Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me figure out schedule1, D, & E Comprehensive Problem 4-1 Skylar and waiter Black have been married for 25 years. They live at

please help me figure out

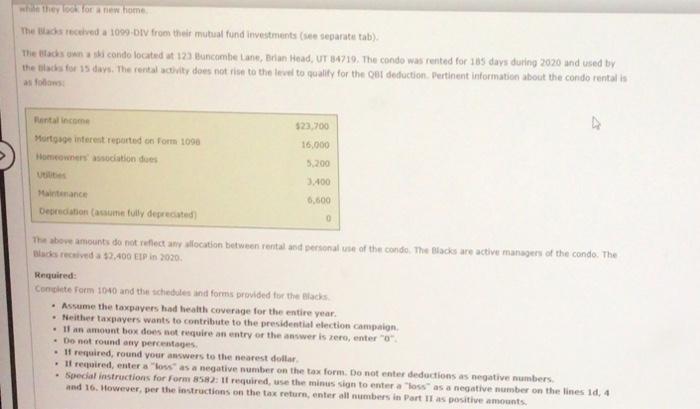

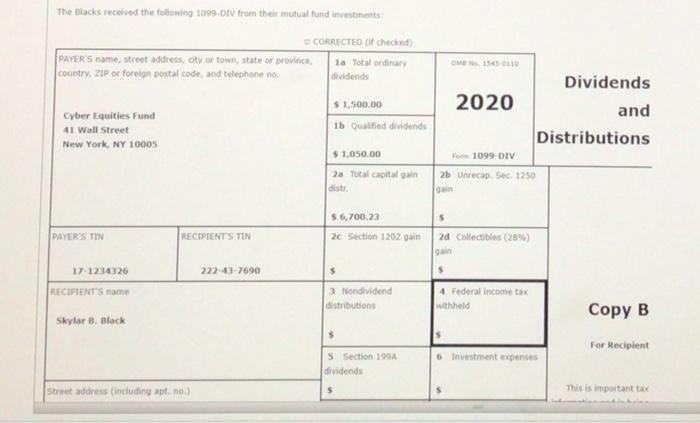

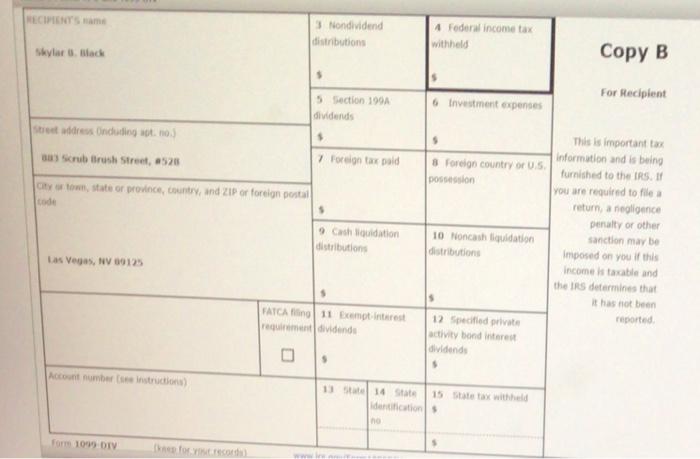

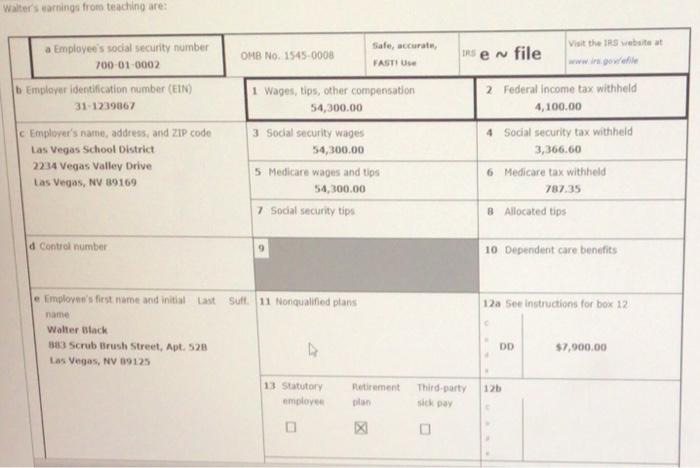

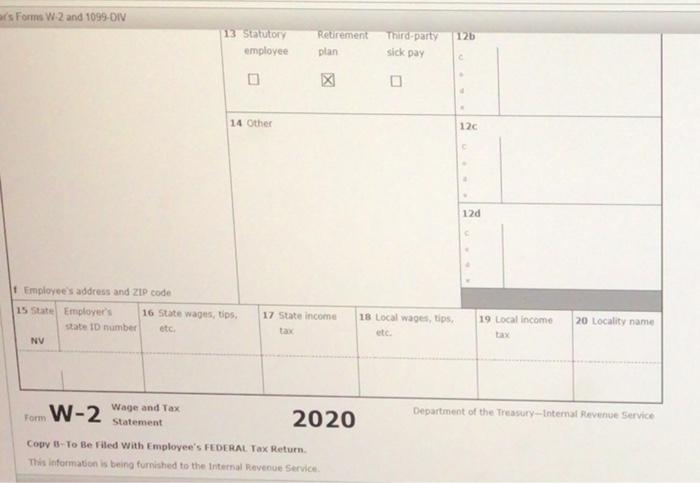

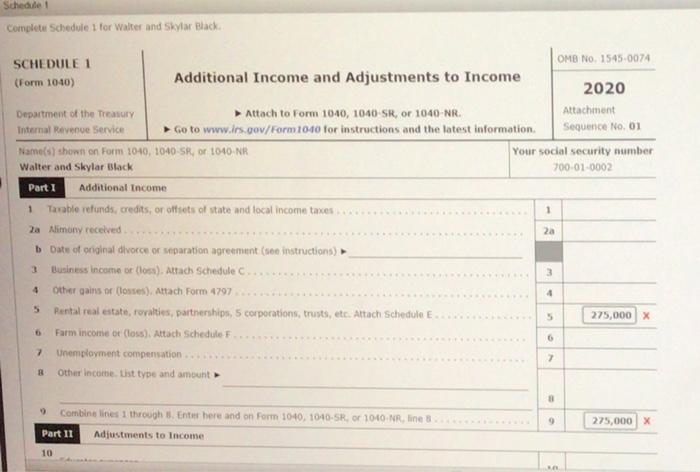

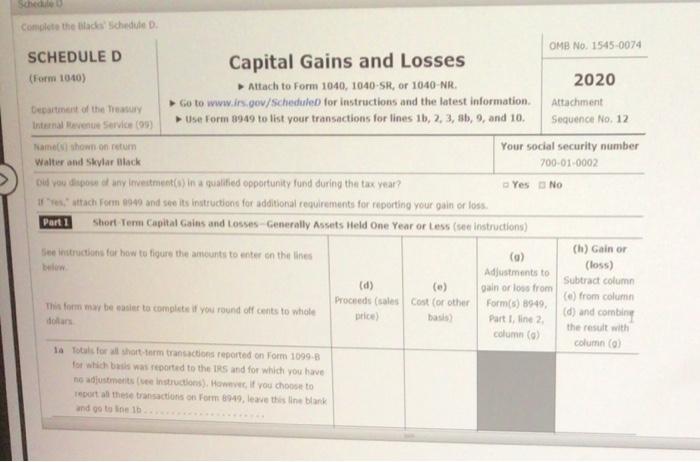

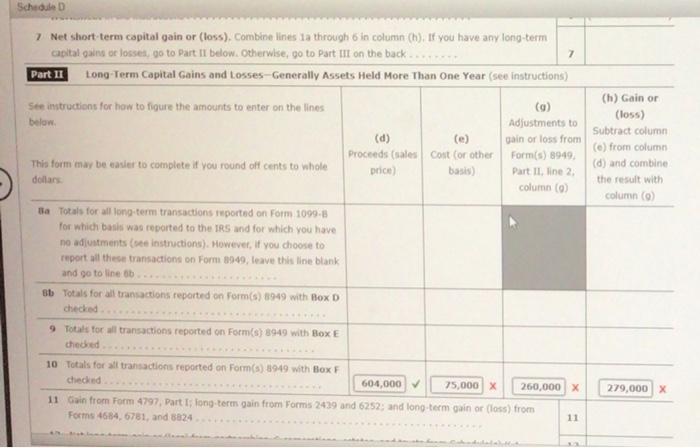

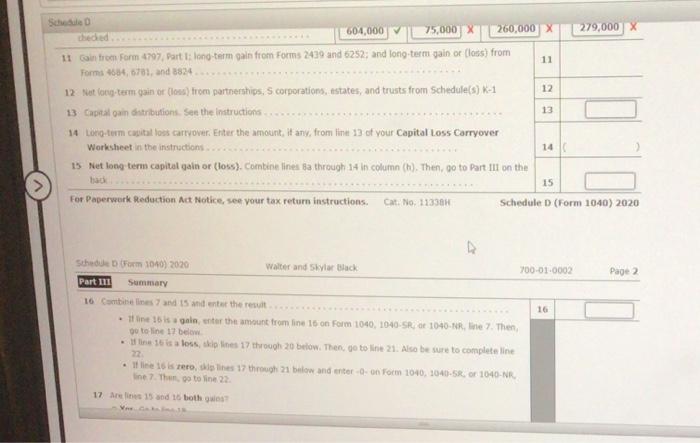

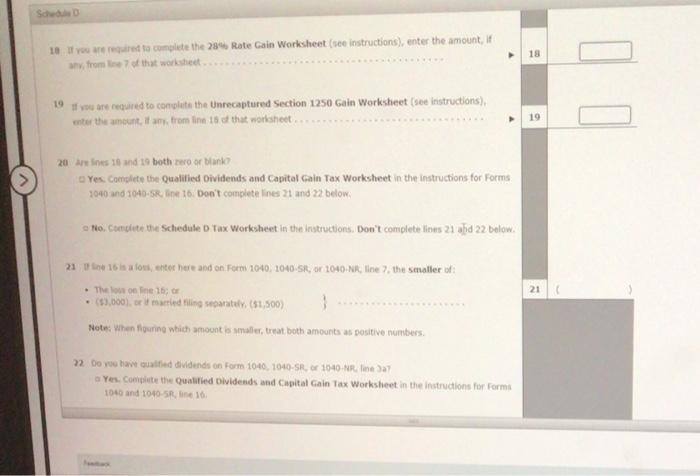

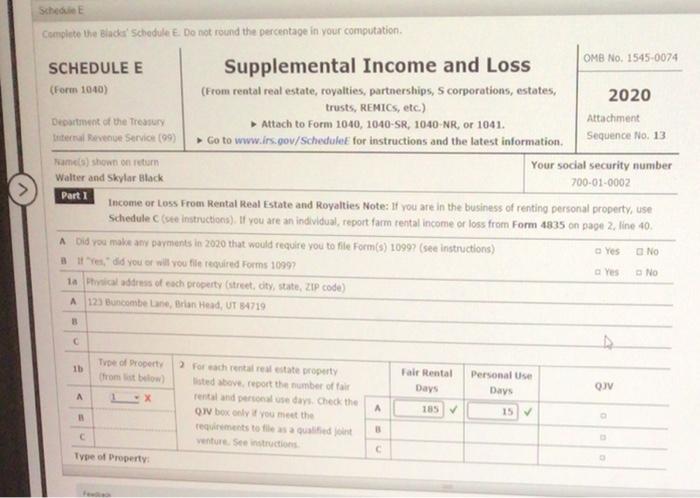

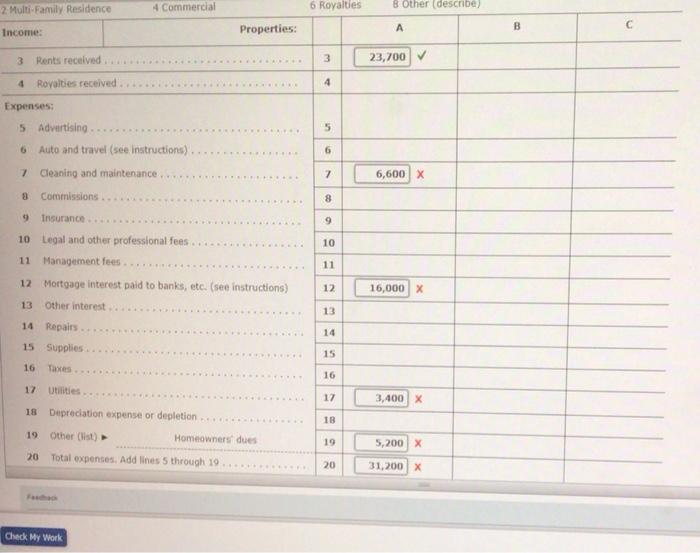

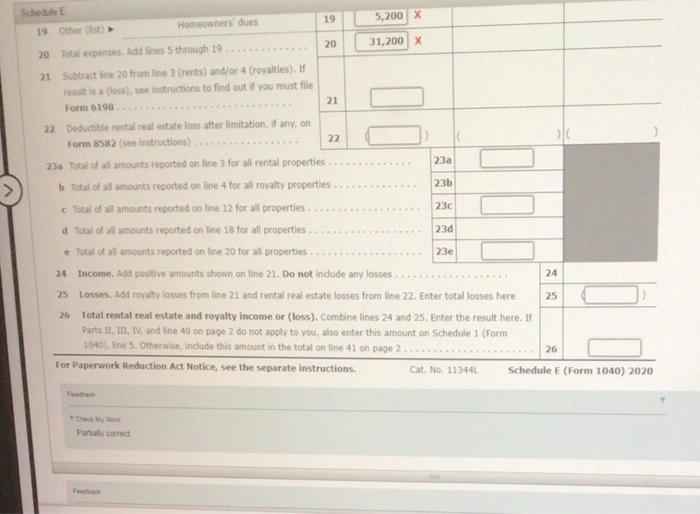

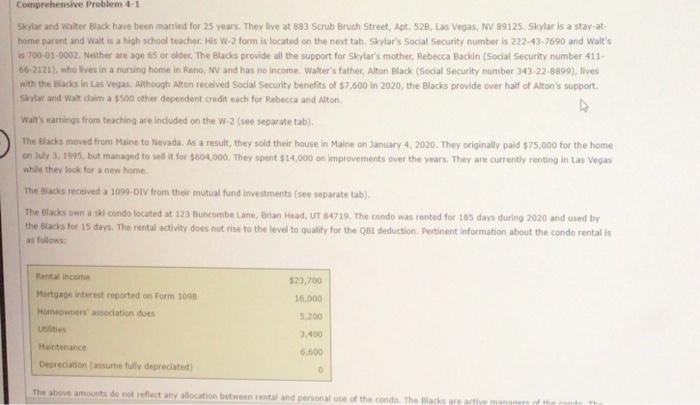

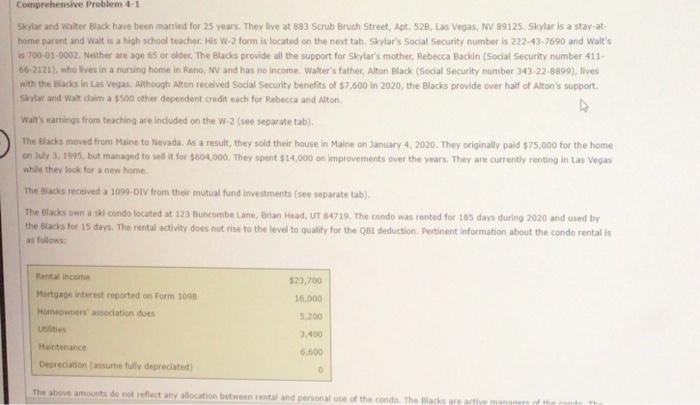

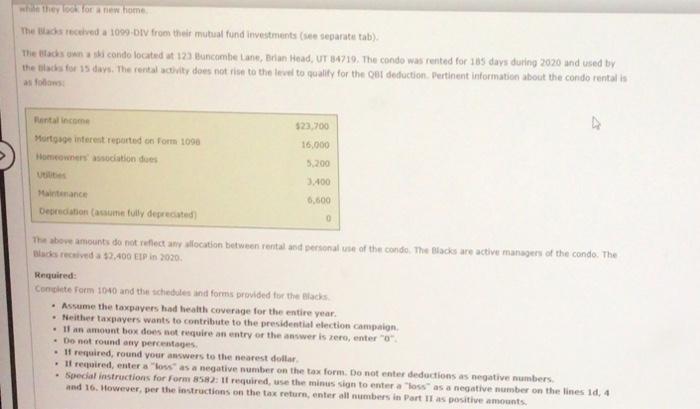

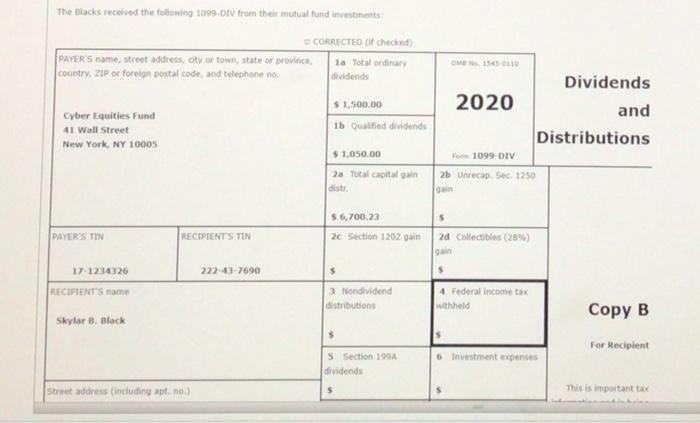

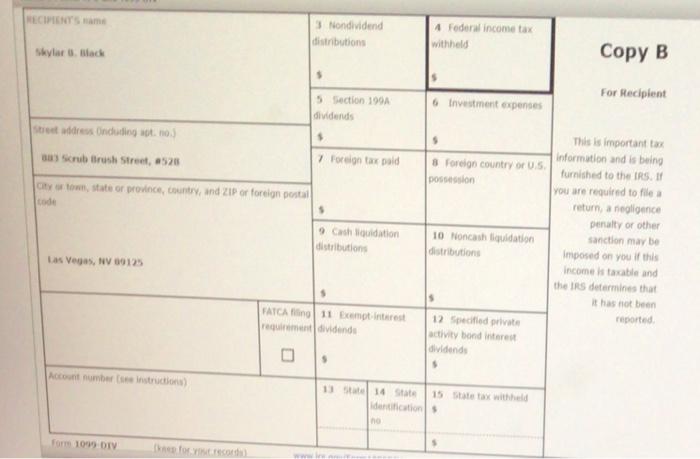

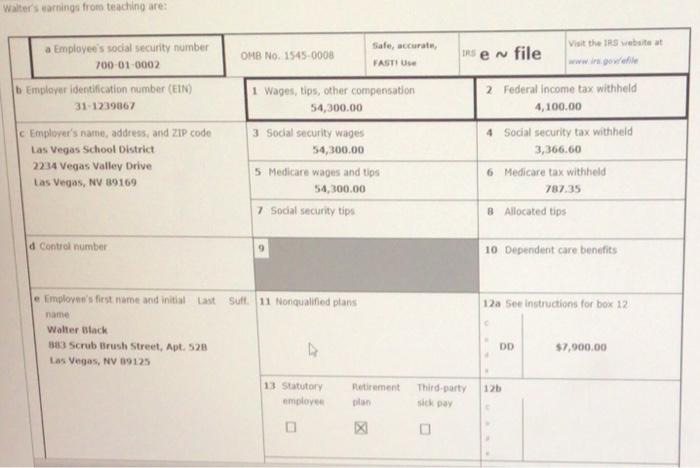

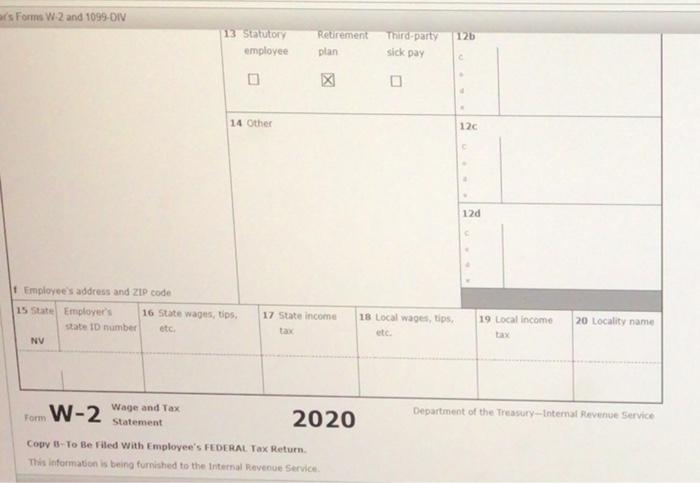

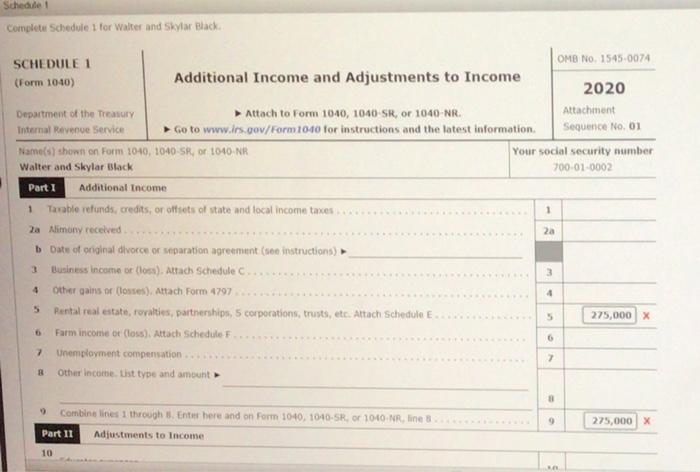

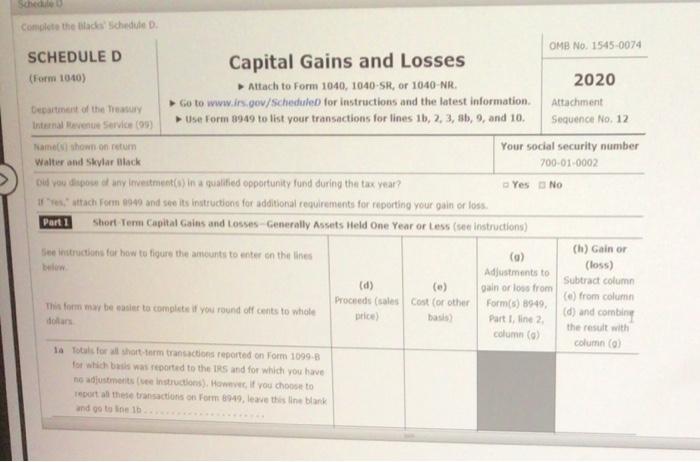

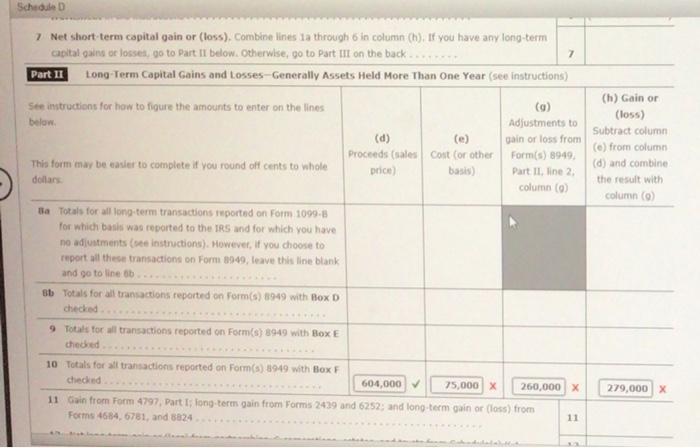

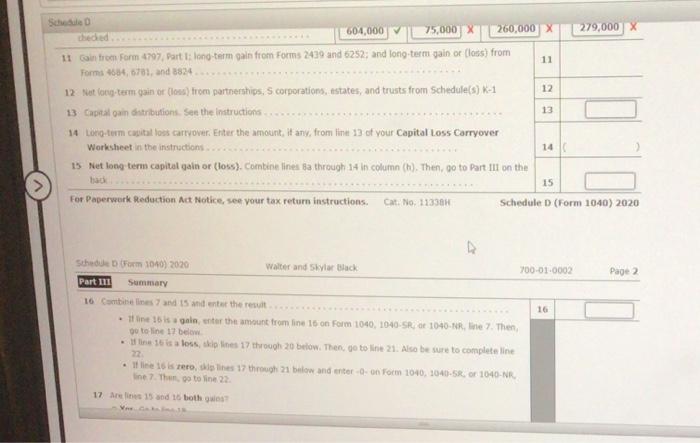

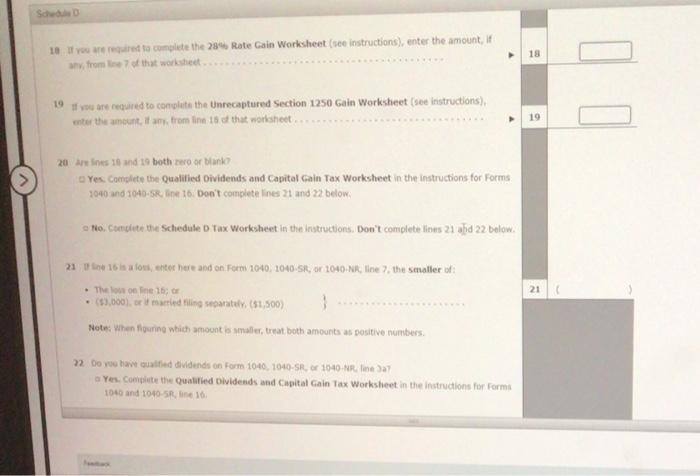

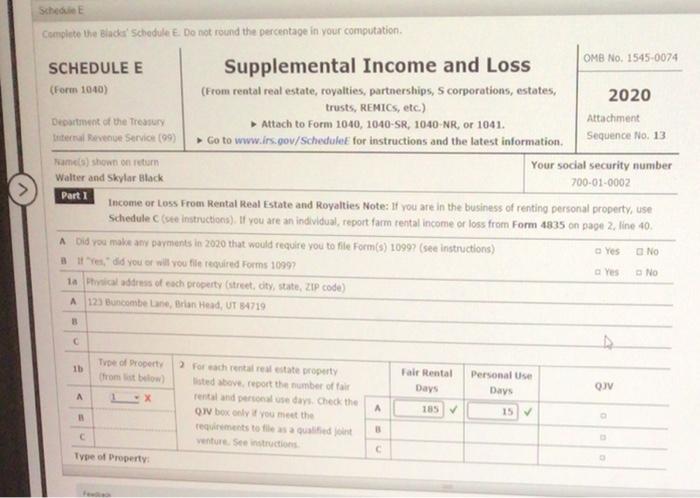

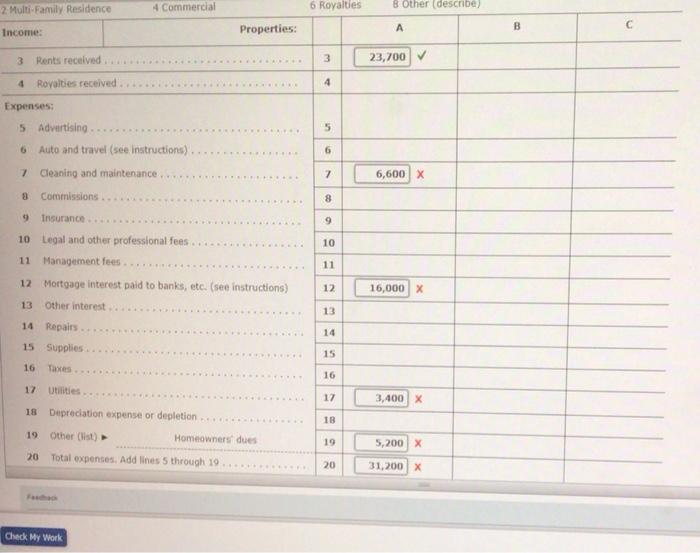

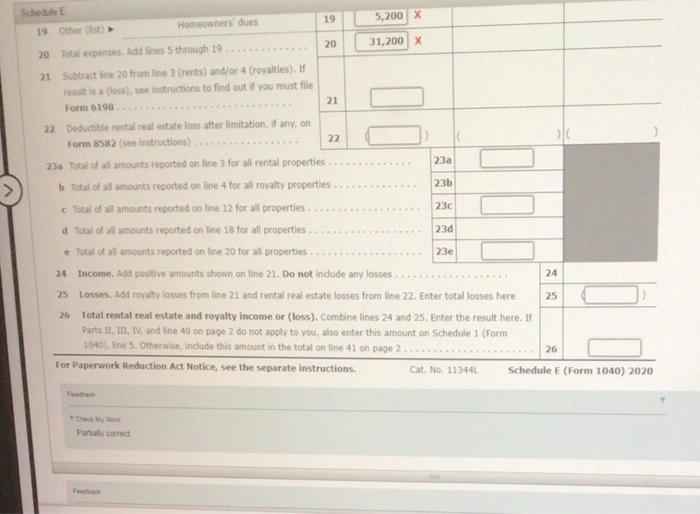

Comprehensive Problem 4-1 Skylar and waiter Black have been married for 25 years. They live at 893 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at- home parent and wait is a high school teacher. His W.2 form is located on the next tab Skylar's Social Security number is 227-43.7690 and Walt's s 700-01-0002. Neither e 200 65 or older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411- 66-21211, who lives in a nursing home in Reno, NV and has no income. Walter's father, Altan Black (Social Security mimber 343 22-8999), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of $7,500 in 2020, the Blacks provide over half of Alton's support, Skytar and watchim a $500 other dependent credit each for Rebecca and Alton wars carrings from teaching are induded on the W-2 (see separate tab) The blacks moved from Maine to nevada. As a result, they sold their house in Maine on January 4, 2020. The originally paid $75,000 for the home on July 3, 1995, but managed to sell it for $604000. They spent $14,000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home The was received a 1090-DIV from their mutual fund investments (see separate tab) The Blacks own a skl condo located at 122 Huncombe Lane, Brian Head, UT 84719. The condo was rented for 10 days during 2020 and used by the Stades for 15 days. The rental activity does not rise to the level to qualify for the 31 deduction, pertinent Information about the condo rentalis follows 129,700 16,000 5.200 Rental income Mortone interest reported on Form 1001 Homeowners association does Uits Maintenance Deprecatione fully deprecated) 3.400 5.500 0 The showe amounts do not reflect any allocation between rental and personale of the conda The Backseative w they look for a new home The received a 1099 DIV from their mutual fund investments (see separate tab) The Bad and condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 185 days during 2020 and used by the ladies for 15 days. The rental activity does not rise to the level to quality for the et deduction, pertinent information about the condo rentalis a fos $23,700 Pantal income Mortgage interest reported on Form 1090 Homeownersation des 16,000 5.200 3.400 Maintenance Deprecation (assunt fully deprecated 0,600 0 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo. The de received a $2.400 EP in 2020 Required: Conchite Form 1040 and the schedules