Question

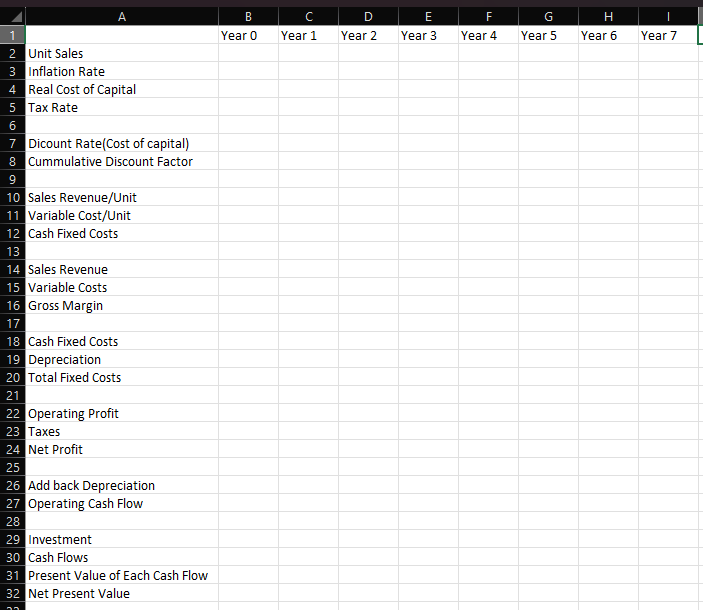

Please help me fill out the following excel spread sheet and provide the answers for the following problems. Thanks in Advance For the problems 1-5,

Please help me fill out the following excel spread sheet and provide the answers for the following problems. Thanks in Advance

For the problems 1-5, begin by assuming you have: Unit Sales: 8275 Sales Growth Rate, years 1-4: 0.07 Inflation Rate: 0.02 Real Cost of Capital: 0.11 Tax Rate: 0.22 Sales Revenue / Unit: 10.79 Variable Cost / Unit: 7.23 Cash Fixed Costs: 8676 Investment: 50271. Problem 1: What are the projected unit sales in year 7 if sales are expected to increase by 12% in year 5, and then decrease by 21% in years 6 and 7? A) 8275 B) 8969.42 C) 7085.84 D) 4389.31

"Problem 2: Assuming sales revenue per unit, variable cost per unit, and cash fixed costs all increase by the rate of inflation, what is your projected gross margin in year 7?" A) 29459 B) 28408.12 C) 57694.03 D) 17597.34 Problem 3: What is the net present value of this project? A) 42990.8 B) -43850.62 C) 42130.98 D) -5523.6 Problem 4: After you conduct your initial analysis, you discover that the firm has the option to abandon the project and sell its specialized equipment at the end of year 8 for $4189.25. What is the new NPV of the project?" A) -42130.98 B) 42130.98 C) -44747 D) 44747.4 "Problem 5: Your boss is apprehensive about your worksheet and your estimation of this project's NP. THIS LOOKS LIKE A JOB FOR SOLVER, you blurt out, only to find out that your boss bought a bootleg version of Excel that does not include the add-in. By changing the unit sales of your existing model as it stands from the prior problem (i.e., assuming the option to abandon from #4 is exercised, basically DO NOT REVERT YOUR ANSWER BACK BEFORE COMPLETING THE PROBLEM), find the number of unit sales needed in year 1 to give you an NPV of zero. A) 2819.26 B) 5125.93 C) 8357.75 D) 3760.9875

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H & 1 \\ \hline 1 & & Year 0 & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 \\ \hline 2 & Unit Sales & & & & & & & & \\ \hline 3 & Inflation Rate & & & & & & & & \\ \hline 4 & Real Cost of Capital & & & & & & & & \\ \hline 5 & Tax Rate & & & & & & & & \\ \hline 6 & & & & & & & & & \\ \hline 7 & Dicount Rate(Cost of capital) & & & & & & & & \\ \hline 8 & Cummulative Discount Factor & & & & & & & & \\ \hline 9 & & & & & & & & & \\ \hline 10 & Sales Revenue/Unit & & & & & & & & \\ \hline 11 & Variable Cost/Unit & & & & & & & & \\ \hline 12 & Cash Fixed Costs & & & & & & & & \\ \hline 13 & & & & & & & & & \\ \hline 14 & Sales Revenue & & & & & & & & \\ \hline 15 & Variable Costs & & & & & & & & \\ \hline 16 & Gross Margin & & & & & & & & \\ \hline 17 & & & & & & & & & \\ \hline 18 & Cash Fixed Costs & & & & & & & & \\ \hline 19 & Depreciation & & & & & & & & \\ \hline 20 & Total Fixed Costs & & & & & & & & \\ \hline 21 & & & & & & & & & \\ \hline 22 & Operating Profit & & & & & & & & \\ \hline 23 & Taxes & & & & & & & & \\ \hline 24 & Net Profit & & & & & & & & \\ \hline 25 & & & & & & & & & \\ \hline 26 & Add back Depreciation & & & & & & & & \\ \hline 27 & Operating Cash Flow & & & & & & & & \\ \hline 28 & & & & & & & & & \\ \hline 29 & Investment & & & & & & & & \\ \hline 30 & Cash Flows & & & & & & & & \\ \hline 31 & Present Value of Each Cash Flow & & & & & & & & \\ \hline 32 & Net Present Value & & & & & & & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H & 1 \\ \hline 1 & & Year 0 & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & Year 6 & Year 7 \\ \hline 2 & Unit Sales & & & & & & & & \\ \hline 3 & Inflation Rate & & & & & & & & \\ \hline 4 & Real Cost of Capital & & & & & & & & \\ \hline 5 & Tax Rate & & & & & & & & \\ \hline 6 & & & & & & & & & \\ \hline 7 & Dicount Rate(Cost of capital) & & & & & & & & \\ \hline 8 & Cummulative Discount Factor & & & & & & & & \\ \hline 9 & & & & & & & & & \\ \hline 10 & Sales Revenue/Unit & & & & & & & & \\ \hline 11 & Variable Cost/Unit & & & & & & & & \\ \hline 12 & Cash Fixed Costs & & & & & & & & \\ \hline 13 & & & & & & & & & \\ \hline 14 & Sales Revenue & & & & & & & & \\ \hline 15 & Variable Costs & & & & & & & & \\ \hline 16 & Gross Margin & & & & & & & & \\ \hline 17 & & & & & & & & & \\ \hline 18 & Cash Fixed Costs & & & & & & & & \\ \hline 19 & Depreciation & & & & & & & & \\ \hline 20 & Total Fixed Costs & & & & & & & & \\ \hline 21 & & & & & & & & & \\ \hline 22 & Operating Profit & & & & & & & & \\ \hline 23 & Taxes & & & & & & & & \\ \hline 24 & Net Profit & & & & & & & & \\ \hline 25 & & & & & & & & & \\ \hline 26 & Add back Depreciation & & & & & & & & \\ \hline 27 & Operating Cash Flow & & & & & & & & \\ \hline 28 & & & & & & & & & \\ \hline 29 & Investment & & & & & & & & \\ \hline 30 & Cash Flows & & & & & & & & \\ \hline 31 & Present Value of Each Cash Flow & & & & & & & & \\ \hline 32 & Net Present Value & & & & & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started