Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me find d. Do not round answers during calculation or the system will mark it wrong, only round at the very end. Please

Please help me find d.

Do not round answers during calculation or the system will mark it wrong, only round at the very end. Please show detailed steps as well.

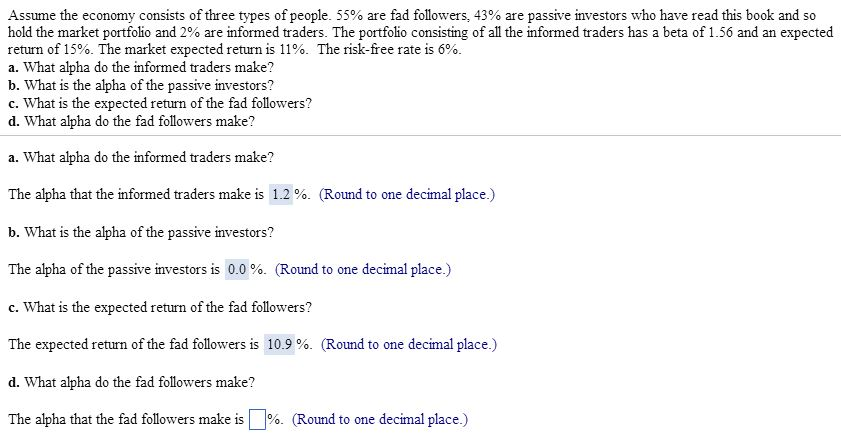

Assume the economy consists of three types of people 55% are fad followers, 43% are passive investors who have read this book and so hold the market portfolio and 200 are informed traders. The portfolio consisting of all the informed traders has a beta of 1.56 and an expected return of 15%. The market expected return is 11%. The risk-free rate is 6%. a. What alpha do the informed traders make? b. What is the alpha of the passive investors? c. What is the expected return of the fad followers? d. What alpha do the fad followers make? a. What alpha do the informed traders make? The alpha that the informed traders make is 12 %. (Round to one decimal place.) b. What is the alpha of the passive investors? The alpha of the passive investors is 0.0 %. (Round to one decimal place.) c. What is the expected return of the fad followers? The expected return of the fad followers is 10.9 %. (Round to one decimal place.) d. What alpha do the fad followers make? The alpha that the fad followers make isPa (Round to one decimal place.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started