Answered step by step

Verified Expert Solution

Question

1 Approved Answer

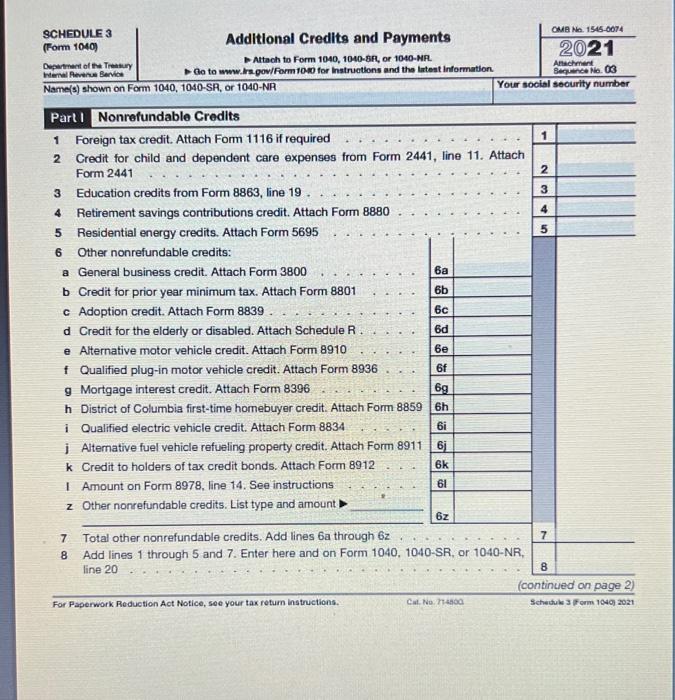

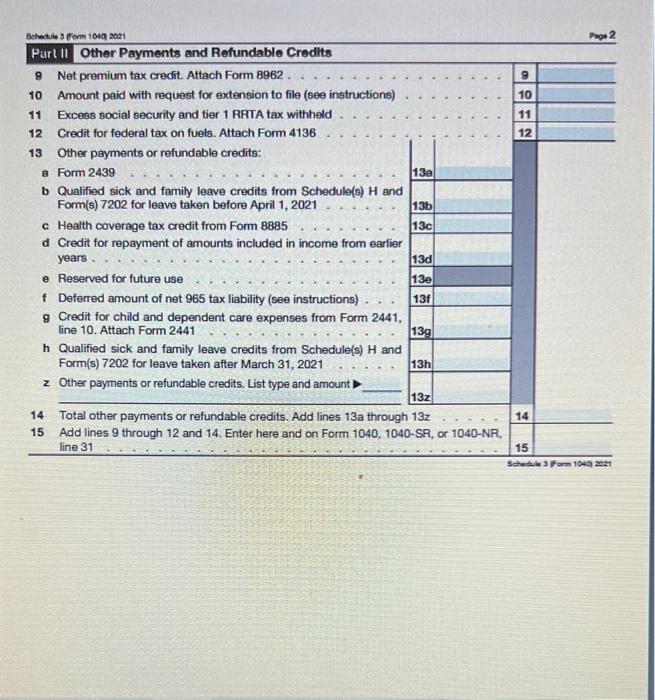

please help me fill out this Schedule 3 form, i need help please, I have no idea what to do General Facts: Rodney and Alice

please help me fill out this Schedule 3 form, i need help please, I have no idea what to do

