Question

please help me feel this 1120 and a 1120s with these information . What is the marginal tax rate for each form? What is the

please help me feel this 1120 and a 1120s with these information .

What is the marginal tax rate for each form?

What is the effective tax rate for each form?

How much is the tax liability for the next income?

If is it a pass-through what is the tax liability assuming that there is only one owner and there is no other income?

Florida

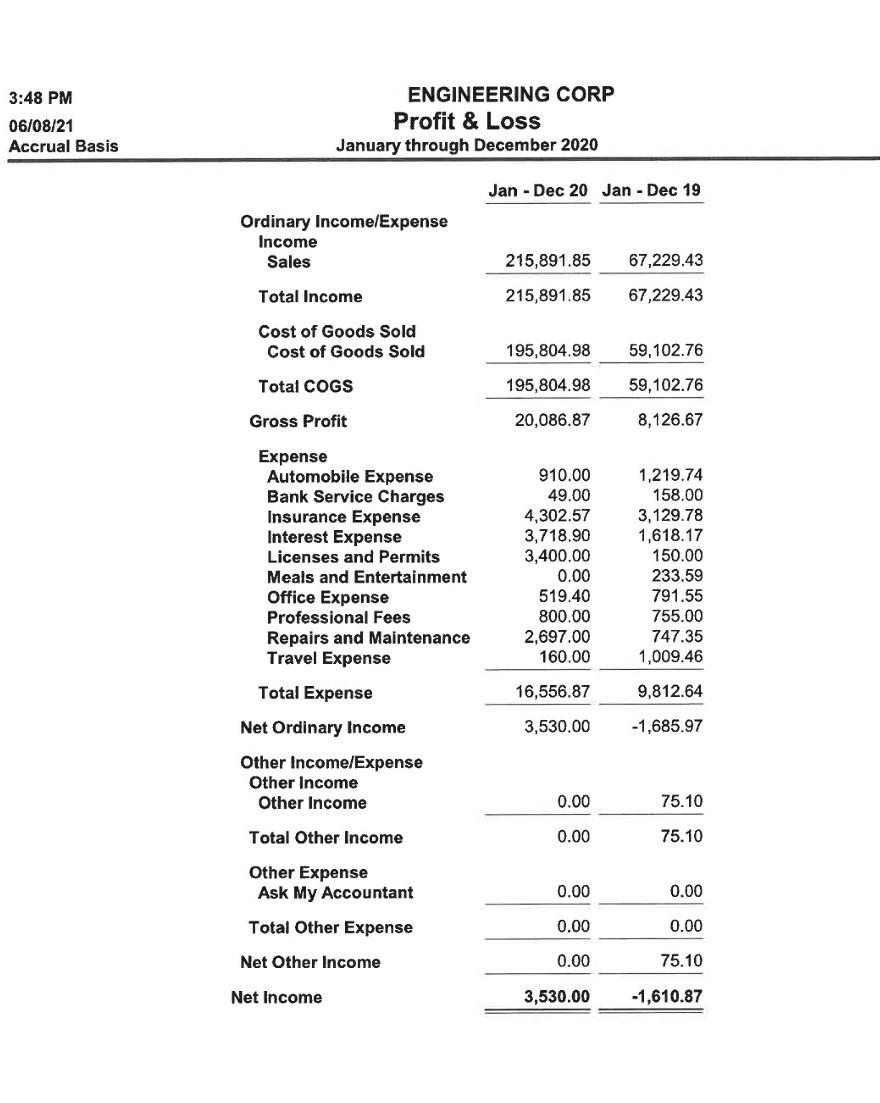

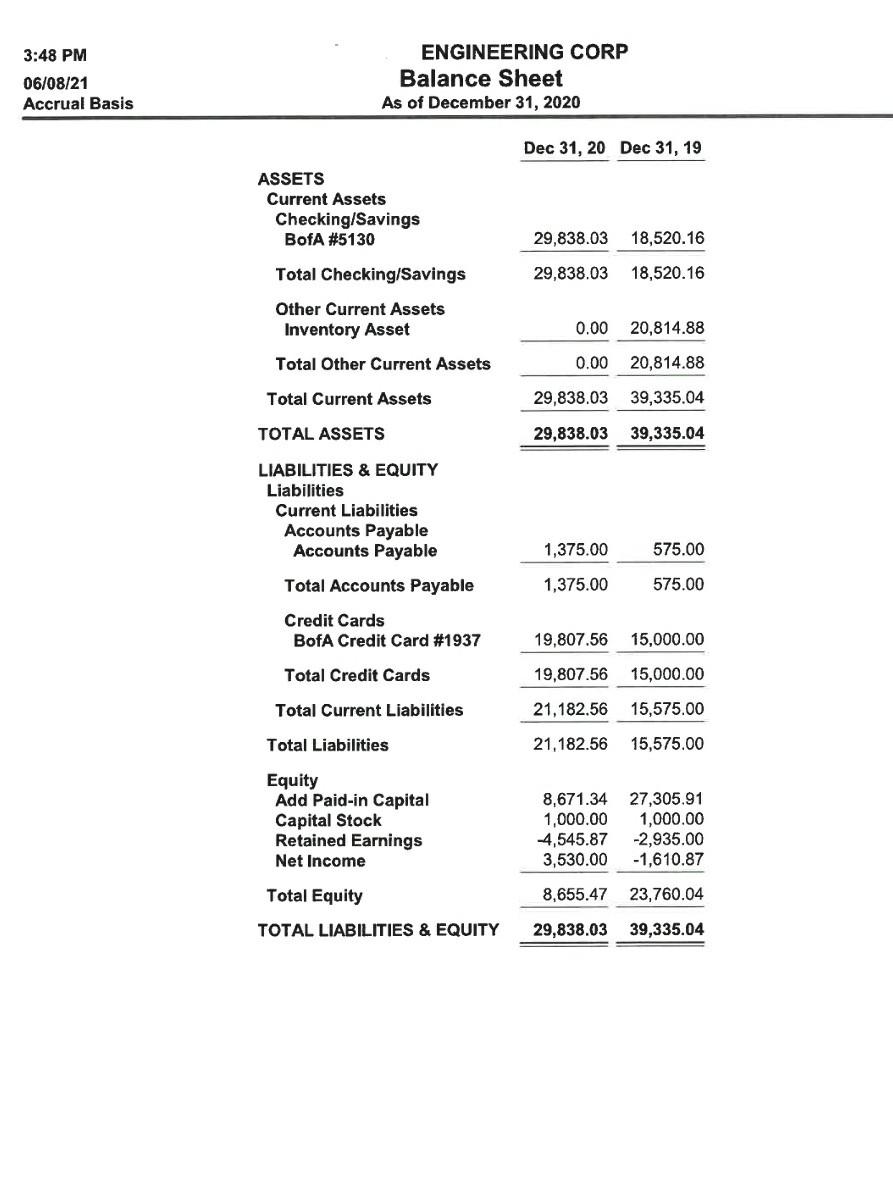

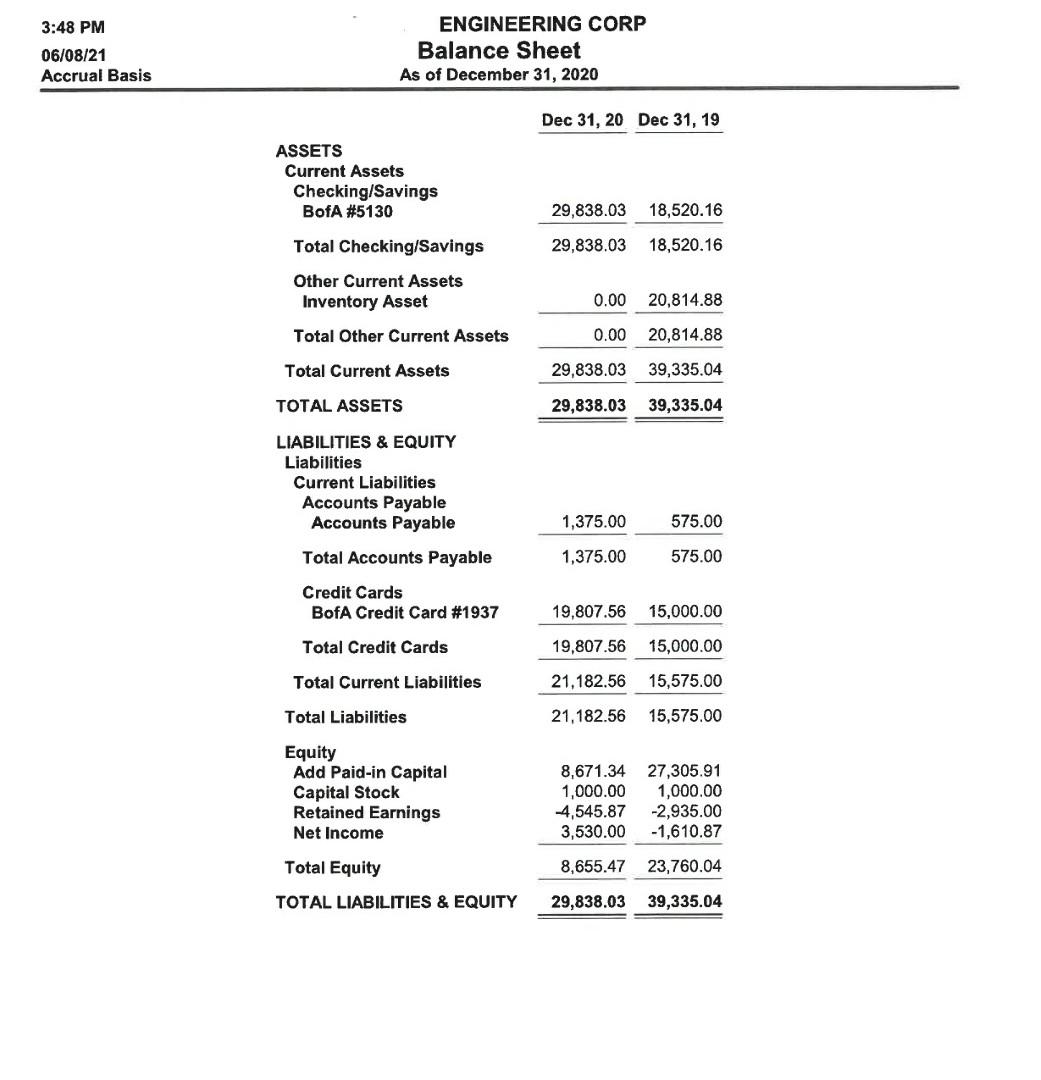

I have attached the financial statements to prepare either a form 1065 or 1120S AND a form 1120.

Once the form and schedules M1/M2 are prepared you should be able to answer the following:

What is the marginal tax rate for each form?

What is the effective tax rate for each form?

How much is the tax liability for the next income?

If is it a pass-through what is the tax liability assuming that there is only one owner and there is no other income?

What would be the differences if the company's net income increases by $100,000?

What would be the differences if the company's net income decreases by $40,000?

that's all the info given using the IRS 2020 tax form.