and forms provided for the blacks Assume the taxpayers had health coverage for the entire year Neither taxpayers wants to contribute to the presidential election campaign If an amount box does not require an entry or the answer is zero, enter" . Do not round any percentages If required, round your answers to the nearest dollar . Il required, enter a loss as a negative number on the tax form. Do not enter deductions as negative numbers Special instructions for Form 58: It required, use the minus sign to enter a loss as a negative number on the lines id, 4 and 16. However, per the instructions on the tax return, enter all numbers in Part II as positive amounts The Blacks received the following 1099.DIV from their mutual fund investments CORRECTED (it checked PAYERS name, street address, city or town, state or province, la Yol ordinary country. ZIP or foreign postal code, and telephone no. dividends 1545-01 $1,500.00 Cyber Equities Fund 41 Wall Street New York, NY 10005 1b Qualified dividends Dividends 2020 and Distributions Forn 1099-0IV 26 Unrecap Sec. 1250 $1,050.00 2a Total capital gain distr gain $ 6,700,23 $ PAYERS TIN RECIPIENTS TIN 2c Section 1202 gain 2d Collectibles (28) gain 17-121426 222-43-7690 $ RECIPIENTS name 3 Nondividend distributions 4 Federal income tax withheld Copy B Skylar B. Black 5 For Recipient Investment expenses 5 Section 1994 dividends Street address (induding no.) This is important tax RECIPIENTS 3 Nondividend distributions 4 Federal income tax withheld Skylar Black Copy B $ For Recipient 5 Section 1994 dividends 6 Investment expenses Street dress Onduling to.) $ Scrubrush Street, 2528 7 Foreign tax pold y to state or province, Country, and ZIP or foreign postal [code Cash odation distribution This is important tax 8 foreign country or U.S. information and is being furnished to the RS. 11 possession you are required to file return, a negligence penalty or other 10 Nocash liquidation sanction may be distribution Imposed on you if this Income Istacable and the IRS determines that 5 it has not been 12 Specified private reported activity bond interest (dividends Las Vegas, NV 89125 FATCA 11 Exempt interest requirement dividende 5 Account number instruction 15 State tax withheld identifications no 10 DIV Walter's carnings from teaching are: Safe, accurate Visit the IRS website at OMB No. 1545-0008 Se file FASTI U a Employee's social security number 700-01-0002 Employer identification number (EIN) 31-1239867 C Employer's name, address, and ZIP code Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 1 Wages, tips, other compensation $4,300.00 3 Sodal security wages 54,300.00 5 Medicare wages and tips 54,300.00 7 Social security tips 2 Federal income tax withheld 4,100.00 4 Social security tax withheld 3,366.60 6 Medicare tax withheld 787.35 8 Allocated tips d Control number 9 10 Dependent care benefits Su 11 Nonqualified plans 12a See Instructions for box 12 e Employee's first name and initial Cast name Walter Black 323 Scrub Brush Street, Apt. 528 Las Vegas, NV 89125 DD $7,900.00 120 13 Statutory emploved Retirement plan Third-party sick pay ar's Forms W2 and 1099-01V Third-party 12b 13 Statutory employee Rourement plan sick pay D 14 Other 12 120 + Employee's address and ZIP code 15 State Employer's 16 state wages, tips state ID number etc NV 17 State income 18 Local wages, tips etc. 19 Local income 20 Locality name Form W-2 Wage and Tax Statement 2020 Department of the Treasury--Internal Revenue Service Copy-To Be Filed with Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Schedule Complete Schedule 1 for Walter and Skylar Black SCHEDULE 1 OMB No 1545-0074 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Treasury Attach to Form 1040, 1040 SR, or 1040-NR. Attachment Internal Revenue Service Go to www.lrs.gov/ Form 1040 for instructions and the latest information Sequence No. 01 Name(s) shown on Form 1040, 1090 SR, or 1040-NR Your social security number Walter and Skylar Black 700-01-0002 Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 1 20 3 4 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (los). Attach Schedule ... 