please help me fill the blanks out and be sure to create a formate or table that way i understand eveything, many thanks

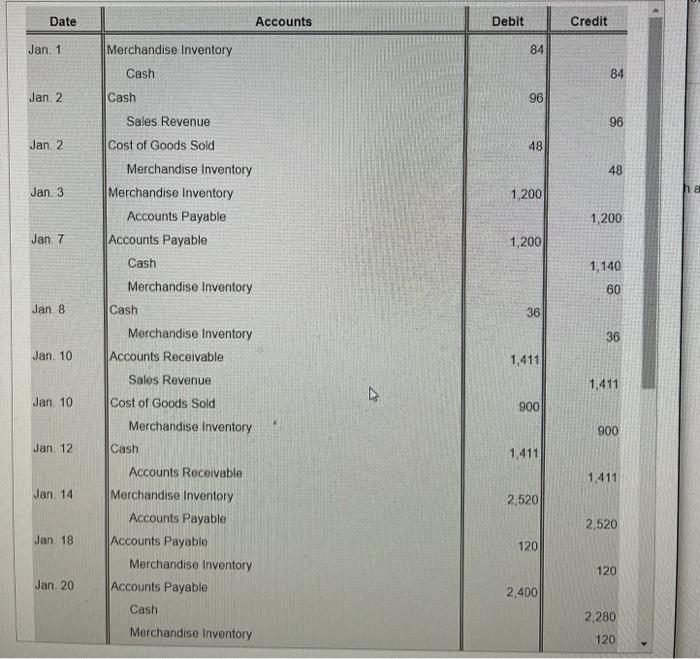

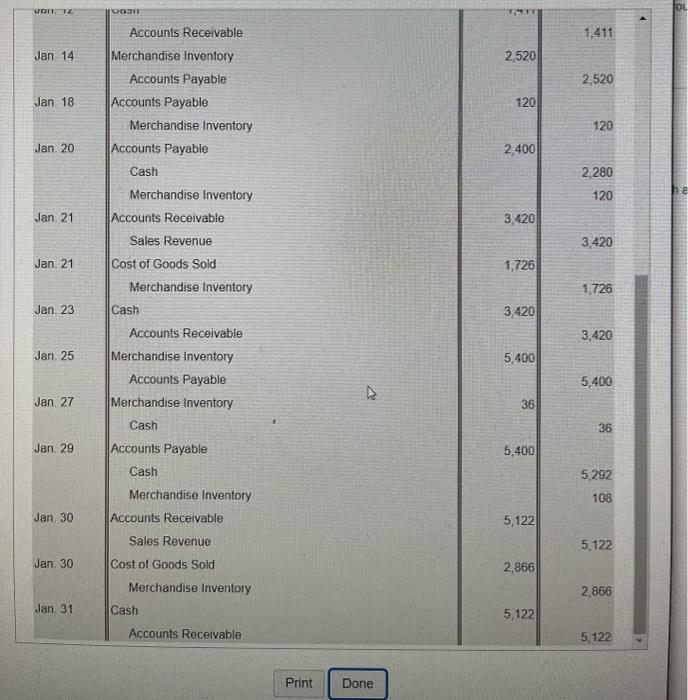

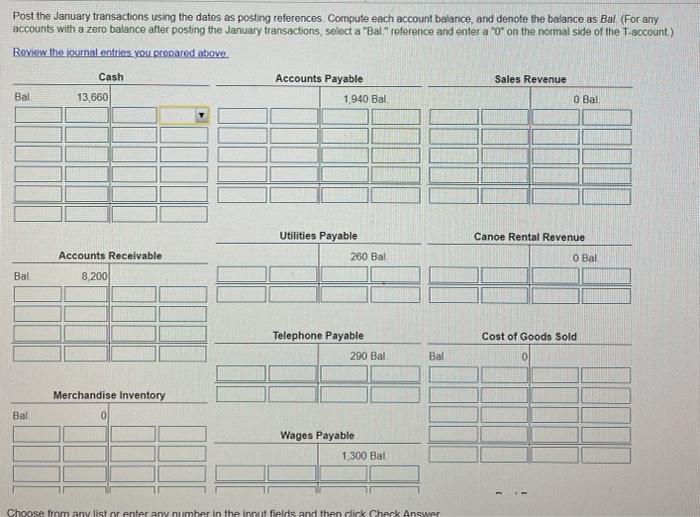

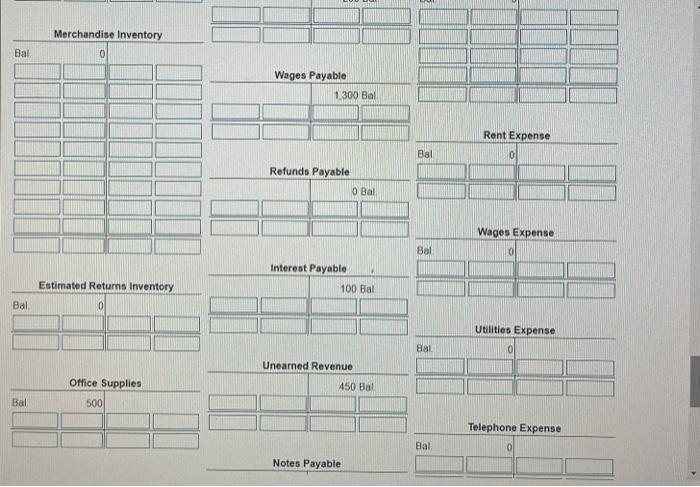

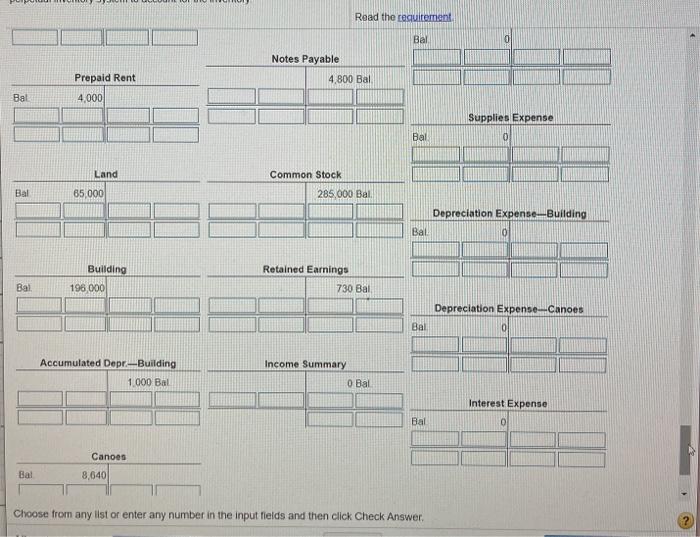

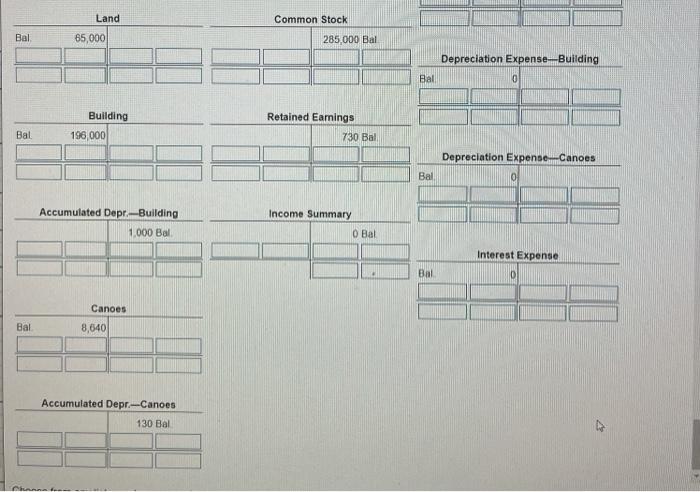

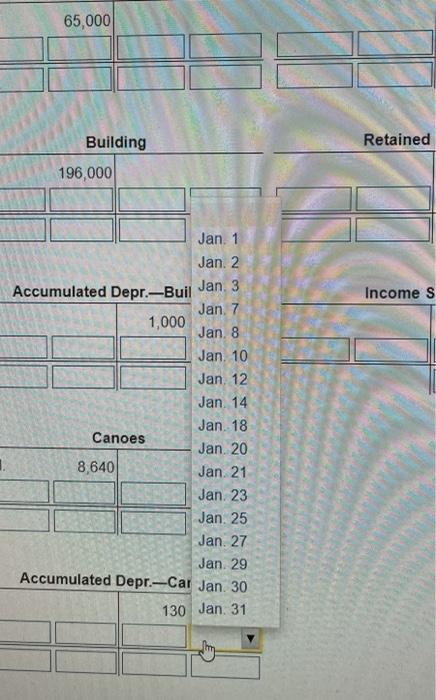

Date Accounts Debit Credit Jan. 1 84 Merchandise Inventory Cash 84 Jan 2 Cash 96 Sales Revenue 96 Jan 2 Cost of Goods Sold 48 48 Jan 3 ha 1,200 1,200 Merchandise Inventory Merchandise Inventory Accounts Payable Accounts Payable Cash Merchandise Inventory Jan 7 1,200 1,140 60 Jan 8 Cash 36 36 Jan 10 1,411 Merchandise Inventory Accounts Receivable Sales Revenue Cost of Goods Sold Merchandise Inventory 1,411 Jan 10 900 900 Jan 12 Cash 1,411 1,411 Jan 14 2,520 2,520 Jan 18 120 Accounts Receivable Merchandise Inventory Accounts Payable Accounts Payable Merchandise Inventory Accounts Payable Cash Merchandise Inventory 120 Jan 20 2,400 2,280 120 wa an T2 DOO 1,411 Jan 14 2,520 2,520 Jan 18 120 Accounts Receivable Merchandise Inventory Accounts Payable Accounts Payable Merchandise Inventory Accounts Payable Cash