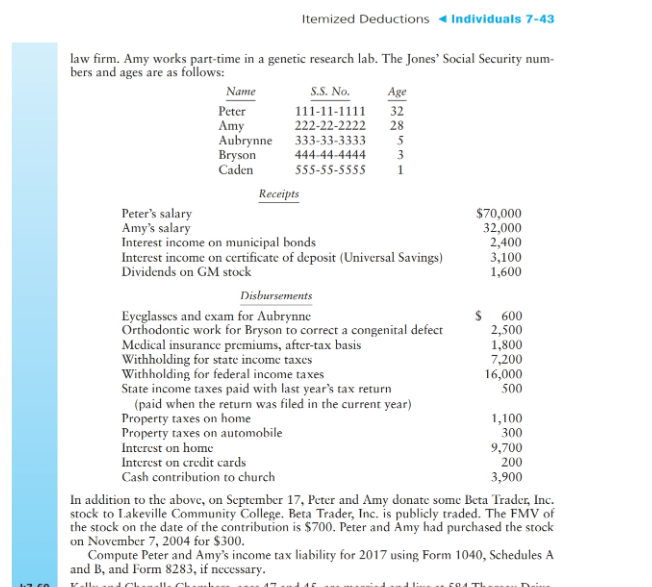

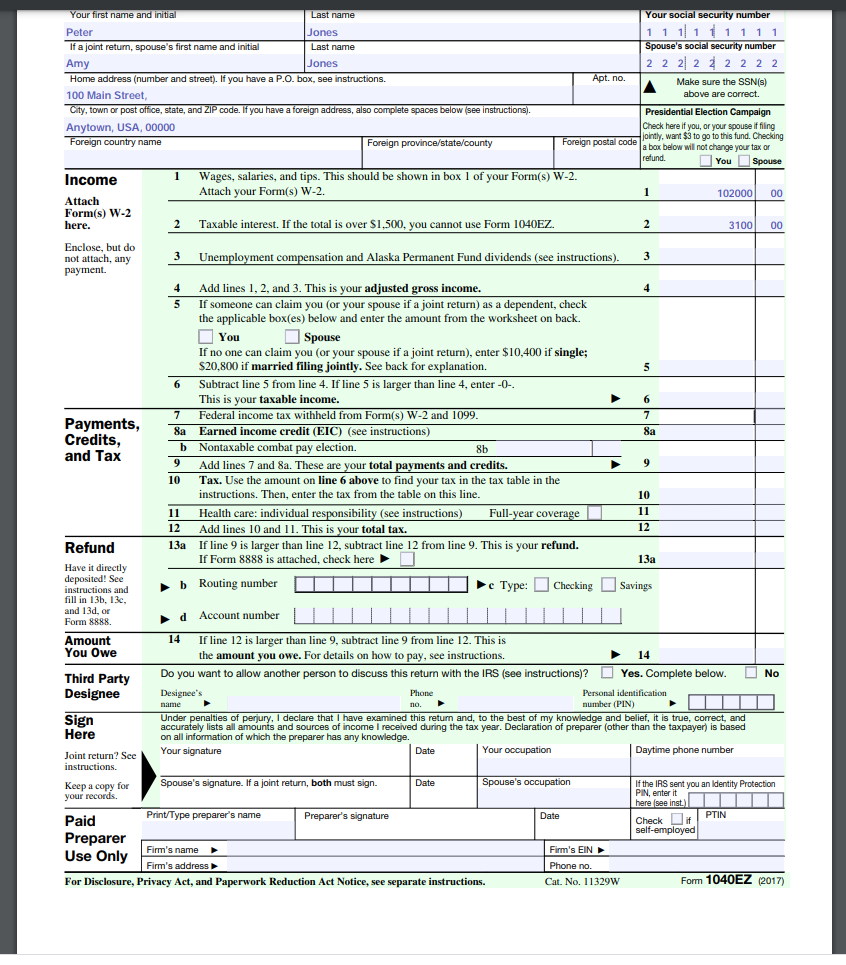

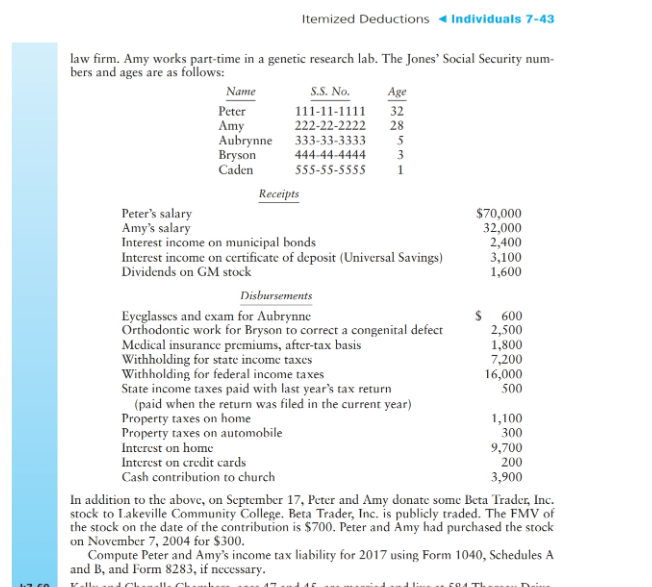

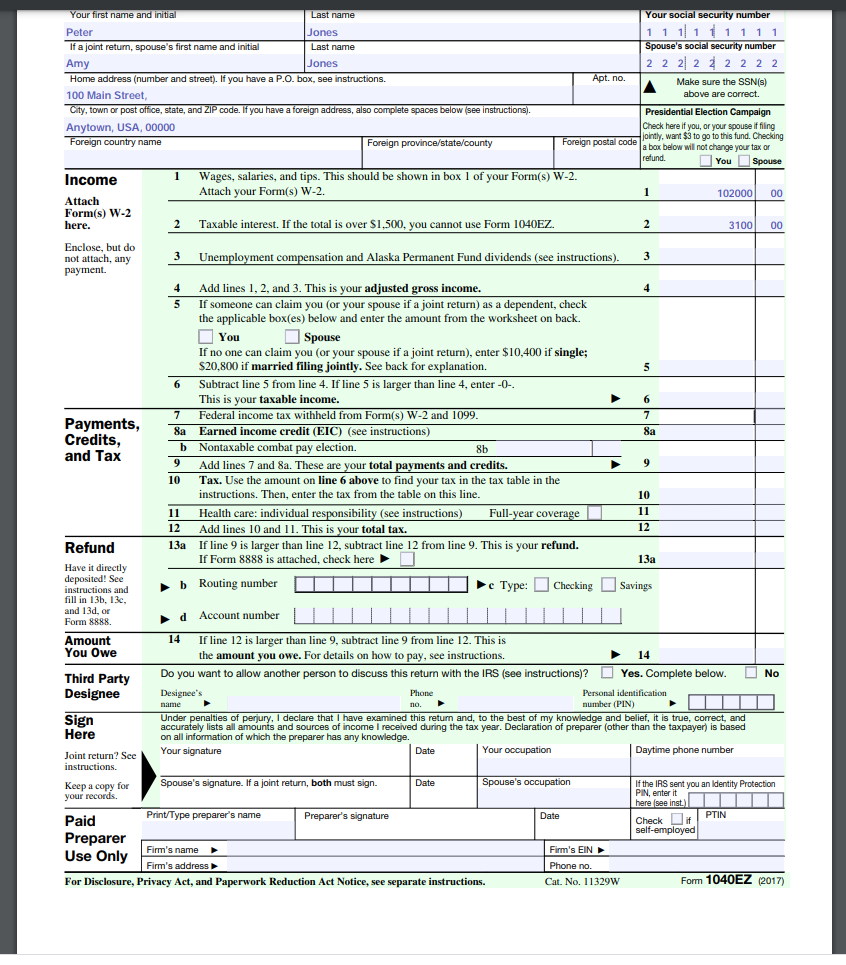

TAX FORM/RETURN PREPARATION PROBLEMS 1:7-59 Following is a list of information for Peter and Amy Jones for the current tax year. Peter and Amy are married and have three children, Aubrynne, Bryson, and Caden. They live at 100 Main Street, Anytown, USA 00000. Peter is a lawyer working for a Native American itemized Deductions Individuals 7-43 Peter law firm. Amy works part-time in a genetic research lab. The Jones' Social Security num- bers and ages are as follows: Name S.S. No. Age 111-11-1111 32 Amy 222-22-2222 28 Aubrynne 333-33-3333 5 Bryson 444-44-4444 3 Caden 555-55-5555 1 Receipts Peter's salary $70,000 Amy's salary 32,000 Interest income on municipal bonds 2,400 Interest income on certificate of deposit (Universal Savings) 3,100 Dividends on GM stock 1,600 Disbursements Eyeglasses and exam for Aubrynne $ 600 Orthodontic work for Bryson to correct a congenital defect 2,500 Medical insurance premiums, after-tax basis 1,800 Withholding for state income taxes 7,200 Withholding for federal income taxes 16,000 State income taxes paid with last year's tax return 500 (paid when the return was filed in the current year) Property taxes on home 1,100 Property taxes on automobile 300 Interest on home 9,700 Interest on credit cards 200 Cash contribution to church 3,900 In addition to the above, on September 17, Peter and Amy donate some Beta Trader, Inc. stock to Lakeville Community College, Beta Trader, Inc. is publicly traded. The FMV of the stock on the date of the contribution is $700. Peter and Amy had purchased the stock on November 7, 2004 for $300. Compute Peter and Amy's income tax liability for 2017 using Form 1040, Schedules A and B, and Form 8283, if necessary. 11 11 591 TL Your first name and initial Last name Your social security number Peter Jones 1 1 1 1 1 1 1 1 1 If a joint return, spouse's first name and initial Last name Spouse's social security number Amy Jones 2 2 2 2 2 2 2 2 Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Make sure the SSN(S) 100 Main Street, above are correct. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Presidential Election Campaign Anytown, USA, 00000 Check here if you, or your spouse if filing Foreign country name Foreign province/state/county Foreign postal code jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. You Spouse 1 Income Wages, salaries, and tips. This should be shown in box 1 of your Form(s) W-2. Attach your Form(s) W-2. 