4 Other gains or losses). Attach Form 4797 Rental real estate, royalties, partnerships, 5 corporations, trusts, etc. Attach Schedule 6 Farm income or loss). Attach Schedule 7 Unemployment compensation Other income List type and amount 5 275,000 x 6 2 Combine lines 1 through 8. Ent here and on Form 1040, 1040-5R or 1040 NR line 8 Part 11 Adjustments to Income . 275,000 X 10 Complete the blads Schedule OMB No 1545-0074 SCHEDULED Capital Gains and Losses (Form 1040) 2020 Attach to Form 1040, 1040-SR, or 1040 NR. Go to www.lrs.gov/scheduled for instructions and the latest information. Attachment Department of the Day Internal Revenue Service (5) Use Form 1949 to list your transactions for lines 1b, 2, 3, 8, 9, and 10. Sequence No. 12 Names shown on retum Your social security number Walter and Skylar black 1700-01 0002 old you dow of any investment in a qualified opportunity fund during the tax year? Yes No tach Form 0940 and see its instructions for additional requirements for reporting your gain or loss. Part 1 Short Term Capital Gains and Losses Generally Assets Held One Year or less (see instructions) (h) Gain or Se intructions for how to figure the amounts to enter on the lines (0) (loss) Adjustments to (d) Subtract column (o) gain or loss from This form may be easier to complete if you round off cents to whole Proceeds (sales Cost (or other () from column Form) 1949 price (d) and combine dollars basis Part I line 2 the result with column column 1a Total for short-term transactions reported on Form 1099-8 for which was reported to the IRS and for which you have ne adjustments Instructions). However, if you choose to report all these transactions on Form 949. leave this line Bank and go to line 1 Schedule 7 Net short term capital gain or loss). Combine lines ia through 6 in column (h). If you have any long-term capital gains or losses, go to Part II below. Otherwise, go to Part II on the back 7 Part II tong-Term Capital Gains and tosses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines (0) below Adjustments to (d) Gain or loss from Proceeds (sales Cost (or other Form(s) 8949 This form may be easier to complete if you round off cents to whole price) basis) Part II line 2 dollars column (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (0) Ba Totals for all long-term transactions reported on Form 1099-3 for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 1949, leave this line blank and go to line 56 Bb Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totalt for all transactions reported on Forms) 8949 with Box E cheed 10 Totals for all transactions reported on Form(s) 1949 with Box F checked 604,000 75,000 x 260,000 x 11 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684.6781, and 8824 11 279,000 X 1279,000 Schedule thede 604,000 75,000 260,000 11 Gintron Form 4797, Part 1: long-term gain from Forms 2439 and 6252, and long-term gain or loss) from 11 Forma 1604, 6701, and 3824 12 13 12 Not ong-term gain or (ons) from partnerships, 5 corporations, estates, and trusts from Schedule(s) K-1 13 Capital gain stribution. See the instructions 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 15 Net long term capital gain or loss). Combine lines sa through 14 in column (1). Then, go to Part II on the 14 15 For Paperwork Reduction Act Notice, see your tax return instructions Cat No. 12338H Schedule D (Form 1040) 2020 Page 2 Schedule Form 1040) 2020 Walter and Skylar Black 700-01.0002 Part 11 Summary 16 Combines 7 and 15 and enter the result 16 - I line 16 is again enter the amount from line 15 on Form 1040 1040 SRE OE 1040-NR. 7. Then go to line 17 below . 