please help me do all question , i need it by 5 PM

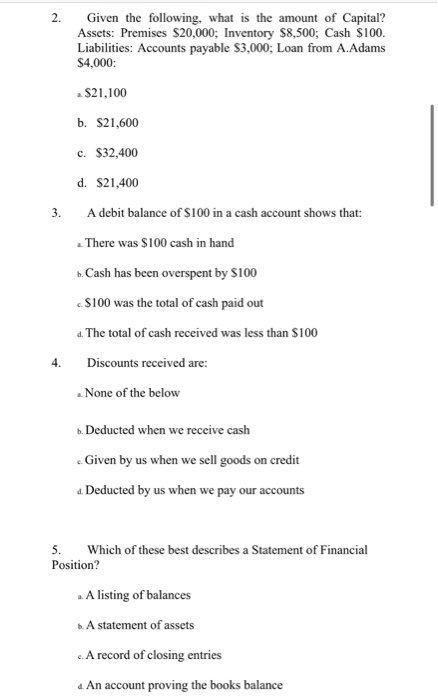

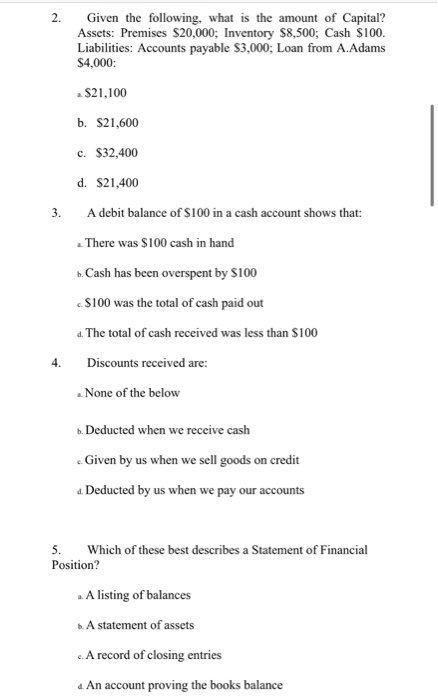

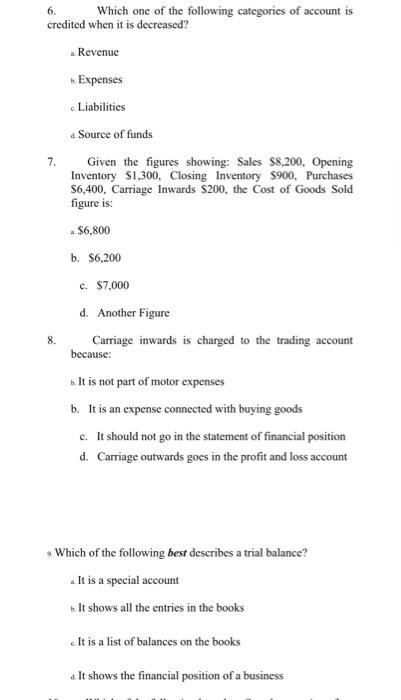

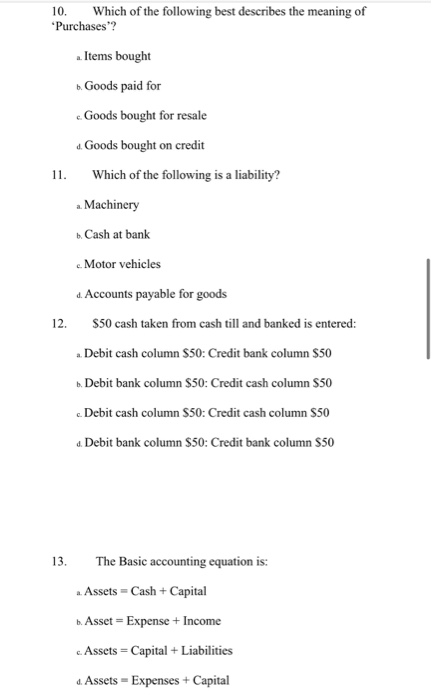

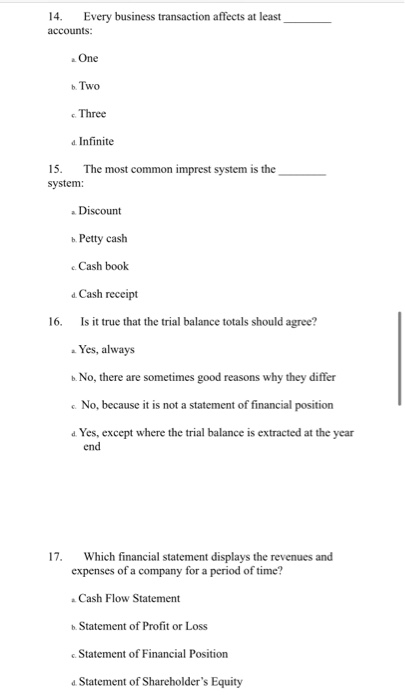

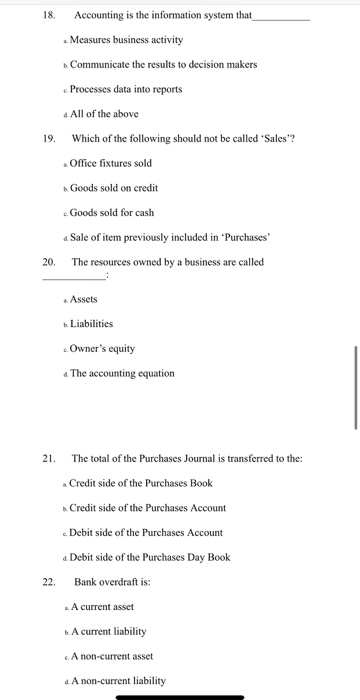

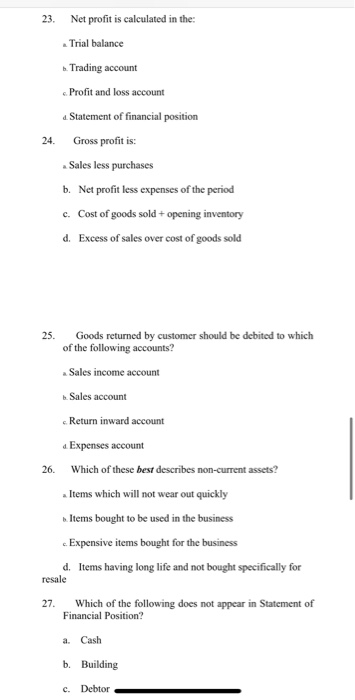

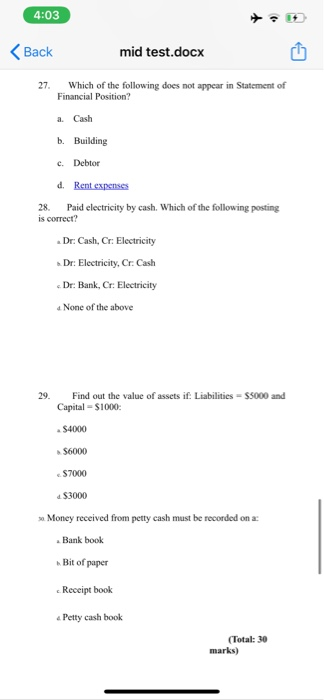

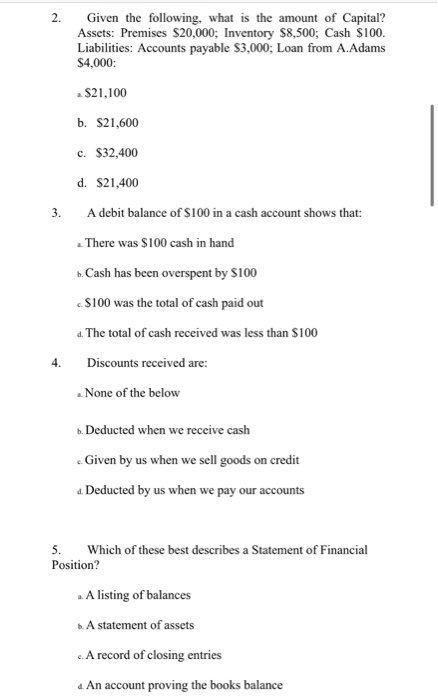

2. Given the following, what is the amount of Capital? Assets: Premises $20,000; Inventory $8,500; Cash $100. Liabilities: Accounts payable $3,000; Loan from A.Adams $4,000 $21,100 b. $21,600 c. $32,400 3. d. $21,400 A debit balance of $100 in a cash account shows that: 2. There was $100 cash in hand b. Cash has been overspent by $100 $100 was the total of cash paid out d. The total of cash received was less than $100 Discounts received are: - None of the below 4. b. Deducted when we receive cash Given by us when we sell goods on credit . Deducted by us when we pay our accounts 5. Which of these best describes a Statement of Financial Position? . A listing of balances b. A statement of assets c. A record of closing entries 1. An account proving the books balance 6. Which one of the following categories of account is credited when it is decreased? Revenue . Expenses Liabilities 4. Source of funds 7. Given the figures showing: Sales $8,200, Opening Inventory $1,300, Closing Inventory $900, Purchases $6,400, Carriage Inwards $200, the cost of Goods Sold figure is: S6,800 b. $6.200 c. $7,000 8. d. Another Figure Carriage inwards is charged to the trading account because b. It is not part of motor expenses b. It is an expense connected with buying goods c. It should not go in the statement of financial positi d. Carriage outwards goes in the profit and loss account Which of the