Please help me fill out the shaded parts, show the formulas on how you got the answers. And if you wouldnt mind check if mine are correct.

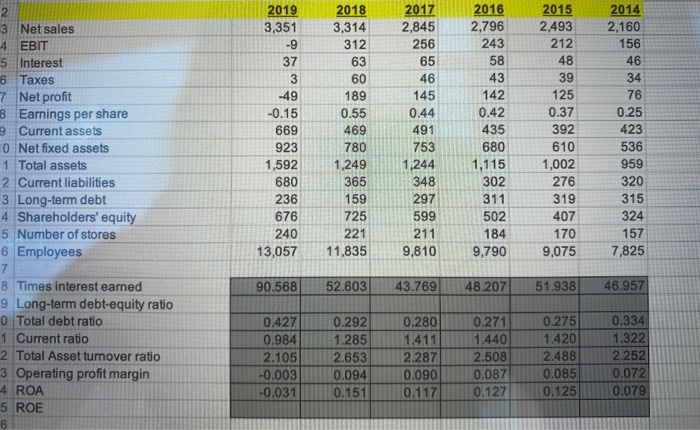

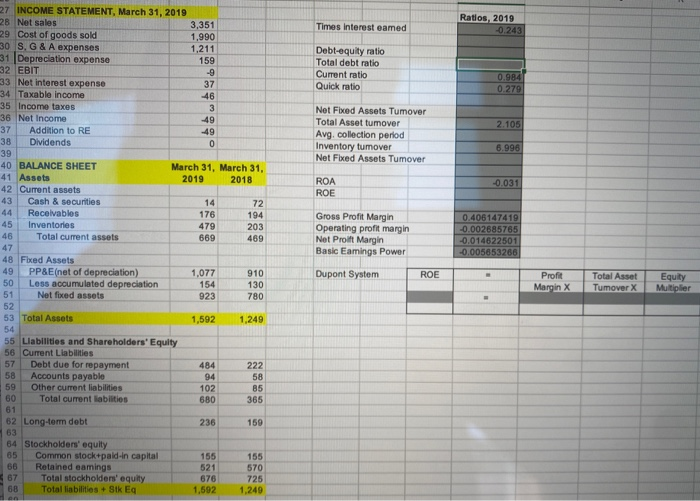

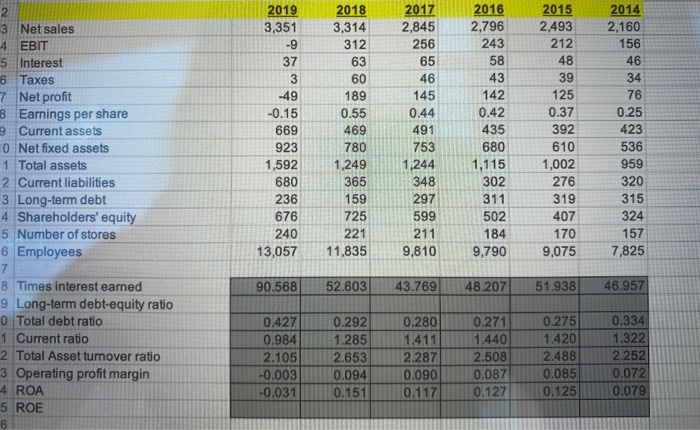

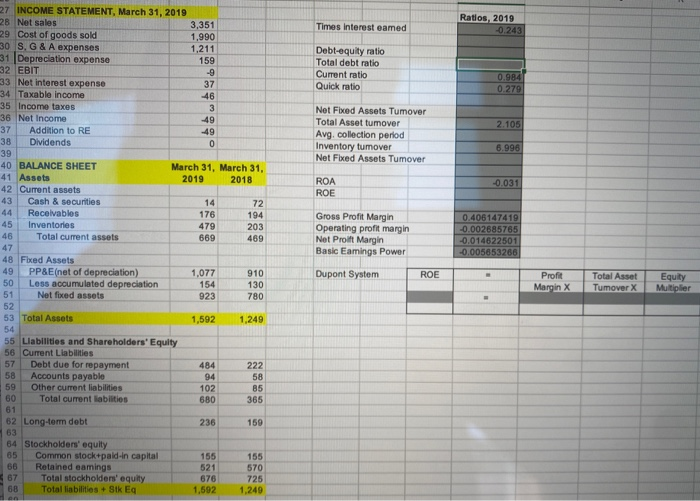

2015 2,493 212 48 3 Net sales 4 EBIT 5 Interest 6 Taxes 7 Net profit 8 Earnings per share 9 Current assets 0 Net fixed assets 1 Total assets 2 Current liabilities 3 Long-term debt 4 Shareholders' equity 5 Number of stores 6 Employees 7 8 Times interest earned 9 Long-term debt-equity ratio 0 Total debt ratio 1 Current ratio 2 Total Asset turnover ratio 3 Operating profit margin 4 ROA 5 ROE 6 2019 3,351 -9 37 3 -49 -0.15 669 923 1,592 680 236 676 240 13,057 2018 3,314 312 63 60 189 0.55 469 780 1,249 365 159 725 221 11,835 2017 2,845 256 65 46 145 0.44 491 753 1,244 348 297 599 211 9,810 2016 2,796 243 58 43 142 0.42 435 680 1,115 302 311 502 184 9,790 39 125 0.37 392 610 1,002 276 319 407 170 9,075 2014 2,160 156 46 34 76 0.25 423 536 959 320 315 324 157 7,825 90.568 52.603 43.769 48.207 51.938 46.957 0.427 0.984 2.105 -0.003 -0.031 0.292 1.285 2.653 0.094 0.151 0.280 1.411 2.287 0.090 0.117 0.271 1.440 2.508 0.087 0.127 0.275 1.420 2.488 0.085 0.125 0.334 1.322 2.252 0.072 0.079 Times Interest eamed Ratios, 2019 -0.243 Debt-equity ratio Total debt ratio Current ratio Quick mtio 0.984 0.279 2.105 Net Fixed Assets Tumover Total Asset tumover Avg. collection period Inventory tumover Net Fixed Assets Tumover 6.996 ROA -0.031 ROE 27 INCOME STATEMENT, March 31, 2019 28 Net sales 3,351 29 Cost of goods sold 1,990 30 SG & A expenses 1,211 31 Depreciation expense 159 32 EBIT -9 33 Net interest expense 37 34 Taxable income 46 35 Income taxes 3 36 Net Income -49 37 Addition to RE -49 38 Dividends 0 39 40 BALANCE SHEET March 31, March 31. 41 Assets 2019 2018 42 Current assets 43 Cash & securities 14 72 Receivables 176 194 45 Inventories 479 203 46 Total current assets 669 469 47 48 Fixed Assets 49 PP&E(net of depreciation) 1,077 910 50 Less accumulated depreciation 154 130 51 Net fixed assets 923 780 52 53 Total Assets 1,592 1,249 54 55 Llabilities and Shareholders' Equity 56 Current Liabilities 57 Debt due for repayment 484 222 58 Accounts payable 94 58 59 Other current liabilities 102 85 60 Total current liabilities 680 365 61 62 Long-term debt 236 159 63 64 Stockholders' equity 65 Common stock paid-in capital 155 155 66 Retained eamings 521 570 67 Total stockholders' equity 676 725 68 Total liabilities + Sik Eg 1,592 1,249 Gross Profit Margin Operating profit margin Net Prof Margin Basic Eamings Power 0.406147419 -0.002685765 -0.014622501 -0.005653266 Dupont System ROE - Profit Margin X Total Asset Tumover X Equity Multiplier - an