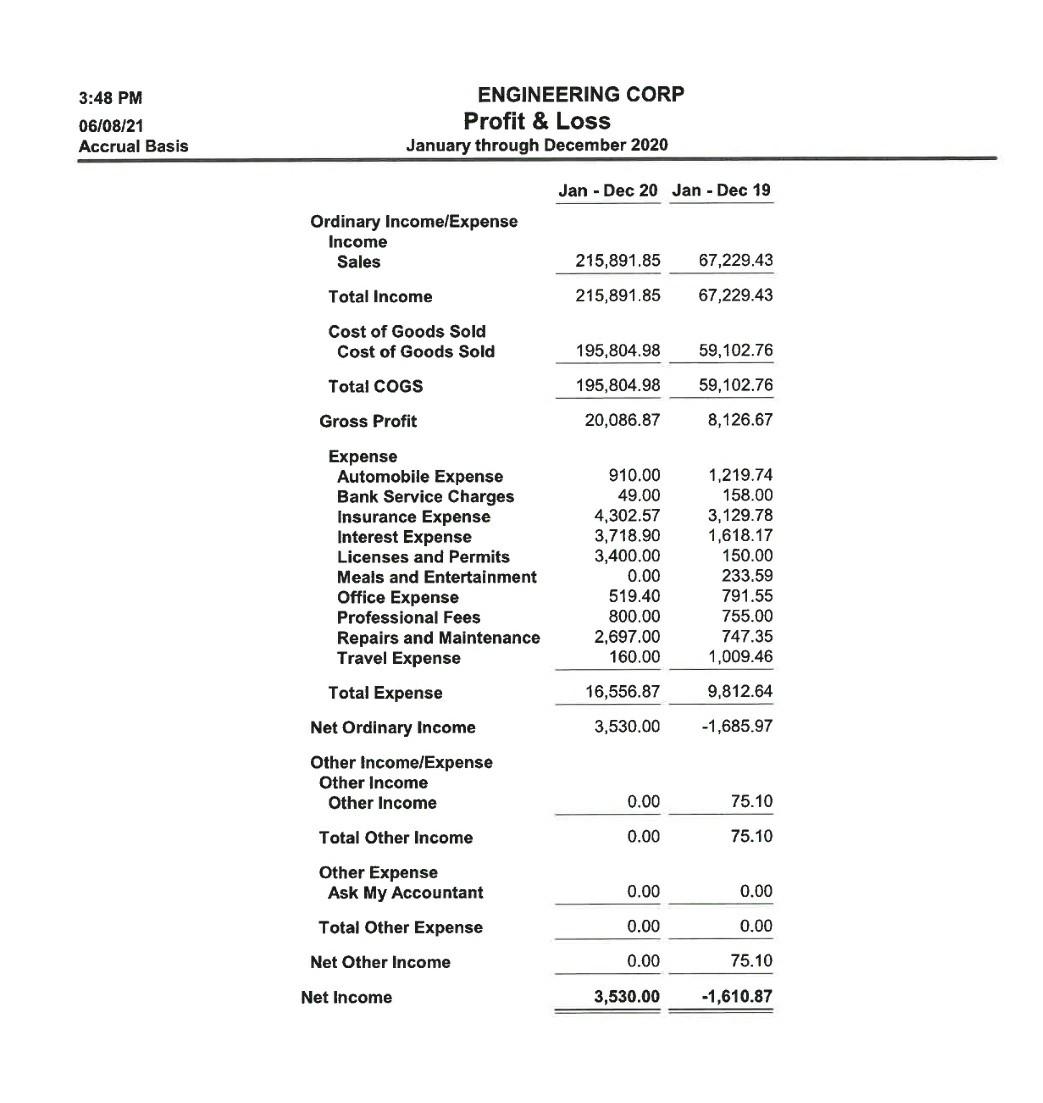

that's all the information provided see the picture for the P and L. and balance sheet

tI have attached the financial statements to prepare either a form 1065 or 1120S AND a form 1120.

Once the form and schedules M1/M2 are prepared you should be able to answer the following:

What is the marginal tax rate for each form?

What is the effective tax rate for each form?

How much is the tax liability for the next income?

If is it a pass-through what is the tax liability assuming that there is only one owner and there is no other income?

What would be the differences if the company's net income increases by $100,000?

What would be the differences if the company's net income decreases by $40,000?

Good Luck!