1 is a loss, skins 17 through 20 below. Then go to line 21. Also be sure to complete line It le 16 is rero, o lines 17 through 21 below and enter on Form 1040 1040-52 of 1040-NR Iine 7 Them go to 22 17 15 and 16 both Scho 10 if you are required to complete the 28 Rate Gain Worksheet (e instructions), enter the amount, any from foot of that worksheet. 18 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount a, trom in 18 that worksheet 19 20 are 10 and 10 both nero or blando Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 1040-SR. I 16. Don't complete lines 21 and 22 below No Comitete Schedule D Tax Worksheet in the Instructions. Don't complete ties 21 abd 22 below. 21 16 is a fons, enter here and on Form 1040 1040-SR, or 1040NR line 7, the smaller of The one 16 . (55.000) maleding set. (51.500) 21 Note: When touring which amount is smaller, treat both amounts as positive numbers 22 Do you have used dividends on Form 1040 1040-SR, 1940-NR. Iine Day a Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 and 1040 5R16 Schedule Complete the Black Schedule E Do not round the percentage in your computation OMB No 1545-0074 SCHEDULE E Supplemental Income and Loss (Form 1040) (From rental real estate, royalties, partnerships, Scorporations, estates, 2020 trusts, REMICS, etc.) Department of the Treasury Attach to Form 1040, 1040-SR, 1040-NR, or 1041 Attachment iteral Revenue Service (99) Go to www.lrs.gov/Schedule for instructions and the latest information. Sequence No. 13 amets) shown on return Your social security number Walter and Skylar Black 700-01-0002 Part 1 Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule (see instructions). If you are an individual, report farm rental income or loss from Form 4835 on page 2. line 40, A Did you make any payments in 2020 that would require you to file Form(s) 10997 (see instructions) Yes Yes," did you or will you file required Forms 10992 Yes No 1a dress of each property (street, ty, state, ZIP code) A123 Buncombe Lane, Brian Head, UT 84719 B 1b Type of property from below) Fair Rental Days Personal use Days Q for each rentar estate property isted above report the number of rental and personal use days. Check the ON box only you meet the requirements to the qualified venture Seestruction A 1857 15 Type of property 4 Commercial 6 Royalties 8 Other (describe) 2 Multi-Family Residence Income: Properties: A B 3 Rents received 3 23,700 4 Royalties received 4 Expenses: 5 5 Advertising 6 Auto and travel (see instructions) 7 Cleaning and maintenance 6 7 6,600 X 8 Commissions 8 9 10 11 12 9 Insurance 10 Legal and other professional fees 11 Management fees 12 Mortgage interest paid to banks, etc. (see instructions) 13 Other interest 14 Repairs 15 Supplies 16 Taxes 16,000 X 14 15 16 17 Utilities 17 3,400 X 18 Depreciation expense or depletion 1B 19 Other (list) Homeowners dues 19 5,200 X 20 Total expenses. Add lines 5 through 19 20 31,200 X Check My Work 19 Schedule 5,200 X Homeowners dues 19 Other 20 31,200 x 20 Tees Add lines 5 through 19. 21 Subtract line 20 from line 3 trents) and/or 4 (royalties). 11 a los instructions to find out if you must file Form 6198 21 22 Deductible with real estate loss after limitation, if any, on Form 582 Constructions).... 