Merchandise Inventory 120 Jan 20 2.400 2,280 120 Jan 21 Accounts Receivable 3,420 3,420 Jan. 21 1,726 1,726 Jan. 23 3.420 3,420 Jan 25 5,400 Sales Revenue Cost of Goods Sold Merchandise Inventory Cash Accounts Receivable Merchandise Inventory Accounts Payable Merchandise Inventory Cash Accounts Payable Cash Merchandise Inventory Accounts Receivable 5,400 Jan 27 36 36 Jan. 29 5,400 5,292 108 Jan. 30 5,122 5,122 Jan 30 2.866 Sales Revenue Cost of Goods Sold Merchandise Inventory Cash 2,866 Jan. 31 5,122 Accounts Receivable 5,122 Print Done Post the January transactions using the datos as posting references Compute each account balance, and denote the balance as Bal (For any accounts with a zero balance after posting the January transactions, select a "Bal" reference and enter a "o on the normal side of the T-account) Review the journal entries you repared above. Cash Accounts Payable Sales Revenue 13,660 1940 Bal Bal O Bal Utilities Payable Canoe Rental Revenue Accounts Receivable 260 Bal O Bal Bal 8.200 Cost of Goods Sold Telephone Payable 290 Bal Bal 0 Merchandise Inventory Bal Wages Payable 1.300 Bal Choose from any list or enter any number in the input fields and then click Check Answer Merchandise Inventory