following best describes a trial balance? . It is a special account b. It shows all the entries in the books c. It is a list of balances on the books d. It shows the financial position of a business 10. Which of the following best describes the meaning of *Purchases"? .. Items bought Goods paid for 11. c. Goods bought for resale 4. Goods bought on credit Which of the following is a liability? . Machinery b. Cash at bank c. Motor vehicles 12 4. Accounts payable for goods $50 cash taken from cash till and banked is entered: . Debit cash column $50: Credit bank column $50 b. Debit bank column $50: Credit cash column $50 . Debit cash column $50: Credit cash column $50 4. Debit bank column $50: Credit bank column $50 13. The Basic accounting equation is: ..Assets =Cash + Capital b. Asset = Expense + Income c. Assets = Capital + Liabilities 1. Assets - Expenses + Capital 14. Every business transaction affects at least accounts: One Two c. Three 4. Infinite 15. The most common imprest system is the system: Discount 1. Petty cash 16. Cash book Cash receipt Is it true that the trial balance totals should agree? . Yes, always b. No, there are sometimes good reasons why they differ 6. No, because it is not a statement of financial position d. Yes, except where the trial balance is extracted at the year end 17. Which financial statement displays the revenues and expenses of a company for a period of time? Cash Flow Statement . Statement of Profit or Loss Statement of Financial Position d. Statement of Shareholder's Equity 18 Accounting is the information system that . Measures business activity 1. Communicate the results to decision makers Processes data into reports 1. All of the above 19. Which of the following should not be called "Sales"? Office fixtures sold Goods sold on credit Goods sold for cash