Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me do (b) and (c), I don't how to do thank you! Cityl Catering is a company preparing ready-made meals, delivered to local

please help me do (b) and (c), I don't how to do thank you!

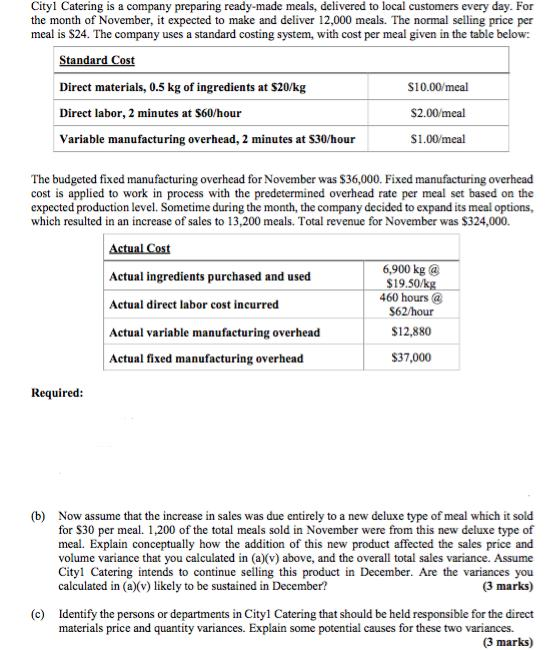

Cityl Catering is a company preparing ready-made meals, delivered to local customers every day. For the month of November, it expected to make and deliver 12,000 meals. The normal selling price per meal is $24. The company uses a standard costing system, with cost per meal given in the table below: Standard Cost Direct materials, 0.5 kg of ingredients at $20/kg S10.00/meal $2.00/meal Direct labor, 2 minutes at 560/hour Variable manufacturing overhead, 2 minutes at $30/hour $1.00/meal The budgeted fixed manufacturing overhead for November was $36,000. Fixed manufacturing overhead cost is applied to work in process with the predetermined overhead rate per meal set based on the expected production level. Sometime during the month, the company decided to expand its meal options, which resulted in an increase of sales to 13,200 meals. Total revenue for November was $324,000. Actual Cost Actual ingredients purchased and used Actual direct labor cost incurred 6,900 kg @ $19.50/kg 460 hours S62/hour $12,880 Actual variable manufacturing overhead Actual fixed manufacturing overhead $37,000 Required: (b) Now assume that the increase in sales was due entirely to a new deluxe type of meal which it sold for $30 per meal. 1,200 of the total meals sold in November were from this new deluxe type of meal. Explain conceptually how the addition of this new product affected the sales price and volume variance that you calculated in (a)(v) above, and the overall total sales variance. Assume Cityl Catering intends to continue selling this product in December. Are the variances you calculated in (a)(v) likely to be sustained in December? (3 marks) (c) Identify the persons or departments in City Catering that should be held responsible for the direct materials price and quantity variances. Explain some potential causes for these two variancesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started