1 102000 00 Attach Form(s) W-2 here. 2 Taxable interest. If the total is over $1,500, you cannot use Form 1040EZ. 2 3100 00 Enclose, but do not attach, any 3 Unemployment compensation and Alaska Permanent Fund dividends (see instructions). 3 payment. 4 Add lines 1, 2, and 3. This is your adjusted gross income. 4 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,400 if single; $20,800 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from line 4. If line 5 is larger than line 4, enter-O- This is your taxable income. 6 7 Federal income tax withheld from Form(s) W-2 and 1099. 7 Payments, 8a Earned income credit (EIC) (see instructions) Sa Credits, b Nontaxable combat pay election. 8b and Tax 9 Add lines 7 and 8a. These are your total payments and credits. 9 10 Tax. Use the amount on line 6 above to find your tax in the tax table in the instructions. Then, enter the tax from the table on this line. 10 11 Health care: individual responsibility (see instructions) Full-year coverage 11 12 Add lines 10 and 11. This is your total tax. 12 Refund 13a If line 9 is larger than line 12, subtract line 12 from line 9. This is your refund. If Form 8888 is attached, check here 13a Have it directly deposited! See instructions and b Routing number c Type: Checking Savings fill in 13b, 13, and 13d, og Form 8888 d Account number Amount 14 If line 12 is larger than line 9, subtract line 9 from line 12. This is You Owe the amount you owe. For details on how to pay, see instructions. 14 Third Party Do you want to allow another person to discuss this return with the IRS (see instructions)? Yes. Complete below. O No Designee Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct, and Here accurately lists all amounts and sources of income I received during the tax year. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge. Your signature Date Your occupation Daytime phone number Joint return? See instructions. Keep a copy for Spouse's signature. If a joint return, both must sign. Spouse's occupation If the IRS sent you an identity Protection your records PIN, enter it here see inst.) Print/Type preparer's name Preparer's signature Date PTIN Paid Check it self-employed Preparer Firm's name Use Only Firm's EIN Firm's address : Phone no. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11329W Form 1040EZ (2017) Date TAX FORM/RETURN PREPARATION PROBLEMS 1:7-59 Following is a list of information for Peter and Amy Jones for the current tax year. Peter and Amy are married and have three children, Aubrynne, Bryson, and Caden. They live at 100 Main Street, Anytown, USA 00000. Peter is a lawyer working for a Native American itemized Deductions Individuals 7-43 Peter law firm. Amy works part-time in a genetic research lab. The Jones' Social Security num- bers and ages are as follows: Name S.S. No. Age 111-11-1111 32 Amy 222-22-2222 28 Aubrynne 333-33-3333 5 Bryson 444-44-4444 3 Caden 555-55-5555 1 Receipts Peter's salary $70,000 Amy's salary 32,000 Interest income on municipal bonds 2,400 Interest income on certificate of deposit (Universal Savings) 3,100 Dividends on GM stock 1,600 Disbursements Eyeglasses and exam for Aubrynne $ 600 Orthodontic work for Bryson to correct a congenital defect 2,500 Medical insurance premiums, after-tax basis 1,800 Withholding for state income taxes 7,200 Withholding for federal income taxes 16,000 State income taxes paid with last year's tax return 500 (paid when the return was filed in the current year) Property taxes on home 1,100 Property taxes on automobile 300 Interest on home 9,700 Interest on credit cards 200 Cash contribution to church 3,900 In addition to the above, on September 17, Peter and Amy donate some Beta Trader, Inc. stock to Lakeville Community College, Beta Trader, Inc. is publicly traded. The FMV of the stock on the date of the contribution is $700. Peter and Amy had purchased the stock on November 7, 2004 for $300. Compute Peter and Amy's income tax liability for 2017 using Form 1040, Schedules A and B, and Form 8283, if necessary. 11 11 591 TL Your first name and initial Last name Your social security number Peter Jones 1 1 1 1 1 1 1 1 1 If a joint return, spouse's first name and initial Last name Spouse's social security number Amy Jones 2 2 2 2 2 2 2 2 Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Make sure the SSN(S) 100 Main Street, above are correct. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Presidential Election Campaign Anytown, USA, 00000 Check here if you, or your spouse if filing Foreign country name Foreign province/state/county Foreign postal code jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. You Spouse 1 Income Wages, salaries, and tips. This should be shown in box 1 of your Form(s) W-2. Attach your Form(s) W-2. 