3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Profit & Loss January through December 2020 Jan - Dec 20 Jan - Dec 19 Ordinary Income/Expense Income Sales 215,891.85 67,229.43 Total Income 215,891.85 67,229.43 Cost of Goods Sold Cost of Goods Sold 195,804.98 59,102.76 Total COGS 195,804.98 59,102.76 Gross Profit 20,086.87 8,126.67 Expense Automobile Expense Bank Service Charges Insurance Expense Interest Expense Licenses and Permits Meals and Entertainment Office Expense Professional Fees Repairs and Maintenance Travel Expense Total Expense 910.00 49.00 4,302.57 3,718.90 3,400.00 0.00 519.40 800.00 2,697.00 160.00 1,219.74 158.00 3,129.78 1,618.17 150.00 233.59 791.55 755.00 747.35 1,009.46 16,556.87 9,812.64 Net Ordinary Income 3,530.00 -1,685.97 Other Income/Expense Other Income Other Income 0.00 75.10 Total Other Income 0.00 75.10 Other Expense Ask My Accountant 0.00 0.00 Total Other Expense 0.00 0.00 Net Other Income 0.00 75.10 Net Income 3,530.00 -1,610.87 3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Balance Sheet As of December 31, 2020 Dec 31, 20 Dec 31, 19 ASSETS Current Assets Checking/Savings BofA #5130 29,838.03 18,520.16 Total Checking/Savings 29,838.03 18,520.16 Other Current Assets Inventory Asset 0.00 20,814.88 Total Other Current Assets 0.00 20,814.88 Total Current Assets 29,838.03 39,335.04 TOTAL ASSETS 29,838.03 39,335.04 LIABILITIES & EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable 1,375.00 575.00 Total Accounts Payable 1,375.00 575.00 Credit Cards BofA Credit Card #1937 19,807.56 15,000.00 Total Credit Cards 19,807.56 15,000.00 Total Current Liabilities 21,182.56 15,575.00 Total Liabilities 21,182.56 15,575.00 Equity Add Paid-in Capital Capital Stock Retained Earnings Net Income 8,671.34 27,305.91 1,000.00 1,000.00 4,545.87 -2,935.00 3,530.00 -1,610.87 8,655.47 23,760.04 Total Equity TOTAL LIABILITIES & EQUITY 29,838.03 39,335.04 3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Balance Sheet As of December 31, 2020 Dec 31, 20 Dec 31, 19 ASSETS Current Assets Checking/Savings BofA #5130 29,838.03 18,520.16 Total Checking/Savings 29,838.03 18,520.16 Other Current Assets Inventory Asset 0.00 20,814.88 Total Other Current Assets 0.00 20,814.88 Total Current Assets 29,838.03 39,335.04 TOTAL ASSETS 29,838.03 39,335.04 LIABILITIES & EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable 1,375.00 575.00 Total Accounts Payable 1,375.00 575.00 Credit Cards BofA Credit Card #1937 19,807.56 15,000.00 Total Credit Cards 19,807.56 15,000.00 Total Current Liabilities 21,182.56 15,575.00 Total Liabilities 21,182.56 15,575.00 Equity Add Paid-in Capital Capital Stock Retained Earnings Net Income 8,671.34 1,000.00 4,545.87 3,530.00 27,305.91 1,000.00 -2,935.00 -1,610.87 Total Equity 8,655.47 23,760.04 TOTAL LIABILITIES & EQUITY 29,838.03 39,335.04 3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Profit & Loss January through December 2020 Jan - Dec 20 Jan - Dec 19 Ordinary Income/Expense Income Sales 215,891.85 67,229.43 Total Income 215,891.85 67,229.43 Cost of Goods Sold Cost of Goods Sold 195,804.98 59,102.76 Total COGS 195,804.98 59,102.76 Gross Profit 20,086.87 8,126.67 Expense Automobile Expense Bank Service Charges Insurance Expense Interest Expense Licenses and Permits Meals and Entertainment Office Expense Professional Fees Repairs and Maintenance Travel Expense Total Expense 910.00 49.00 4,302.57 3,718.90 3,400.00 0.00 519.40 800.00 2,697.00 160.00 1,219.74 158.00 3,129.78 1,618.17 150.00 233.59 791.55 755.00 747.35 1,009.46 16,556.87 9,812.64 Net Ordinary Income 3,530.00 -1,685.97 Other Income/Expense Other Income Other Income 0.00 75.10 Total Other Income 0.00 75.10 Other Expense Ask My Accountant 0.00 0.00 Total Other Expense 0.00 0.00 Net Other Income 0.00 75.10 Net Income 3,530.00 -1,610.87 