Answered step by step

Verified Expert Solution

Question

1 Approved Answer

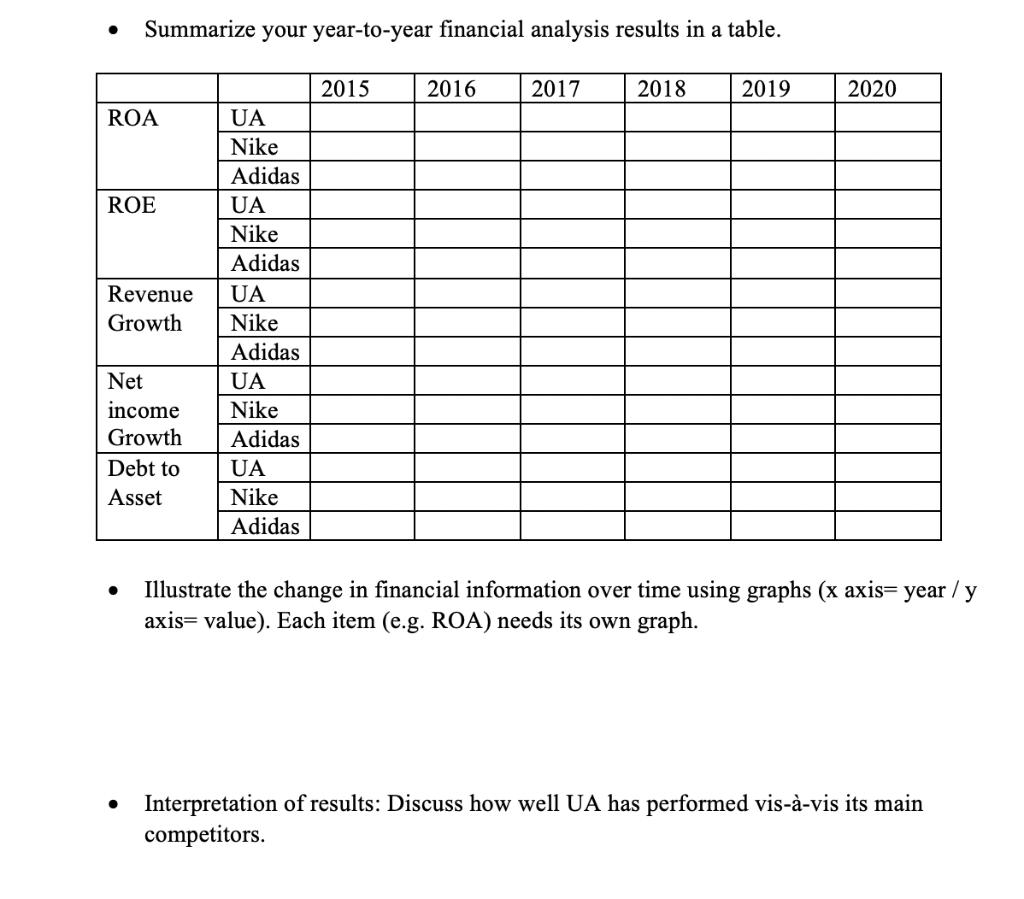

Summarize your year-to-year financial analysis results in a table. 2015 2016 2017 2018 2019 2020 ROA UA Nike Adidas ROE UA Nike Adidas Revenue