22 238 Toit of all amounts reported on line 3 for all rental properties 23a Total of all amounts reported on line 4 for all royalty properties 23b Total of all amounts reported on line 12 for all properties 23c Test of all amounts reported on line 18 for all properties 23d e Totulot all amounts reported on line 20 for all properties 23e 24 Income, and positive amounts shown on line 21. Do not include any losses 24 25 Losses. Add revyfosses from line 21 and rental real estate losses from line 22. Enter total losses here 25 26 Total rental real estate and royalty income or loss). Combine lines 24 and 25. Enter the result here. It Parts II, III, IV, and fine 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), line 5. Otherwise, indude this amount in the total on line 41 on page 2 For Paperwork Reduction Act Notice, see the separate instructions. Cat No. 11344 Schedule E (Form 1040) 2020 26 Che Wos Paraty correct Comprehensive Problem 4-1 Skylar and waiter Black have been married for 25 years. They live at 893 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at- home parent and wait is a high school teacher. His W.2 form is located on the next tab Skylar's Social Security number is 227-43.7690 and Walt's s 700-01-0002. Neither e 200 65 or older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411- 66-21211, who lives in a nursing home in Reno, NV and has no income. Walter's father, Altan Black (Social Security mimber 343 22-8999), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of $7,500 in 2020, the Blacks provide over half of Alton's support, Skytar and watchim a $500 other dependent credit each for Rebecca and Alton wars carrings from teaching are induded on the W-2 (see separate tab) The blacks moved from Maine to nevada. As a result, they sold their house in Maine on January 4, 2020. The originally paid $75,000 for the home on July 3, 1995, but managed to sell it for $604000. They spent $14,000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home The was received a 1090-DIV from their mutual fund investments (see separate tab) The Blacks own a skl condo located at 122 Huncombe Lane, Brian Head, UT 84719. The condo was rented for 10 days during 2020 and used by the Stades for 15 days. The rental activity does not rise to the level to qualify for the 31 deduction, pertinent Information about the condo rentalis follows 129,700 16,000 5.200 Rental income Mortone interest reported on Form 1001 Homeowners association does Uits Maintenance Deprecatione fully deprecated) 3.400 5.500 0 The showe amounts do not reflect any allocation between rental and personale of the conda The Backseative w they look for a new home The received a 1099 DIV from their mutual fund investments (see separate tab) The Bad and condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 185 days during 2020 and used by the ladies for 15 days. The rental activity does not rise to the level to quality for the et deduction, pertinent information about the condo rentalis a fos $23,700 Pantal income Mortgage interest reported on Form 1090 Homeownersation des 16,000 5.200 3.400 Maintenance Deprecation (assunt fully deprecated 0,600 0 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo. The de received a $2.400 EP in 2020 Required: Conchite Form 1040 and the schedules and forms provided for the blacks Assume the taxpayers had health coverage for the entire year Neither taxpayers wants to contribute to the presidential election campaign If an amount box does not require an entry or the answer is zero, enter" . Do not round any percentages If required, round your answers to the nearest dollar . Il required, enter a loss as a negative number on the tax form. Do not enter deductions as negative numbers Special instructions for Form 58: It required, use the minus sign to enter a loss as a negative number on the lines id, 4 and 16. However, per the instructions on the tax return, enter all numbers in Part II as positive amounts The Blacks received the following 1099.DIV from their mutual