Please help me fill out the form 1040, schedule A, B and C I'm willing to tip up to $50

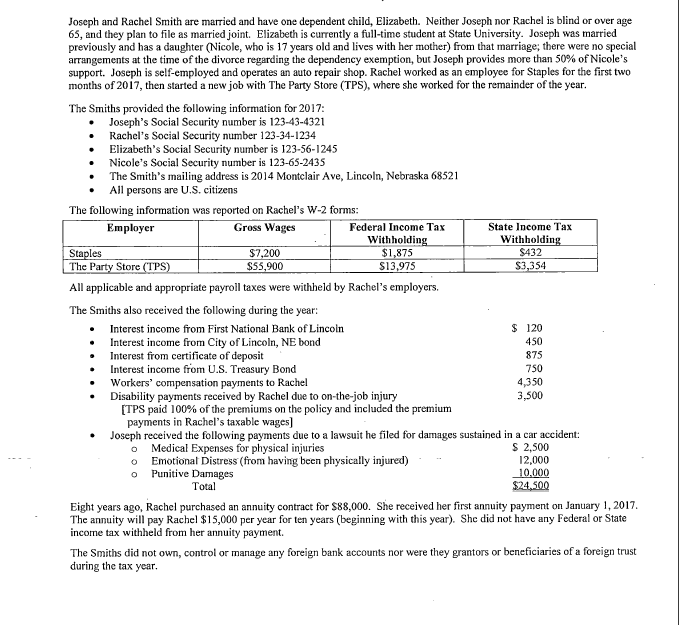

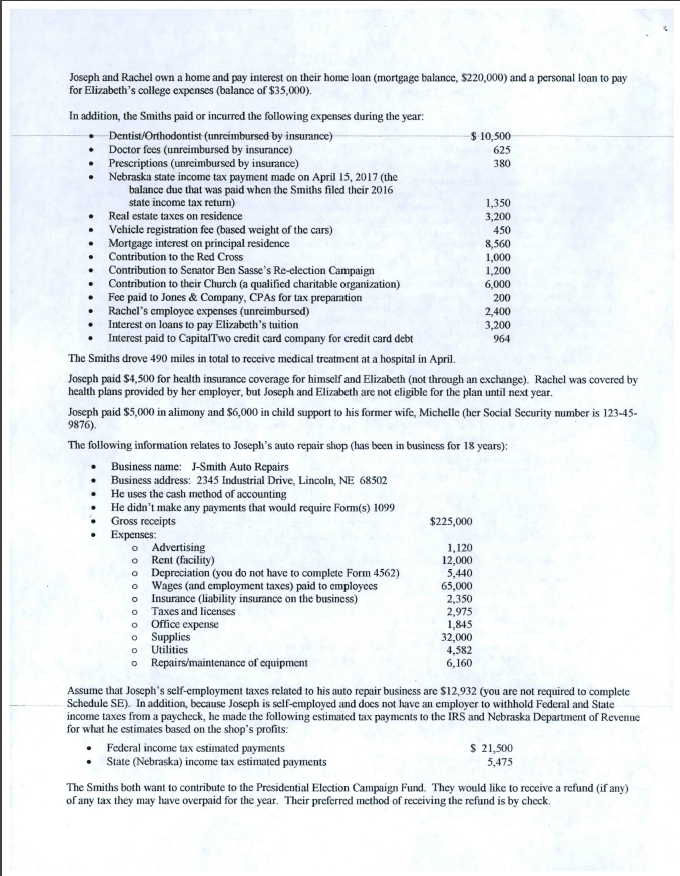

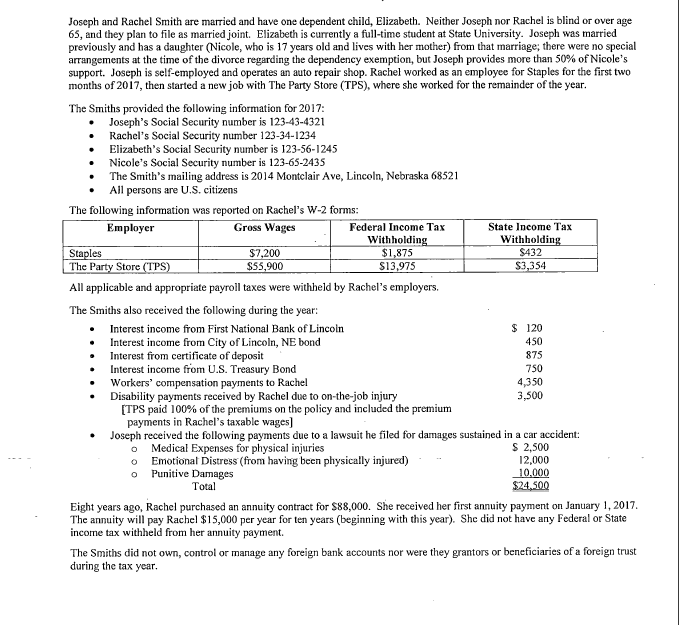

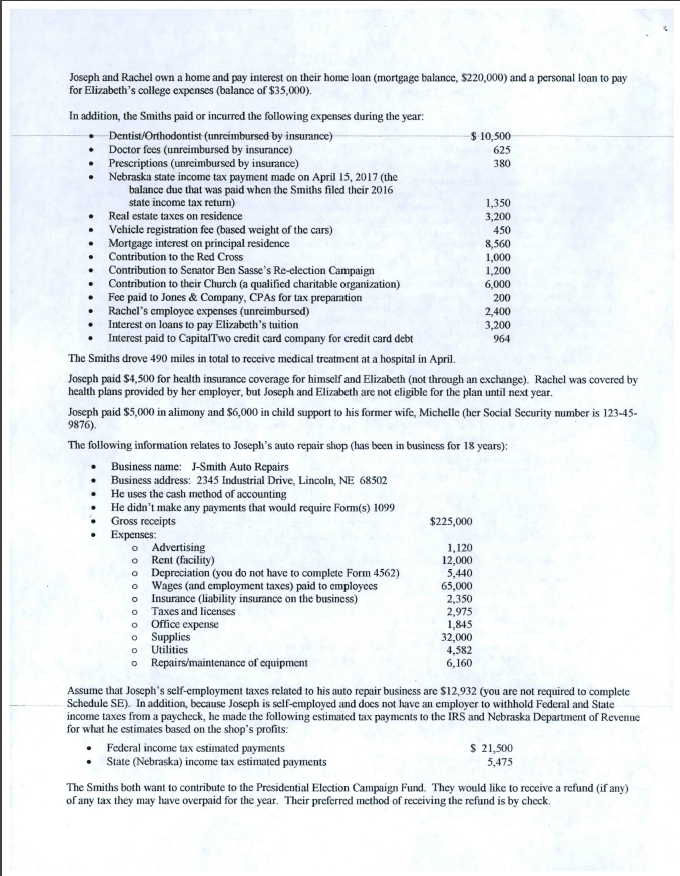

Joseph and Rachel Smith are married and have one dependent child, Elizabeth. Neither Joseph nor Rachel is blind or over age 65, and they plan to file as married joint. Elizabeth is currently a full-time student at State University. Joseph was married previously and has a daughter (Nicole, who is 17 years old and lives with her mother) from that marriage; there were no special arrangements at the time of the divorce regarding the dependency exemption, but Joseph provides more than 50% of Nicole's support. Joseph is self-employed and operates an auto repair shop. Rachel worked as an employee for Staples for the first two months of 2017, then started a new job with The Party Store (TPS), where she worked for the remainder of the year The Smiths provided the following information for 2017: Joseph's Social Security number is 123-43-4321 Rachel's Social Security number 123-34-1234 Elizabeth's Social Security number is 123-56-1245 Nicole's Social Security number is 123-65-2435 .The Smith's mailing address is 2014 Montclair Ave, Lincoln, Nebraska 68521 . All persons are U.S. citizens The following information was reported on Rachel's W-2 forms: Federal Income Tax Withholdin $1875 S13.975 Gross Wages State Income Tax Withholding S432 $3,354 Employer S7.2 S55,900 Staples The Party Store All applicable and appropriate payroll taxes were withheld by Rachel's employers. The Smiths also received the following during the year: Interest income from First National Bank of Lincoin Interest income from City of Lincoln, NE bond Interest from certificate of deposit Interest income from U.S. Treasury Bond Workers' compensation payments to Rachel Disability payments received by Rachel due to on-the-job injury S 120 450 875 750 4,350 3,500 [TPS paid 100% of the premiums on the policy and included the premium payments in Rachel's taxable wages] Joseph received the following payments due to a lawsuit he filed for damages sustained in a car accident: o Medical Expenses for physical injuries o Emotional Distress (from having been physically injured) o Punitive Damages S 2,500 12,000 Total $24,500 Eight years ago, Rachel purchased an annuity contract for $88,000. She received her first annuity payment on January 1, 2017 The annuity will pay Rachel $15,000 per year for ten years (beginning with this year). She did not have any Federal or State income tax withheld from her annuity payment. The Smiths did not own, control or manage any foreign bank accounts nor were they grantors or beneficiaries of a foreign trust during the tax year