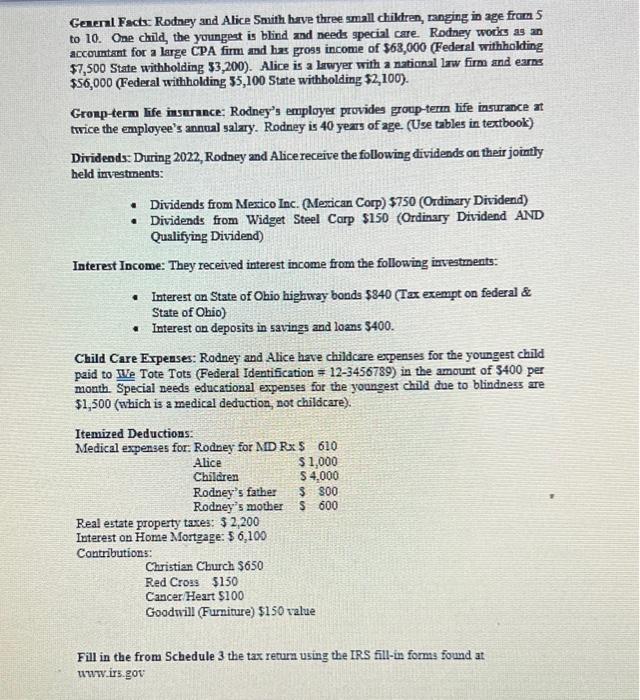

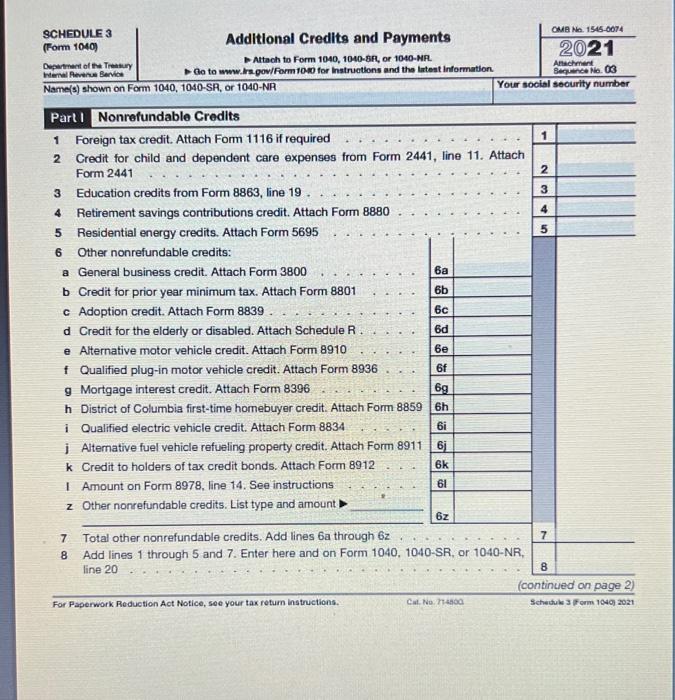

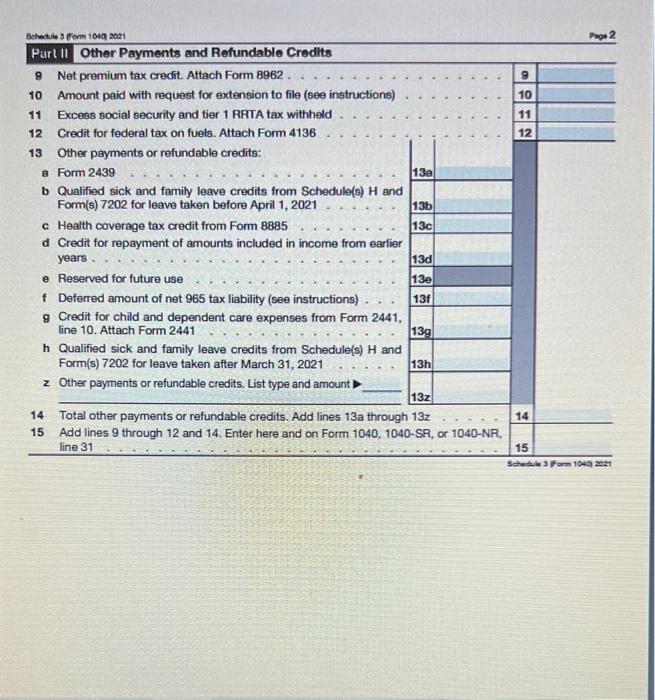

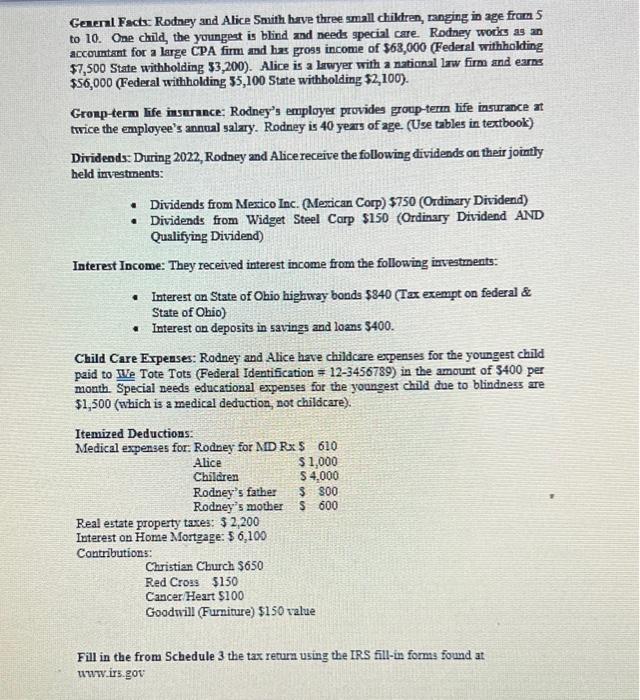

General Facts: Rodney and Alice Smith have three small children, ranging in age from 5 to 10 . One child, the youngest is blind and needs special care. Rodney works as an accoumtant for a large CPA firm and has gross income of $68,000 (Federal withholding $7,500 State withholding 33,200 ). Alice is a lawyer with a national law firm and earns $56,000 (Federal withholding 35,100 . State withholding $2,100 ). Gromp-term life insunance: Rodney's employer provides group-tem life insurace at twice the employee's annual salary. Rodney is 40 years of age. (Use tables in textbook) Dividends: During 2022, Rodney and Alice receive the following dividends on their jointly held imestments: - Dividends from Mexico Inc. (Merican Corp) $750 (Ordinary Dividend) - Dividends from Widget Steel Carp $150 (Ordinary Dividend AND Qualifying Dividend) Interest Income: They received interest income from the following invegtments: - Interest on State of Ohio highway bonds $840 (Tax exempt on federal \& State of Ohio) - Interest on deposite in savings and loans $400. Child Care Expenses: Rodney and Alice have childcare expenses for the youngest child paid to TWe Tote Tots (Federal Identification =123456789 ) in the amount of 3400 per month. Special needs educational expenses for the youngest child due to blindness are $1,500 (which is a medical deduction, not childcare). Itemized Deductions: Real estate property tases: $2,200 Interest on Home Mortgage: $6,100 Contributions: Christian Church $650 Red Cross 5150 Cancer/Heart \$100 Goodwill (Furniture) $150 value Fill in the from Schedule 3 the tax return using the IRS fill-in forms found at uwwirs.gov Gchadile 3 form 