fund investments CORRECTED (it checked PAYERS name, street address, city or town, state or province, la Yol ordinary country. ZIP or foreign postal code, and telephone no. dividends 1545-01 $1,500.00 Cyber Equities Fund 41 Wall Street New York, NY 10005 1b Qualified dividends Dividends 2020 and Distributions Forn 1099-0IV 26 Unrecap Sec. 1250 $1,050.00 2a Total capital gain distr gain $ 6,700,23 $ PAYERS TIN RECIPIENTS TIN 2c Section 1202 gain 2d Collectibles (28) gain 17-121426 222-43-7690 $ RECIPIENTS name 3 Nondividend distributions 4 Federal income tax withheld Copy B Skylar B. Black 5 For Recipient Investment expenses 5 Section 1994 dividends Street address (induding no.) This is important tax RECIPIENTS 3 Nondividend distributions 4 Federal income tax withheld Skylar Black Copy B $ For Recipient 5 Section 1994 dividends 6 Investment expenses Street dress Onduling to.) $ Scrubrush Street, 2528 7 Foreign tax pold y to state or province, Country, and ZIP or foreign postal [code Cash odation distribution This is important tax 8 foreign country or U.S. information and is being furnished to the RS. 11 possession you are required to file return, a negligence penalty or other 10 Nocash liquidation sanction may be distribution Imposed on you if this Income Istacable and the IRS determines that 5 it has not been 12 Specified private reported activity bond interest (dividends Las Vegas, NV 89125 FATCA 11 Exempt interest requirement dividende 5 Account number instruction 15 State tax withheld identifications no 10 DIV Walter's carnings from teaching are: Safe, accurate Visit the IRS website at OMB No. 1545-0008 Se file FASTI U a Employee's social security number 700-01-0002 Employer identification number (EIN) 31-1239867 C Employer's name, address, and ZIP code Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 1 Wages, tips, other compensation $4,300.00 3 Sodal security wages 54,300.00 5 Medicare wages and tips 54,300.00 7 Social security tips 2 Federal income tax withheld 4,100.00 4 Social security tax withheld 3,366.60 6 Medicare tax withheld 787.35 8 Allocated tips d Control number 9 10 Dependent care benefits Su 11 Nonqualified plans 12a See Instructions for box 12 e Employee's first name and initial Cast name Walter Black 323 Scrub Brush Street, Apt. 528 Las Vegas, NV 89125 DD $7,900.00 120 13 Statutory emploved Retirement plan Third-party sick pay ar's Forms W2 and 1099-01V Third-party 12b 13 Statutory employee Rourement plan sick pay D 14 Other 12 120 + Employee's address and ZIP code 15 State Employer's 16 state wages, tips state ID number etc NV 17 State income 18 Local wages, tips etc. 19 Local income 20 Locality name Form W-2 Wage and Tax Statement 2020 Department of the Treasury--Internal Revenue Service Copy-To Be Filed with Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Schedule Complete Schedule 1 for Walter and Skylar Black SCHEDULE 1 OMB No 1545-0074 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Treasury Attach to Form 1040, 1040 SR, or 1040-NR. Attachment Internal Revenue Service Go to www.lrs.gov/ Form 1040 for instructions and the latest information Sequence No. 01 Name(s) shown on Form 1040, 1090 SR, or 1040-NR Your social security number Walter and Skylar Black 700-01-0002 Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 1 20 3 4 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (los). Attach Schedule ... 4 Other gains or losses). Attach Form 4797 Rental real estate, royalties, partnerships, 5 corporations, trusts, etc. Attach Schedule 6 Farm income or loss). Attach Schedule 7 Unemployment compensation Other income List type and amount 5 275,000 x 6 2 Combine lines 1 through 8. Ent here and on Form 1040, 1040-5R or 1040 NR line 8 Part 11 Adjustments to Income . 