Please help me fill out the empty boxes below. Siren Company builds custom fishing lures for sporting goods stores. In its first year of operations,

Please help me fill out the empty boxes below.

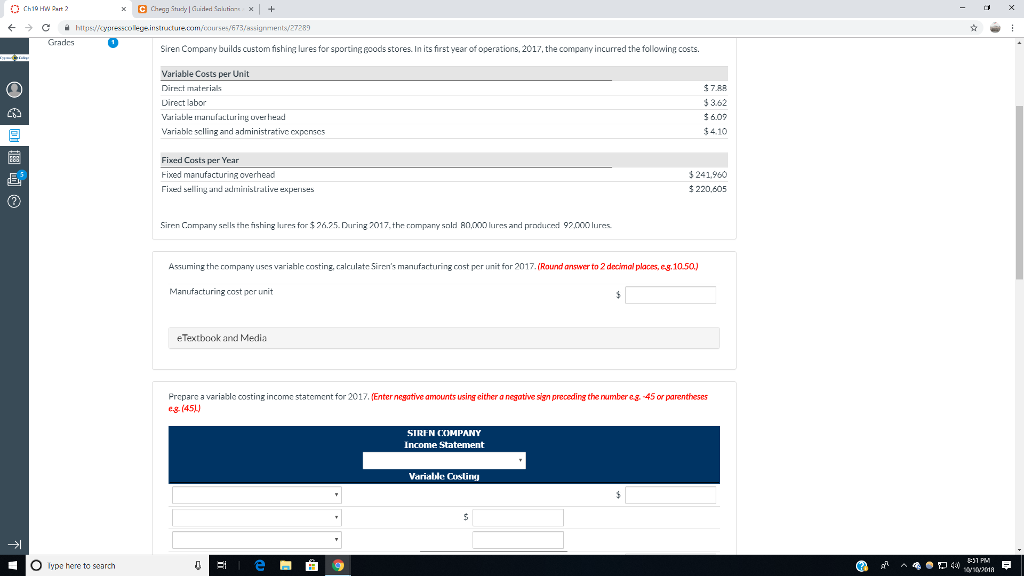

Siren Company builds custom fishing lures for sporting goods stores. In its first year of operations, 2017, the company incurred the following costs.

| Variable Costs per Unit | ||

| Direct materials | $ 7.88 | |

| Direct labor | $ 3.62 | |

| Variable manufacturing overhead | $ 6.09 | |

| Variable selling and administrative expenses | $ 4.10 | |

| Fixed Costs per Year | ||

| Fixed manufacturing overhead | $ 241,960 | |

| Fixed selling and administrative expenses | $ 220,605 |

Siren Company sells the fishing lures for $ 26.25. During 2017, the company sold 80,000 lures and produced 92,000 lures.

Assuming the company uses variable costing, calculate Sirens manufacturing cost per unit for 2017. (Round answer to 2 decimal places, e.g.10.50.)

| Manufacturing cost per unit | $ |

eTextbook and Media

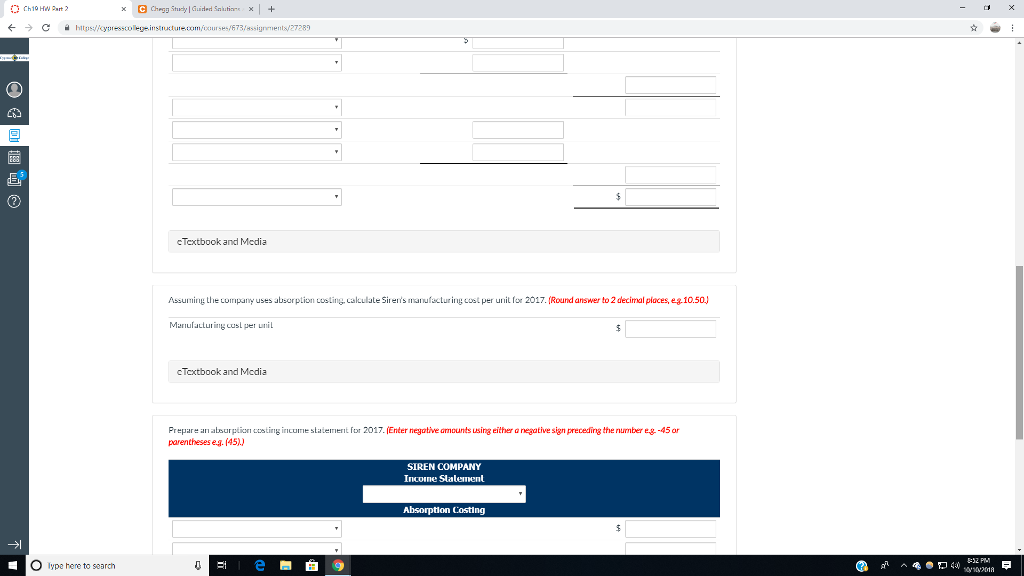

Prepare a variable costing income statement for 2017. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

