Please help me figure this out. I don't even know where to start or where to find the appropriate document to use. I am supposed to use the provided excel to answer the questions. I'm not even sure how to create the proper excel formulas to arrive at the correct answers. Please point me in the right direction so I can learn how to do this for my class.

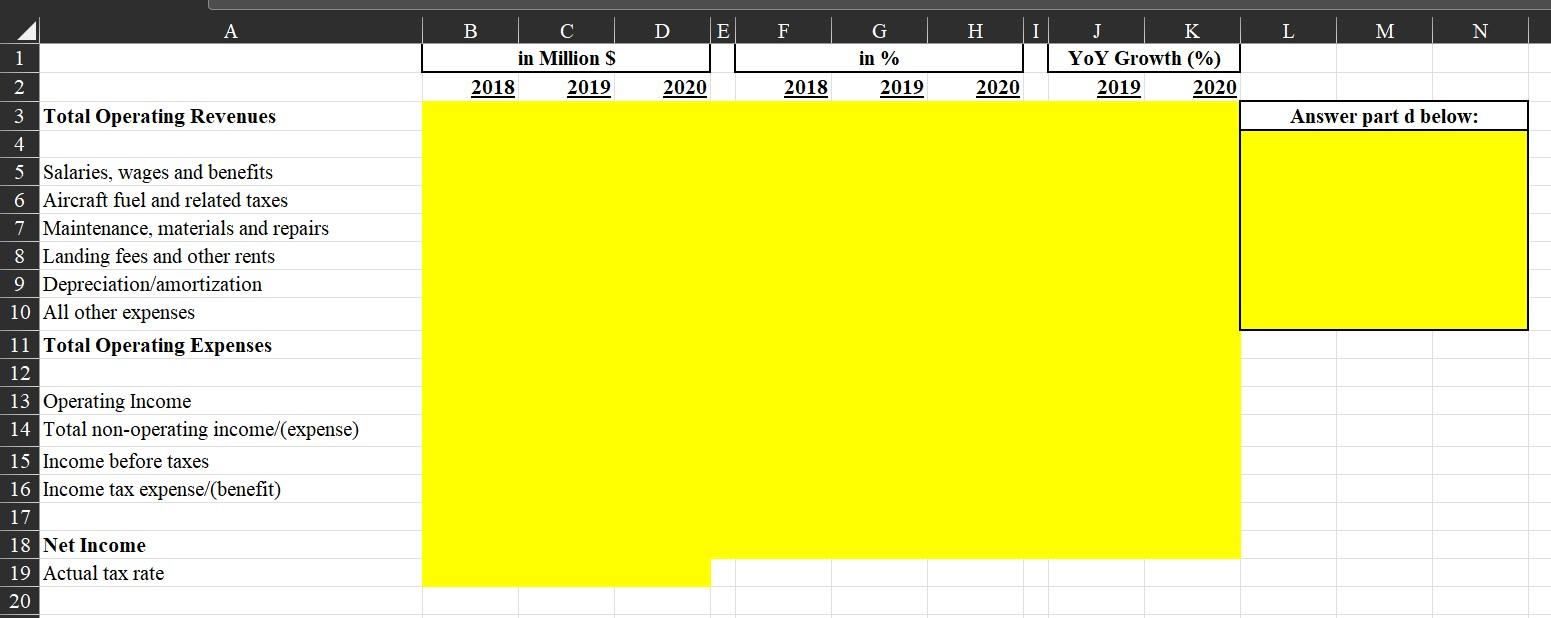

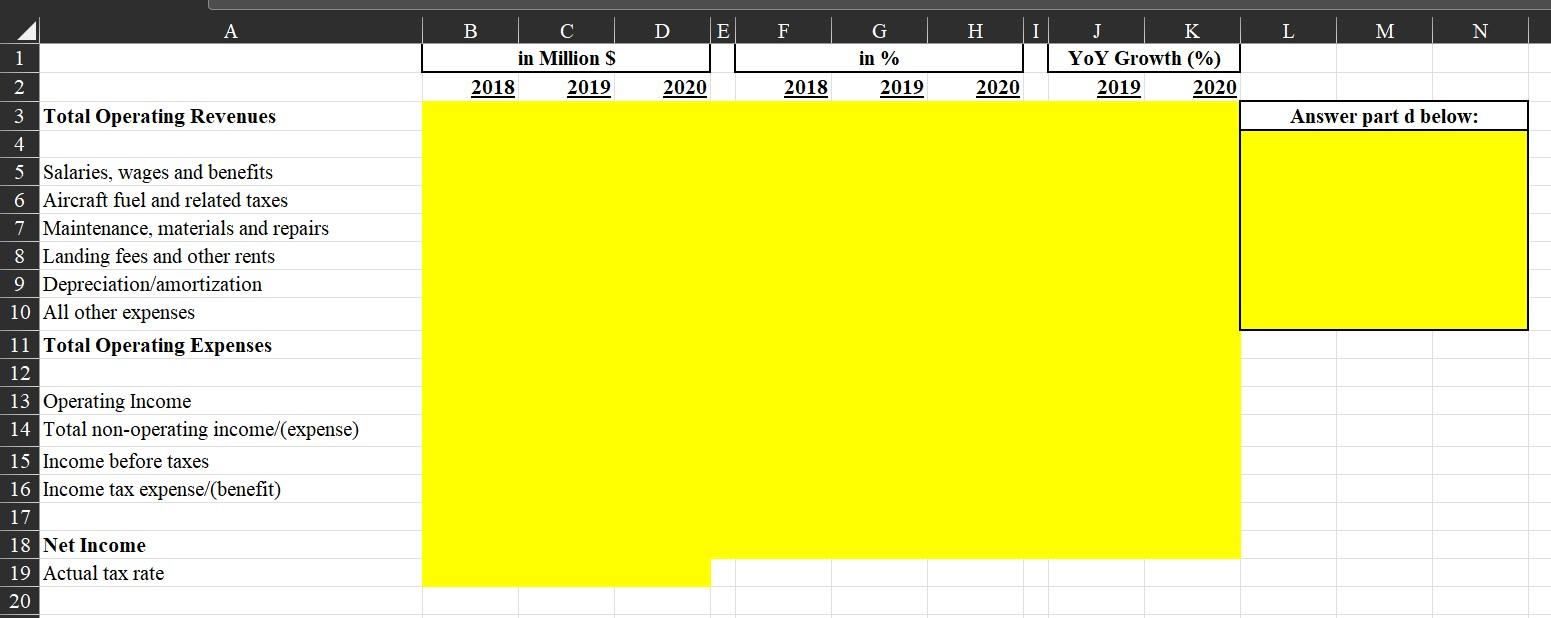

Use Delta as the basis for ALL questions. Go to its investor relations page and get its latest annual report (10-K). Use the Excel template provided. 1. Using its financial data: a. Show the income statement (in million $). Expenses without their own specific line listed should go under "All other expenses". Show all your formulas. b. Create a common size income statement (% of revenues for that year) c. Show year-on-year (YoY) growth in % d. What happened to profit margins? e. What were the actual tax rates?