Bal 0 Wages Payable 1.300 Bal Rent Expense 0 Bal Refunds Payable 0 Bal Wages Expense Bal d + Interest Payable 100 Bal Estimated Returns Inventory 0 Bal Utilities Expense Bal 0 Unearned Revenue Office Supplies 450 Bal Bal 500 Telephone Expense Bal 0 Notes Payable Read the recrutement Bal Notes Payable 4,800 Bal Prepaid Rent Bal 4.000 Supplies Expense Bal 0 Land Common Stock Bal 65,000 285,000 Bal Depreciation Expense Building Bal 0 Building Retained Earnings 730 Bal Bal 196 000 Depreciation Expense Canoes ol Bal Income Summary Accumulated Depr-Building 1.000 Bal 0 Bal Interest Expense 0 Bal Canoes 8,640 Bal Choose from any list or enter any number in the input fields and then click Check Answer Land Common Stock Bal 65,000 285 000 Bai Depreciation Expense Building 0 Bal Retained Eamings Building 196,000 Bal 730 Bal Depreciation Expense-Canoes Bal 0 Accumulated Depr.- Building 1,000 Bal Income Summary O Bal Interest Expense Bal D Canoes Bal 8,640 Accumulated Depr.-Canoes 130 Bal 65,000 Building Retained 196,000 Income S Jan. 1 Jan. 2 Jan. 3 Accumulated Depr.-Buil Jan. 7 1,000 Jan. 8 Jan 10 Jan 12 Jan 14 Jan 18 Canoes Jan 20 8,640 Jan. 21 Jan. 23 Jan. 25 Jan. 27 Jan. 29 Accumulated Depr.-Car Jan. 30 130 Jan. 31