| SIREN COMPANY Income Statement December 31, 2017For the Quarter Ended December 31, 2017For the Year Ended December 31, 2017 Variable Costing | ||||

| Administrative ExpensesContribution MarginFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | $ | |||

| Administrative ExpensesContribution MarginFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | $ | |||

| Administrative ExpensesContribution MarginFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | ||||

| Administrative ExpensesContribution MarginFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | ||||

| Administrative ExpensesContribution MarginFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | ||||

| Administrative ExpensesContribution MarginFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | ||||

| Administrative ExpensesContribution MarginFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | $ | |||

eTextbook and Media

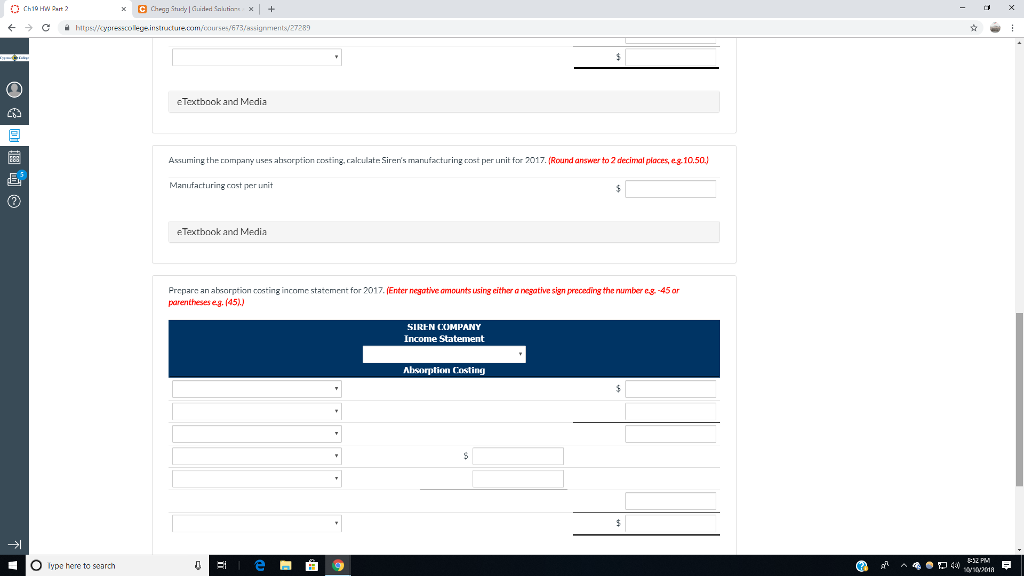

Assuming the company uses absorption costing, calculate Sirens manufacturing cost per unit for 2017. (Round answer to 2 decimal places, e.g.10.50.)

| Manufacturing cost per unit | $ |

eTextbook and Media

Prepare an absorption costing income statement for 2017. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

| SIREN COMPANY Income Statement For the Year Ended December 31, 2017For the Quarter Ended December 31, 2017December 31, 2017 Absorption Costing | ||||

| Administrative ExpensesContribution MarginCost of Goods SoldFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | $ | |||

| Administrative ExpensesContribution MarginCost of Goods SoldFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | ||||

| Administrative ExpensesContribution MarginCost of Goods SoldFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | ||||

| Administrative ExpensesContribution MarginCost of Goods SoldFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | $ | |||

| Administrative ExpensesContribution MarginCost of Goods SoldFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses | ||||

| Administrative ExpensesContribution MarginCost of Goods SoldFixed Manufacturing OverheadFixed Selling and Administrative ExpensesGross ProfitNet Income/(Loss)SalesTotal Fixed ExpensesTotal Variable ExpensesVariable Cost of Goods SoldVariable Selling and Administrative Expenses

| $ | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started