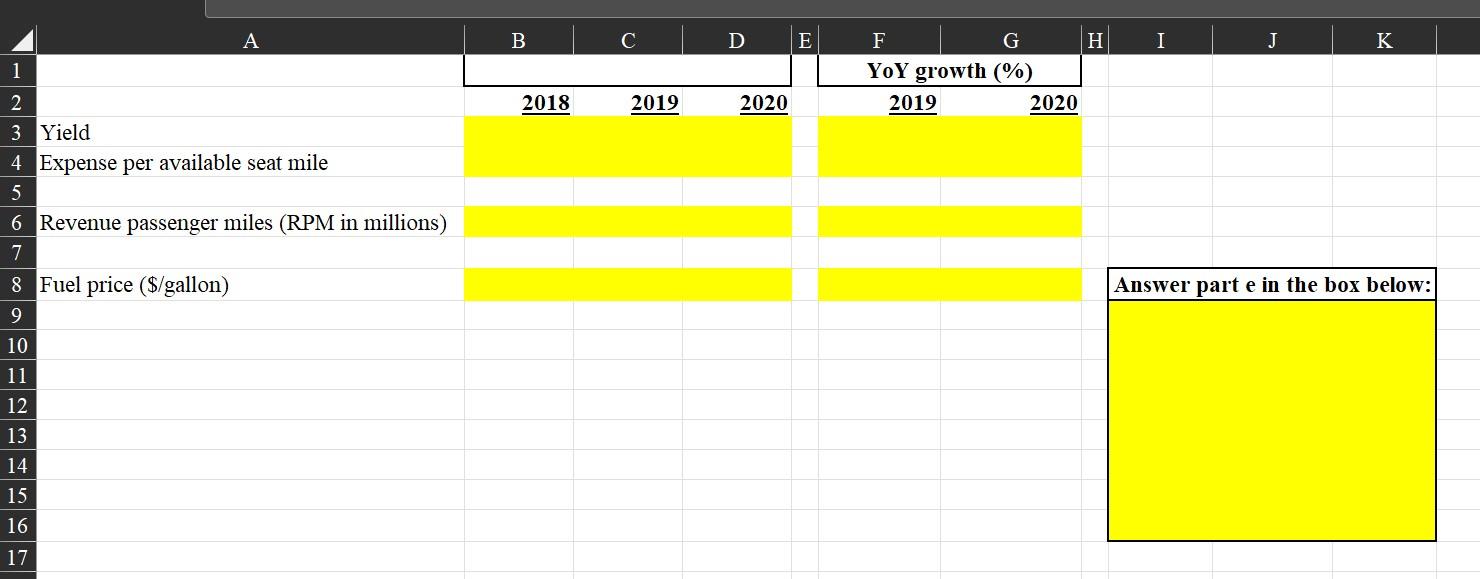

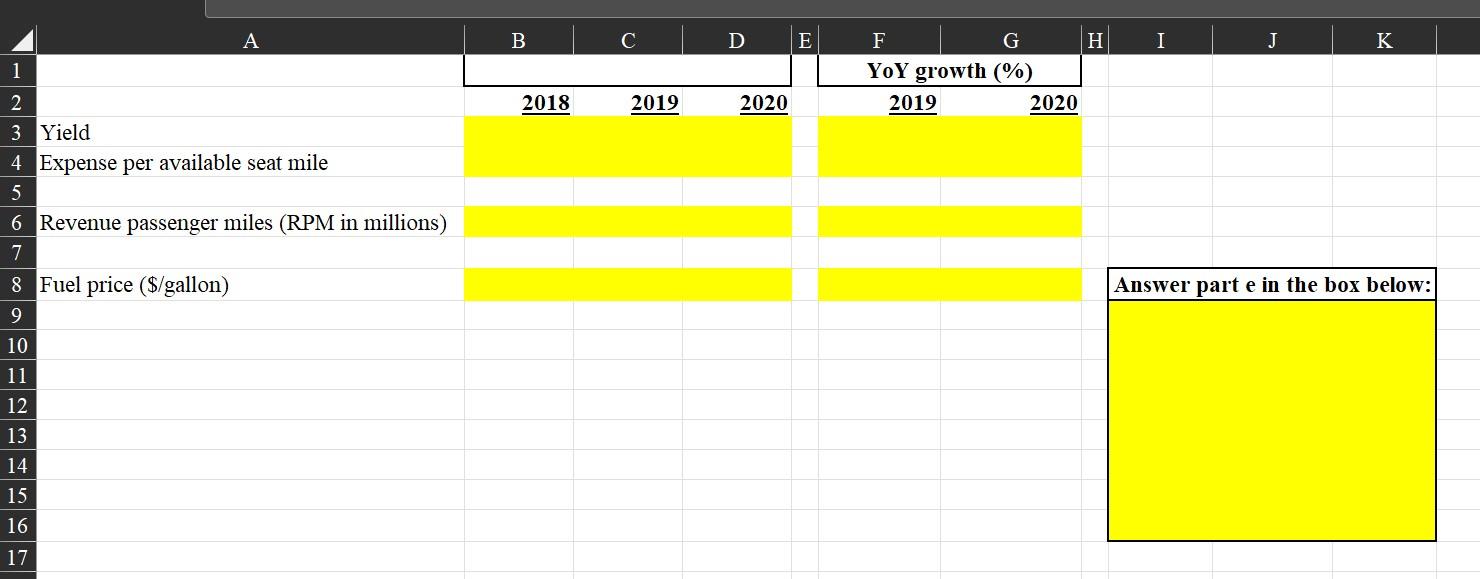

2. Using the operating statistics, what are the values and YoY growth rates for: a. Yield b. Operating expense per available seat mile (ASM) c. Revenue passenger miles (in millions) d. Fuel price ($/gallon) e. What factors, other than the pandemic, affected margins the most? Be specific.