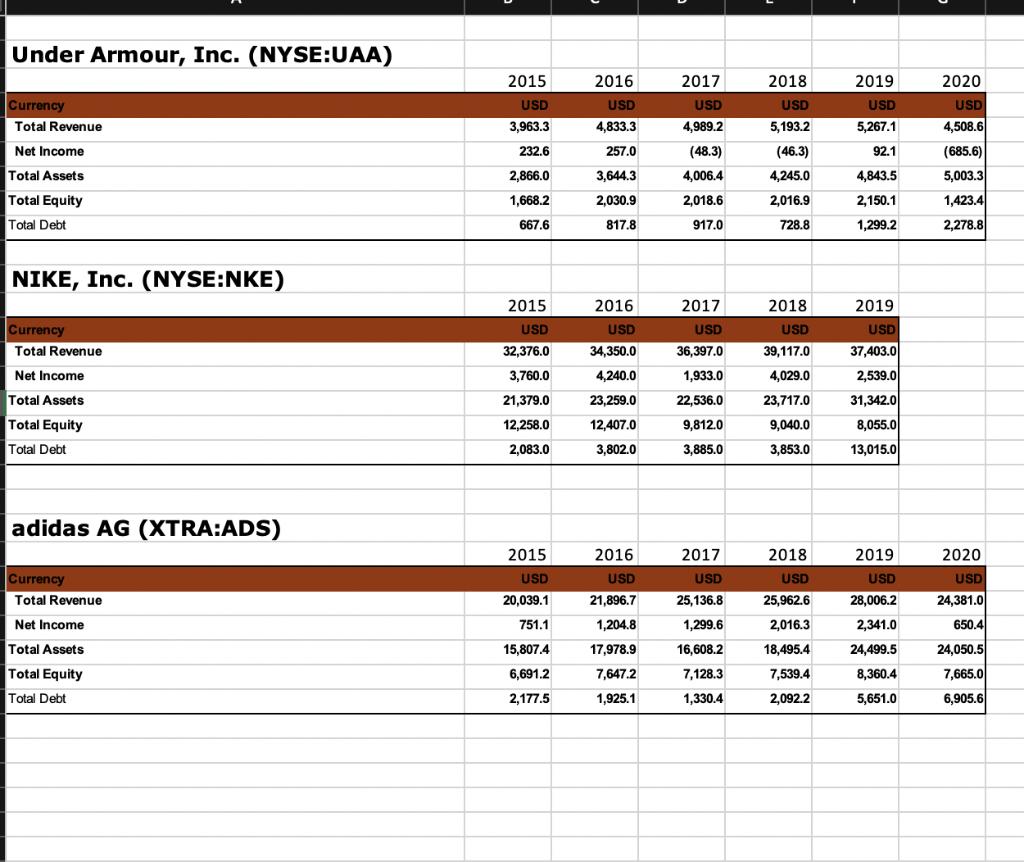

Summarize your year-to-year financial analysis results in a table. 2015 2016 2017 2018 2019 2020 ROA UA Nike Adidas ROE UA Nike Adidas Revenue UA Growth Nike Adidas Net UA income Growth Nike Adidas Debt to UA Asset Nike Adidas Illustrate the change in financial information over time using graphs (x axis= year /y axis= value). Each item (e.g. ROA) needs its own graph. Interpretation of results: Discuss how well UA has performed vis--vis its main competitors. Under Armour, Inc. (NYSE:UAA) 2015 2016 2017 2018 2019 2020 Currency USD USD USD USD USD USD Total Revenue 3,963.3 4,833.3 4,989.2 5,193.2 5,267.1 4,508.6 Net Income 232.6 257.0 (48.3) (46.3) 92.1 (685.6) Total Assets 2,866.0 3,644.3 4,006.4 4,245.0 4,843.5 5,003.3 Total Equity 1,668.2 2,030.9 2,018.6 2,016.9 2,150.1 1,423.4 Total Debt 667.6 817.8 917.0 728.8 1,299.2 2,278.8 KE, Inc. ( NYSE: N K ) 2015 2016 2017 2018 2019 USD Currency Total Revenue USD USD USD USD 32,376.0 34,350.0 36,397.0 39,117.0 37,403.0 Net Income 3,760.0 4,240.0 1,933.0 4,029.0 2,539.0 Total Assets 21,379.0 23,259.0 22,536.0 23,717.0 31,342.0 Total Equity 12,258.0 12,407.0 9,812.0 9,040.0 8,055.0 Total Debt 2,083.0 3,802.0 3,885.0 3,853.0 13,015.0 adidas AG (XTRA:ADS) 2015 2016 2017 2018 2019 2020 Currency USD USD USD USD USD USD Total Revenue 20,039.1 21,896.7 25,136.8 25,962.6 28,006.2 24,381.0 Net Income 751.1 1,204.8 1,299.6 2,016.3 2,341.0 650.4 Total Assets 15,807.4 17,978.9 16,608.2 18,495.4 24,499.5 24,050.5 Total Equity 6,691.2 7,647.2 7,128.3 7,539.4 8,360.4 7,665.0 Total Debt 2.177.5 1.925.1 1,330.4 2,092.2 5,651.0 6,905.6

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ROA or Return on Assets Net IncomeTotal Assets ROE or Return on Equity Net IncomeTotal Equity Revenu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started