1 102000 00 Attach Form(s) W-2 here. 2 Taxable interest. If the total is over $1,500, you cannot use Form 1040EZ. 2 3100 00 Enclose, but do not attach, any 3 Unemployment compensation and Alaska Permanent Fund dividends (see instructions). 3 payment. 4 Add lines 1, 2, and 3. This is your adjusted gross income. 4 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,400 if single; $20,800 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from line 4. If line 5 is larger than line 4, enter-O- This is your taxable income. 6 7 Federal income tax withheld from Form(s) W-2 and 1099. 7 Payments, 8a Earned income credit (EIC) (see instructions) Sa Credits, b Nontaxable combat pay election. 8b and Tax 9 Add lines 7 and 8a. These are your total payments and credits. 9 10 Tax. Use the amount on line 6 above to find your tax in the tax table in the instructions. Then, enter the tax from the table on this line. 10 11 Health care: individual responsibility (see instructions) Full-year coverage 11 12 Add lines 10 and 11. This is your total tax. 12 Refund 13a If line 9 is larger than line 12, subtract line 12 from line 9. This is your refund. If Form 8888 is attached, check here 13a Have it directly deposited! See instructions and b Routing number c Type: Checking Savings fill in 13b, 13, and 13d, og Form 8888 d Account number Amount 14 If line 12 is larger than line 9, subtract line 9 from line 12. This is You Owe the amount you owe. For details on how to pay, see instructions. 14 Third Party Do you want to allow another person to discuss this return with the IRS (see instructions)? Yes. Complete below. O No Designee Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct, and Here accurately lists all amounts and sources of income I received during the tax year. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge. Your signature Date Your occupation Daytime phone number Joint return? See instructions. Keep a copy for Spouse's signature. If a joint return, both must sign. Spouse's occupation If the IRS sent you an identity Protection your records PIN, enter it here see inst.) Print/Type preparer's name Preparer's signature Date PTIN Paid Check it self-employed Preparer Firm's name Use Only Firm's EIN Firm's address : Phone no. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11329W Form 1040EZ (2017) Date