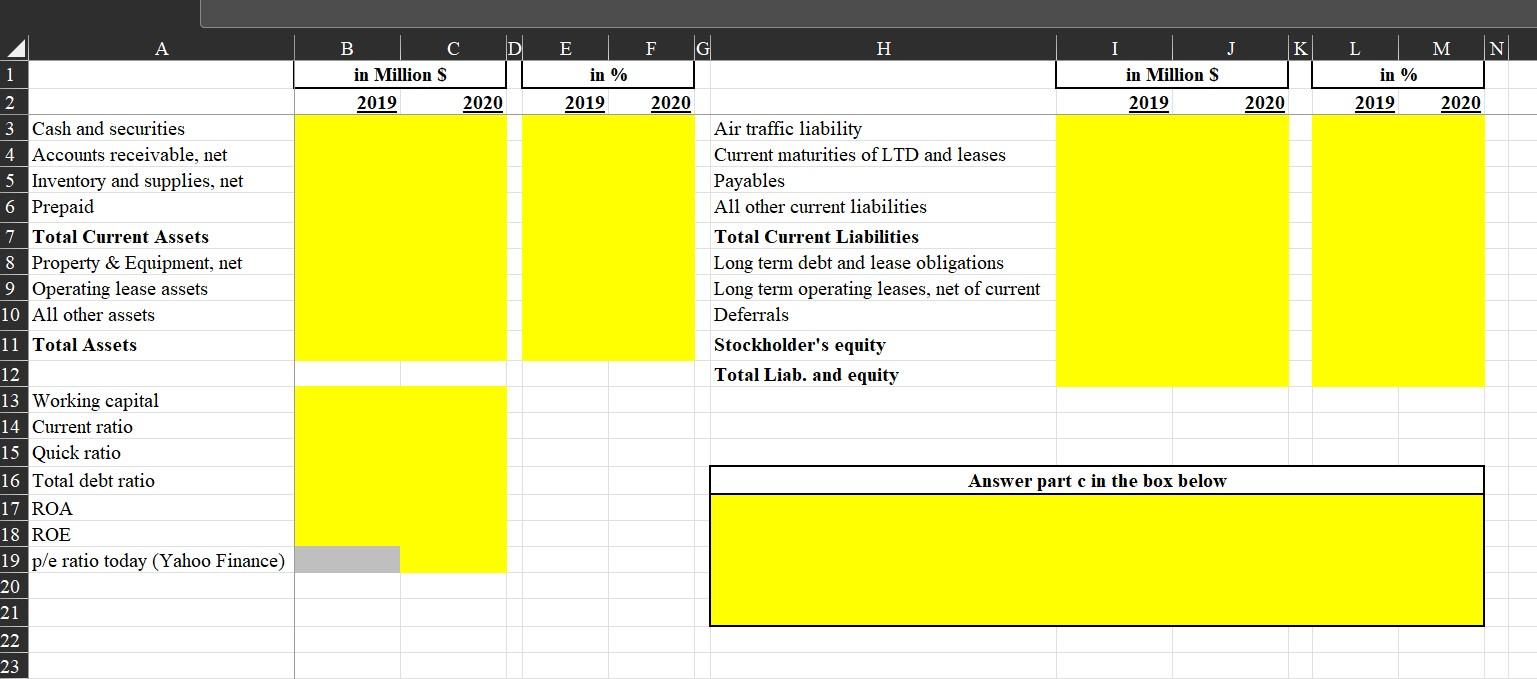

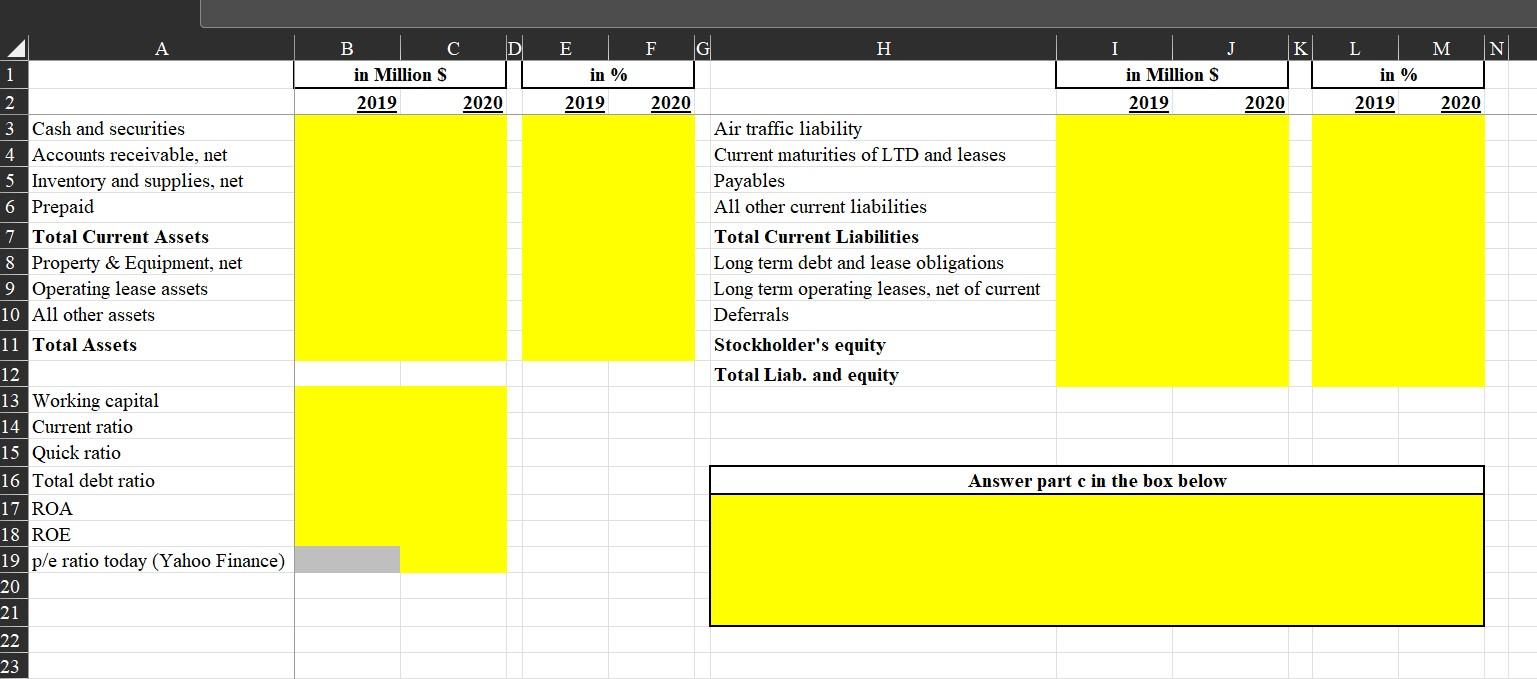

3. Using the firm's balance sheets, show: a. Balance sheet items (in million $) b. Common size balance sheets c. Are there any outliers that merit mentioning? d. Working capital, current ratio, quick ratio, total debt ratio, return on assets (ROA), return on equity (ROE) and the latest p/e ratio