1040 amet Parlil Other Payments and Refundable Credits General Facts: Rodney and Alice Smith have three small children, ranging in age from 5 to 10 . One child, the youngest is blind and needs special care. Rodney works as an accoumtant for a large CPA firm and has gross income of $68,000 (Federal withholding $7,500 State withholding 33,200 ). Alice is a lawyer with a national law firm and earns $56,000 (Federal withholding 35,100 . State withholding $2,100 ). Gromp-term life insunance: Rodney's employer provides group-tem life insurace at twice the employee's annual salary. Rodney is 40 years of age. (Use tables in textbook) Dividends: During 2022, Rodney and Alice receive the following dividends on their jointly held imestments: - Dividends from Mexico Inc. (Merican Corp) $750 (Ordinary Dividend) - Dividends from Widget Steel Carp $150 (Ordinary Dividend AND Qualifying Dividend) Interest Income: They received interest income from the following invegtments: - Interest on State of Ohio highway bonds $840 (Tax exempt on federal \& State of Ohio) - Interest on deposite in savings and loans $400. Child Care Expenses: Rodney and Alice have childcare expenses for the youngest child paid to TWe Tote Tots (Federal Identification =123456789 ) in the amount of 3400 per month. Special needs educational expenses for the youngest child due to blindness are $1,500 (which is a medical deduction, not childcare). Itemized Deductions: Real estate property tases: $2,200 Interest on Home Mortgage: $6,100 Contributions: Christian Church $650 Red Cross 5150 Cancer/Heart \$100 Goodwill (Furniture) $150 value Fill in the from Schedule 3 the tax return using the IRS fill-in forms found at uwwirs.gov Gchadile 3 form 1040 amet Parlil Other Payments and Refundable Credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started