3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Profit & Loss January through December 2020 Jan - Dec 20 Jan - Dec 19 Ordinary Income/Expense Income Sales 215,891.85 67,229.43 Total Income 215,891.85 67,229.43 Cost of Goods Sold Cost of Goods Sold 195,804.98 59,102.76 Total COGS 195,804.98 59,102.76 Gross Profit 20,086.87 8,126.67 Expense Automobile Expense Bank Service Charges Insurance Expense Interest Expense Licenses and Permits Meals and Entertainment Office Expense Professional Fees Repairs and Maintenance Travel Expense Total Expense 910.00 49.00 4,302.57 3,718.90 3,400.00 0.00 519.40 800.00 2,697.00 160.00 1,219.74 158.00 3,129.78 1,618.17 150.00 233.59 791.55 755.00 747.35 1,009.46 16,556.87 9,812.64 Net Ordinary Income 3,530.00 -1,685.97 Other Income/Expense Other Income Other Income 0.00 75.10 Total Other Income 0.00 75.10 Other Expense Ask My Accountant 0.00 0.00 Total Other Expense 0.00 0.00 Net Other Income 0.00 75.10 Net Income 3,530.00 -1,610.87 3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Balance Sheet As of December 31, 2020 Dec 31, 20 Dec 31, 19 ASSETS Current Assets Checking/Savings BofA #5130 29,838.03 18,520.16 Total Checking/Savings 29,838.03 18,520.16 Other Current Assets Inventory Asset 0.00 20,814.88 Total Other Current Assets 0.00 20,814.88 Total Current Assets 29,838.03 39,335.04 TOTAL ASSETS 29,838.03 39,335.04 LIABILITIES & EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable 1,375.00 575.00 Total Accounts Payable 1,375.00 575.00 Credit Cards BofA Credit Card #1937 19,807.56 15,000.00 Total Credit Cards 19,807.56 15,000.00 Total Current Liabilities 21,182.56 15,575.00 Total Liabilities 21,182.56 15,575.00 Equity Add Paid-in Capital Capital Stock Retained Earnings Net Income 8,671.34 27,305.91 1,000.00 1,000.00 4,545.87 -2,935.00 3,530.00 -1,610.87 8,655.47 23,760.04 Total Equity TOTAL LIABILITIES & EQUITY 29,838.03 39,335.04 3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Balance Sheet As of December 31, 2020 Dec 31, 20 Dec 31, 19 ASSETS Current Assets Checking/Savings BofA #5130 29,838.03 18,520.16 Total Checking/Savings 29,838.03 18,520.16 Other Current Assets Inventory Asset 0.00 20,814.88 Total Other Current Assets 0.00 20,814.88 Total Current Assets 29,838.03 39,335.04 TOTAL ASSETS 29,838.03 39,335.04 LIABILITIES & EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable 1,375.00 575.00 Total Accounts Payable 1,375.00 575.00 Credit Cards BofA Credit Card #1937 19,807.56 15,000.00 Total Credit Cards 19,807.56 15,000.00 Total Current Liabilities 21,182.56 15,575.00 Total Liabilities 21,182.56 15,575.00 Equity Add Paid-in Capital Capital Stock Retained Earnings Net Income 8,671.34 1,000.00 4,545.87 3,530.00 27,305.91 1,000.00 -2,935.00 -1,610.87 Total Equity 8,655.47 23,760.04 TOTAL LIABILITIES & EQUITY 29,838.03 39,335.04 3:48 PM 06/08/21 Accrual Basis ENGINEERING CORP Profit & Loss January through December 2020 Jan - Dec 20 Jan - Dec 19 Ordinary Income/Expense Income Sales 215,891.85 67,229.43 Total Income 215,891.85 67,229.43 Cost of Goods Sold Cost of Goods Sold 195,804.98 59,102.76 Total COGS 195,804.98 59,102.76 Gross Profit 20,086.87 8,126.67 Expense Automobile Expense Bank Service Charges Insurance Expense Interest Expense Licenses and Permits Meals and Entertainment Office Expense Professional Fees Repairs and Maintenance Travel Expense Total Expense 910.00 49.00 4,302.57 3,718.90 3,400.00 0.00 519.40 800.00 2,697.00 160.00 1,219.74 158.00 3,129.78 1,618.17 150.00 233.59 791.55 755.00 747.35 1,009.46 16,556.87 9,812.64 Net Ordinary Income 3,530.00 -1,685.97 Other Income/Expense Other Income Other Income 0.00 75.10 Total Other Income 0.00 75.10 Other Expense Ask My Accountant 0.00 0.00 Total Other Expense 0.00 0.00 Net Other Income 0.00 75.10 Net Income 3,530.00 -1,610.87Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started