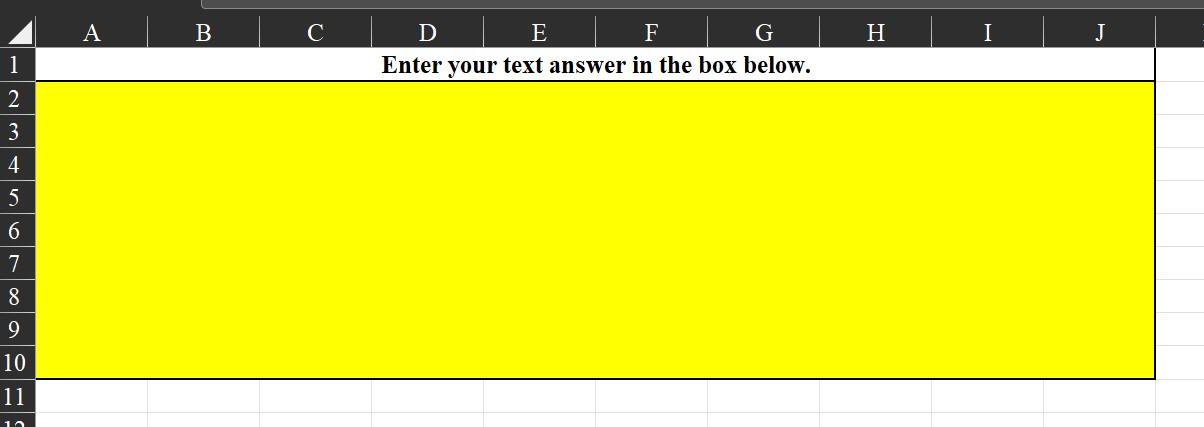

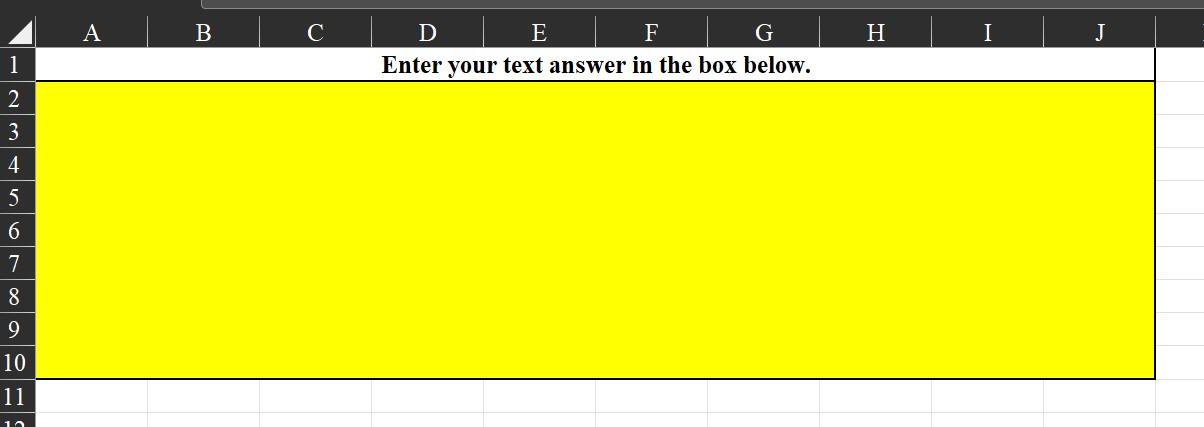

4. Using the Statement of Cash Flows, which items stand out and why?

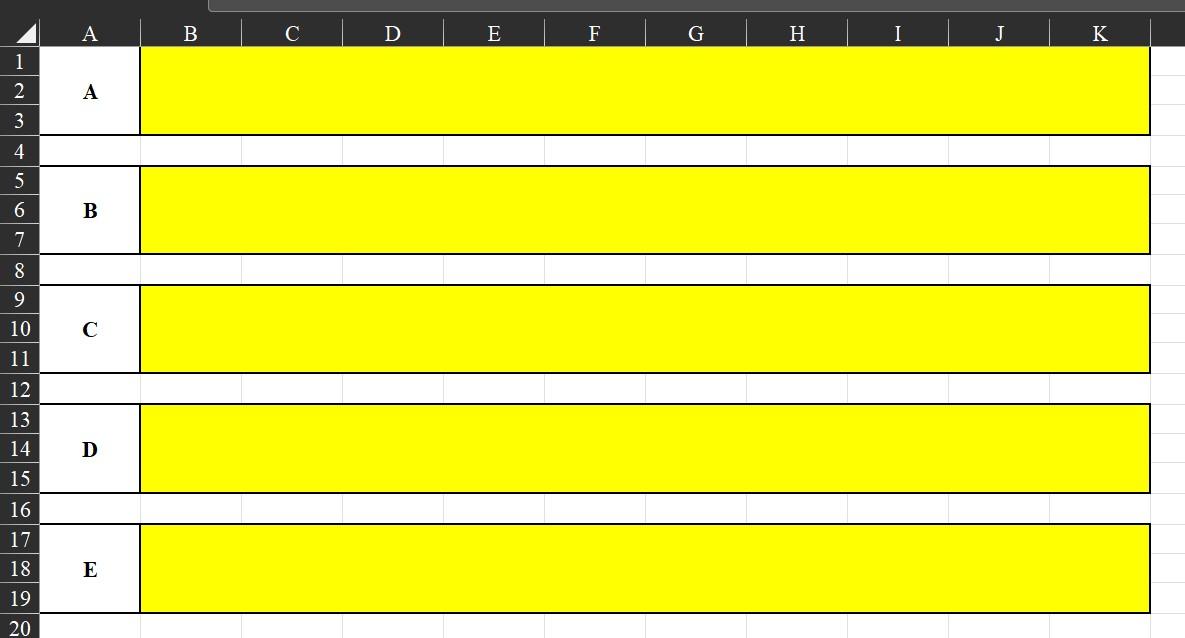

5. Use the carrier snapshot section in the Bureau of Transportation Statistics (BTS) of the U.S. Department of Transportation to show: a. Top three airports by share b. Passenger yields and their changes over time c. Costs per ASM and their changes over time d. Using b and c, what happened to the bottom line? e. Top three city pairs