Sale of item previously included in "Purchases The resources owned by a business are called 20, Assets Liabilities Owner's equity . The accounting equation 21. The total of the Purchases Journal is transferred to the: Credit side of the Purchases Book Credit side of the Purchases Account Debit side of the Purchases Account Debit side of the Purchases Day Book Bank overdraft is: A current asset A current liability 22 A non-current asset 1 A non-current liability 23. Net profit is calculated in the Trial balance 6. Trading account c. Profit and loss account 4 Statement of financial position Gross profit is: Sales less purchases b. Net profit less expenses of the period c. Cost of goods sold + opening inventory d. Excess of sales over cost of goods sold 24. 25. Goods returned by customer should be debited to which of the following accounts? Sales income account Sales account c. Return inward account 1. Expenses account Which of these best describes non-current assets? Items which will not wear out quickly .Items bought to be used in the business c. Expensive items bought for the business d. Items having long life and not bought specifically for 26. resale 27. Which of the following does not appear in Statement of Financial Position? Cash b. Building c. Debtor 4:03 Back mid test.docx 27. Which of the following does not appear in Statement of Financial Position? a. Cash b. Building c. Debtor d. Rent expenses 28 is correct? Paid electricity by cash. Which of the following posting Dr. Cash, Cr: Electricity De: Electricity, Cr Cash Dr: Bank, Cr: Electricity 4 None of the above 29. Find out the value of assets if: Liabilities = $5000 and Capital - S1000: S4000 S6000 $7000 $3000 S. Money received from petty cash must be recorded on a - Bank book Bit of paper Receipt book 4 Petty cash book (Total: 30 marks)