275,000 X 10 Complete the blads Schedule OMB No 1545-0074 SCHEDULED Capital Gains and Losses (Form 1040) 2020 Attach to Form 1040, 1040-SR, or 1040 NR. Go to www.lrs.gov/scheduled for instructions and the latest information. Attachment Department of the Day Internal Revenue Service (5) Use Form 1949 to list your transactions for lines 1b, 2, 3, 8, 9, and 10. Sequence No. 12 Names shown on retum Your social security number Walter and Skylar black 1700-01 0002 old you dow of any investment in a qualified opportunity fund during the tax year? Yes No tach Form 0940 and see its instructions for additional requirements for reporting your gain or loss. Part 1 Short Term Capital Gains and Losses Generally Assets Held One Year or less (see instructions) (h) Gain or Se intructions for how to figure the amounts to enter on the lines (0) (loss) Adjustments to (d) Subtract column (o) gain or loss from This form may be easier to complete if you round off cents to whole Proceeds (sales Cost (or other () from column Form) 1949 price (d) and combine dollars basis Part I line 2 the result with column column 1a Total for short-term transactions reported on Form 1099-8 for which was reported to the IRS and for which you have ne adjustments Instructions). However, if you choose to report all these transactions on Form 949. leave this line Bank and go to line 1 Schedule 7 Net short term capital gain or loss). Combine lines ia through 6 in column (h). If you have any long-term capital gains or losses, go to Part II below. Otherwise, go to Part II on the back 7 Part II tong-Term Capital Gains and tosses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines (0) below Adjustments to (d) Gain or loss from Proceeds (sales Cost (or other Form(s) 8949 This form may be easier to complete if you round off cents to whole price) basis) Part II line 2 dollars column (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (0) Ba Totals for all long-term transactions reported on Form 1099-3 for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 1949, leave this line blank and go to line 56 Bb Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totalt for all transactions reported on Forms) 8949 with Box E cheed 10 Totals for all transactions reported on Form(s) 1949 with Box F checked 604,000 75,000 x 260,000 x 11 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684.6781, and 8824 11 279,000 X 1279,000 Schedule thede 604,000 75,000 260,000 11 Gintron Form 4797, Part 1: long-term gain from Forms 2439 and 6252, and long-term gain or loss) from 11 Forma 1604, 6701, and 3824 12 13 12 Not ong-term gain or (ons) from partnerships, 5 corporations, estates, and trusts from Schedule(s) K-1 13 Capital gain stribution. See the instructions 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 15 Net long term capital gain or loss). Combine lines sa through 14 in column (1). Then, go to Part II on the 14 15 For Paperwork Reduction Act Notice, see your tax return instructions Cat No. 12338H Schedule D (Form 1040) 2020 Page 2 Schedule Form 1040) 2020 Walter and Skylar Black 700-01.0002 Part 11 Summary 16 Combines 7 and 15 and enter the result 16 - I line 16 is again enter the amount from line 15 on Form 1040 1040 SRE OE 1040-NR. 7. Then go to line 17 below . 1 is a loss, skins 17 through 20 below. Then go to line 21. Also be sure to complete line It le 16 is rero, o lines 17 through 21 below and enter on Form 1040 1040-52 of 1040-NR Iine 7 Them go to 22 17 15 and 16 both Scho 10 if you are required to complete the 28 Rate Gain Worksheet (e instructions), enter the amount, any from foot of that worksheet. 