A D E F G H I L M N 1 B in Million $ 2018 2019 in % K YOY Growth (%) 2019 2020 2020 2018 2019 2020 Answer part d below: 2 3 Total Operating Revenues 4 5 Salaries, wages and benefits 6 Aircraft fuel and related taxes 7 Maintenance, materials and repairs 8 Landing fees and other rents 9 Depreciation amortization 10 All other expenses 11 Total Operating Expenses 12 13 Operating Income 14 Total non-operating income/expense) 15 Income before taxes 16 Income tax expense/(benefit) 17 18 Net Income 19 Actual tax rate 20 A B C ID E I J K 1 F G H YoY growth (%) 2019 2020 2018 2019 2020 Answer part e in the box below: 2 3 Yield 4 Expense per available seat mile 5 6 Revenue passenger miles (RPM in millions) 7 8 Fuel price ($/gallon) 9 10 11 12 13 14 15 16 17 A D H M N 1 B in Million S 2019 E F in % 2019 2020 J K in Million S 2019 2020 in % 2020 2019 2020 2 3 Cash and securities 4 Accounts receivable, net 5 Inventory and supplies, net 6 Prepaid 7 Total Current Assets 8 Property & Equipment, net 9 Operating lease assets 10 All other assets 11 Total Assets 12 13 Working capital 14 Current ratio 15 Quick ratio 16 Total debt ratio 17 ROA 18 ROE 19 p/e ratio today (Yahoo Finance) 20 21 Air traffic liability Current maturities of LTD and leases Payables All other current liabilities Total Current Liabilities Long term debt and lease obligations Long term operating leases, net of current Deferrals Stockholder's equity Total Liab. and equity Answer part c in the box below alala 22 23 A B H II J D E F G Enter your text answer in the box below. 1 2 3 4 5 6 7 8 9 10 11 10 4 B D | E F G E I I I K 1 2 A 4 5 B 7 co 9 11 1 C D 13 14 15 16 17 18 19 20 E A D E F G H I L M N 1 B in Million $ 2018 2019 in % K YOY Growth (%) 2019 2020 2020 2018 2019 2020 Answer part d below: 2 3 Total Operating Revenues 4 5 Salaries, wages and benefits 6 Aircraft fuel and related taxes 7 Maintenance, materials and repairs 8 Landing fees and other rents 9 Depreciation amortization 10 All other expenses 11 Total Operating Expenses 12 13 Operating Income 14 Total non-operating income/expense) 15 Income before taxes 16 Income tax expense/(benefit) 17 18 Net Income 19 Actual tax rate 20 A B C ID E I J K 1 F G H YoY growth (%) 2019 2020 2018 2019 2020 Answer part e in the box below: 2 3 Yield 4 Expense per available seat mile 5 6 Revenue passenger miles (RPM in millions) 7 8 Fuel price ($/gallon) 9 10 11 12 13 14 15 16 17 A D H M N 1 B in Million S 2019 E F in % 2019 2020 J K in Million S 2019 2020 in % 2020 2019 2020 2 3 Cash and securities 4 Accounts receivable, net 5 Inventory and supplies, net 6 Prepaid 7 Total Current Assets 8 Property & Equipment, net 9 Operating lease assets 10 All other assets 11 Total Assets 12 13 Working capital 14 Current ratio 15 Quick ratio 16 Total debt ratio 17 ROA 18 ROE 19 p/e ratio today (Yahoo Finance) 20 21 Air traffic liability Current maturities of LTD and leases Payables All other current liabilities Total Current Liabilities Long term debt and lease obligations Long term operating leases, net of current Deferrals Stockholder's equity Total Liab. and equity Answer part c in the box below alala 22 23 A B H II J D E F G Enter your text answer in the box below. 1 2 3 4 5 6 7 8 9 10 11 10 4 B D | E F G E I I I K 1 2 A 4 5 B 7 co 9 11 1 C D 13 14 15 16 17 18 19 20 E