18 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount a, trom in 18 that worksheet 19 20 are 10 and 10 both nero or blando Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 1040-SR. I 16. Don't complete lines 21 and 22 below No Comitete Schedule D Tax Worksheet in the Instructions. Don't complete ties 21 abd 22 below. 21 16 is a fons, enter here and on Form 1040 1040-SR, or 1040NR line 7, the smaller of The one 16 . (55.000) maleding set. (51.500) 21 Note: When touring which amount is smaller, treat both amounts as positive numbers 22 Do you have used dividends on Form 1040 1040-SR, 1940-NR. Iine Day a Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 and 1040 5R16 Schedule Complete the Black Schedule E Do not round the percentage in your computation OMB No 1545-0074 SCHEDULE E Supplemental Income and Loss (Form 1040) (From rental real estate, royalties, partnerships, Scorporations, estates, 2020 trusts, REMICS, etc.) Department of the Treasury Attach to Form 1040, 1040-SR, 1040-NR, or 1041 Attachment iteral Revenue Service (99) Go to www.lrs.gov/Schedule for instructions and the latest information. Sequence No. 13 amets) shown on return Your social security number Walter and Skylar Black 700-01-0002 Part 1 Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule (see instructions). If you are an individual, report farm rental income or loss from Form 4835 on page 2. line 40, A Did you make any payments in 2020 that would require you to file Form(s) 10997 (see instructions) Yes Yes," did you or will you file required Forms 10992 Yes No 1a dress of each property (street, ty, state, ZIP code) A123 Buncombe Lane, Brian Head, UT 84719 B 1b Type of property from below) Fair Rental Days Personal use Days Q for each rentar estate property isted above report the number of rental and personal use days. Check the ON box only you meet the requirements to the qualified venture Seestruction A 1857 15 Type of property 4 Commercial 6 Royalties 8 Other (describe) 2 Multi-Family Residence Income: Properties: A B 3 Rents received 3 23,700 4 Royalties received 4 Expenses: 5 5 Advertising 6 Auto and travel (see instructions) 7 Cleaning and maintenance 6 7 6,600 X 8 Commissions 8 9 10 11 12 9 Insurance 10 Legal and other professional fees 11 Management fees 12 Mortgage interest paid to banks, etc. (see instructions) 13 Other interest 14 Repairs 15 Supplies 16 Taxes 16,000 X 14 15 16 17 Utilities 17 3,400 X 18 Depreciation expense or depletion 1B 19 Other (list) Homeowners dues 19 5,200 X 20 Total expenses. Add lines 5 through 19 20 31,200 X Check My Work 19 Schedule 5,200 X Homeowners dues 19 Other 20 31,200 x 20 Tees Add lines 5 through 19. 21 Subtract line 20 from line 3 trents) and/or 4 (royalties). 11 a los instructions to find out if you must file Form 6198 21 22 Deductible with real estate loss after limitation, if any, on Form 582 Constructions).... 22 238 Toit of all amounts reported on line 3 for all rental properties 23a Total of all amounts reported on line 4 for all royalty properties 23b Total of all amounts reported on line 12 for all properties 23c Test of all amounts reported on line 18 for all properties 23d e Totulot all amounts reported on line 20 for all properties 23e 24 Income, and positive amounts shown on line 21. Do not include any losses 24 25 Losses. Add revyfosses from line 21 and rental real estate losses from line 22. Enter total losses here 25 26 Total rental real estate and royalty income or loss). Combine lines 24 and 25. Enter the result here. It Parts II, III, IV, and fine 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), line 5. Otherwise, indude this amount in the total on line 41 on page 2 For Paperwork Reduction Act Notice, see the separate instructions. Cat No. 11344 Schedule E (Form 1040) 2020 26 Che Wos Paraty correct schedule1, D, & E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started